Morocco's diverse landscapes, from vibrant coastal cities to serene mountain retreats, offer a rich tapestry of real estate opportunities for savvy investors and lifestyle buyers alike. As the market evolves, identifying the right location is paramount for maximising returns and finding your perfect home or investment. This guide delves into the most promising cities and regions across the country, providing a detailed analysis of current market trends, property price ranges, and unique lifestyle benefits.

Whether you're drawn to the historic charm of a Marrakech riad, the modern appeal of a Casablanca apartment, or the coastal allure of an Essaouira villa, understanding the nuances of each market is critical. We will explore the specific factors that make each destination one of the best places to buy property, from economic growth and rental yields to infrastructure development and quality of life.

This roundup is designed to be your practical resource, offering actionable insights for making an informed decision. We cut through the complexity to give you a clear, professional overview of Morocco’s top property hotspots for the year ahead, ensuring you are well-equipped to navigate your purchase with confidence. Let's uncover the prime locations for your next real estate investment.

1. Austin, Texas

Austin, Texas, has cemented its reputation as one of the best places to buy property in the United States, offering a compelling mix of economic vitality and cultural appeal. The city's thriving technology sector, famously dubbed "Silicon Hills," combined with Texas's no-state-income-tax policy, creates a powerful magnet for high-earning professionals and major corporate relocations. This influx fuels consistent demand for housing, making it a prime target for real estate investment.

Why Invest in Austin?

The investment thesis for Austin is built on sustainable growth and strong market fundamentals. Neighbourhoods showcase diverse opportunities:

- Rapid Gentrification: Areas like East Austin have seen property values increase by over 300% since 2010, demonstrating the potential for significant capital appreciation.

- Luxury Development: The Domain area continues to attract high-end residential and mixed-use projects, catering to an affluent demographic.

- Consistent Appreciation: Established, desirable neighbourhoods such as Zilker and South Lamar consistently see annual appreciation rates exceeding 15%, driven by their proximity to downtown and lifestyle amenities.

