Thinking about buying an apartment in Casablanca? You’re looking at a fantastic opportunity in the heart of Morocco's economic engine. The city is a vibrant mix of modern ambition and deep-rooted culture, making it an incredible place to live and a smart place to invest. But to do it right, you need to understand what makes its property market tick.

Getting to Grips with the Casablanca Property Market

Casablanca is more than just Morocco's biggest city—it’s the core of its business and social life. This constant buzz is what powers its real estate market, creating a dynamic landscape that's full of potential if you know where to look.

Unlike cities that rely heavily on seasonal tourism, Casablanca’s market is built on a solid foundation: a strong local economy, a rising professional class, and serious foreign investment. This creates a stable and consistently growing environment for property owners.

The city’s charm is its diversity. You can find everything from fast-paced business hubs to quiet, leafy residential streets. The first real step in your buying journey is figuring out which of these unique areas fits your lifestyle and financial goals. To get a better feel for the city's day-to-day rhythm, have a look at our guide on https://richlionproperties.com/living-in-casablanca-morocco/.

Why Casablanca is a Top-Tier Investment Hub

So, what makes Casablanca stand out? A few key things. The city is always evolving, with major infrastructure projects like the tramway expansion and the development of new business districts. This kind of forward-thinking urban planning constantly boosts the value of nearby properties, which is great news for long-term appreciation.

On top of that, Casablanca draws a wide range of people—young professionals, families, and expats alike. This creates a constant, healthy demand for good housing. For investors, this translates into a dependable rental market and a reliable income stream. It all adds up to a secure and promising place to put your money.

Casablanca offers a mature yet growing market. While other cities might be at the mercy of tourism trends, property values here are supported by real economic activity and local demand. That makes for a much more stable investment.

Understanding the Vibe of Key Neighbourhoods

Every district in Casablanca has its own distinct flavour and price range. Finding the right fit is everything.

Here’s a quick rundown of some of the most popular areas:

- Sidi Maârouf & Casablanca Finance City: Think of these as the modern, beating heart of Casablanca's business scene. They're packed with sleek, contemporary apartment buildings and are perfect for professionals who want to be close to the action.

- Racine & Gauthier: These central neighbourhoods are effortlessly chic and upscale. You'll find a fantastic mix of luxury apartments, stylish boutiques, and some of the city's best restaurants. It’s the place to be if you’re after a cosmopolitan lifestyle.

- Anfa & Corniche: For the absolute pinnacle of prestigious living, look no further. Offering breathtaking ocean views, these areas feature a mix of high-end apartments and sprawling villas. The prices are higher, but the quality of life is simply unmatched.

The market data backs this up. Apartments are overwhelmingly the most popular property type, making up around 66% of all buyer searches. Neighbourhoods like Sidi Maârouf and Racine are especially hot right now, with prices ticking up due to high demand. Government initiatives aimed at helping homebuyers are also fuelling this trend, making it a bit easier for people to get on the property ladder. A solid understanding of these dynamics is the foundation for making a truly smart purchase.

Getting Your Finances in Order

Diving into Casablanca's property market is exciting, but the real first step isn't scrolling through listings—it's getting your finances rock-solid. Before you fall in love with a view of the Hassan II Mosque, you need a crystal-clear understanding of the total cost. The price you see on an advert is just the beginning of the story.

A common mistake I see buyers make is fixating on the sale price alone. In Morocco, you need to budget for what are known as acquisition fees, which typically add an extra 7% to 10% on top of the property's declared value. Overlooking this can quickly turn your dream home into a financial headache.

Looking Beyond the Sale Price

The real number you’ll be paying for your Casablanca apartment is a sum of the sale price plus several other essential fees. Knowing these from the get-go is the key to creating a budget that actually works.

Let’s break down the main costs you can expect:

- Notary Fees (Frais de Notaire): The notary is a neutral, state-appointed legal expert who makes the sale official. Their fee is usually around 1% to 1.5% of the sale price.

