Before you even start browsing property listings in Morocco, you need to know what you can actually afford. Getting a clear financial picture from the outset is non-negotiable, and a simulation crédit immobilier bmce is your best first move. It’s a quick, no-strings-attached way to get a realistic handle on your borrowing power.

This simple online tool instantly shows you how tweaking your down payment or the loan term changes what you’ll pay each month.

Your First Step in Moroccan Property Financing

Walking into a meeting with a bank advisor without having run a simulation is like going into an exam without studying. This simple step gives you a solid foundation, turning a vague idea of "buying a home" into a tangible financial plan. It's essentially a financial dress rehearsal. You can play around with different numbers and scenarios, all from the comfort of your own home, ensuring the final decision truly fits your budget.

Taking this preliminary step is more than just a good idea; it's a strategic advantage.

- It grounds you in reality. You'll immediately see which properties are genuinely within your reach.

- It gives you confidence. You can have a much more productive conversation with a bank advisor when you already understand the basic mechanics of your potential loan.

- It saves you a ton of time. No more wasting hours on listings you can't afford. You can filter your search right from the start.

Navigating the BMCE Simulation Tool

Getting started with the Bank of Africa simulator is quite intuitive. The process boils down to adjusting three main inputs that shape your final estimate.

You'll see an interface that looks something like this, keeping things clean and simple.

The tool clearly prompts you for the project cost, your personal contribution, and the repayment period, making it easy to see how one change affects the others.

The two most critical fields are the 'montant du projet' (the total cost of your purchase) and your 'apport personnel' (your personal down payment). Don't underestimate the importance of your down payment. Moroccan banks typically expect a contribution of at least 20-30% of the property’s value, and sometimes more for non-resident buyers.

Expert Tip: My advice is to always be conservative here. Plug in a realistic, maybe even slightly cautious, estimate for your down payment and the property cost. It's far better to find out you can afford more than to have your hopes dashed later on.

The last piece of the puzzle is the 'durée de remboursement' (the repayment term). Stretching the loan over a longer period, like 20 or 25 years, means your monthly payments will be lower and more manageable. However, you'll end up paying more in total interest over the life of the loan. Playing with this slider in the simulation crédit immobilier bmce is a great way to visualise the direct trade-off between short-term affordability and long-term cost.

How Market Trends Shape Your Loan Simulation

When you run a simulation crédit immobilier bmce, you’re doing more than just crunching numbers based on your income. You’re tapping into the broader rhythm of the Moroccan real estate market. Lenders like BMCE Bank of Africa don't evaluate your file in isolation; their decisions are constantly being shaped by what’s happening in the market at large.

Think of it this way: factors completely beyond your control, like national property prices or the sheer number of homes being sold, can influence your simulation. A hot, active market might mean more competitive offers from banks. But when the market cools down, lenders naturally become more careful.

The Impact of Transaction Volumes

To see just how much the market can sway, you only need to look at recent figures. A report from Bank Al-Maghrib and other national agencies highlighted a significant drop in housing sales—down by a sharp 29.3% in just one quarter.

This slowdown, along with a 15.2% fall in the total number of transactions compared to the previous year, shows that buyers are becoming more hesitant. So, what does this actually mean for your mortgage simulation?

- Tighter Valuations: In a slow market, accurately pricing a property gets tricky. Banks often err on the side of caution, which could lead to a more conservative valuation of the home you want to buy.

- Loan-to-Value (LTV) Ratios: A lower-than-expected valuation directly affects your LTV ratio. This might mean the bank is willing to lend you less, requiring you to come up with a larger down payment.

- Higher Perceived Risk: A drop in transactions can signal economic uncertainty. For a bank, this can translate to higher perceived risk, potentially leading to stricter lending criteria or more thorough checks on your application.

A smart borrower knows their loan application is one piece of a much larger economic puzzle. If you keep an eye on market health, you can better understand the bank's perspective and go into your financing discussions with realistic expectations.

