So, you’re looking to buy an apartment in Morocco. Before you even type "appartement a vendre au maroc" into a search bar, it’s crucial to get a feel for the market's unique personality. Morocco isn’t just one single property market; it’s a vibrant tapestry of different regions, each with its own rhythm and opportunities.

From the tourist-fuelled energy of Marrakech to the steady, business-like pulse of Casablanca and Rabat, knowing these local differences is the first real step towards making a brilliant investment.

Understanding the Moroccan Property Market

Jumping into the Moroccan property scene can feel a bit like wandering through one of its famous souks for the first time. Every city, every neighbourhood, has a distinct character and offers something completely different. The real secret is to look past the beautiful riads and modern complexes to understand the economic forces that are actually shaping property values on the ground.

Think of it this way: the market in Marrakech is largely a story of international tourism and foreign buyers. This creates a high-energy, sometimes volatile environment with fantastic potential for rental income. In stark contrast, Casablanca is the country's economic powerhouse. Its market is far more stable, driven by local Moroccans looking for primary homes and long-term investments. They are two completely different worlds.

Key Economic Drivers and Trends

A few key factors are constantly shaping property prices across Morocco, creating a landscape that’s complex but definitely not random. For instance, government initiatives for social housing can influence the more affordable end of the market, while laws on foreign investment have a direct impact on the luxury sector.

Financing is another major piece of the puzzle. While Moroccan banks are open to offering mortgages to non-residents, they’re often cautious. You can typically expect to need a down payment of 20-30%. This simple fact has a ripple effect, determining who can buy property and where, which in turn steers demand in specific price brackets.

For a deeper dive, our comprehensive guide to property investment in Morocco covers these financial nuances in much more detail.

The Moroccan property market isn't monolithic. A successful investment hinges on understanding that the forces driving Marrakech's growth are vastly different from those shaping Rabat or Tangier. Your strategy must be tailored to the specific city you're targeting.

A Tale of Two Markets

Recent figures paint a really interesting picture of how these regional markets are behaving. While on a national level, the Moroccan apartment market hasn't shown dramatic growth, certain hotspots are definitely bucking the trend. Marrakech, for example, has seen prices inch upwards, while other major cities have seen a slight cooling off.

Let's look at the numbers. While residential prices in Marrakech rose by a modest 0.32% over the year, that number actually dips to -1.26% once you factor in inflation. Other cities saw more pronounced declines in real terms: Casablanca’s prices fell by 1%, and Fes saw a drop of 2%. This really drives home the need for a local, not national, perspective.

Moroccan Property Market Snapshot by City

To give you a clearer idea, this table breaks down the recent performance across a few key cities, showing just how much they can differ.

| City | Nominal Price Change Y-o-Y | Real Price Change (Inflation Adjusted) |

|---|---|---|

| Marrakech | +0.32% | -1.26% |

| Casablanca | -0.10% | -1.00% |

| Fes | -1.10% | -2.00% |

The takeaway here is crystal clear for anyone searching for an "appartement a vendre au maroc": a blanket approach just won't work. Success lies in digging into the micro-market of your chosen city and neighbourhood to find where the real value and opportunity are hiding.

Navigating the Legal Path to Ownership

Buying property in Morocco isn't some bewildering maze of red tape. It’s actually a very structured process, built on a clear sequence of steps designed to protect everyone involved. Once you understand the key players and milestones, you'll see it’s a logical path from finding the perfect appartement a vendre au maroc to getting the keys in your hand.

Think of it as a three-act play. Act One is about making your offer official. Act Two is where the experts do their homework behind the scenes. And the final act is the official transfer of ownership. Getting each stage right is what makes your investment solid and secure.

The Initial Agreement and Offer

So, you’ve found the apartment you want. What's next? The first official step is making an offer. Once the seller accepts, you’ll sign a preliminary sales agreement, known here as the ‘compromis de vente’. This isn't just a casual handshake; it’s a serious, legally binding document.

The ‘compromis de vente’ lays out all the ground rules for the sale. It will clearly state:

- The final purchase price you've both agreed on.

- A precise description of the property.

- Any special conditions, like the sale being subject to you securing a mortgage.

- A clear timeline for completing the purchase.