- Registration Tax (Droits d'Enregistrement): This is a government tax, set at about 4% for residential property, to officially log the transfer of ownership.

- Land Registry Fees (Conservation Foncière): This fee covers the cost of updating the official property records with your name. It’s typically 1% of the value, plus a small fixed administrative charge.

- Real Estate Agency Commission: If you’re using an agent, their fee is generally 2.5% (+VAT) of the purchase price. This is often split down the middle between the buyer and the seller, but it's always good to confirm.

A crucial tip: these percentages are based on the declared sale price. Early on, ask your notary for a detailed cost simulation (simulation des frais). This will give you a precise breakdown for your specific purchase, leaving no room for surprises.

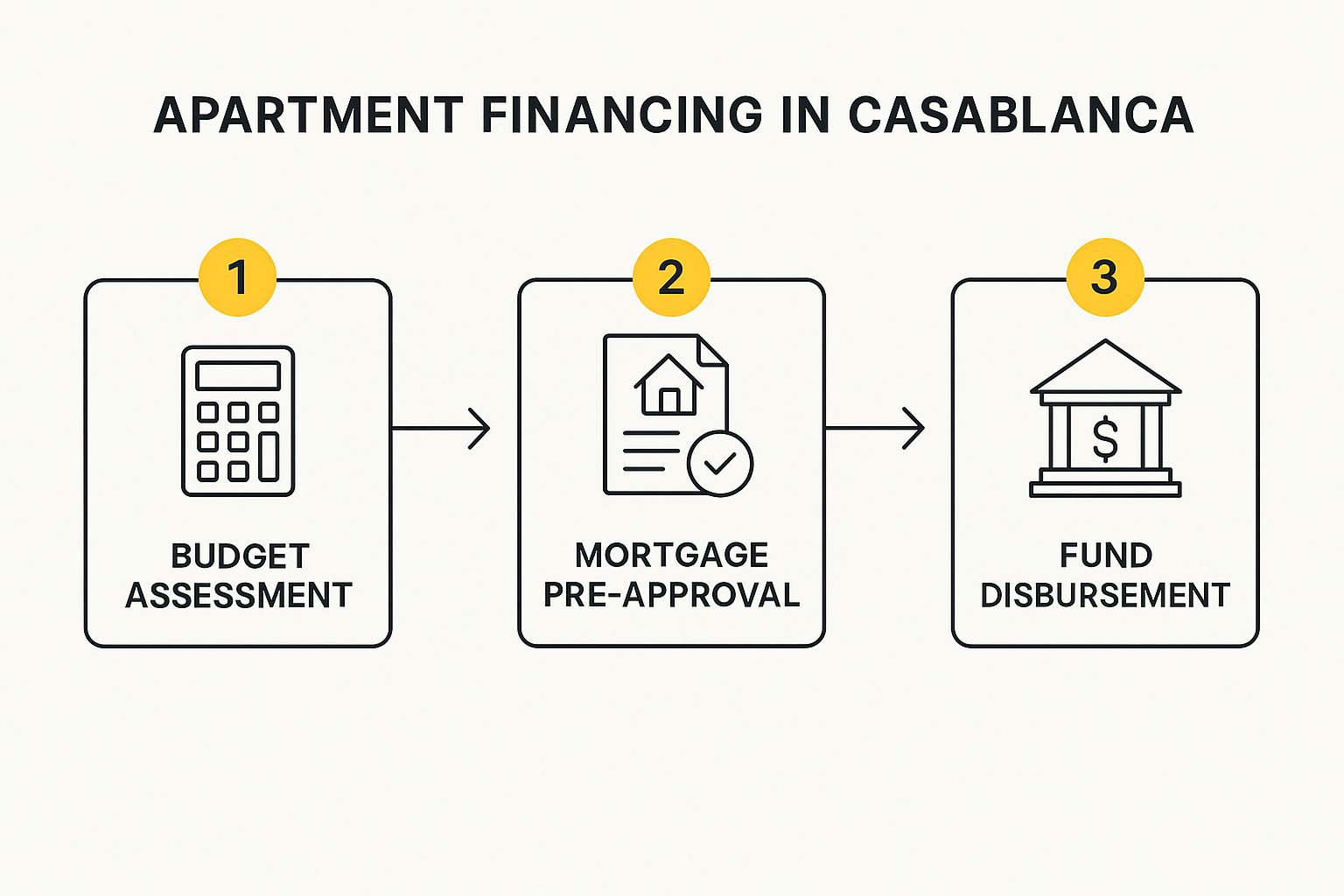

Arranging Your Financing

Once you have a handle on the total investment, it's time to think about how you'll pay for it. For most buyers, this means getting a mortgage, or crédit immobilier, from a local Moroccan bank. The market here is quite competitive, so it really pays to shop around for the best terms and rates.

Your success in securing a loan will come down to your financial health. Banks will take a close look at your income, how stable it is, any existing debt you have, and the size of your down payment (apport personnel). Putting down a larger deposit not only makes you a more attractive borrower but can also unlock better interest rates.

To get a realistic sense of what properties cost across the city, it’s worth checking our guide on the Casablanca property price reference.

The Smart Move: Mortgage Pre-Approval

Here’s a piece of advice I give every serious buyer: get pre-approved for a mortgage before you start your property search in earnest. Walking into a viewing with a pre-approval letter from a bank signals to sellers that you're not just a window shopper; you're a qualified buyer ready to make a move. It gives you serious leverage when it's time to negotiate.

To get the ball rolling, you'll need to pull together some documents. Each bank has a slightly different checklist, but you can get a head start by preparing these essentials:

- Proof of Identity: Your Moroccan ID card (CIN) or passport.

- Proof of Income: Your last three payslips, your employment contract, and a letter from your employer (attestation de travail).

- Bank Statements: Statements from the last three to six months to show your savings and spending patterns.

- Credit History: The bank will run a check on any existing loans or lines of credit.

