So, you're thinking about buying an apartment in Morocco. It's an exciting prospect, and for good reason. Whether you're dreaming of a sun-drenched holiday home, a smart rental investment, or a new place to live, Morocco’s property market is buzzing with opportunity. But before you get lost in listings, the first step—and the most important one—is to get a real feel for the landscape.

Getting to Grips with the Moroccan Property Market

Diving straight into the search without understanding the market is a bit like navigating a souk blindfolded. You might get lucky, but you're more likely to get lost. Morocco's real estate scene isn't one-size-fits-all; it's a mosaic of different cities, each with its own rhythm, price points, and buyer profile.

Taking the time to understand these nuances will pay off massively. It helps you set a realistic budget, zero in on the right locations, and spot the hidden gems with the best potential for growth.

A Tale of Three Cities: Where to Buy

The Moroccan property market really revolves around a few key urban centres, and they couldn't be more different. Marrakech, Casablanca, and Rabat are the big players, but each one is playing a completely different game.

- Marrakech: The legendary "Red City" is a magnet for international buyers and tourists, and that's its secret weapon. This constant flow of visitors keeps the property market incredibly resilient, even when other areas slow down. If generating rental income from tourism is your goal, Marrakech is hard to beat.

- Casablanca: This is Morocco's economic engine. Here, the market is driven by local professionals and families, not holidaymakers. You’ll find a huge stock of modern apartments perfect for city living, but be prepared for some of the highest prices in the country.

- Rabat: As the capital, Rabat has a very stable, upscale market. It's the preferred home for diplomats, government officials, and wealthy Moroccan families, which ensures steady demand for high-quality, well-located properties.

The latest numbers really tell the story. While the national property market has had its ups and downs, Marrakech has been a standout performer. In the first quarter of 2025, for instance, prices there edged up by 0.32% year-on-year—which, when you account for inflation, is a real-terms increase of 2.1%. Meanwhile, other major cities saw prices flatten or even dip slightly. This makes Marrakech a relatively safe harbour for anyone looking to acheter un appartement au Maroc. If you want to dig deeper, you can explore more detailed Moroccan property price trends to see the performance city by city.

To give you a clearer picture, here’s a quick comparison of the main hubs.

Moroccan Property Market Snapshot: Key Cities

This table offers a comparative look at average apartment prices and market characteristics in Morocco's major real estate hubs.

| City | Average Price per m² (Apartment) | Market Trend | Best For |

|---|---|---|---|

| Marrakech | MAD 15,000 – 25,000 | Resilient & Growing | Tourism rentals, holiday homes |

| Casablanca | MAD 18,000 – 30,000+ | Stable (High-End) | Long-term rentals, primary residences |

| Rabat | MAD 17,000 – 28,000 | Stable & Consistent | Families, professionals, secure investment |

| Tangier | MAD 12,000 – 20,000 | Strong Growth | International investors, port-driven economy |

| Agadir | MAD 10,000 – 18,000 | Seasonal Demand | Retirees, holiday apartments |

As you can see, the right city for you depends entirely on what you're trying to achieve with your purchase.

Modern Convenience or Traditional Charm?

Once you have a city in mind, what kind of property are you after? The choice often comes down to two very different lifestyles.

- Modern Apartments: These are typically found in new residential complexes, or résidences. They come with all the mod-cons you'd expect: swimming pools, 24/7 security, and underground parking. You'll find them all over Casablanca and in the newer parts of Marrakech like Guéliz.

- Traditional Riads: These are the classic Moroccan houses built around an internal courtyard, usually hidden away in the ancient medinas. They are stunningly beautiful but come with a catch: they often require significant upkeep and are better suited as guesthouses than a low-maintenance personal apartment.

- Seafront Properties: For many, the dream is an ocean view. Coastal cities like Tangier, Agadir, and Essaouira are full of apartments that offer just that, making them incredibly popular with holidaymakers and retirees.