This kind of awareness is invaluable, especially for long-term investments. Even when the market dips, certain regions can still offer fantastic potential. For instance, you might find our insights on the top reasons to invest in Marrakech real estate in 2024 useful. By grasping these external forces, you can look at your simulation results not just as numbers, but as a strategic snapshot of your borrowing power in the current climate.

How Property Prices Directly Shape Your Mortgage

When you start playing with a simulation crédit immobilier bmce, you'll quickly realise one number matters more than any other: the price of the property you want to buy. This isn't just about the final sticker price; it's the foundation of your entire loan calculation.

Even a small change in the property's value can have a ripple effect, changing everything from your required down payment to the size of your monthly bill and the total interest you'll pay over the life of the loan. Why? Because it directly sets the loan-to-value (LTV) ratio—a critical figure banks use to gauge their risk. A lower price often means a lower LTV, making you a more attractive borrower.

The Real-World Effect of Price Shifts

Let's ground this in reality. Recent figures from the Bank for International Settlements showed Morocco's residential property price index easing slightly, from 103.2 down to 101 in the first quarter. That’s a real price adjustment of about -1.96% compared to the previous year. You can dig deeper into this data with these insights on Moroccan house prices from TheGlobalEconomy.com.

For someone looking to buy, this can be a mixed bag. A lower market price might bring your dream home within reach, but it could also make banks a bit more cautious with their own valuations.

From Property Price to Monthly Payments

As you adjust the property price in the BMCE simulator, watch how the mensualité (your monthly payment) responds instantly. A less expensive property means a smaller loan, which naturally leads to a more comfortable monthly outgoing. This is especially true if you’re looking in pricier markets, like the high-end districts of major cities. If that's your focus, our guide on what sets the Marrakech luxury property market apart offers some valuable context.

To truly grasp this, let's look at how changing the property price affects the numbers in a typical simulation.

Impact of Property Price Changes on a Sample Mortgage Simulation

This table demonstrates how a different property value can alter your loan details, even when the down payment and loan term stay the same.

| Property Value (MAD) | Loan Amount (MAD) | Simulated Monthly Payment (MAD) | Total Interest Paid (MAD) |

|---|---|---|---|

| 2,000,000 | 1,600,000 | 10,133 | 1,031,920 |

| 2,200,000 | 1,760,000 | 11,146 | 1,135,040 |

| 2,400,000 | 1,920,000 | 12,160 | 1,238,400 |

As you can see, a MAD 200,000 increase in property price results in a monthly payment jump of over MAD 1,000 and adds more than MAD 100,000 in total interest over the loan's term. This illustrates just how sensitive your mortgage is to the initial property cost.

The key lesson here is that the property's price does more than just set your budget. It fundamentally shapes the bank's perception of risk and dictates the kind of terms you’ll be offered. My advice? Run simulations for your best-case, worst-case, and most-likely scenarios.

