So, you're eyeing a property and want to know if it's a solid investment. The first thing any seasoned investor looks at is the rental yield. It's the most straightforward way to gauge a property's earning power.

At its core, working out the rental yield is simple: you take the annual rent you'll collect, divide it by the property's total cost, and turn that figure into a percentage. This basic calculation gives you the gross yield, a quick, back-of-the-napkin number that tells you a lot. It's the essential starting point for comparing different properties before you get bogged down in the finer details.

What Rental Yield Reveals About Your Investment

Thinking in terms of rental yield forces you to look past the monthly rent figure and evaluate how effectively your money is working. It’s a common mistake to be dazzled by a high monthly rent, but if that rent comes from an incredibly expensive property, the actual return—the yield—could be disappointingly low. A more modestly priced apartment with a reasonable rent might easily outperform it.

Think of yield as the financial pulse of your property. A strong, steady pulse suggests a healthy, profitable asset. A weak or erratic one is a clear signal that something needs a closer look, whether it's the purchase price, the rent you're charging, or the associated costs.

Why This Metric is a Global Benchmark

The beauty of rental yield is that it’s a universal language for investors. It’s not just a concept we use here in Morocco; it's a critical benchmark worldwide.

Look at a competitive market like Dubai, for instance. Investors there live and breathe by this metric. Recent data shows Dubai's rental yields hitting anywhere from 6.8% to over 8.5%, depending on the neighbourhood and property type. High-demand spots like Dubai Marina and Business Bay are magnets for expatriates and locals, which keeps rental performance strong and makes the city a global real estate hotspot. You can read a full analysis of global property investment hotspots to see how this plays out elsewhere.

This global context really drives home the point. Whether you’re considering an apartment in Marrakech or a villa in Monaco, the yield calculation provides a standardised, reliable tool to evaluate potential returns.

Gross vs Net Rental Yield At a Glance

To truly understand a property's performance, you need to look at both gross and net yield. The gross yield is your quick overview, but the net yield gives you the real picture of profitability. Here’s a simple breakdown to see the difference.

| Metric | Gross Rental Yield | Net Rental Yield |

|---|---|---|

| What It Includes | Only the annual rental income and the property's purchase price. | Annual rental income, purchase price, and all annual operating expenses. |

| Calculation | (Annual Rent / Property Cost) x 100 | ([Annual Rent – Annual Expenses] / Property Cost) x 100 |

| Best For | Quickly comparing multiple properties at a high level. | Getting a precise, real-world picture of a single property's profitability. |

While the gross figure is great for initial shortlisting, you should always drill down to the net yield before making a final decision. That’s the number that tells you what will actually end up in your pocket.

Calculating Gross Rental Yield for Quick Comparisons

When you're first sizing up potential investments, you need a quick way to sort the promising from the mediocre. This is exactly what gross rental yield is for. Think of it as a back-of-the-envelope calculation that gives you a high-level look at a property's earning power before factoring in any of the day-to-day costs. It’s perfect for making those initial, rapid-fire comparisons.

The formula is beautifully simple: take the total rent you'd collect in a year, divide it by the property's all-in cost, and multiply by 100 to express it as a percentage. This lets you line up several properties and instantly see how they measure up against one another.

The Basic Formula in Action

Let's put this into practice with a realistic example. Say you're looking at an apartment in Casablanca valued at 2,000,000 MAD. Based on the local market, you estimate it can command a monthly rent of 10,000 MAD.

First, let's figure out the annual income:

- Annual Rental Income: 10,000 MAD/month x 12 months = 120,000 MAD

- Total Property Cost: 2,000,000 MAD

Now, we just pop those numbers into our formula:

(120,000 MAD / 2,000,000 MAD) x 100 = 6% Gross Rental Yield

A 6% yield gives you a hard number to work with. If the next property you analyse only comes out to 4%, you know at a glance which one has better earning potential on paper. This ability to make swift, data-backed decisions is what makes gross yield such an essential tool in any investor's kit.