My Two Cents: Your choice between a modern build and a traditional property boils down to your personal goals. If you want ease, convenience, and low maintenance, go for a new apartment. If you're seeking a unique cultural experience and a property with rental charm, a well-maintained riad could be perfect.

What Really Drives Property Value Here?

A smart buyer looks beyond the four walls of the apartment. In Morocco, several key forces shape property values, and knowing them can help you make a much shrewder investment.

Tourism is, without a doubt, a huge factor, especially in Marrakech and along the coast. Properties in areas with a heavy tourist footprint almost always have higher price tags and, more importantly, deliver better rental yields.

Keep an eye on infrastructure projects, too. The new tram lines in Casablanca and expansions to the national road network have sent property values soaring in the neighbourhoods they connect. Proximity to good amenities—international schools, modern shopping centres, and private clinics—is another massive plus. A savvy investor doesn't just buy an apartment; they buy into an area's future growth. This is the kind of strategic thinking that makes all the difference when you decide to acheter un appartement au Maroc.

Finding and Viewing Your Ideal Property

Alright, you’ve picked your city and you know the kind of apartment you’re after. Now for the exciting part—the hunt. While scrolling through property sites is a good way to get your bearings, the real secret to successfully acheter un appartement au Maroc is blending online research with solid, on-the-ground expertise.

Online listings give you a decent pulse on market prices, but they rarely paint the full picture. Trust me, many of the best deals, particularly in hot markets like Marrakech or Casablanca, are snapped up before they ever get listed online. These properties are often sold quietly through an agent's personal network.

This is exactly why a good agent immobilier (real estate agent) is worth their weight in gold. A well-connected local agent doesn't just find you listings; they get you access to off-market properties and help you dodge potential bullets. They know the city inside and out and can be your strongest advocate when it's time to negotiate.

Mastering the Art of the Property Viewing

It’s easy to walk into a viewing and get distracted by the stylish furniture and fresh coat of paint. But your job is to play detective. Look past the staging and get a real sense of the apartment's condition and long-term potential.

Don't just wander through—be systematic. Start with the building's fundamentals. Keep an eye out for signs of damp, hairline cracks in the walls, or shoddy finishes, as these can hint at bigger, more expensive problems down the line. And don't be shy! Turn on the taps, flush the toilets, and flick every light switch.

Expert Tip: One of the most overlooked yet crucial aspects is the ensoleillement, or how much sun the apartment gets. Try to visit at different times of the day. A space flooded with natural light feels entirely different from one that's constantly in shadow, and a dark, north-facing flat can be gloomy and costly to heat in winter.

Your Essential Viewing Checklist

Walking into a viewing with a clear plan helps you stay focused and catch details you might otherwise miss. I recommend organising your inspection around these key areas.

Structural and Maintenance Checks:

- Walls and Ceilings: Look for any water stains, persistent cracks, or even the slightest hint of mould.

- Windows and Doors: Do they seal properly? Is the glass single or double-glazed? This makes a huge difference for both noise and insulation.

- Plumbing and Electrics: Check the water pressure in both the kitchen and bathroom. Ask how old the electrical wiring is.

- Building Common Areas: Take a hard look at the entrance, stairs, and lift. If the common areas are poorly maintained, it’s often a red flag about how the building is managed.

Practical and Lifestyle Considerations:

- Noise Levels: Pause for a moment and just listen. Can you hear the neighbours, traffic, or nearby commercial activity?

- Storage Space: Is there enough built-in storage for your needs, or will you have to get creative (and spend more)?

- Neighbourhood Vibe: Take a walk around the block. Does it feel safe and welcoming? Note the proximity to shops, cafés, and public transport. For a deeper dive, check out our guide on how to choose the perfect property in Morocco.

Asking the Right Questions

What you see is only half the story. The questions you ask the agent or owner are just as critical for uncovering hidden costs and future headaches.