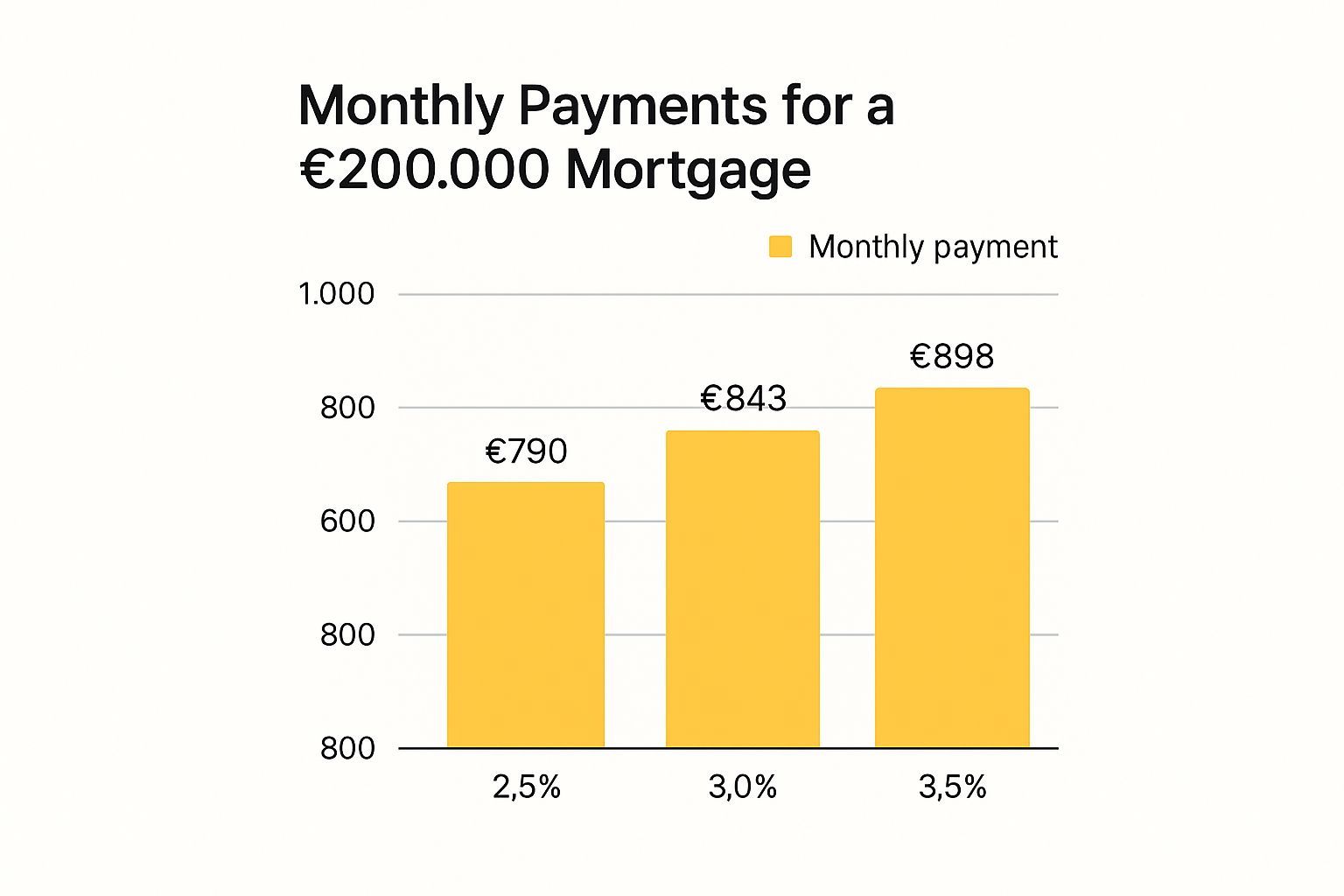

This relationship between price, risk, and rates is powerfully illustrated below. The infographic highlights how interest rate changes—often tied to market conditions and perceived risk—can dramatically inflate your monthly mortgage payment.

It’s a stark reminder: even a seemingly small 1% rise in your interest rate can lead to a surprisingly large increase in what you owe the bank each month.

Interpreting Your Simulation Results Like a Pro

Once you've plugged all your details into the simulation crédit immobilier bmce tool, you’ll see a summary of your potential loan. This screen isn't just a jumble of numbers; it's a blueprint for one of the biggest financial commitments you'll ever make. Taking the time to understand what each figure really means is absolutely crucial before you move forward.

The first number that usually jumps out is the 'mensualité', or your monthly payment. This is the core amount you'll owe the bank every month. You need to be honest with yourself: does this payment fit comfortably within your budget, leaving enough room for daily life, savings, and unexpected costs?

Decoding the Core Metrics

Beyond that initial monthly figure, a couple of other key numbers tell a much bigger story about the loan's structure and long-term impact.

- Taux d'intérêt (Interest Rate): This is the bank's fee for lending you the money. In Morocco, you'll typically see fixed rates between 4.2% and 4.75%, though this can vary based on your financial profile and the loan term. Even a small difference in the rate can save you a significant amount over the years.