To seal the deal, you’ll pay a deposit, usually between 5% and 10% of the purchase price. This money doesn’t go to the seller directly but is held safely by a neutral third party—the notary—which shows you’re a committed buyer. This agreement locks the property down for you, stopping the seller from entertaining other offers while all the legal checks are completed.

The Central Role of the Notaire

In Morocco, the ‘notaire’ (notary) is the linchpin of the entire property transaction. Don't confuse them with a notary in other countries who might just witness a signature. Here, the notaire is a state-appointed legal expert who acts as a neutral referee, overseeing the whole process from start to finish. Their job is to be your legal guardian, ensuring every single detail complies with Moroccan law.

The notaire isn’t just a paper-pusher; they are the ultimate guarantor of the deal's legality. Their most important responsibility is to protect both you and the seller by making sure the property is completely clear of any legal trouble before a single dirham changes hands.

The notaire’s most critical task is to dig deep into the property's legal history by verifying its ‘titre foncier’ (title deed). This document is the absolute bedrock of property ownership in Morocco. It provides irrefutable proof of who owns the property, its exact boundaries, and any registered claims against it, like mortgages or liens. To get a better handle on this vital document, you can learn more about the titre foncier and why it’s so important.

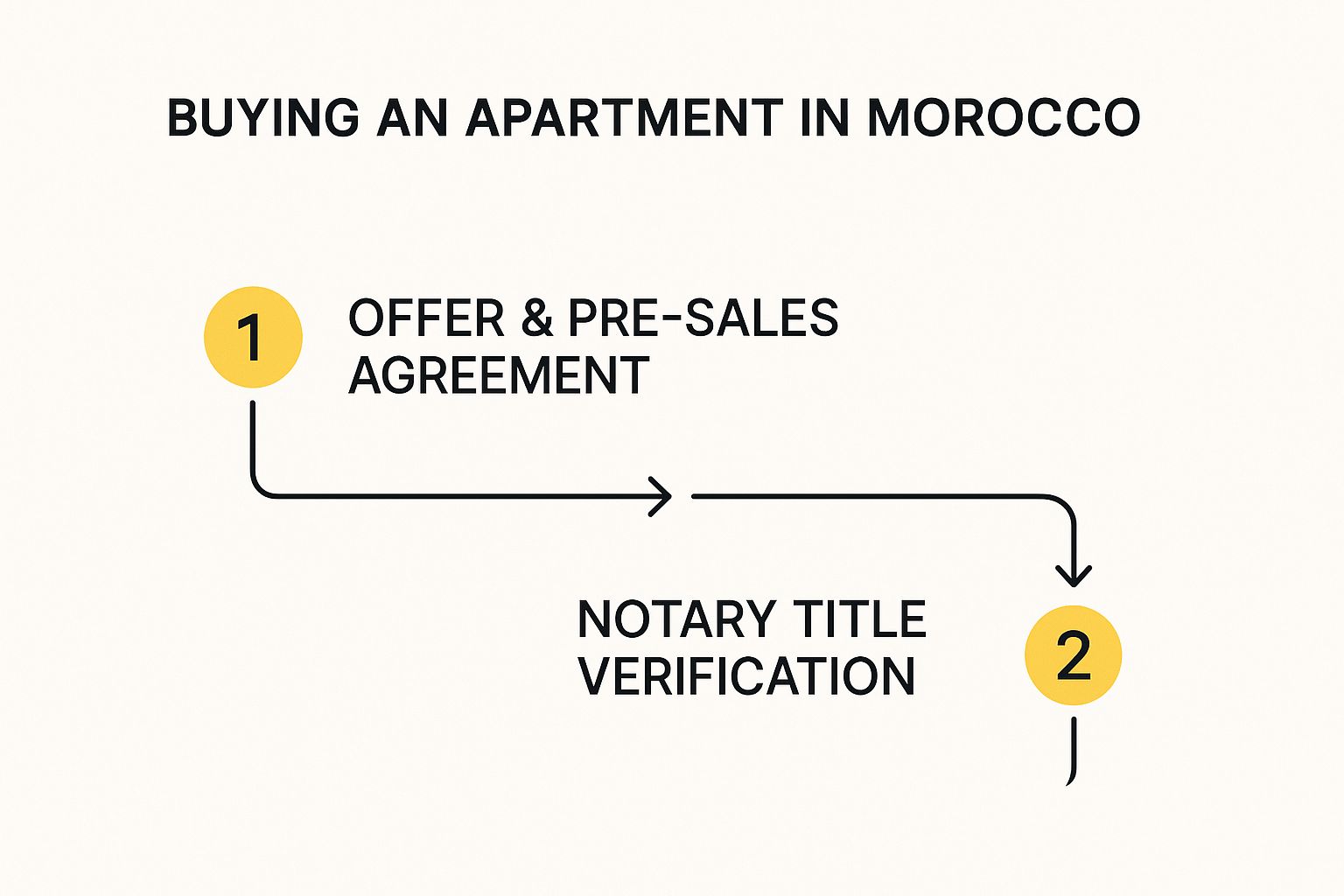

The infographic below breaks down these main stages for you, giving you a bird's-eye view of the journey from offer to ownership.

This visual roadmap makes the legal process much easier to digest, showing how one step flows logically into the next for a secure and transparent purchase.

Finalising the Purchase

Once the notaire has done their due diligence and given the all-clear—confirming the title is clean and all legal boxes are ticked—you're on the home stretch. The final step is signing the ‘acte de vente’, or the deed of sale. This is the document that makes it all official, legally transferring the apartment into your name.

This final signing ceremony happens at the notaire’s office. Here, you’ll pay the remaining balance of the purchase price, plus all the related taxes and fees. Budget for around 7-10% of the property’s value to cover things like registration duties, notary fees, and land registry charges.

With everything signed and paid, the notaire then registers the new deed with the Land Registry (‘Conservation Foncière’). A brand new ‘titre foncier’ is then issued in your name. And that’s it—you are now the official, undisputed owner of your new home in Morocco, with your investment fully protected by the law.

How to Finance Your Apartment Purchase

Figuring out how to pay for your new apartment is, of course, a massive part of the puzzle. When you're looking for an appartement a vendre au maroc, getting your finances in order early is non-negotiable, whether you're a local or buying from abroad. The route you take—be it a Moroccan mortgage, financing from your home country, or an all-cash deal—will colour your entire buying journey.