Expert Tip: Use gross yield as your first filter. It’s the fastest way to weed out properties that simply don't have the numbers to justify a closer look, letting you focus your energy on the real contenders.

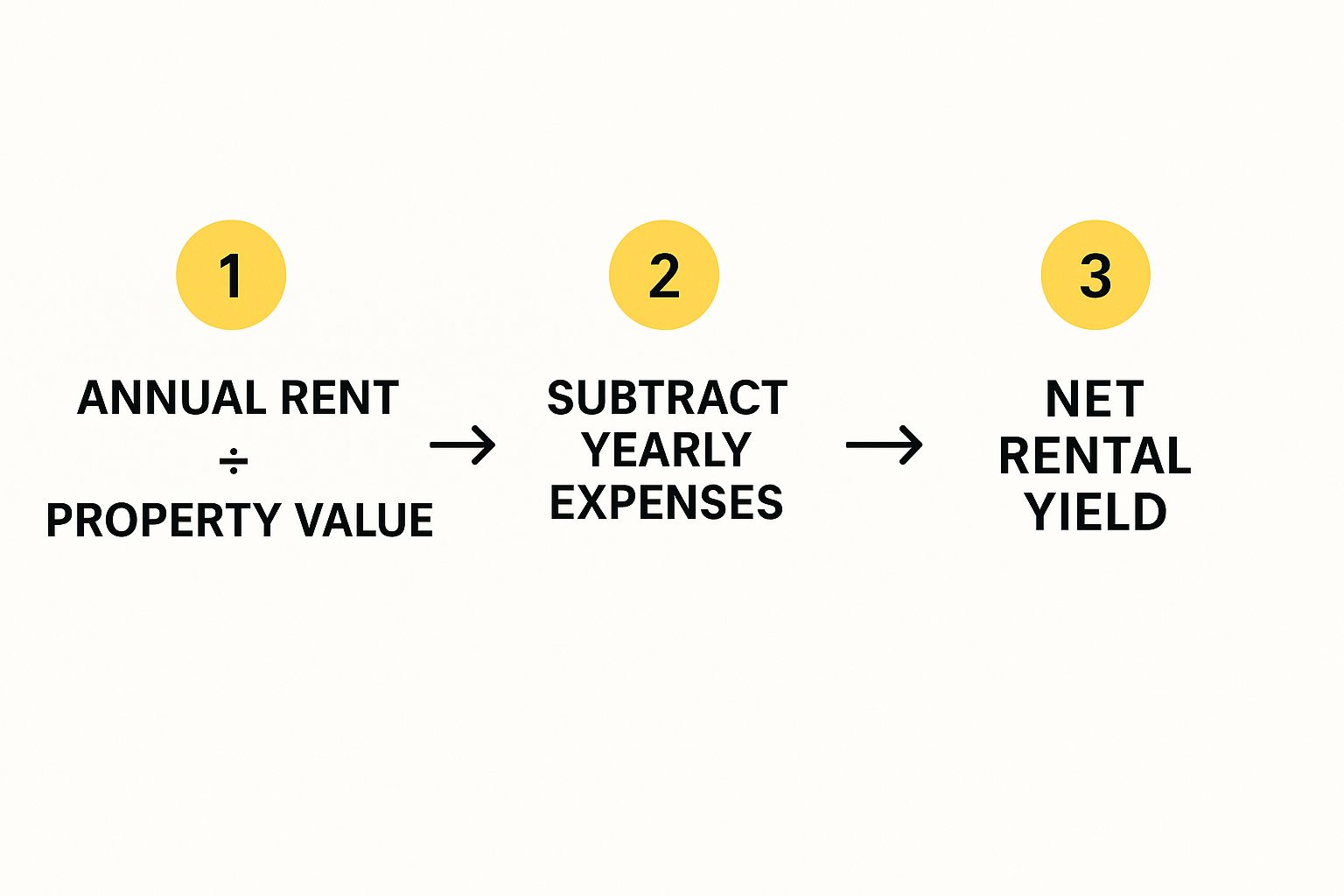

This visual breakdown shows how you go from the simple gross calculation to the more detailed net yield, which ultimately paints the true picture of profitability.

