Understanding Frais Notaire Maroc (Without The Confusion)

Buying property in Morocco is exciting, but understanding the associated costs can feel overwhelming. One key area that often creates confusion is the "frais notaire maroc," or notary fees. These fees are integral to legally transferring property, ensuring a secure and legally sound transaction. Let's break down these fees and how they affect your budget.

What Exactly Are Frais Notaire Maroc?

Frais notaire maroc isn't a single payment. It comprises several components, each with a specific role in finalizing your purchase. This includes the notary's service fees, registration fees, land registry fees, and various administrative costs. Understanding this breakdown is crucial for avoiding unexpected costs.

One common misunderstanding is that the notary's fee constitutes the majority of the frais notaire. In reality, these fees cover several government taxes and administrative procedures. A significant portion of your payment goes directly to the Moroccan government, not the notary.

For example, notary fees for real estate transactions in Morocco include several elements. Notary service fees are typically 1% of the purchase price (excluding VAT) with a minimum of 2,500 Dirhams (DH) (excluding VAT). VAT on the notary's invoice is 10%. Registration fees are 4% of the purchase price for most properties, but 3% for social housing and 5% for undeveloped land (unless developed within seven years). Land registry fees are 1.5% of the purchase price plus a fixed fee of 200 DH. Learn more about these fees here.

Breaking Down the Fees

To illustrate this structure, consider a hypothetical purchase of a property for 1,000,000 DH. The notary's fee would be 10,000 DH (1%), plus 1,000 DH in VAT. Registration fees would be 40,000 DH (4%). Land registry fees would be 15,200 DH (1.5% + 200 DH), plus other minor administrative costs. The total frais notaire can be substantial, significantly affecting your overall budget.

To provide a clearer picture, let's examine a breakdown of these components in a table:

To better understand the composition of these fees, the following table provides a detailed breakdown:

Breakdown of Frais Notaire Maroc Components:

Detailed breakdown of all fee components in Moroccan property transactions

| Fee Type | Percentage | Minimum Amount | VAT Applied |

|---|---|---|---|

| Notary Service Fee | 1% | 2,500 DH | 10% |

| Registration Fee | 4% (3% for social housing, 5% for undeveloped land) | N/A | N/A |

| Land Registry Fee | 1.5% + 200 DH fixed fee | 200 DH | N/A |

This table summarizes the main components of the Frais Notaire Maroc, allowing for a quick comparison and overview of the costs involved. It's crucial to remember that these percentages and minimum amounts can vary, so it's always best to consult with a notary for precise figures.

Why These Fees Exist

These fees, while complex, protect both buyer and seller. They ensure the legal transfer of ownership, accurate documentation, and adherence to Moroccan property laws. The notary acts as an impartial third party, verifying all transaction details and facilitating the smooth transfer of ownership. This process minimizes risks and safeguards your investment. Understanding frais notaire maroc allows you to budget effectively and navigate your purchase confidently.

Who Pays What: The Real Cost Distribution Story

When buying property in Morocco, understanding the distribution of frais notaire maroc (notary fees) is crucial for effective budgeting and a smooth transaction. The cost distribution isn't always evenly split, so this section clarifies the typical responsibilities of buyers and sellers in Moroccan property transactions.

The Buyer's Burden: A Deeper Look

Buyers typically bear the brunt of the frais notaire maroc in Morocco. This includes the notary fees themselves, along with administrative and registration costs. These expenses can significantly add to the overall purchase price.

For instance, the buyer typically covers all notary fees, ranging from 6% to 7% of the sale price. Additional costs include VAT, land conservation fees, and registration fees. Consider a property sold for 2 million Moroccan Dirhams (MAD). Notary fees could be around 20,000 MAD, with VAT adding 4,000 MAD, land conservation fees at 30,000 MAD, and registration fees at 80,000 MAD. Other miscellaneous fees may also apply. This substantial financial commitment necessitates careful budgeting when purchasing property in Morocco. Learn more: Notary Fees in Morocco for Real Estate Purchase.

The Seller's Share: What to Expect

While buyers usually shoulder most of the frais notaire maroc, sellers also have responsibilities. These typically involve providing necessary documentation, such as proof of ownership and compliance certificates. Sellers may also be responsible for clearing any existing liens or mortgages on the property.

Though generally lower than the buyer's expenses, these costs are still important factors for sellers to consider. Addressing these responsibilities upfront ensures a smoother and more transparent transaction for everyone involved. For insights into the luxury market, see: Understanding the Marrakech Luxury Property Market.