Have a list of questions ready before you even step through the door. For instance, always ask about the monthly frais de syndic (co-ownership or building maintenance fees). These can vary wildly from one building to another. It's also smart to ask about any major renovations the building has recently undergone or if any are planned for the near future—these could lead to a hefty special levy you weren't expecting. Finally, asking why the owner is selling can sometimes give you a little extra insight and leverage.

Securing Financing for Your Purchase

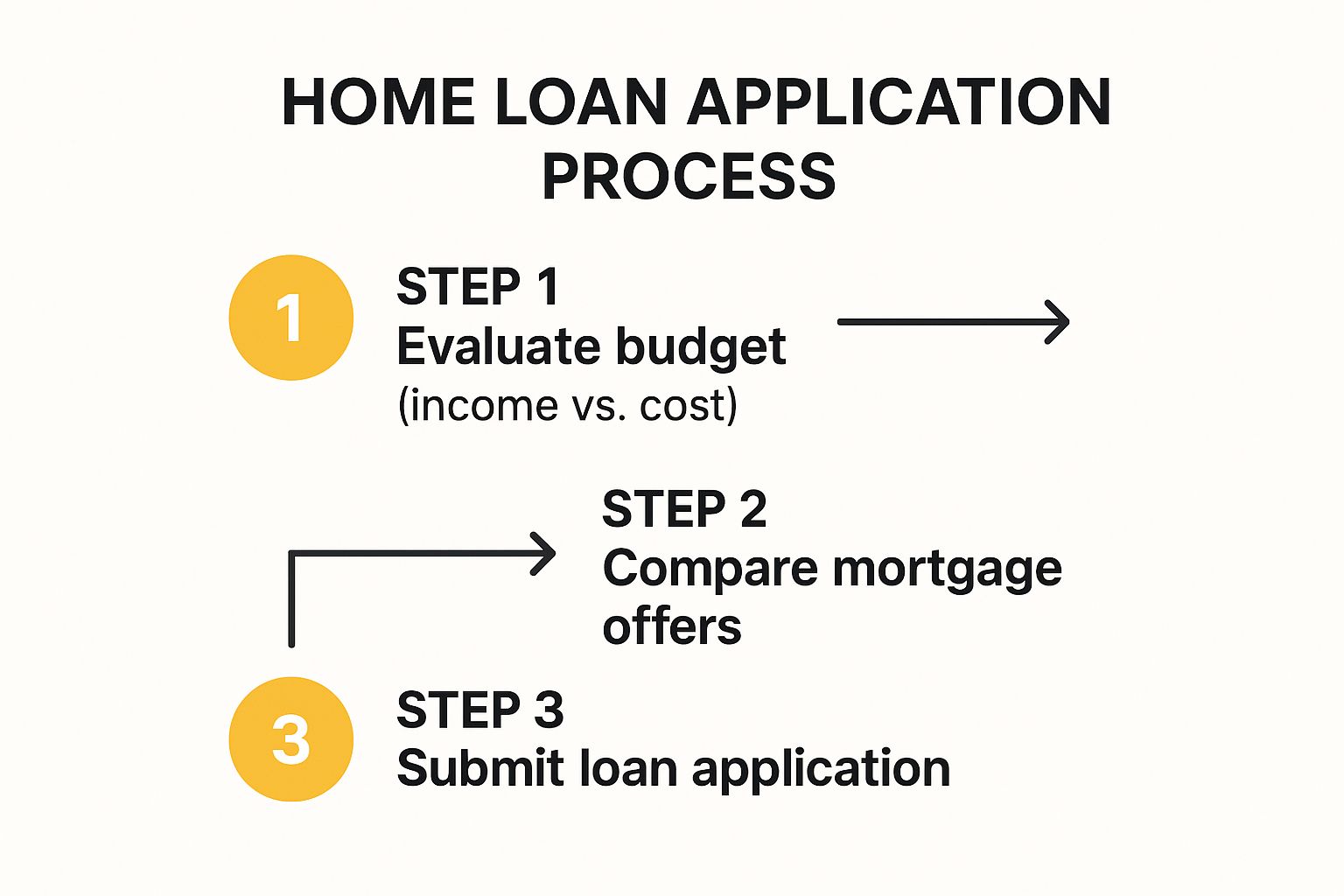

The infographic above breaks down the typical journey of getting a home loan, starting with a solid budget before you even sit down with a lender. It’s a great visual reminder that a successful mortgage application starts with a clear understanding of your own finances.

Understanding Mortgage Options in Morocco

Once you've found an apartment that feels like home, the next big question is how to finance it. For most buyers, this means getting a mortgage from a Moroccan bank. The good news is that financing is available to both residents and non-residents, but you'll find the terms and conditions can be quite different depending on your status.

Moroccan banks generally offer two main mortgage products. You have the fixed-rate mortgage, where the interest rate stays the same for the entire loan period, giving you predictable monthly payments. Then there's the variable-rate mortgage, where the rate can change with market fluctuations. This might start off cheaper, but it definitely carries more long-term risk.

A Word of Caution: That lower initial rate on a variable mortgage can be tempting, but it can quickly become a burden if market rates climb. For most buyers, especially those looking for long-term stability in their investment, a fixed-rate mortgage is almost always the safer bet.

The Down Payment and Required Documents

If you're a non-resident looking to acheter un appartement au Maroc, be prepared for a higher down payment. Banks will typically ask for 20% to 30% of the property's value upfront. Residents, on the other hand, can often secure a loan with as little as 10% down.

To get your application approved, you’ll need to assemble a detailed file of documents. Getting this organised ahead of time can make a world of difference and seriously speed up the process.

Typical Document Checklist:

