So, you're thinking about buying an apartment in Agadir. Great choice. But before you get swept away by visions of ocean sunsets from your balcony, it’s crucial to get your feet on the ground and understand what you're stepping into. To successfully acheter un appartement à Agadir, your first move isn't browsing listings—it's getting a feel for the unique rhythm of its property market.

This city's real estate pulse is driven by a powerful mix of strong tourism and significant European investment. Prices and the types of properties you'll find can change dramatically from one neighbourhood to the next. The vibe—and the price tag—in the glitzy Marina is a world away from a traditional area like Hay Mohammadi. Getting a solid handle on these dynamics isn't just a suggestion; it’s the foundation of a smart purchase.

Decoding the Agadir Real Estate Market

Before you even think about putting in an offer, you need to know what makes Agadir's property market tick. This is about more than just a great view; it's an investment in a city with a unique economic heartbeat.

The market here is a fascinating blend of local demand, a steady stream of European buyers—especially retirees and those looking for a holiday home—and Moroccans living abroad who want a piece of one of the country's most cherished coastal cities.

This diverse group of buyers creates a remarkably stable and active market. Agadir's property values are consistently supported by its reputation as a top-tier tourist destination and a comfortable, welcoming place for expats. The strong demand for both short-term holiday lets and long-term residential rentals gives property investment here a very solid footing.

Understanding Local Price Variations

When you start to acheter un appartement au Maroc, Agadir presents a surprisingly varied pricing landscape. Your budget will go a lot further in some areas than others, so knowing the lay of the land is key.

- Agadir Marina & The Tourist Zone: This is where you'll find the highest prices, and for good reason. You're paying a premium for being steps from the beach, top-tier restaurants, and modern amenities. These apartments are perfectly positioned for high-yield holiday rentals.

- Hay Mohammadi & Dakhla: Looking for a more authentic Moroccan living experience? These residential neighbourhoods are your best bet. Prices are significantly lower, offering fantastic value if you're seeking a permanent home or a long-term rental investment.

- Founty & Sonaba: These are the new kids on the block. They're newer, still-developing areas filled with modern apartment complexes that often come with pools and security. They offer a great middle-ground between the tourist buzz and a quiet residential feel.

To give you a clearer picture, let's look at some numbers.

Agadir Apartment Market Snapshot

Here’s a quick overview of what you can generally expect when looking at apartments in Agadir, based on recent market data.

| Metric | Average Value |

|---|---|

| Price per Square Metre (m²) | MAD 13,500 |

| Typical 2-Bedroom Apartment | 80 – 100 m² |

| High-Demand Neighbourhoods | Marina, Founty |

| Value-Oriented Neighbourhoods | Hay Mohammadi, Dakhla |

This data from 2025 shows that Agadir is often more accessible than property hotspots like Casablanca or Marrakech. It strikes an excellent balance between lifestyle appeal and investment value.

Types of Properties Available

The word "apartment" in Agadir can mean many things. You'll find everything from compact studios perfect for a solo buyer or couple to sprawling multi-bedroom flats in luxury residences.

It's clear that many of the newer developments have been built with an international clientele in mind. Think open-plan living spaces, generous balconies or terraces, and access to shared facilities like swimming pools and gyms.

The most important thing is to match the property type to your goal. A small, perfectly located flat near the beach is a goldmine for the short-term rental market. On the other hand, a larger apartment in a quieter part of town is probably a better fit for a family or a long-term tenant.

This sheer variety means the market can meet almost any need. Whether you're after a simple holiday getaway, a profitable rental machine, or a permanent home under the Moroccan sun, you'll find options.

A great way to start is by browsing a curated list of Agadir property for sale to see what's really out there. This isn't just window shopping—it's about aligning your expectations with the market reality. Doing this homework gives you a huge strategic advantage before you even pick up the phone.

Mapping Out Your Budget and Financing Strategy

The sticker price you see on a property listing in Agadir? That’s just the beginning. To successfully acheter un appartement au Maroc, Agadir, you need to think like a seasoned buyer and map out the entire financial journey, not just the initial purchase price.

I’ve seen too many hopeful buyers, particularly those from overseas, get caught off guard by the additional fees that pop up along the way. A proper financial plan isn’t just a good idea—it’s the only way to ensure your purchase goes smoothly, without any last-minute financial panic.