To illustrate the typical cost breakdown, let's look at a comparison table:

The following table provides a comparison of typical cost responsibilities between buyers and sellers in Moroccan property transactions.

| Cost Type | Buyer Responsibility | Seller Responsibility | Negotiable |

|---|---|---|---|

| Notary Fees | Typically 6-7% of sale price | Usually none | Sometimes |

| VAT on Notary Fees | Yes | No | Rarely |

| Registration Fees | Yes | No | Sometimes |

| Land Conservation Fees | Yes | No | Rarely |

| Property Taxes (pre-sale) | No | Yes | Sometimes |

| Certificate of Ownership | No | Responsible for providing | N/A |

| Mortgage Clearance | No | Responsible for clearing if applicable | N/A |

This table highlights the main cost distinctions in a typical Moroccan property transaction, emphasizing the buyer's larger financial obligation. However, as indicated, some costs are open to negotiation.

Negotiating the Split: Is it Possible?

Though the traditional frais notaire maroc distribution favors the seller, negotiation is sometimes possible. In a buyer's market, sellers might be more willing to cover some of the buyer's costs to incentivize the sale.

This can be a valuable negotiating point for buyers seeking to minimize expenses. Understanding current market dynamics and working with an experienced real estate agent can significantly strengthen a buyer's negotiating position, potentially leading to substantial savings.