- Proof of Identity: Your passport is a must. If you're a resident, you'll also need your Moroccan ID card (carte nationale).

- Proof of Income: The bank wants to see stability, so have your last three months of payslips, your employment contract, and recent bank statements ready.

- Tax Returns: Your last one or two years of tax returns will be needed to back up your income claims.

- Preliminary Sales Agreement (Compromis de Vente): This is the signed agreement that proves to the bank you have a committed deal on a specific property.

The bank's credit assessment is thorough. They'll dig into your income-to-debt ratio, savings, and overall financial health. A clean, well-documented financial profile is your single most powerful asset in getting that loan approved.

A Real-World Mortgage Scenario

Let's look at a real-life example. An expatriate couple, Alex and Sarah, wanted to buy a two-bedroom apartment in Marrakech for 1,500,000 MAD. As non-residents, the bank required a 30% down payment, which came to 450,000 MAD.

Their application hit a common snag: the bank found inconsistencies between their declared self-employment income and what their bank statements showed. To fix this, they hired an accountant who provided a certified letter explaining the income fluctuations and submitted extra business records. After a bit of back-and-forth, their loan for the remaining 1,050,000 MAD was approved with a fixed rate. It just goes to show how being proactive with your documentation can overcome these kinds of hurdles.

Opting for a Cash Purchase

If you're fortunate enough to be a cash buyer, the process is certainly faster, but it has its own strict rules. You can't just arrive with a suitcase of money—all funds must be moved through official banking channels.

You'll need to open a convertible dirham bank account in Morocco. This special account is designed to let you transfer foreign currency into the country, convert it to dirhams, and—crucially—repatriate the funds if you sell the property down the line. The notaire will require official documentation from your bank confirming the international transfer before the sale can be finalised.

Getting your funding sorted, whether through a bank loan or a direct transfer, is a critical step towards owning your piece of Morocco. If you're still exploring the market, you might find it helpful to learn more about why Morocco's real estate is worth your attention.