Uncovering the Hidden Costs of Purchase

When you buy property in Morocco, a handful of mandatory fees are baked into the process. These aren’t optional extras; they're the standard legal costs of transferring ownership, and budgeting for them from the start will save you a world of stress.

Think of it this way: your total cost will be the apartment's price plus a collection of taxes and professional fees. As a solid rule of thumb, you should set aside an extra 7% to 10% of the property’s value to cover everything.

Here’s a realistic breakdown of what you're looking at:

- Registration Tax (Droits d'Enregistrement): This is the big one, usually running from 4% to 6% of the property's declared value. It’s what officially registers the sale with the Moroccan authorities.

- Notary Fees (Frais de Notaire): The notaire is your neutral legal guide through the transaction. Their fees are regulated and typically land between 1% and 1.5% of the purchase price.

- Land Registry Fees (Conservation Foncière): This fee, about 1.5%, is for registering your ownership in the land registry. This is what secures your official property title, the Titre Foncier.

- Agency Commission: If you work with a real estate agent, expect a commission of 2.5% from both you and the seller. On top of that, there's a 20% VAT applied to the commission itself.

Let’s put that into perspective. For an apartment priced at MAD 1,000,000, you could easily be looking at an additional MAD 80,000 to MAD 100,000. Knowing this upfront is what separates a smooth closing from a frantic scramble for funds.

Securing Your Financing

Whether you’re a local resident or an international buyer, nailing down your financing is a critical step. While many foreign buyers come to the table with cash, it's worth knowing that Moroccan banks are becoming more open to lending to non-residents who can meet their criteria.

For Moroccan residents, getting a mortgage is a pretty standard affair, much like in Europe or North America. You'll need to show proof of a stable income, a good credit history, and have a respectable down payment ready.

For foreign buyers, the bar is set a bit higher. The banks will want to see:

- A substantial down payment, often in the realm of 40-50% of the property's value.

- Clear proof of a stable, verifiable income from your home country.

- A Moroccan bank account to handle the loan repayments.

A common myth is that foreigners can't get a mortgage in Morocco. It's not impossible, just more challenging. You have to be meticulous with your paperwork. Honestly, most international buyers find it far simpler to either arrange financing in their home country or use personal funds transferred directly to Morocco.

To get a clearer picture of what a local mortgage could cost you, using an online calculator is a great move. You can find a detailed mortgage credit simulation for Moroccan banks that will help you estimate monthly payments and see the total cost over the life of the loan. It's a vital tool for smart financial planning.

Managing International Fund Transfers

If you’re funding your purchase from outside Morocco, you’ll need a strategy for currency exchange and international transfers. The Moroccan Dirham (MAD) is a closed currency, which means you can’t just buy it from your bank back home.

You'll be transferring your funds (EUR, GBP, USD, etc.) into a special convertible dirham account at a Moroccan bank. Once the money lands, the bank converts it into dirhams for you to complete the purchase.

There are a few things you absolutely must keep in mind:

- Exchange Rate Fluctuation: The rate can shift between the day you agree on a price and the day your money actually arrives. Keep a close eye on the rates, or better yet, use a currency specialist who might be able to lock in a favourable rate for you.

- Transfer Fees: Don't forget that both your bank and the receiving bank in Morocco will charge fees. It pays to shop around and understand these costs.

- Proof of Origin: This is crucial. The Moroccan government needs official proof that the funds came from a foreign source. Keep every single piece of paper from your bank transfers. This documentation is your ticket to being able to repatriate your money if you decide to sell the property down the road.

Finding and Vetting Your Ideal Property

Alright, you've got your budget sorted. Now for the exciting part—the actual hunt for your perfect spot in Agadir. While it's tempting to spend all your time scrolling through online listings, the real magic happens on the ground, often through local connections.

This stage is about more than just falling in love with a listing's photos. It's about putting on your detective hat and doing the essential checks that will protect your investment down the line. Getting this right is how you successfully acheter un appartement au Maroc, Agadir style—by mixing modern search tools with some old-fashioned, feet-on-the-street expertise.

Why You Need a Local Real Estate Expert

You can absolutely start your search on popular sites like Mubawab or Avito to get a feel for the market. But if you're serious, partnering with a reputable local agence immobilière (real estate agency) is non-negotiable. These professionals have the kind of insider knowledge you simply can't find online, including access to off-market properties that never get publicly listed.

A great agent is more than a salesperson; they're your guide. They know the subtle differences between neighbourhoods, what a fair price really is, and can spot potential red flags from a mile away.