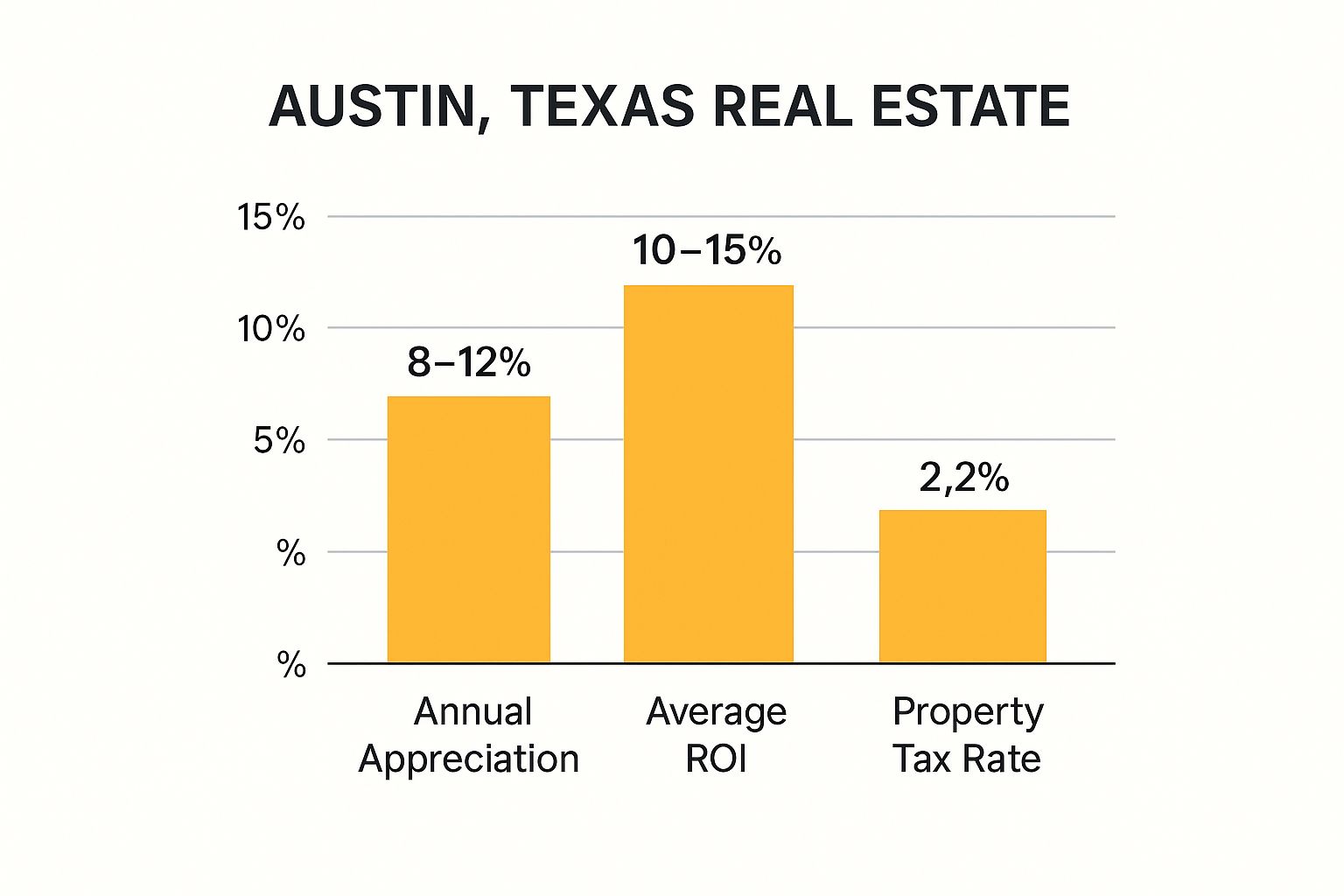

The following data chart highlights the key financial metrics that make Austin an attractive market for investors.

This chart clearly illustrates a market with robust returns, though investors must strategically balance these gains against the state's higher property tax rates.

Actionable Investment Strategies

To maximise returns in Austin's competitive market, focus on strategic acquisitions. Prioritise properties in up-and-coming areas like Mueller or Whisper Valley, which offer newer inventory and planned community infrastructure. Proximity to major employers (like Tesla, Apple, and Oracle) and key transport corridors is crucial for securing long-term rental demand and resale value. As you analyse opportunities, you can learn more about how to evaluate competitive real estate markets to sharpen your approach.

2. Tampa, Florida

Tampa, Florida, has rapidly evolved from a quiet Gulf Coast destination into a dynamic metropolitan centre, establishing itself as one of the best places to buy property. The city's appeal is fuelled by significant population growth, a diversifying job market, and Florida's advantageous no-state-income-tax policy. This powerful combination attracts a steady stream of domestic migrants and international investors, creating robust and sustained demand in the housing market.

Why Invest in Tampa?

The investment case for Tampa is anchored in its economic transformation and lifestyle offerings. The city presents a variety of neighbourhood profiles for investors:

- Urban Core Growth: The downtown Tampa condominium market has experienced price growth of over 25% in the last three years, driven by new developments and demand for urban living.

- Corporate Hub Demand: The Westshore business district, a major employment hub, is fuelling strong demand for luxury apartments and high-end rental properties.

- Historic Premium: Established and sought-after historic neighbourhoods like Hyde Park consistently command premium prices and maintain high resale values due to their charm and location.

Actionable Investment Strategies

To succeed in Tampa's burgeoning market, investors should focus on strategic analysis and location. Carefully evaluate flood zone maps and associated insurance costs, as these are critical factors in waterfront and low-lying areas. Targeting properties near major employment centres like Westshore or the burgeoning downtown core can secure reliable, long-term rental income. Additionally, given Tampa's status as a top tourist destination, exploring the short-term rental potential in areas like Seminole Heights or near the beaches can offer a lucrative alternative investment path. When evaluating condominiums, a thorough investigation of HOA fees and regulations is essential.

3. Nashville, Tennessee

Nashville, Tennessee, has transformed from a music-centric city into a dynamic economic hub, establishing its credentials as one of the best places to buy property. Its explosive growth, driven by corporate relocations in sectors like healthcare and technology, combined with a vibrant cultural scene, fuels strong and consistent housing demand. This unique blend of business appeal and lifestyle quality makes Nashville a highly attractive market for real estate investors seeking both appreciation and rental income.