Each path has its own rules, perks, and potential headaches. It’s a bit like planning a trip. A local mortgage is like renting a sturdy 4×4; it’s perfect for the local roads but comes with some strict rental agreements. Using a bank from back home is like driving your own car—it's familiar, but dealing with foreign paperwork can be a hassle. Paying cash? That’s the direct flight: fast, simple, but you need all the funds ready to go.

Applying for a Mortgage with a Moroccan Bank

For a lot of people, getting a mortgage from a local Moroccan bank is the most sensible option. The process is fairly straightforward, though you'll find that banks here tend to be more careful when lending to non-residents. You’ll need a solid application that proves you’re a reliable borrower.

Here’s what they’ll typically ask for:

- A hefty down payment: Non-residents are usually expected to put down a significant amount, often between 20% and 50% of the property’s price.

- Proof of stable income: Get ready to show detailed proof of your earnings—payslips, tax returns, and bank statements are all on the list. They need to see you can handle the repayments without a problem.

- A clean financial history: The bank will definitely look into your credit history to make sure you're a low-risk client.

A local mortgage has its advantages. You're financing in Moroccan Dirhams, which keeps the transaction simple. Just be prepared for interest rates that might be a bit higher than what you’re used to back home.

Weighing Your Financing Alternatives

A Moroccan mortgage might be the well-trodden path, but it’s not your only choice. Depending on your personal situation, another route could make more sense. It’s smart to look at the pros and cons of each before you make a decision.

Choosing how to finance your purchase is more than just a numbers game—it's a strategic move. You need to think about things like currency exchange risk, how quickly you can get approved, and your long-term flexibility. Make sure your financing choice fits your overall investment plan.

An all-cash offer is easily the simplest way to go. You sidestep interest payments entirely, the legal process is smoother, and sellers often find cash offers more appealing. The obvious catch, however, is having that much capital on hand.

Another option is to get a loan from a bank in your own country. You might secure better interest rates and the application process will feel more familiar. The trade-off is the added layer of complexity. You'll have to manage large international transfers and keep an eye on exchange rate fluctuations, which can affect the final price you pay for the apartment.

The Critical Role of a Convertible Dirham Account

If you’re an international buyer, there’s one step you absolutely cannot skip: opening a convertible Dirham bank account in Morocco. This specific type of account is your gateway for bringing funds in from another country to pay for the property.