So, how do you find the right one?

- Ask Around: The best leads often come from other expats or investors in Agadir. A word-of-mouth referral is worth its weight in gold.

- Check Them Out: Make sure any agency you consider is licensed and has a proper office. A legitimate physical presence is a sign of a serious, professional operation.

- Have a Chat: Don't just go with the first person you meet. Talk to a few agents. You need to find someone who gets what you're looking for and communicates clearly.

This partnership is invaluable. For example, a good agent might know that a gorgeous apartment in the Marina has a history of eye-watering syndic (building management) fees—a crucial detail you'd almost certainly miss on your own. For a wider perspective on the city's major players, it's worth checking out a guide on the top real estate developers in Agadir to understand who is building what.

The Most Important Document: The Titre Foncier

Once you find an apartment that catches your eye, the real work starts. In Morocco, one document trumps all others: the Titre Foncier. This is the official property title deed, registered with the national land agency, the ANCFCC. It's your ultimate proof of ownership.

Let me be crystal clear: Never, ever proceed with a purchase if the property does not have a clean and verified Titre Foncier. This is the golden rule of Moroccan real estate.

This single document confirms who the legal owner is, the exact property boundaries, and—most critically—if there are any outstanding debts or legal claims against it. Your notaire (notary) will handle the official verification, but you should ask the seller for a copy upfront. It will show if there are any mortgages (hypothèques), liens, or other issues that could derail the sale. Skipping this step is the single biggest and most costly mistake a buyer can make.

Your On-site Inspection Checklist

When you view a property, you need to look past the fresh paint and the nice staging. That beautiful sea view can be incredibly distracting, so walk in with a clear plan to inspect the place with a critical eye.

Think like an owner, not a guest. Here’s a practical checklist to keep you focused:

The Apartment Itself:

- Look for Damp: Check for water stains on ceilings and walls, especially in corners, around windows, and in bathrooms. A musty smell is a dead giveaway.

- Test Plumbing & Electrics: Turn on the taps to check the water pressure. Flush the toilets. Flip every light switch and test the outlets to make sure the electrical system works and isn’t ancient.

- Check Windows & Doors: Open and close everything. Do they seal properly? Any drafts? Look for signs of rot in the frames.

- Consider the Age: In older buildings, ask about recent updates. An apartment that needs a complete rewiring can add a massive, unexpected cost to your budget.

The Building & Neighbourhood:

- Common Areas: Take a hard look at the lobby, stairs, and lift (parties communes). If they're well-kept, it's a good sign the building is managed well by responsible co-owners.

- Noise Check: Try to visit at different times of the day. A street that's peaceful at 11 a.m. could be a nightmare at 6 p.m. Listen for noise from the neighbours next door and above you.

- The Syndic: Ask about the monthly syndic fees and exactly what they cover. It's also smart to ask for the minutes from the last co-ownership meeting; this can reveal ongoing disputes or big, expensive repairs coming down the pipeline.

By being methodical in your search and rigorous in your checks, you shift from being a hopeful buyer to a savvy investor. This hands-on approach is your best protection against future headaches and the key to finding a place in Agadir you'll truly love.

Making It Official: The Purchase and Legal Process

Once you’ve found the perfect apartment, the real work begins. This is where you transition from browsing to buying, stepping into the structured legal process of purchasing property in Morocco. It’s a well-defined path designed to protect both you and the seller, but it has its own unique rhythm and language that can feel a bit different if you're coming from abroad.

Getting a handle on this framework is more than just for peace of mind; it's absolutely essential for a smooth, secure purchase. Every step, from your initial offer to the final signature, carries legal weight. This is where having professional guidance really pays off.

The Notaire: Your Transaction’s Quarterback

In Morocco, the entire property transaction pivots around one key person: the notaire (notary). Their role is far more significant than in many other countries. A Moroccan notaire is a government-appointed legal professional who serves as a neutral anchor for the deal, ensuring everything is above board for both parties.

Think of them as the guardian of the transaction. The notaire is responsible for:

- Digging into the Paperwork: They perform a deep dive into the property's title deed (Titre Foncier) to confirm the seller is the true owner and that there are no hidden debts, mortgages, or legal claims against it.

- Drafting the Contracts: From the preliminary agreement to the final deed of sale, the notaire prepares all the official legal documents.

- Securing Your Funds: Your deposit is held safely in the notaire’s secure escrow account until every condition of the sale is met. This is a critical protection for your money.