Why Invest in Nashville?

The investment case for Nashville is anchored in its powerful population growth and ongoing urban development. The city presents a variety of neighbourhood profiles for strategic investment:

- Luxury Urban Renewal: The Gulch has evolved from an industrial area into a premier luxury district, with high-end condos and retail spaces commanding premium prices and attracting affluent residents.

- Sustained Gentrification: East Nashville continues its transformation, offering significant returns for investors who capitalised on its gentrification. The area remains a hotspot for its eclectic vibe and proximity to downtown.

- Mixed-Use Expansion: Areas surrounding Music Row are experiencing a boom in mixed-use development, blending residential, commercial, and entertainment spaces, which enhances property values and rental appeal.

Actionable Investment Strategies

To succeed in Nashville’s evolving market, investors must conduct careful, localised research. Focus on properties near major employment centres like Vanderbilt University Medical Center or the downtown corporate corridor to ensure a steady tenant pool. It is also crucial to stay informed on neighbourhood-specific short-term rental regulations, as they vary across the city and can significantly impact profitability. As you analyse potential deals, consider properties along proposed future transit corridors, as these areas are poised for substantial long-term appreciation and offer a strategic advantage.

4. Phoenix, Arizona

Phoenix, Arizona, has emerged as one of the best places to buy property, fuelled by its status as one of the fastest-growing metropolitan areas in the United States. Its appeal stems from a combination of robust job growth, significant corporate relocations, and a steady influx of retirees and families seeking a lower cost of living compared to neighbouring states like California. This sustained population boom creates consistent and diverse housing demand, solidifying its position as a top-tier real estate investment market.

Why Invest in Phoenix?

The investment case for Phoenix is anchored in its diverse economic drivers and varied housing stock. The market offers a wide spectrum of opportunities catering to different investor profiles and strategies:

- High-End Retirement: Scottsdale remains a premier destination for luxury properties, attracting affluent retirees with its upscale amenities, golf courses, and high quality of life.

- Student Rentals: Proximity to Arizona State University in Tempe provides a reliable stream of rental income from a large and consistent student population.

- Suburban Family Growth: Cities like Chandler and Gilbert are experiencing high demand for single-family homes, driven by strong school districts and family-friendly community developments.

These distinct submarkets allow investors to tailor their approach, from securing high-yield rentals to pursuing long-term capital appreciation in rapidly expanding suburban corridors.

Actionable Investment Strategies

To succeed in the dynamic Phoenix market, investors should focus on locations with modern infrastructure and forward-thinking development. Prioritise properties in master-planned communities or areas with recent upgrades to amenities and transport links. Understanding the region's seasonal rental patterns, particularly the winter "snowbird" season, can significantly boost rental income. Furthermore, given the desert climate, it is crucial to research water rights and potential restrictions associated with a property. Targeting neighbourhoods with highly-rated school districts is a reliable strategy for attracting long-term family tenants and ensuring strong resale value.

5. Raleigh-Durham, North Carolina

The Raleigh-Durham region, often called the Research Triangle, stands out as one of the best places to buy property due to its powerful combination of academic prestige and corporate innovation. This area, anchored by three major universities (Duke, UNC-Chapel Hill, and NC State), and a world-renowned technology and research park, fosters a highly educated workforce and consistent economic growth. This synergy creates a stable and appreciating real estate market that offers a high quality of life at a more accessible price point than many other tech hubs.

Why Invest in Raleigh-Durham?

The investment case for the Research Triangle is built on its recession-resistant economy and steady population growth. The market offers a variety of investment opportunities:

- Urban Revitalisation: Downtown Durham's ongoing revitalisation has attracted a wave of young professionals and start-ups, leading to significant appreciation in condo and townhouse values.

- Student Housing Demand: The constant presence of a large student population in Chapel Hill provides a reliable and lucrative rental market, especially for properties near campus.

- Suburban Growth: Established and family-friendly neighbourhoods in Raleigh and Cary see strong demand, driven by excellent school districts and proximity to major employment centres in the Research Triangle Park.