Having all your paperwork in order from day one makes the entire process smoother. It shows the lender you're organised and serious, which sets a positive and professional tone for the entire journey.

Finding Your Ideal Apartment and Verifying Its Legitimacy

With your budget sorted, you can finally dive into the exciting part: the hunt for your new home. Looking for the right achat appartement Maroc Casablanca is really about a two-pronged attack: smart online searching combined with old-school, on-the-ground legwork. Trust me, the best way to find those hidden gems is by balancing both.

Of course, start with the big online players like Mubawab, Sarouty, and Avito. They’re fantastic for getting a broad sense of what’s out there and helping you filter by neighbourhood, price, and size. But don't stop there.

Many of the best properties, especially in sought-after older buildings, never even make it online. They’re snapped up through local real estate agencies (agences immobilières). A well-connected agent knows the city inside and out and often gets wind of listings before they go public, giving you a serious head start.

Making the Most of Property Viewings

Once you’ve got a shortlist, it's time for viewings. This is your chance to see past the professional photos and really gauge the apartment's condition and potential. It's easy to be wowed by a new coat of paint or a modern kitchen, but your real focus should be on the things you can't easily change.

Here’s what I always look for during a viewing:

- Structural Health: Scan for any tell-tale signs of damp, cracks in the walls, or stains on the ceiling. These can signal bigger, more expensive problems with plumbing or even the building's integrity.

- Light and Orientation: How does the light hit the apartment? In Casablanca, getting this right can make a huge difference to the feel of a space and can even help keep your utility bills down.

- Building Upkeep: Take a good look at the common areas—the entrance, the lift, the stairways. A well-maintained building is usually a sign of a well-run and proactive residents' association (syndic).

- The Neighbourhood Vibe: Don't just visit once. Pop by on a weekday morning and then again on a weekend evening. This gives you a much more realistic picture of the noise, traffic, and general atmosphere.

Don’t be afraid to ask direct questions. Get details on the age of the plumbing and wiring, find out the monthly syndic fees, and ask if any major building works are planned. A serious seller or agent will have this information handy.