- Handling Taxes and Registration: The notaire calculates all the necessary taxes and ensures the sale is properly registered with the authorities, making your ownership official.

A key point to remember: the notaire works for the transaction, not for you personally. They ensure legality but don't offer personalised advice. For complex deals or just for extra assurance, many buyers choose to hire their own independent lawyer to review everything from their specific point of view.

From a Handshake to a Binding Contract

It all starts with an offer. After finding your apartment, you'll typically begin with a verbal negotiation, usually managed by your real estate agent. Once you and the seller have settled on a price, it's time to formalise things with a written offer, known as an offre d'achat.

This document confirms your intention to buy and lays out the price and any crucial conditions (clauses suspensives). These conditions are your safety net. For example, you can make the purchase contingent on securing a mortgage or getting a satisfactory report from a structural engineer.

Once the seller accepts your offer, the notaire steps in to draft the compromis de vente, or the preliminary sales agreement. This is a serious, legally binding contract that details everything—price, payment schedules, the closing date, and all those conditions you agreed upon. Signing this is a major step forward.

At this point, you'll need to pay the deposit, which is typically 10% of the purchase price. This money goes directly into the notaire's escrow account, never to the seller.

The Final Stretch to Getting Your Keys

With the compromis de vente signed and your deposit secured, the notaire gets to work on the final due diligence. This can take a few weeks as they gather all the necessary legal clearances and prepare the final ownership documents.

The whole process comes to a head with the signing of the acte de vente—the final deed of sale. This happens at the notaire’s office, with you (or a legal representative) and the seller present. Just before you sign, you'll transfer the remaining balance of the purchase price, plus any taxes and fees, to the notaire's account.

Once the ink is dry on the acte de vente, the deal is officially done. The notaire then registers the sale with the Land Registry (Conservation Foncière). A few weeks later, you’ll receive the updated Titre Foncier with your name on it and, most importantly, the keys to your new apartment in Agadir.

Unlocking Your Agadir Property's Investment Potential

When you acheter un appartement au Maroc, Agadir is more than just a sunny getaway; it's a real chance to see a significant return on your investment. Your new property isn't just a holiday spot—it's a financial asset with serious potential. To really make it work for you, you need to get to grips with the local rental market and the city's long-term growth prospects.

The big question isn't just if you should rent it out, but how. The path you choose—short-term holiday lets or a long-term tenancy—will fundamentally shape your income, how involved you need to be, and the overall success of your investment.

Tapping into the Thriving Short-Term Rental Market

Agadir’s reputation as a top-tier tourist destination makes the short-term rental scene incredibly appealing. With platforms like Airbnb and Booking.com, you have a direct line to millions of international travellers. Many of them are looking for an authentic local experience and prefer the space and privacy of an apartment over a standard hotel room.

The income potential here is huge, especially during the peak season from October to April when Europeans escape their winter for Agadir's mild climate. A well-placed apartment, particularly in the Marina, Founty, or near the beach, can fetch premium nightly rates.

The numbers really drive this point home. As of 2025, Agadir has around 3,835 active Airbnb listings. They see an average occupancy rate of roughly 50%, which shows just how strong the demand is. The average daily rate is MAD 516 (about $51), pushing the average annual revenue for a short-term rental up to MAD 90,000 ($8,000). For a deeper dive, you can learn more about Agadir's Airbnb market statistics.

Of course, higher rewards usually mean more work. Managing a short-term rental is very hands-on. You'll be dealing with constant guest communication, organising cleaning between stays, and sorting out maintenance issues on the fly.