This diverse economic base ensures a resilient demand for housing across various price points and property types, making it an attractive market for both long-term holds and capital appreciation strategies.

Actionable Investment Strategies

To succeed in the Raleigh-Durham market, investors should focus on properties that cater to its core demographic drivers. Prioritise locations with easy access to the Research Triangle Park, major universities, and healthcare centres like Duke University Hospital. Evaluating neighbourhoods with strong school districts is crucial for attracting long-term family tenants. Additionally, understanding specific municipal regulations, particularly concerning student rentals in towns like Chapel Hill, is essential for maximising rental yields and ensuring compliance. This strategic focus will help you secure properties with sustained demand and strong resale potential in a market poised for continued growth.

6. Denver, Colorado

Denver, Colorado, has firmly established itself as a premier destination for real estate investment, blending a robust economy with an unparalleled lifestyle appeal. The city’s dynamic job market, fuelled by the tech, aerospace, and renewable energy sectors, attracts a steady stream of young professionals and families. This consistent population growth, combined with its reputation as a gateway to the Rocky Mountains, makes Denver one of the best places to buy property for both long-term appreciation and strong rental demand.

Why Invest in Denver?

Denver's investment appeal is rooted in its diverse neighbourhood profiles and sustained economic expansion. The city offers a variety of strategic opportunities for discerning buyers:

- Artistic and Urban Renewal: The RiNo (River North) Art District has transformed from an industrial zone into a vibrant cultural hub, with loft conversions and new developments driving significant property value increases.

- Stable Rental Markets: Classic neighbourhoods like Capitol Hill and Cheesman Park maintain high desirability and consistent rental demand due to their historic charm and proximity to downtown.

- Suburban Growth: As urban prices climb, suburban markets such as Lakewood and Littleton are attracting families with more affordable single-family homes and excellent amenities, creating new pockets for investment.

This variety allows investors to target different demographics, from urban millennials to growing families, securing a resilient portfolio.

Actionable Investment Strategies

To succeed in Denver’s competitive market, investors should focus on properties that align with key lifestyle and economic drivers. Prioritise locations with excellent access to public transport, such as the RTD Light Rail, and proximity to major employment centres in the Denver Tech Center or downtown. Additionally, properties near parks, trails, and recreational facilities command a premium and attract long-term tenants. When evaluating opportunities, factor in the appeal of the outdoor lifestyle, as this is a primary motivator for people relocating to the area. Analysing gentrification patterns in neighbourhoods like Sunnyside or Globeville can also uncover opportunities for substantial capital growth.

7. Atlanta, Georgia

Atlanta, Georgia, stands as the undisputed economic powerhouse of the American Southeast, presenting investors with one of the best places to buy property due to its diverse and expanding market. The city's landscape is a blend of major corporate headquarters, the world's busiest airport, and a vibrant cultural scene, all underpinned by relatively accessible real estate prices compared to other major U.S. metropolitan areas. This combination of economic strength and affordability creates a fertile ground for both rental income and long-term capital appreciation.

Why Invest in Atlanta?

The investment appeal of Atlanta is rooted in its dynamic growth and neighbourhood-specific opportunities. Its diverse economic base, spanning logistics, technology, and entertainment, ensures resilient housing demand.

- BeltLine-Driven Growth: The Atlanta BeltLine, a massive urban redevelopment project, has dramatically revitalised adjacent neighbourhoods, with property values in areas like the Old Fourth Ward and West End experiencing significant increases.

- Corporate Relocations: Suburban markets such as Alpharetta and Cumming are magnets for corporate relocations, fuelling demand for family homes and boosting local economies.

- Luxury and High-Density: Midtown continues its ascent as a premier destination for luxury high-rise condos and apartments, catering to a growing population of young professionals and executives.

Actionable Investment Strategies

To succeed in Atlanta’s multifaceted market, investors should adopt a targeted approach. Focus on properties located near planned infrastructure improvements or major employment hubs to secure future growth. Proximity to MARTA rail stations remains a key driver for rental demand, offering tenants convenient transit access across the sprawling metro area. Furthermore, in suburban markets, thoroughly researching the quality of local school districts is paramount, as this is a primary consideration for the family-oriented renter and buyer demographic, directly impacting property value and desirability.