The All-Important Due Diligence

Finding an apartment you love is a great feeling, but verifying that it's a sound, legal investment is what truly matters. This due diligence phase is absolutely non-negotiable in Morocco. The single most critical document is the 'titre foncier'—the official property title deed.

This is the ultimate proof of ownership. Registered with the National Agency for Land Conservation, Cadastre, and Cartography (ANCFCC), it provides an ironclad record of the property's legal status, its precise measurements, and any mortgages or liens (hypothèques) held against it.

An apartment without a clean 'titre foncier' is a massive red flag. Your notary (notaire) is your most important ally here; they will conduct an official search to confirm the title is clear and that the seller has the undisputed right to sell.

But the title deed is just the beginning. To ensure total transparency, there are a handful of other documents you need to get your hands on.

Essential Document Checklist for Buyers in Casablanca

Before you get close to signing anything, you or your notary must meticulously review a specific set of documents. This checklist covers the core paperwork needed to protect your investment and ensure a smooth transaction.

| Document Name (French) | Document Name (English) | Purpose and What to Check |

|---|---|---|

| Titre Foncier | Property Title Deed | The master document. Verify the seller's name, property details, and ensure there are no outstanding liens or legal disputes. |

| Plan Cadastral | Cadastral Plan | This official map shows the exact boundaries and layout of the apartment. It must match the physical property perfectly. |

| Permis d'Habiter | Certificate of Occupancy | Confirms the building was constructed in compliance with building codes and is legally habitable. This is vital for new constructions. |

| Attestation de Syndic | Co-ownership Certificate | A letter from the building's syndic confirming the seller is up-to-date with all co-ownership fees. |

| Quitus Fiscal | Tax Clearance Certificate | Proof that all property-related taxes, like the 'taxe d'habitation', have been paid by the current owner. |

It might feel like a lot of paperwork, but this verification process is the foundation of a secure purchase. Insisting on seeing and validating every single one of these documents is the only way to safeguard your investment and make sure your achat appartement Maroc Casablanca goes off without a hitch. It's the peace of mind you need to move forward with confidence.

Navigating the Legal Journey to Ownership

Once you've done your due diligence and are confident about the apartment, you'll move into the most formal part of the process: the legal transfer of ownership. This isn’t a stage to be rushed when undertaking an achat appartement Maroc Casablanca. It’s a carefully structured process, and at the centre of it all is a key figure in Moroccan property law.

Every property transaction here is handled by a 'notaire' (notary). It's important to understand they aren't like a lawyer who represents one side. The notaire is a neutral, state-appointed official whose job is to make sure the sale is fair, transparent, and legally watertight for both you and the seller. They are the guardians of the entire transaction.

The Cornerstone Contract: The Compromis de Vente

After your offer is accepted, the first major legal step is signing the 'compromis de vente', or the preliminary sales agreement. This is far more than an informal handshake; it's a legally binding contract that commits both parties to the sale. It effectively takes the property off the market and sets the wheels in motion for the final transfer.

This document is incredibly thorough, detailing every single term you've agreed upon.

- Identities: Full legal details of both the buyer and the seller.

- Property Description: An exact description of the apartment, which must match the details on the official title deed ('titre foncier').

- Agreed Price: The final sale price you negotiated.

- Deposit Amount: The 'avance' or 'acompte', which is usually 10% of the purchase price. This is held in a secure account by the notaire.

- Suspensive Clauses: Any 'get-out' clauses. The most common one is a condition making the sale dependent on you securing a mortgage.

- Completion Date: A target date for signing the final deed.

You should treat the 'compromis de vente' as the definitive blueprint for the sale. Once it's signed, backing out without a valid legal reason (like your mortgage falling through, if that's a condition) will almost certainly mean forfeiting your deposit.

The Role of the Notaire Unveiled

In the weeks between signing the preliminary agreement and the final deed, your notaire is hard at work behind the scenes. They conduct a whole series of checks to ensure there are no hidden surprises and that the title can be transferred cleanly. They'll verify that all property taxes are paid up and confirm there are no liens or legal claims against the apartment.