I can't stress this enough. This account creates an official paper trail of your investment, proving the funds came from outside Morocco. This record is absolutely essential when you decide to sell down the line. It’s what guarantees your right to repatriate the proceeds of the sale—your initial investment plus any profit—back to your home country in your original currency. Without it, getting your money out of Morocco becomes a bureaucratic nightmare.

Discovering the Top Cities for Investment

When you're looking for an appartement a vendre au maroc, the old real estate mantra rings especially true: location is everything. Morocco isn't one single property market; it's a vibrant mosaic of local markets, each with its own character, pace, and potential.

Choosing the right city is less about finding the "best" one and more about finding the one that fits your goals. From the tourist-fuelled buzz of Marrakech to the business-like pulse of Casablanca, the key is to match your investment strategy to the city's unique economic and lifestyle drivers.

Marrakech: The Investor Magnet

Marrakech is, without a doubt, the crown jewel of Morocco's property scene, especially for international buyers. It’s a city that effortlessly blends ancient charm with modern luxury, creating a powerful allure for tourists and investors alike. If your aim is to generate strong rental income from the holiday market, this is where you want to be.

The options here are wonderfully diverse. You can find traditional riads tucked away in the historic Medina or opt for a sleek, contemporary apartment in one of the newer developments. It remains one of the most dynamic city markets in the country, with average prices climbing to around 13,000 MAD/m².

Interestingly, even with a reported 18% dip in overall sales volume year-over-year, prices have remained remarkably stable. This resilience is largely thanks to consistent interest from foreign buyers, particularly Europeans. You can dig deeper into Moroccan property price trends to see the full picture.

Top neighbourhoods for investors include:

- Guéliz: This is the modern core of Marrakech, famed for its European-style avenues, chic boutiques, and contemporary apartments.

- Hivernage: An elegant, upscale district known for its luxury hotels, fine dining, and prestigious residential complexes.

- La Palmeraie: A sprawling palm grove just outside the city centre, offering a more tranquil setting with exclusive villas and private apartment communities.

Casablanca: The Economic Engine

If Marrakech is the glamorous star of the show, Casablanca is the country's steady, reliable economic engine. As Morocco's commercial and financial hub, its real estate market is powered by strong, consistent demand from a growing class of local professionals. This makes it a far more stable, less volatile choice for a long-term investment.

The rental market here is built for long-term leases, not short-term holiday lets. While you may not see the sky-high seasonal yields of Marrakech, you'll gain a predictable income stream and much lower vacancy rates. It’s a market grounded in solid economic fundamentals.

Think of it this way: investing in Marrakech is like buying shares in a high-growth tech company—high potential, but higher risk. Casablanca is like investing in a blue-chip stock—stable, reliable, and built for the long haul.

Rabat: The Elegant Capital

Rabat, Morocco’s political capital, offers a compelling blend of stability and an exceptional quality of life. The city is known for its immaculate streets, lush green spaces, and a generally sophisticated atmosphere, making it a magnet for diplomats, government officials, and affluent families. This creates a solid base of demand for high-quality housing.

Because Rabat's market isn't tied to the whims of tourism, it provides a secure environment for preserving capital and enjoying steady appreciation over time. Neighbourhoods like Hay Riad and Agdal are especially sought-after for their modern apartments and tranquil, amenity-rich environment. Buying an appartement a vendre au maroc in Rabat is a vote for stability and class.

Tangier and Agadir: Coastal Gems

For those dreaming of a life by the sea, Tangier and Agadir offer two distinct but equally attractive opportunities.

Tangier, sitting at the strategic crossroads of Europe and Africa, is a city reborn. Massive infrastructure projects, most notably the Tanger Med port, have injected new life into its economy and, by extension, its real estate market. Its international vibe and prime location give it serious growth potential.

Agadir, by contrast, is Morocco’s premier beach resort. A long-time favourite among European retirees and sun-seeking holidaymakers, its market is driven by the demand for second homes and seasonal rentals. Its laid-back lifestyle and year-round sunshine ensure it never goes out of style.

To help you weigh your options, here's a quick look at how these major hubs stack up against each other.