8. Las Vegas, Nevada

Las Vegas, Nevada, has evolved from a pure entertainment hub into one of the best places to buy property, driven by economic diversification and relative affordability. Beyond the Strip, the city's expanding business landscape, coupled with Nevada's favourable tax policies, attracts a steady stream of new residents and companies. This dynamic growth supports a resilient housing market, presenting unique opportunities for investors in both traditional and short-term rental sectors.

Why Invest in Las Vegas?

The investment case for Las Vegas is rooted in its continuous expansion and diverse real estate inventory. Neighbourhoods offer distinct advantages:

- Urban Revitalisation: Downtown Las Vegas is undergoing a significant transformation, spurred by projects like Tony Hsieh's Downtown Project, leading to increased demand for urban-style living and commercial spaces.

- Master-Planned Success: Communities like Summerlin consistently command high property values due to their premium amenities, excellent schools, and high quality of life, making them a stable investment.

- Short-Term Rental Hotspot: Proximity to the Strip creates a lucrative market for short-term rentals, with high occupancy rates driven by year-round tourism and major conventions.

Actionable Investment Strategies

To capitalise on the Las Vegas market, investors should focus on targeted opportunities. Areas with robust economic diversification, away from sole reliance on tourism, offer more sustainable long-term growth. It is critical to thoroughly research Homeowners' Association (HOA) regulations, as many have stringent restrictions on short-term rentals. Additionally, understanding seasonal tourism patterns can help forecast rental income more accurately. When evaluating properties, factor in Nevada's unique water rights and potential future restrictions, as this can impact long-term property viability and costs.

9. Kansas City, Missouri

Kansas City, Missouri, has emerged as one of the best places to buy property for investors prioritising affordability and strong cash flow. This Midwest hub offers a compelling alternative to coastal markets, boasting a diversified economy that includes technology, health services, and advanced manufacturing. Its stable growth and low entry costs create a fertile ground for real estate investment, attracting those looking for sustainable returns without the intense competition of more saturated cities.

Why Invest in Kansas City?

The investment appeal of Kansas City is rooted in its potent combination of affordability and rental demand. Unlike markets driven primarily by appreciation, Kansas City excels in generating consistent income, making it a favourite among cash-flow-focused investors.

- Dynamic Urban Core: Revitalisation in areas like the Crossroads Arts District and the Power & Light District has transformed the city centre, attracting young professionals and driving rental demand.

- Suburban Strength: Surrounding suburbs, such as Overland Park (technically in Kansas but part of the metro area), offer highly-rated schools and family-friendly amenities, creating a robust market for single-family rentals.

- Impressive Yields: The city's favourable price-to-rent ratio frequently allows investors to achieve rental yields exceeding 8-10%, a figure difficult to match in more expensive markets.

This focus on yield provides a buffer against market fluctuations and offers a more predictable investment path.

Actionable Investment Strategies

Success in the Kansas City market hinges on targeting properties that deliver immediate and reliable cash flow. Investors should prioritise neighbourhoods with strong employment anchors and community development plans. Researching city-led revitalisation projects can uncover future growth areas before prices escalate. Due to the market's nature, securing a reliable property management team is crucial for out-of-state investors to handle day-to-day operations effectively. As you explore opportunities, you can view a curated list of available houses for sale in markets like Kansas City to see real-world examples.

Top 9 Cities for Property Purchase Comparison

| City | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Austin, Texas | Moderate: Competitive market and limited inventory | High: High property taxes and prices | High ROI (10-15% annually), strong appreciation | Long-term appreciation, tech sector proximity | No state income tax, booming tech jobs |

| Tampa, Florida | Moderate: Hurricane risks and insurance complexities | Moderate: Manage seasonal tourism impact | Solid ROI (8-12%), growth in urban & waterfront | Waterfront investments, short-term rentals | No state income tax, growing job diversification |

| Nashville, Tennessee | Moderate to High: Gentrification and competitive market | Moderate: Need to assess neighborhood dynamics | High ROI (12-18%), strong rental demand | Investments in appreciating neighborhoods | No state income tax, strong cultural appeal |