- Coût total du crédit (Total Loan Cost): This is the real eye-opener. It shows you the total interest you'll pay over the entire life of the loan, on top of the original amount you borrowed. The number can be surprisingly large, but it's vital for understanding the true cost of buying your property.

Your simulation is a powerful planning tool. Always look beyond the monthly payment to the total cost of credit. This gives you the full financial picture and helps you decide if a shorter repayment period—even with higher monthly payments—might be the smarter long-term strategy.

Let’s put it into perspective. A MAD 500,000 loan at a 4.5% interest rate over 20 years might seem manageable with a MAD 3,164 monthly payment. However, the total cost of the credit alone is over MAD 259,000. Seeing that complete figure is what empowers you to make a truly informed and responsible financial decision.

How Regional Markets Affect Your Loan: A Marrakech Example

When you run a simulation crédit immobilier bmce, it’s easy to think of it as a purely financial calculation. But here’s something experienced buyers know: where you buy matters just as much as your personal finances. Morocco’s property market isn’t one big, uniform entity.

A loan for a modern apartment in Casablanca is viewed very differently by a lender than one for a holiday villa in Agadir. Banks like BMCE aren't just looking at your income; they’re assessing the risk and potential of the property itself, which is tied directly to its local market.

Diving Into The Marrakech Market

Let's get practical and look at Marrakech. This city offers a perfect case study because its property market is so distinctly divided. On one hand, you have the ancient Medina, a magnet for international investors chasing authentic, luxury riads. On the other, you have newer neighbourhoods like Targa, which appeal to local families seeking modern homes.

These two segments present completely different risk profiles for a lender. Financing a multi-million dirham riad that relies on the high-end tourist economy is a world away from a mortgage for a family home in a stable, growing suburb. So, when you enter your numbers into a simulator, the unspoken variable is always the specific type of property and its exact location. You can explore more about why Marrakech is a perfect holiday home location to see what makes it so attractive to different buyers.

Recent market analysis reinforces this split. There's a consistent, strong demand for traditional riads in historic zones, but we're also seeing a major shift towards villas with pools and gardens in the city's newer districts.

Key Takeaway: A smart borrower treats a loan simulation as a starting point, not a final promise. The bank's formal offer will always be tailored after they’ve evaluated the unique opportunities and risks of the specific property you’ve chosen.

Of course. Here is the rewritten section, designed to sound natural and expert-driven, following all your specific requirements.

Got Questions About the BMCE Mortgage Simulation? We've Got Answers

It’s completely normal to have a few questions when you start playing around with a bank's mortgage calculator. After all, this isn't just a simple online tool; it's the first step toward figuring out your property budget. Let's tackle some of the most common queries I hear from clients using the simulation crédit immobilier BMCE.

The biggest question is always about accuracy. Think of the simulator as a very reliable first draft. It gives you a solid, realistic estimate based on the numbers you provide, making it a fantastic tool for planning. It shows you what's possible.

But remember, it's not the final word. The official, binding mortgage offer from BMCE Bank of Africa will only be issued after their team has done a full deep-dive into your financial situation. That means verifying your income, reviewing your credit history, and appraising the property you want to buy.

So, You've Run the Numbers. What's Next?

Okay, you've completed the simulation and have a monthly payment figure in front of you. What do you do with that information? Here’s how to move forward intelligently.

-

Can I use this for any type of property? Absolutely. The calculator works just as well whether you're eyeing a chic apartment in Casablanca, a family villa near Marrakech, or a brand-new build. The key is to be as accurate as possible with the montant du projet (your total project cost).

-

How do I turn this simulation into a real mortgage? If the numbers look good and fit within your budget, it's time to make it official. The next step is to get in touch with a BMCE advisor. They'll guide you through the formal application process, where you'll need to submit the documents to back up the details you entered into the simulator.

Planning your property purchase in Morocco requires expert guidance. At Rich Lion Properties, we provide the market insights and support you need to make informed decisions. Learn more about how we can assist you on richlionproperties.com.