As you can see, the journey from gross income to actual profit involves subtracting all the necessary expenses—something we'll dive into next.

A Regional Perspective on Yields

The beauty of this calculation is that it’s a universal standard, which means you can easily compare opportunities across different markets. Take Dubai, for instance, where investors use the same method to gauge cash flow. Recent rental market research shows that surging rents have pushed prime gross yields there to around 5.3%, proving that strong rental income is a massive driver of returns, not just capital appreciation.

But here’s the crucial thing to remember: gross yield is only the first step. It’s an optimistic figure because it completely ignores all the running costs that will eat into your income. While it's fantastic for quick assessments, it doesn’t tell the full story. For that, you need to get into the details and calculate the net rental yield.

Finding Your True Profit with Net Rental Yield

While gross yield is a handy number for a quick first look, it only tells part of the story. Honestly, it’s an overly optimistic one. If you want to understand the real financial health of your investment, you absolutely must calculate the net rental yield.

This is the figure that shows you what’s actually left in your pocket after paying all the bills that come with owning a property. It’s your true profit.

Net yield paints a realistic picture because it forces you to face the real-world costs of being a landlord. Ignoring these expenses is a bit like a shop owner calculating their profit from total sales without subtracting the cost of goods, staff wages, or rent. It’s just not the full picture. For making genuinely smart investment decisions, net yield is the only number that matters.

Deconstructing the Net Yield Formula

The formula for net rental yield is a bit more involved, but the clarity it provides is well worth the extra step.

Here’s the breakdown:

[(Annual Rental Income – Annual Operating Expenses) / Total Property Cost] x 100

The key difference, of course, is Annual Operating Expenses. This is where I see so many new investors stumble. They either underestimate what these costs will be or, worse, forget to include certain items completely. This figure needs to be the sum of every single Dirham you spend over the year just to keep the property running and tenanted.

What to Include in Annual Operating Expenses

Getting your expenses right is everything. A comprehensive list protects you from nasty surprises down the line. Based on my experience, here are the non-negotiables you need to track:

- Property Taxes: The annual tax bill from the local municipality.

- Insurance: Essential building and landlord insurance. This is your safety net against damage and liability claims.

- Maintenance and Repairs: This covers everything from a dripping tap to repainting between tenants. As a solid rule of thumb, I always advise clients to budget 1-2% of the property’s value each year for this.

- Property Management Fees: If you’ve partnered with an agency like Rich Lion Properties to look after your investment, their fee (usually a percentage of the rent) goes right here.

- Vacancy Buffer: No property stays occupied 100% of the time. It’s just not realistic. Prudent investors always set aside 5-10% of the annual rent to cover potential empty periods.

Missing even one of these can seriously inflate your perceived yield, giving you a false sense of security about your investment's performance.

A Worked Example of Net Rental Yield

Let's go back to our Casablanca apartment example to see how this works in practice.

We already know these figures:

- Total Property Cost: 2,000,000 MAD

- Annual Rental Income: 120,000 MAD

Now, let's tally up the likely annual expenses based on common estimates.

| Expense Category | Estimated Annual Cost (MAD) |

|---|---|

| Property Taxes | 12,000 |

| Insurance | 4,000 |

| Maintenance (1% of value) | 20,000 |

| Vacancy Buffer (5% of rent) | 6,000 |

| Total Annual Expenses | 42,000 |

With our total expenses calculated, we can finally get to the real number.

[(120,000 MAD – 42,000 MAD) / 2,000,000 MAD] x 100 = 3.9%

So, while the gross yield looked like an attractive 6%, the reality is a more sober 3.9% net rental yield. This is the actual return your investment is generating. It's not just a number; it's the financial truth of your asset.

This stark difference shows exactly why you can't stop at the gross figure. A 3.9% return is a very different investment proposition than a 6% one, and having this clarity is what allows you to properly judge whether a property truly aligns with your financial goals.

What Really Drives Your Rental Yield?