Navigating the Legal Process with a Notaire

Once your financing is lined up, you’re stepping into what is arguably the most critical phase of buying an apartment in Morocco: the legal process. This isn't something to be rushed. Moroccan property law has robust protections for both buyers and sellers, but navigating it successfully all comes down to one person—the notaire.

In Morocco, a notaire is more than just a lawyer; they are a public official appointed by the state. Their job is to act as a neutral third party, ensuring the entire transaction is above board, authenticating all the paperwork, and guaranteeing the legal transfer of ownership. Honestly, finding a good, reputable notaire is non-negotiable. They are your best defence against any potential legal headaches down the road.

The Notaire's Indispensable Role

Think of the notaire as the captain of the ship, expertly guiding your purchase through potentially tricky waters and safely into port. Their duties are comprehensive and legally required.

- Deep-Dive Due Diligence: The notaire will thoroughly investigate the property’s legal history and current status.

- Drafting and Authenticating Documents: They are responsible for preparing and certifying all official agreements, from the preliminary contract to the final deed.

- Managing Funds Securely: All your funds, including the deposit and final payment, are held in the notaire’s secure escrow account until the sale is finalised.

- Registering the Property: Once the deal is done, they handle the crucial final step of registering the property title in your name at the land registry.

This impartial oversight provides the security and finality that makes the whole process work. Their involvement is a cornerstone of any legitimate property deal in Morocco.

Verifying the All-Important Titre Foncier

The single most crucial document your notaire will scrutinise is the titre foncier—the property's title deed. This is the official certificate from the land registry (Agence Nationale de la Conservation Foncière, du Cadastre et de la Cartographie, or ANCFCC) that serves as undeniable proof of ownership.

Your notaire will pull a fresh, up-to-date certificate to confirm a few vital things. They’ll make sure the person selling the apartment is the actual, legitimate owner. They'll also check for any nasty surprises like existing mortgages, liens (hypothèques), or ongoing legal disputes tied to the property. A clean titre foncier is the green light you need to move forward with peace of mind.

Crucial Insight: Be very, very careful with properties offered without a definitive titre foncier. You might hear them referred to as 'Melkia'. While these are common with older, inherited family properties, a Melkia title just doesn't provide the same legal certainty. It can leave you vulnerable to future ownership claims or messy boundary disputes. For a secure investment, insisting on a registered titre foncier is a must.

Demystifying Key Legal Documents

The journey to getting your keys involves several specific legal documents, and it helps to know what they are before you see them. Your notaire will walk you through everything, but being prepared makes you a much more confident buyer.

The first major document you’ll encounter is the compromis de vente, which is the preliminary sales agreement. Don’t let the word "preliminary" fool you; this is a legally binding contract that locks in all the key terms of the sale.

What the Compromis de Vente Includes:

- Full identification of both you (the buyer) and the seller.

- A precise description of the apartment, including its registration number from the titre foncier.

- The final, agreed-upon sale price and the payment timeline.

- The deposit amount, which is usually between 5% and 10% of the purchase price.

- Any suspensive clauses (clauses suspensives), which are conditions that must be met for the sale to proceed—the most common one being "conditional on securing a mortgage."

Once this is signed, both you and the seller are committed. If you back out for a reason not covered in the suspensive clauses, you’ll almost certainly lose your deposit. If the seller pulls out, the standard penalty is that they must pay you back double the deposit.

When all the conditions are met and the final funds are in place, you'll sign the acte de vente, the final deed of sale. This is the document that makes the transfer of ownership official. This signing happens at the notaire’s office, where you’ll transfer the final payment. From there, the notaire registers the sale with the land registry, and just like that—you're officially a homeowner in Morocco.

Analysing Your Property's Investment Potential

Once the initial excitement of finding an apartment you love settles, it's time to put on your investor hat. Whether this property is for you to live in, to rent out, or simply to watch it grow in value, crunching the numbers is what separates a good purchase from a great investment when you acheter un appartement au Maroc.