Your Transaction Journey: From Handshake To House Keys

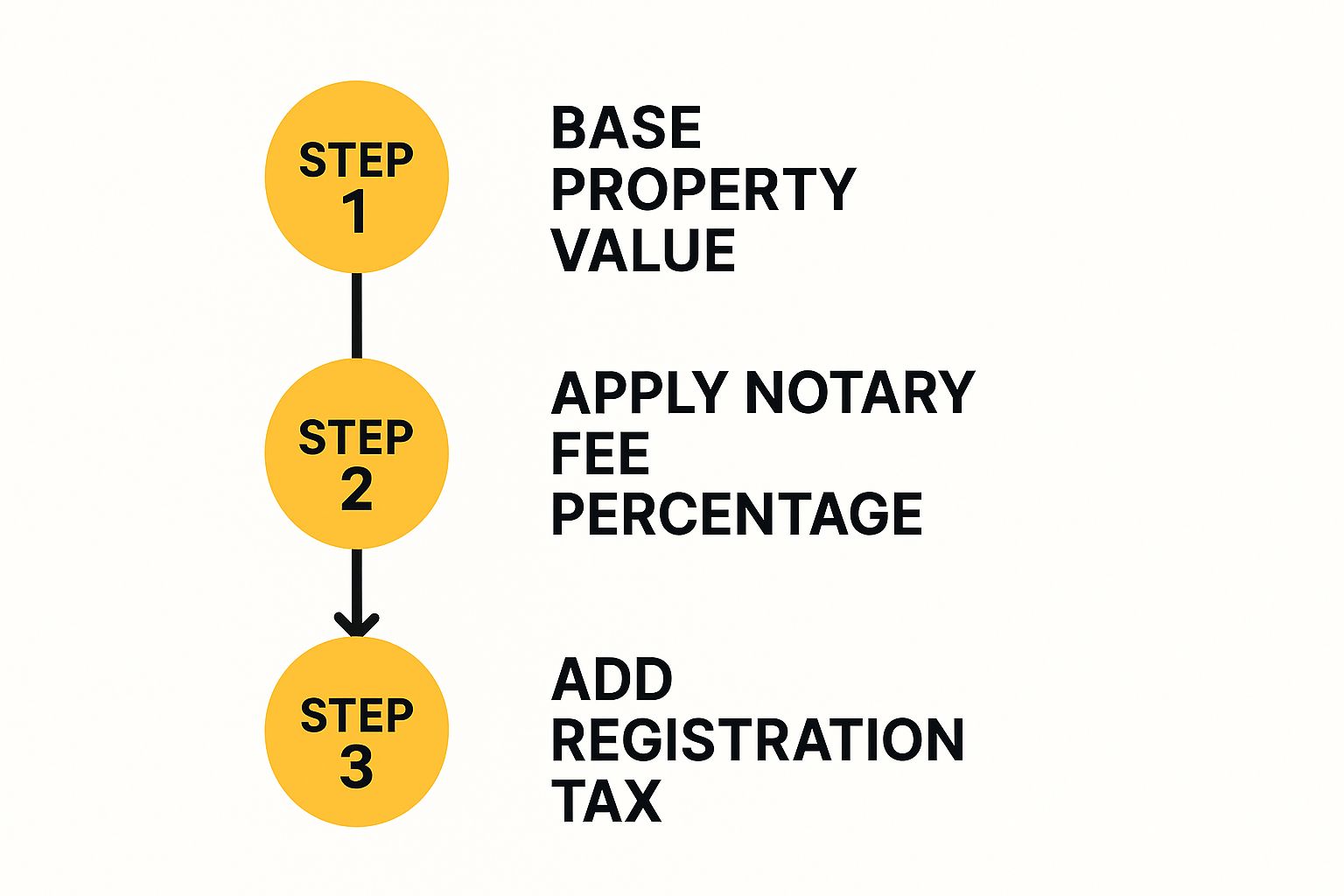

The infographic above illustrates how frais notaire maroc (notary fees) are calculated. The process begins with the property's base value. Then, the notary fee percentage is applied, followed by the addition of the registration tax. The visual representation clearly demonstrates how these fees accumulate, adding a significant amount to the initial property price. This underscores the importance of budgeting for these costs early in your property search.

So, what are the next steps after you've agreed on a price? The journey from that initial agreement to receiving your house keys involves several important stages, each with its own timeline and specific requirements. Understanding this process is essential for a smooth and stress-free buying experience.

Initial Agreement and Due Diligence

This first phase formalizes your offer and involves comprehensive due diligence. Your notary plays a critical role in verifying the property's legal standing, ensuring there are no hidden issues or encumbrances that could complicate the sale. This is also the time to finalize your mortgage or financing arrangements and gather all the necessary documents. This stage generally takes a few weeks, but the timeline can vary based on the complexity of the transaction.

The complexity often comes from the legal research required to ensure a clean title. Your notary will meticulously examine the property's history, ensuring that there are no outstanding liens or legal disputes that could affect your ownership.

Signing the Preliminary Contract (Compromis de Vente)

The Compromis de Vente is a legally binding contract that details the terms of the sale. This crucial document outlines the agreed-upon sale price, the payment schedule, and any conditions that must be met before the sale is finalized. Typically, a deposit of 10% of the purchase price is paid at this stage. Signing the Compromis de Vente is a significant milestone, solidifying your commitment to the purchase.

This contract provides legal protection for both the buyer and the seller, ensuring that all parties are aware of their obligations and responsibilities. It's a crucial step in the process.

Finalizing the Sale: The Authentic Deed (Titre Foncier)

Once all the conditions outlined in the Compromis de Vente have been fulfilled, the final step is signing the authentic deed (Titre Foncier) at the notary's office. This officially transfers ownership of the property to you. At this point, you will pay the remaining balance, which includes the frais notaire maroc. This final stage usually takes a few weeks to complete. For a comprehensive guide to buying property in Morocco, you can also refer to this resource: How to Buy Property in Morocco Easily.

The Titre Foncier is the official document that registers your ownership of the property with the Moroccan authorities. It's the culmination of the entire purchasing process.

Potential Delays and How to Avoid Them

While the process is usually straightforward, delays can sometimes occur. Common issues that can cause delays include financing complications, incomplete documentation, or unforeseen legal complexities. To minimize potential setbacks, ensure you have all necessary documents prepared in advance, maintain consistent communication with your notary, and address any issues promptly. Proactive planning and preparation are crucial for a timely and efficient closing.

Being organized and responsive can significantly streamline the process and reduce the likelihood of unexpected delays.

Tracking Your Progress and Staying Informed

Throughout the buying process, stay informed about your transaction's progress. Regularly communicate with your notary and real estate agent. Don't hesitate to ask questions and seek clarification on any aspects that are unclear. Staying proactive ensures that you're aware of any potential problems and can address them quickly, preventing costly delays and maintaining control of your purchase timeline. This knowledge empowers you to navigate the process confidently and ensures a seamless transition to owning your new property in Morocco.

Open communication is key to a successful property purchase. By staying informed and engaged, you can ensure a smooth and efficient transaction.

Special Property Types: Where Standard Rules Don't Apply

Not all properties in Morocco face the same frais notaire maroc (notary fees). Understanding these nuances can lead to significant savings. This section explores how property type affects your final costs. We'll examine social housing, undeveloped land, and commercial properties, highlighting the cost implications for each.

Social Housing: Reduced Fees and Incentives

Social housing programs in Morocco often feature reduced frais notaire maroc. This makes homeownership more accessible, especially for first-time buyers. The standard registration fee, typically 4%, can be lowered to 3%. This difference can translate into substantial savings.

Additionally, certain government incentives might further reduce costs. These programs aim to encourage homeownership among specific demographics, easing the financial burden.

Undeveloped Land: Development Commitments and Cost Savings

Undeveloped land transactions have unique frais notaire maroc implications. The standard 4% registration fee can sometimes increase to 5%.