Top Investment Cities Comparison

| City | Primary Appeal | Average Price per m² (Approx.) | Key Neighbourhoods |

|---|---|---|---|

| Marrakech | Tourism & short-term rentals | 13,000 MAD | Guéliz, Hivernage, La Palmeraie |

| Casablanca | Local economy & long-term rentals | 14,500 MAD | Maarif, Gauthier, Anfa |

| Rabat | Stability & high quality of life | 15,000 MAD | Hay Riad, Agdal, Souissi |

| Tangier | Economic growth & strategic location | 11,000 MAD | City Centre, Malabata, Iberia |

| Agadir | Holiday homes & lifestyle | 12,000 MAD | Founty, City Centre, Marina |

Ultimately, whether you're drawn to the cultural energy of Marrakech or the coastal calm of Agadir, understanding the unique profile of each city is the first step toward making a sound and rewarding investment.

Maximising Your Investment with Rental Income

When you start looking for an appartement a vendre au maroc, it’s easy to focus on the sun-drenched terraces and beautiful design. But beyond being a personal getaway, your apartment can be a serious financial asset. The rental market here offers two very different paths to generating income, and the one you choose will shape your entire investment journey.

You could go the traditional route with long-term leases, which is a popular choice in the business centres of Casablanca and Rabat. This approach offers a steady, reliable stream of income month after month. It's the "set it and forget it" option for investors who value predictability over high-risk, high-reward scenarios.

Then there’s the dynamic, fast-paced world of short-term holiday lets. In Morocco’s tourism-heavy cities, this can be an incredibly profitable venture, often out-earning traditional rentals by a significant margin and turning your property into a cash-flow machine.

The Allure of the Short-Term Rental Market

Cities like Marrakech, Agadir, and Essaouira are magnets for international travellers, and that creates a constant, year-round demand for quality short-term accommodation. By tapping into this market, you gain the power to adjust your pricing with the seasons, capitalising on peak demand to really maximise your earnings. It’s certainly more hands-on, but the financial upside can be huge.

Just look at the numbers coming out of Marrakech. The average Airbnb property there is booked for a staggering 237 nights per year, hitting an impressive 65% occupancy rate. Over the last year, the average annual revenue for an Airbnb in the city was 196,000 MAD (around $19,000). Monthly income fluctuates, of course, from about 14,198 MAD in the slower months to 23,655 MAD when tourism is at its peak. You can dig deeper into the data with these insights into Marrakech's Airbnb market.

These figures paint a clear picture. A well-placed apartment in a prime tourist hub isn't just a property; it's a small-scale hospitality business with serious potential.

For any investor weighing their options, the choice becomes pretty clear. While a long-term tenant provides security, a short-term rental in a sought-after destination offers the potential for far higher rental yields. For an appartement a vendre au maroc, this is often the most profitable path.

Calculating Your Potential Rental Yield

Before you commit, you need to understand your potential return. Rental yield is the go-to metric for this. It’s a straightforward calculation that shows your annual rental income as a percentage of the property's total cost, giving you a clear financial snapshot.

In Morocco's tourist hotspots, a well-managed short-term let can produce rental yields between 8% and 13%, which is incredibly attractive. This simple number allows you to compare different properties and cities on an even playing field, helping you forecast your investment's performance. For a step-by-step guide, have a look at our article on how to work out rental yield.

The Practicalities of Property Management

Whether you choose long-term stability or short-term gains, one thing is non-negotiable: solid property management. This is the engine that keeps your investment running smoothly and profitably, especially if you’re not living in Morocco full-time.

Good management is more than just collecting rent. It covers everything:

- Marketing and Bookings: Getting your property seen on the right platforms and handling all reservations.

- Guest Communication: Being the point of contact for enquiries, check-ins, and any issues that crop up.

- Maintenance and Cleaning: Making sure the apartment is immaculate and well-maintained for every new guest.

- Financial Admin: Managing payments, tracking expenses, and navigating local tax requirements.

Many overseas owners find it makes sense to hire a professional property management company. Yes, they take a percentage of the rental income, but a good manager will often increase your occupancy rates and secure better reviews, more than covering their own fee and taking all the stress off your plate.

Common Pitfalls and How to Avoid Them

Knowing what not to do when searching for an appartement a vendre au maroc is just as important as knowing the right steps to take. While the path to ownership is generally secure, a few common missteps can easily turn your dream purchase into a costly headache. The good news? They are entirely avoidable with a bit of foresight.