| Phoenix, Arizona | Moderate: Consider water issues and heat effects | Moderate: HOA fees common in new developments | ROI varies (8-14%), stable appreciation | Retiree housing, family rentals | Rapid population growth, no major weather risks |

| Raleigh-Durham, NC | Moderate: University and tech-driven market | Moderate: Seasonal student rental factors | Stable ROI (9-13%), consistent appreciation | Student rentals, tech employees housing | Three major universities, strong tech sector |

| Denver, Colorado | Moderate: Limited housing supply and seasonal weather | Moderate to High: High prices and competition | Moderate ROI (7-11%), steady property growth | Outdoor lifestyle rentals, tech sector proximity | Strong job market, high quality of life |

| Atlanta, Georgia | Moderate: Urban sprawl and traffic issues | Moderate: Crime concerns in some districts | ROI approx. 8-12%, diverse rental demand | Corporate relocations, affordable urban investments | Major corporate hubs, diverse economy |

| Las Vegas, Nevada | Moderate: Tourism-dependent economy and desert climate | Moderate: Water scarcity and market volatility | High ROI (10-16%) including short-term rentals | Short-term rentals, diversified economic investments | No state income tax, strong short-term rental market |

| Kansas City, Missouri | Low to Moderate: Emerging market with slower appreciation | Low: Affordable entry with stable rentals | High cash-on-cash returns (12-18%) | Cash flow-focused investments, affordable market entry | Very affordable prices, strong rental yields |

Your Next Step in Moroccan Property Investment

Navigating Morocco's dynamic property market presents a journey filled with unique opportunities and regional nuances. From the high-energy, cosmopolitan pulse of Casablanca to the sun-drenched, tranquil allure of Agadir, and the historic, cultural depth of Fes, this guide has showcased the diverse investment landscapes available across the nation. Each location offers a distinct proposition, whether you are seeking high rental yields in a bustling tourist hub like Marrakech, a serene retirement villa in Essaouira, or a modern apartment in the administrative capital, Rabat.

The common thread connecting a successful purchase in any of these top-tier locations is the critical importance of aligning your personal and financial objectives with the specific market's character. Understanding the local economic drivers, future development plans, and cultural intricacies is not just advisable; it is essential for making an informed decision. This is where moving beyond online research and into on-the-ground, expert-led exploration becomes paramount in your search for the best places to buy property.

Synthesising Your Strategy

To move forward with confidence, it is time to synthesise the insights from this article into a concrete action plan. Consider the following key takeaways as your strategic framework:

- Define Your "Why": Revisit your primary motivation. Is this a lifestyle purchase for a holiday home, a long-term rental investment, a commercial venture, or a future family residence? Your goal will heavily influence which city or region is the best fit.

- Financial Readiness: A successful investment goes beyond the purchase price. Have you accounted for notary fees (frais de notaire), registration taxes, potential renovation costs, and ongoing property management expenses? A comprehensive budget is your best defence against unforeseen costs.

- The Power of Local Expertise: The Moroccan property market has its own legal and administrative procedures. Engaging with professionals who have mastered these complexities, from navigating title deeds (titres fonciers) to understanding local zoning laws, is non-negotiable for a secure transaction.

Key Insight: The most successful property investors in Morocco do not just buy a building; they invest in a location's future. This requires a deep understanding of micro-market trends, something that can only be gained through localised, professional guidance.

Ultimately, your journey to property ownership in Morocco is a significant undertaking, but it is one filled with immense potential for both personal enrichment and financial return. The difference between a good investment and a great one often lies in the quality of the advice you receive and the thoroughness of your preparation. By taking a methodical, well-researched approach, you position yourself to not only find a property but to secure a valuable asset that aligns perfectly with your vision for the future.

Ready to turn your Moroccan property aspirations into reality? The expertise of a trusted partner can make all the difference. The team at Rich Lion Properties provides the in-depth local knowledge and professional support necessary to navigate the complexities of the market, ensuring you find the perfect property with confidence. Explore your opportunities and begin your journey today by visiting Rich Lion Properties.