Knowing the formulas for rental yield is a great start, but it's only half the story. The real art of property investment lies in understanding the forces that shape those numbers. Your property's profitability isn't just a figure on a spreadsheet; it's a dynamic result of real-world market conditions.

An experienced investor doesn’t just run the numbers—they dig into the why behind them. This is the key to moving beyond simple calculations and making truly strategic decisions that will protect and grow your returns for years to come.

The Power of Location

It’s the oldest rule in the property book for a reason: location is everything. The neighbourhood your property is in has a huge, direct impact on how much rent you can realistically charge and, by extension, your final yield.

Think about it. An apartment right in the heart of a bustling city centre, steps away from transport links and major employers, will always command a higher rent than a similar flat on the outskirts. It’s not just about convenience; it’s about tenant demand. Where demand is high, you have more leverage, and your yield will be healthier.

For example, a property in a neighbourhood known for its great schools, modern cafes, and safe, community feel won't just attract better tenants. It's also more likely to see stronger capital growth over time. Getting both high yield and appreciation is the ultimate goal for any serious investor.

Certain cities also offer unique advantages. If you're looking for high-growth potential, our guide on the top reasons to invest in Marrakech real estate in 2024 is a must-read.

Property Type and Condition

Next, you have to look at the property itself. Not all properties are created equal, especially when viewed through the lens of the rental market.

Here are a few things I always consider:

- Property Type: Is it a modern, well-designed apartment in a secure building or an older, larger villa that needs constant upkeep? Often, the former generates a better yield because it appeals to a wider pool of professional tenants. Demand for different property types can vary a lot between cities.

- Property Condition: A property that’s been recently renovated with a stylish kitchen or a new bathroom can justify a higher price tag. On the flip side, a tired-looking property won't just get you a lower rent—it'll probably sit empty for longer between tenants, which directly eats into your net yield.

- Amenities: Don't underestimate the small things. Features like secure parking, a balcony, access to a swimming pool, or 24/7 security can dramatically increase a property's rental appeal and value.

Local Economic Health and Market Demand

Finally, never evaluate a property in isolation. Its true potential is directly linked to the economic pulse of the city or region. An area that's seeing job growth, new infrastructure projects, and an influx of people will naturally have stronger rental demand.

This kind of economic energy creates a competitive rental market where landlords can confidently charge higher rents, pushing yields up. Conversely, a region with a stagnant economy often means flat or even falling rents. Smart investors always keep a close watch on local economic news—it’s one of the best predictors of how the rental market will perform in the future.

Practical Strategies to Increase Your Rental Yield

Once you’ve got a handle on how to work out rental yield, you're holding a powerful tool for measuring performance. But this isn't just a static number on a spreadsheet—it's a figure you can actively shape and improve. Boosting your property's yield is all about smart management and strategic improvements, turning what might be a good investment into a truly great one.

Simply sitting back and collecting rent can lead to stagnant returns. A more proactive approach, however, can significantly lift your profitability. The secret lies in focusing your efforts on changes that deliver the biggest impact for the lowest cost, which directly feeds the income side of your yield calculation.

Make Your Property More Desirable

One of the most straightforward ways to justify a higher rent is by enhancing the property itself. From my experience, tenants are almost always willing to pay a premium for a home that feels more attractive, modern, or convenient.

Think about these high-impact upgrades:

- Modernise the Kitchen: A fresh kitchen is a huge selling point. You don't always need a full gut job; sometimes updated appliances, new countertops, or even professionally repainted cabinets can completely transform the space.

- Update the Bathroom: Simple changes here go a long way. A new vanity, modern fixtures, or even just re-grouting tired tiles can make a bathroom feel cleaner and more luxurious.

- Add Desirable Features: If the property allows for it, think about adding an in-unit washing machine, installing air conditioning, or tidying up outdoor spaces like a small garden or balcony. These are features that will attract higher-paying tenants.

Another angle to consider is offering the property fully or partially furnished. This is particularly effective in markets with a lot of expats or professionals on temporary contracts. You're adding a layer of convenience that many renters will happily pay extra for.