The ability to generate income is often the biggest piece of the puzzle. Thanks to Morocco's dynamic tourism sector, especially in cities like Marrakech, the rental market is absolutely thriving. This opens up some fantastic opportunities for both long-term and short-term letting.

Evaluating Rental Income Streams

The first big decision you'll face is whether to go for a long-term or short-term rental strategy. Each path has its own rhythm, demands, and, of course, potential returns.

- Long-Term Rentals: This is your classic route to a steady, predictable income with far less tenant turnover. It’s a great fit if you're looking for stability and a more hands-off approach. This model works particularly well in business hubs like Casablanca and Rabat, where there's constant demand from professionals and families needing a place to live.

- Short-Term Rentals: On the flip side, platforms like Airbnb have completely changed the game in tourist hotspots. This can bring in much higher nightly rates and, ultimately, more revenue. But be prepared—it demands active management, savvy marketing, and being on call for your guests.

Take Marrakech, for example. The short-term rental scene there is on fire. A recent look at the numbers shows that an average Airbnb listing can pull in around MAD 179,000 (that's about $17,000) a year, with a solid 64% occupancy rate. With over 9,600 active rentals and relatively relaxed local rules, it's a powerful engine for returns. If you're a data geek, you can dig into more stats about the Airbnb market in Marrakech.

My Two Cents: Choosing between long and short-term lets is about more than just the money. It’s a lifestyle choice. Short-term rentals can be incredibly profitable, but you're essentially running a small hospitality business.

Calculating Your True Rental Yield

Here’s a classic mistake I see all the time: people get fixated on the potential monthly rent without adding up all the costs. To get a real, honest picture of your return, you need to calculate the net rental yield.

It's a simple formula: (Annual Rental Income – Annual Expenses) / Total Property Cost x 100.

Let's unpack what actually goes into that calculation so you don't miss a thing.

1. Total Property Cost: This isn't just the sticker price.

- The purchase price

- Notary fees

- Registration taxes

- Agency commissions

- Any immediate costs for renovations or furniture

2. Annual Expenses: These are the recurring costs that eat into your profit.

- Frais de syndic (the building's service and maintenance charges)

- Property taxes (taxe d'habitation and taxe de services communaux)

- Building insurance

- A fund for maintenance and repairs (I always advise clients to set aside 1% of the property's value each year)

- Utilities, if they aren't covered by the tenant

- Property management fees, if you decide to hire an agency to handle things for you

When you calculate this properly, you stop guessing and start making a real financial projection. This data-driven thinking is what allows you to confidently compare different apartments and find the one that truly fits your financial goals. To get a better sense of the market's potential, you should check out our guide on the top reasons to invest in Marrakech real estate in 2024.

Closing the Deal and Managing Your New Home

After all the searching, viewings, and diligent legal checks, you've finally arrived at the most rewarding part of the journey. This is the moment your plan to acheter un appartement au Maroc truly comes to life. It all happens at the notaire's office, where you'll sign the final deed of sale, known as the acte de vente.

This meeting is the official handover. You’ll transfer the remaining balance of the purchase price, and in return, you'll receive the keys to your new apartment. It’s an exciting milestone, but it's crucial to be prepared for the closing costs—the last set of fees that make the property legally yours.

Understanding Your Final Closing Costs

If you've budgeted well, there shouldn't be any last-minute financial surprises. Closing costs in Morocco are fairly standard, typically falling somewhere between 6% and 8% of the property’s purchase price. This amount bundles together the various taxes and professional fees needed to finalise your ownership.

Here’s a breakdown of what that figure usually covers:

- Notary Fees (Frais de Notaire): This is the government-regulated fee for the notaire’s professional services, generally around 1% to 1.5% of the property value.

- Registration Tax (Droits d'Enregistrement): A government tax to register the sale, which is calculated at a standard rate of 4%.