Budgeting for all the associated costs is critical. For a clear breakdown of these expenses, it's worth reading our detailed guide on notary fees in Morocco. If you're getting a mortgage, this is also when your bank will be doing its final checks before preparing the funds for transfer. The legal and financial processes essentially run in parallel at this point, both heading towards the final signing.

As you can see, each step logically follows the last, which really highlights why having a solid financial plan is a must before you even get to the legal phase.

It's also reassuring to know you're investing in a stable market. Moroccan house prices recently posted a 0.8% year-over-year increase, which points to a steady, reliable environment for property buyers. This stability, often supported by government initiatives, makes Casablanca an attractive place to own a home.

The Final Act: The Acte de Vente

The culmination of your entire journey is signing the 'acte de vente'—the final deed of sale. This is the moment when ownership officially passes to you. The signing happens at the notaire’s office, with you and the seller both present.

Before you put pen to paper, the notaire will read the entire deed aloud. This is done to ensure everyone understands all the terms and that everything is exactly as agreed. It's your last chance to ask any questions.

Once everyone is satisfied, the documents are signed. The remaining balance of the purchase price is then transferred from the notaire’s secure escrow account to the seller. At that moment, you'll be handed the keys to your new home and an 'attestation of ownership'. The notaire then takes care of registering the new title deed in your name with the Land Registry, a process that can take a few weeks to finalise, but rest assured, your ownership is legally secure from the second you sign.

Securing the Best Deal and Finalising Your Purchase

You’ve found the perfect apartment, the paperwork checks out, and your financing is lined up. Now for the exciting part—turning a good deal into a great one. Don't be shy; negotiation is a completely normal, expected step when you achat appartement Maroc Casablanca. A thoughtful, respectful approach here can make a real difference to your final price.

In Morocco, it's often more about the relationship than a cold, hard transaction. Building a good rapport with the seller or their agent can sometimes be more powerful than just throwing out a lowball number. Your first offer should always be grounded in reality, backed by your market research and a clear-eyed assessment of the apartment's condition.

Did your inspection turn up some tired plumbing or windows that have seen better days? These are your leverage points. When you make your offer, frame it not just as a price, but as a fair valuation that reflects the money you'll need to spend to bring the place up to scratch.

Crafting a Compelling Offer

A strong offer is about more than just the price tag; it's about showing you're a serious, reliable buyer who won't waste anyone's time. This is where your mortgage pre-approval is worth its weight in gold. Waving that piece of paper proves you have the funds ready to go and can close the deal without any last-minute drama.

Beyond the headline price, there are other creative ways to negotiate value into your purchase. Think about asking for things like:

- Included Fixtures and Furnishings: If the apartment has fantastic kitchen appliances, custom wardrobes, or air conditioning units, it's perfectly reasonable to negotiate for them to be included in the sale.

- Closing Date Flexibility: Sometimes, being able to close on a date that suits the seller's schedule can make your offer stand out, even if it isn't the highest bid.

- Minor Repairs: As a condition of the sale, you can ask the seller to take care of specific small repairs before you get the keys.

Your offer needs to be in writing, usually submitted through your agent or directly to the seller's notary. A clear, well-organised offer detailing every condition shows you mean business and sets a professional tone for the rest of the process.

Knowing the local market trends gives you a real advantage. For example, while the high-end market remains strong, the wider Casablanca property scene has seen some minor price adjustments lately. In the first quarter of the year, residential prices actually dipped by 0.1% compared to the previous year. This suggests that while prime real estate holds its value, there's definitely wiggle room in other segments. You can find more Moroccan property price history on globalpropertyguide.com to inform your strategy.

The Final Walkthrough and Closing Day

Once your offer is accepted and the preliminary contract (compromis de vente) is signed, you're on the home stretch. Right before the final signing at the notary's office, you must do a final walkthrough of the apartment. This is your last chance to make sure everything is exactly as you agreed.