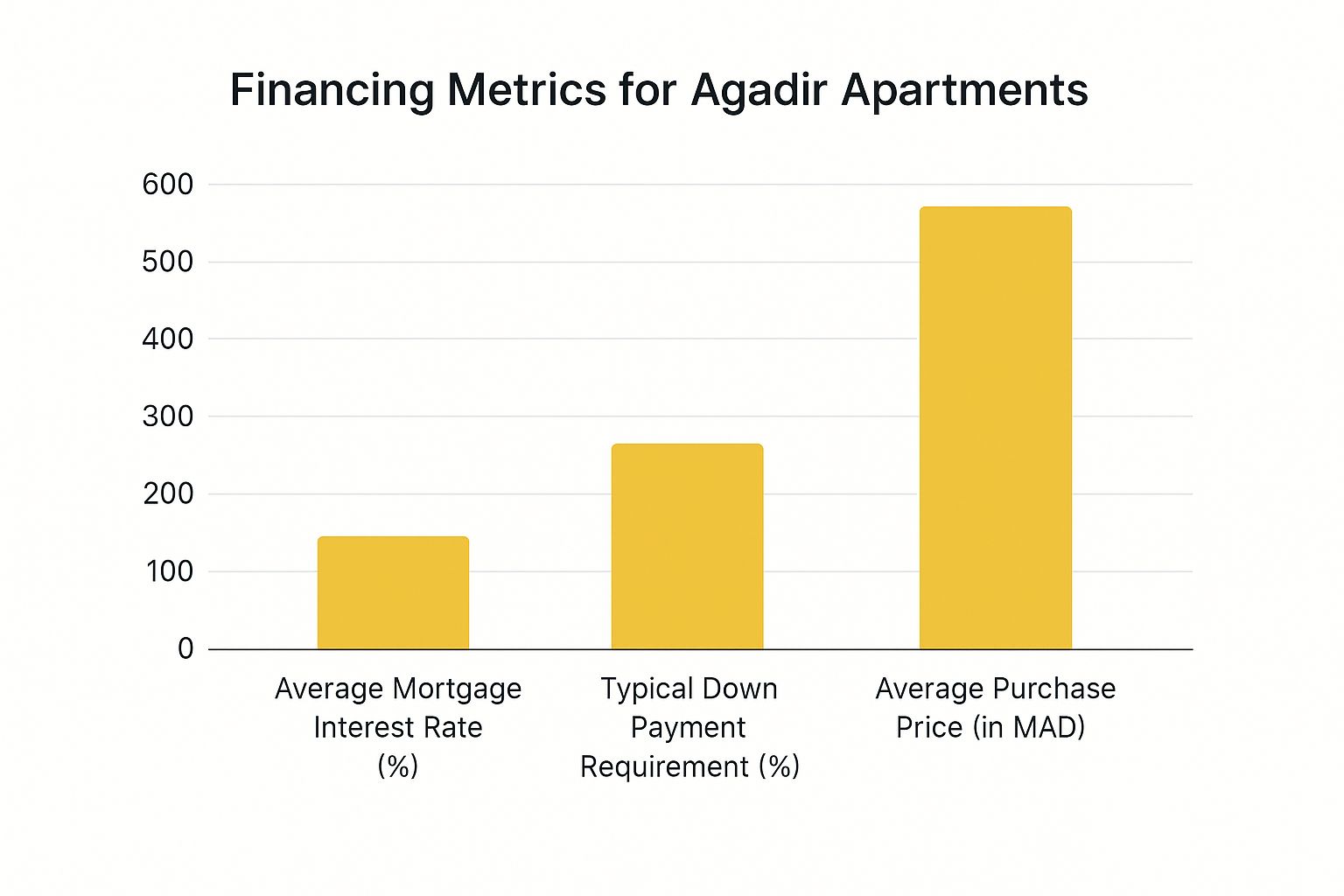

The infographic above gives you a clearer picture of the financial side. While property prices are reasonable, you'll need a solid down payment, and understanding the local interest rates is absolutely critical for smart budgeting.

The Stability of Long-Term Rentals

If you're looking for a more passive, steady income stream, long-term rentals are an excellent alternative. This strategy means finding a tenant to lease your apartment for a year or more, giving you a predictable monthly income you can count on.

Demand for long-term lets in Agadir is solid. It's fuelled by a growing number of local professionals, expatriates working in the city, and retirees who've chosen to make it their year-round home.

The advantages are pretty clear:

- Consistent Cash Flow: No more worrying about the seasonal dips that affect tourism. Your income is locked in.

- Lower Management Burden: Once you have a good tenant, your day-to-day involvement drops dramatically. Forget about weekly check-ins and constant cleaning schedules.

- Reduced Wear and Tear: Long-term tenants often treat a property like their own home, which typically means less damage compared to the high turnover of holiday guests.

The trade-off? Your monthly income will be lower than what you could potentially earn during peak season with a short-term let. But for many owners, the stability and simplicity make it a worthwhile compromise.