Key Insight: Don't view strategic renovations as mere expenses. They are direct investments in your property's future earning potential. The goal is for the increase in annual rent to far outweigh the one-time cost of the upgrade, giving your yield a healthy boost.

Optimise Your Management Strategy

Physical upgrades are only one piece of the puzzle. How you actually manage your property and your tenants plays a massive role in maximising your returns and, just as importantly, minimising the expenses that eat into your net yield.

At its core, effective management is about maintaining consistent cash flow. Vacancy is the ultimate yield-killer, so your top priority should always be reducing empty periods between tenants. This involves more than just finding new people quickly; it's also about keeping the good ones you already have.

To tighten up your management, focus on these key areas:

- Minimise Vacancy Periods: As soon as you know a property will be available, get it marketed. Use high-quality photos and list it across multiple platforms to cast a wide net.

- Retain Good Tenants: Be a responsive landlord. When you address maintenance issues quickly and maintain a positive relationship, reliable tenants are far more likely to renew their leases. This saves you the headache and cost of finding someone new.

- Regularly Review Market Rents: The rental market isn't static. At least once a year, take the time to research what similar properties in your area are charging. This ensures your rent is competitive without being undervalued.

These actionable steps put you back in the driver's seat. If you're looking for a deeper dive into the market dynamics, you can explore why properties in Morocco are perfect for investment right now. By actively managing and improving your asset, you can ensure it performs at its absolute best.

Common Questions About Calculating Rental Yield

Once you’ve got the formulas down, you’ll find certain questions pop up again and again as you start plugging in numbers for actual properties. Getting these details right is absolutely essential. A small miscalculation can completely distort your view of how an investment is truly performing.

Let's walk through some of the most common questions I hear from investors. Nailing these answers is what takes you from just knowing the theory to applying it like a seasoned pro who can confidently spot a great opportunity.

What Is a Good Rental Yield?

This is the big one, isn't it? The truth is, there's no single magic number. It all comes down to the market you're in.

As a solid rule of thumb, most experienced investors I know are looking for a net rental yield somewhere between 4% and 7%. In really hot urban markets like Casablanca or high-demand tourist spots in Marrakech, you might see that figure creep even higher.

But that range is just a starting point. A "good" yield for you needs to be competitive with other local properties and also hold its own against completely different investments. For instance, if you could get a better return from the stock market with far less hassle, you have to seriously ask if the hands-on nature of property management is worth it.

Expert Insight: Don't get fixated on a high yield alone. A high yield in a shaky market is a much bigger gamble than a steady, moderate yield in a stable area poised for growth. Always look at the yield alongside the location's economic health and potential for capital growth.

Should Mortgage Payments Be Included in the Calculation?

This trips a lot of people up, but the answer is a clear and simple no.

Standard rental yield formulas are designed to measure the performance of the property itself, completely separate from how you chose to finance it. Think of it as grading the asset, not your personal loan situation.

If you’re interested in measuring the return on your own cash outlay, that’s a different metric entirely. It’s called cash-on-cash return, and it does include mortgage payments because its whole purpose is to analyse the return on the actual money that came out of your pocket.

For a true, apples-to-apples rental yield comparison between properties, always leave financing costs out of the equation.

How Do I Factor in Property Purchase Costs?

To get a truly accurate net yield, your "Total Property Cost" has to be more than just the price on the sales agreement. Forgetting this will make your yield look much better than it actually is, giving you a false sense of security.

You absolutely must include all the one-off costs of buying the property. This list usually includes:

- Legal fees for the transaction

- Property registration taxes (often called droits d'enregistrement)

- Inspection and valuation fees

- Any agent commissions you paid

Tallying these up and adding them to the purchase price gives you the real, all-in cost of your investment. Using this complete figure is the only way to get an honest assessment of your property's financial performance. For those looking to understand the full financial landscape, you can get more details when you decide to invest in Morocco real estate.

Ready to find a high-yield property investment in Morocco? The experts at Rich Lion Properties can guide you through every step, from market analysis to acquisition. Visit us today to start building your portfolio.