One of the most frequent errors I see is buyers underestimating the total closing costs. It's easy to get fixated on the property's price tag and forget about all the other expenses that come with it. Think of it like buying a car—the sticker price is just the beginning; you still have insurance, registration, and taxes to think about.

Budgeting Beyond the Purchase Price

The final bill for your new apartment will be noticeably higher than the number on the sales agreement. Failing to account for this can create a serious financial shortfall right when you’re about to close the deal.

As a rule of thumb, always budget an extra 7% to 10% of the property’s value to cover all the associated costs. These will typically include:

- Registration Duties: Around 4% of the sale price.

- Notary Fees: Expect 1% to 1.5% for the notaire's services.

- Land Registry Fees: This is about 1.5% for the conservation foncière.

- Agency Fees: If you used an agent, this is usually between 2.5% and 5%.

Planning for these expenses from day one means you'll have a much smoother transaction, free of any nasty last-minute financial surprises. It’s what separates a savvy buyer from a stressed one.

The Dangers of Incomplete Due Diligence

Another critical mistake is rushing through due diligence—or worse, skipping it altogether. This is like buying a high-end watch without checking if it’s genuine. You absolutely must verify every single legal and administrative detail before you sign anything.

The single most important document is the ‘titre foncier’ (title deed). Buying a property without a clean, verified title is an enormous risk. It’s the only document that provides absolute proof of ownership and protects you from future claims.

Make sure your chosen notaire conducts a thorough title search. This confirms the seller is the legitimate owner and that there are no liens, mortgages, or other claims against the property. You also need to verify local zoning laws and the building permit, known as the permis d’habiter. An apartment built without proper authorisation can become a legal nightmare that’s impossible to sell down the line.

Never sign a compromis de vente or pay a deposit until these checks are complete. This groundwork is the foundation of a secure investment.

Your Questions Answered: Buying an Apartment in Morocco

Jumping into the Moroccan property market for the first time can feel like learning a new language. You're bound to have questions, especially if you're buying from overseas. We get it. That's why we've put together this final section to tackle the most common queries we hear from clients searching for an appartement a vendre au maroc.

Think of this as your practical cheat sheet. We'll give you clear, straight-to-the-point answers to help you move forward with complete confidence.

Can Foreigners Really Buy Property Without Restrictions?

Yes, absolutely. For the most part, Morocco rolls out the welcome mat for international buyers. As a foreign national, you have the same legal rights to own property as a Moroccan citizen, with one key condition: the property must have a formal title deed, known as a 'titre foncier'.

Luckily, this covers virtually every apartment you'll find in a city. The only real exception is agricultural land, which foreigners can't own outright but can lease for long periods (often up to 99 years). So, for that city apartment you've been dreaming of, the process is straightforward and secure.

What Should I Budget for Closing Costs?

This is a big one. The price on the listing is just the starting point. A good rule of thumb is to budget an extra 7% to 10% of the purchase price to cover all the fees and taxes that come with finalising the sale.

Here’s a rough breakdown of where that money goes:

- Registration Duties: This is the largest chunk, typically around 4% of the property's value.

- Notary Fees (Notaire): Expect to pay your notary about 1% to 1.5% for handling the legal work.

- Land Registry Fees: The conservation foncière will charge around 1.5% to officially register your ownership.

- Miscellaneous Charges: A few smaller administrative fees usually pop up as well.

Your notaire is your best friend here. Make sure to ask for a detailed cost estimate early on so you're not caught off guard when it's time to sign on the dotted line.

If I Sell, Can I Take My Money Home?

Yes, you can. Morocco allows foreign owners to repatriate the funds from a property sale back to their home country. But there's a critical step you must take right at the beginning to make this a smooth process.

To guarantee your right to repatriate your funds later, your initial investment must be made in a foreign currency (like Euros or Dollars) and officially transferred into a convertible Dirham bank account in Morocco.

Doing this creates an official paper trail with the Moroccan foreign exchange authority, the 'Office des Changes'. It proves the money came from outside the country in the first place. When you follow this procedure, converting your sale proceeds back into your original currency and sending it home becomes a simple, hassle-free administrative task.

Ready to find your ideal property in Morocco with expert guidance every step of the way? The team at Rich Lion Properties is here to make your search for an "appartement a vendre au maroc" simple and secure. Explore our listings and get in touch with our experts today!