Rental Income Comparison Long-Term vs Short-Term in Agadir

Deciding between a steady, long-term tenant and the high-yield potential of short-term holiday lets is a crucial step. Each approach has its own set of demands and rewards. This table breaks down the key differences to help you figure out which strategy best fits your financial goals and lifestyle.

| Factor | Long-Term Rental | Short-Term Rental (e.g., Airbnb) |

|---|---|---|

| Potential Yield | Moderate but stable. Typically 3-5% annual net yield. | Higher potential, especially during peak season. Can reach 6-10% or more. |

| Income Consistency | Very high. Predictable monthly payments for the lease term. | Variable. Subject to seasonality, tourism trends, and competition. |

| Management Effort | Low. Minimal day-to-day involvement after securing a tenant. | High. Requires constant guest communication, check-ins, and cleaning. |

| Vacancy Risk | Low risk of extended vacancies, but re-letting can take time. | Higher risk of vacant nights between bookings, especially off-season. |

| Wear and Tear | Generally lower, as tenants treat it as their home. | Higher due to frequent turnover of guests with varying levels of care. |

Ultimately, the right choice depends on your risk tolerance and how hands-on you want to be. For a truly passive investment, long-term is the way to go. If you're willing to put in the work for higher returns, the short-term market is calling your name.

Capitalising on Agadir’s Future Growth

Beyond rent, the real long-term prize is capital appreciation. Agadir is a city on the move. Major urban development projects are underway, from the marina expansion and corniche upgrades to big investments in public transport. These aren't just cosmetic changes; they are designed to boost the city's appeal for decades to come.

These improvements will almost certainly have a positive knock-on effect on property values, especially in the areas being redeveloped. By choosing your location carefully now, you're setting yourself up to benefit from Agadir's growth tomorrow. It's how you ensure your decision to acheter un appartement à Agadir becomes a profitable legacy.

Common Questions About Buying Property in Agadir

https://www.youtube.com/embed/eTbbczFn8kc

Once you're nearing the finish line of a property purchase, a lot of final questions tend to pop up. This is completely normal, especially if you're navigating the Moroccan real estate market for the first time. We've gathered the most common queries we hear from buyers to give you clear, straightforward answers and help you finalise your decision to acheter un appartement à Agadir with absolute confidence.

Can Foreigners Legally Own Property in Morocco?

Yes, absolutely. Morocco's laws are quite favourable to foreign buyers. As a non-Moroccan, you can legally purchase and hold the freehold title for most properties, including apartments in residential buildings. This gives you full ownership rights, which are officially recorded on the title deed, known as the Titre Foncier.

The only real restriction to be aware of involves agricultural land, which foreigners are not permitted to own directly. But for anyone looking to buy an apartment in a city like Agadir, this simply doesn't apply. Your ownership is just as secure as that of any Moroccan citizen.

What Ongoing Costs Should I Budget For Annually?

Once you have the keys, there are a few ongoing costs to keep in mind. The good news is they are generally quite reasonable, especially when compared to many European countries, but it's smart to factor them into your budget from day one.

- Taxe d'Habitation: Think of this as the annual local council tax. It's calculated based on the property's estimated rental value and is usually a pretty modest sum, often just a few hundred euros a year.

- Taxe de Services Communaux: This tax covers essential municipal services like rubbish collection and street maintenance. It's calculated on the same basis as the Taxe d'Habitation and paid along with it.

- Syndic Fees: If your apartment is part of a complex with shared amenities—like a lift, swimming pool, or communal gardens—you'll contribute to their upkeep. These fees are paid to the building's co-ownership association (the syndic) and cover the maintenance of all common areas.

Before you sign on the dotted line, always make a point to ask for a clear breakdown of the current annual taxes and the latest syndic fees. Getting this information upfront ensures there are no financial surprises waiting for you down the road.

Repatriating Funds After Selling or Renting

For many international buyers, a key question is, "Can I get my money back out of the country?" Morocco has a well-defined legal framework in place to protect foreign investment and make this process possible.

There's one golden rule you must follow to repatriate funds from rental income or a future sale: prove the initial investment came from a foreign source.

This is why it's vital to keep meticulous records of your international bank transfers into your convertible dirham account in Morocco. When you send the funds for the purchase, your bank will provide a certificate confirming the foreign currency import. This document is your proof. It authorises the Moroccan Exchange Office (Office des Changes) to approve the transfer of your capital or profits back to your home country, after any relevant taxes are paid. Without it, things can get very complicated.

At Rich Lion Properties, we provide the clarity and expertise you need to navigate every aspect of your property purchase in Morocco. Explore our services and find your ideal Agadir apartment with a team you can trust.