- Land Registry Fee (Conservation Foncière): This fee, set at 1.5%, is for officially updating the land registry and title deed with your name as the new owner.

- Miscellaneous Fees: You'll also see a small charge for administrative odds and ends like stamps and certificates, often called timbres.

A Practical Example: For an apartment bought at 1,500,000 MAD, a smart move is to budget an extra 90,000 MAD to 120,000 MAD (the 6-8%) to cover all these closing expenses without any stress.

Your First Steps as a New Homeowner

With the keys in your hand, your role shifts from buyer to homeowner. The first few weeks are all about ticking off a few administrative boxes to get settled in. Taking care of these tasks right away makes for a much smoother transition.

Your first priority should be getting the utility accounts—electricity and water—transferred into your name. This typically means a quick trip to the local provider's office with your new title deed and ID. At the same time, you can look into arranging for internet and television services.

Working with the Syndic and Paying Property Taxes

Living in a Moroccan apartment building means becoming part of a co-ownership, which is managed by a residents' association called the syndic de copropriété. The syndic is in charge of maintaining and managing all the common areas, from the lobby and lift to any pools or gardens.

Make a point to introduce yourself to the syndic or building manager soon after you move in. It’s the best way to get a clear understanding of the building's rules and set up your monthly payments for the syndic fees. These fees are a standard part of apartment life, covering the upkeep of all shared spaces.

Finally, don't forget about property taxes. There are two main ones to be aware of: the taxe d'habitation (residence tax) and the taxe de services communaux (municipal services tax). Often, the notaire can help with the initial registration, ensuring the local tax office has your details on file for future billing.

Still Have Questions About Buying Property in Morocco?

Even with a comprehensive guide, it's natural to have a few lingering questions when you're ready to acheter un appartement au maroc. Let's tackle some of the most common queries we hear from buyers, giving you the clear answers you need to proceed with confidence.

Can a Foreigner Actually Buy Property in Morocco?

Yes, absolutely. The process is quite welcoming for foreign nationals. You have the same rights as a Moroccan citizen to purchase freehold property, as long as it comes with a definitive title deed, known as a titre foncier.

The only real restriction is on agricultural land, which foreigners can't own outright but can lease for periods of up to 99 years. This means buying an apartment in a city like Marrakech, Casablanca, or Tangier is typically a very smooth and secure process.

What Are the Day-to-Day Costs of Owning an Apartment?

Once you have the keys, you'll need to budget for a few recurring annual expenses. The good news is these costs are generally quite reasonable.

- Property Taxes: You'll encounter two main taxes: the taxe d'habitation (residence tax) and the taxe de services communaux (municipal services tax).

- Syndic Fees: Think of these as your monthly homeowners' association or co-ownership fees. They cover the upkeep of common areas like lifts, gardens, swimming pools, and security.

- Utilities: Your standard electricity, water, and internet bills will be in your name.

- Insurance: It’s always a smart move to get building and contents insurance to protect your investment.

To give you a real-world idea, owning an apartment in Morocco is often more affordable than in many European countries. For a typical two-bedroom flat in Marrakech, you can expect your annual property taxes to fall somewhere between 2,000 and 5,000 MAD.

If I Sell, Can I Take My Money Out of the Country?

This is a critical question, and the answer is yes, you can. Morocco has a well-defined system for repatriating funds, but it all hinges on getting the initial transfer right.

The key is to bring your purchase funds into Morocco through a convertible dirham bank account. Your bank will provide official certification of this transfer, which acts as your proof for the Office des Changes (the Foreign Exchange Office).

When the time comes to sell, this initial documentation is your golden ticket. It allows you to transfer the full proceeds of the sale, including any capital gains, back out of Morocco in your original currency without any hassle.

Navigating the Moroccan property market can feel complex, but you don't have to go it alone. At Rich Lion Properties, our experienced team is on the ground to guide you through every single step, ensuring your purchase is both secure and successful. Start your property search with us today!