Use this visit to confirm that any negotiated repairs are done and all the fixtures you asked for are still there. Flick the light switches, run the taps, and test the appliances that are part of the deal. The whole point is to avoid any unwelcome surprises on closing day.

Closing day itself is a formal affair at the notary’s office, where you'll sign the final deed of sale (acte de vente). The notary will read the entire document aloud to make sure everyone understands and agrees to the terms. Then, the rest of the money, which has been sitting safely in the notary's escrow account, is finally transferred to the seller.

With the ink dry and the payment made, it’s official. You’ll be handed an attestation of ownership and, the best part, the keys to your new home. Your achat appartement Maroc Casablanca journey is complete—congratulations on becoming a homeowner in this incredible city.

Answering Your Key Questions About Buying in Casablanca

Stepping into the Casablanca property market often comes with a lot of questions, especially if you're a first-time buyer or new to how things work in Morocco. Getting straight answers is the best way to feel confident about your decisions. Let's tackle some of the most common queries we hear from buyers.

Think of this as your go-to guide for the big questions. These are the details that can sometimes feel overwhelming, so having the facts upfront will make your entire experience feel much more straightforward.

Can Foreigners Buy Property in Casablanca?

This is easily the question we get asked most often, and the answer is a clear and simple yes. Foreign nationals have the exact same rights as Moroccan citizens when it's time to purchase a titled property, known as a ‘titre foncier’, within city limits like Casablanca. There are no special hoops to jump through or restrictions that prevent you from owning an apartment outright.

The legal system here is built to be welcoming. It ensures the process for registering and securing your ownership is the same for everyone. The most important piece of advice for any buyer—Moroccan or foreign—is to work with a trusted ‘notaire’ (notary). They are your legal expert, handling all the paperwork to make sure your investment is completely secure. It's just worth remembering that these rules apply to urban properties; buying agricultural land as a non-Moroccan is restricted.

What Are the Typical Closing Costs?

One of the biggest mistakes buyers make is forgetting to budget for the costs on top of the apartment's sale price. A good rule of thumb is to set aside an extra 7% to 10% of the purchase price to cover all the closing expenses.

These costs, often grouped together as 'frais de notaire', are actually made up of several different fees:

- Notary Fees: This is the notary's professional fee, usually between 1% and 1.5% of the property’s value.

- Property Registration Tax: A government tax that sits around 4% for residential properties.

- Land Registry Fees: A fee of about 1% to officially update the land registry with your name.

- Agency Commission: If a real estate agent helped you find your place, their commission is also settled at this stage.

Pro Tip: Always ask your notary for a detailed cost estimate (simulation des frais) right at the beginning. This document breaks everything down so you know exactly what to expect and avoid any nasty financial surprises when it's time to sign.

How Long Does the Buying Process Take?

You'll need a bit of patience, as the timeline isn't set in stone. Generally speaking, you can expect the whole process to take between four and eight weeks. This clock starts ticking from the moment you sign the preliminary sales agreement, or 'compromis de vente', and ends when you sign the final deed, the 'acte de vente'.

What makes it vary? If you're getting a mortgage, the bank's approval process and paperwork can add a couple of weeks. On the flip side, a cash purchase where all the property documents are ready and in order can sometimes close much faster. Your notary is the best person to give you a realistic timeline based on your specific situation.

What Is a Titre Foncier and Why Is It So Important?

Let's be crystal clear: the 'titre foncier' is the single most important document you'll deal with. This is the official title deed, registered with the national land registry (ANCFCC), and it is your absolute, indisputable proof of ownership. It contains everything: who legally owns the property, its precise boundaries, and any debts or claims against it.

In short, buying an apartment that has a clean and verified 'titre foncier' is the only way to invest safely in Moroccan property. You should never, ever move forward with a purchase if the property doesn't have a clear title deed. Confirming this is one of your notary's most critical jobs—it's the foundation of a secure and successful purchase.

Navigating these details is much easier with an experienced partner by your side. At Rich Lion Properties, we specialise in making your property journey in Casablanca as clear and seamless as possible. Discover how our expertise can help you find your perfect home.