However, this higher rate can be mitigated. By committing to develop the land within seven years, buyers can often secure the lower 4% rate. This significantly reduces their initial outlay and incentivizes development.

Commercial Property: A Different Landscape

Commercial properties operate under distinct frais notaire maroc rules. These fees often differ significantly from residential transactions, reflecting the different nature of commercial investments.

Due diligence is crucial here. The intricacies of commercial real estate transactions often demand expert guidance. Working with an experienced notary is vital for navigating these complexities.

Regional Variations and Special Programs

Frais notaire maroc can also vary regionally. Special programs or local incentives might exist, impacting the final cost.

For example, certain regions might offer reduced registration fees to stimulate economic activity. Consulting with a local notary or real estate agent familiar with regional specifics is essential. This will ensure you're aware of all potential cost savings in your area. Being informed about these variations can provide a significant advantage when budgeting.

Understanding how these special property types affect frais notaire maroc allows for strategic purchasing. This knowledge can help minimize costs and maximize your investment.

Smart Strategies For Managing Your Notary Costs

While frais notaire maroc (notary fees in Morocco) are an unavoidable part of purchasing property in Morocco, minimizing them is entirely possible with careful planning. This involves understanding the fee structure, selecting the right notary, and asking the right questions upfront.

Selecting The Right Notary: Experience Matters

Not all notaries offer the same level of service or expertise. An experienced notary, particularly one familiar with the specific region of your purchase, can prove invaluable. Their local knowledge can streamline the process, potentially identifying cost savings related to regional variations in frais notaire maroc.

For example, an experienced notary can advise on the implications of pre-existing development commitments for undeveloped land, potentially lowering your registration fees. They might also have insights into social housing programs that offer reduced frais notaire maroc.

Asking The Right Questions Upfront: Transparency Is Key

Open communication with your notary from the outset is essential. A transparent notary will readily provide a detailed breakdown of all expected frais notaire maroc. This allows for accurate budgeting and facilitates comparison shopping among different notaries.

Be sure to inquire about any optional services and confirm that you're only paying for what you need. Some services, while beneficial, may not be essential for your specific transaction. This proactive approach can help avoid unexpected costs.

Timing Strategies: When You Buy Can Affect Your Costs

In certain circumstances, the timing of your purchase can influence the frais notaire maroc. Regional incentives or specific programs aimed at reducing notary fees might be time-limited.

Working with a knowledgeable real estate agent can be extremely beneficial in navigating these timing considerations. Understanding payment schedules is also crucial for effective budget management. For further insights on property investment in Morocco, you might find this article helpful: Top Reasons to Invest in Marrakech Real Estate in 2024.

Optimizing Costs Through An Experienced Real Estate Agent

Partnering with an experienced real estate agent in Morocco can provide a significant advantage. Local agents often have established relationships with reputable notaries known for fair pricing and efficient service.

Beyond notary recommendations, agents can offer valuable negotiation strategies and help you avoid unnecessary expenses. Their market knowledge can also help identify properties with potential for lower frais notaire maroc, such as social housing or land with existing development commitments.

Spotting Potential Overcharges: Know Your Rights

Understanding the standard fee structures for frais notaire maroc is essential for protecting yourself from potential overcharges. This knowledge empowers you to negotiate effectively and ensures fair pricing. Comparing quotes from multiple notaries can help establish a reasonable market price.

While most notaries adhere to established fee schedules, being aware of potential discrepancies is important. This vigilance allows you to identify any inflated costs, ensuring you receive fair value for your investment. By implementing these strategies, you can effectively manage your frais notaire maroc and maximize your property investment in Morocco.

Costly Mistakes (And How Smart Buyers Avoid Them)

Navigating the Moroccan property market presents unique challenges. Understanding frais notaire maroc, or notary fees, is crucial. This section explores common pitfalls that can complicate your purchase and how to avoid them.

Budgeting Blunders: The Hidden Costs of Frais Notaire Maroc

Underestimating the total cost of frais notaire maroc is a frequent mistake. These fees typically range from 6% to 7% of the property price. This represents a substantial sum that can easily surprise unprepared buyers. For instance, on a 2,000,000 MAD property, these fees could reach 140,000 MAD.

Inadequate budgeting can lead to significant financial stress and potentially delay closing. In some cases, it could even jeopardize the entire purchase. Smart buyers proactively obtain a detailed breakdown of all anticipated costs from their notary. This ensures a clear and realistic understanding of their financial obligations.

Documentation Disasters: The Price of Poor Preparation

Insufficient document preparation is another common pitfall. The Moroccan property buying process involves specific documentation requirements at each stage. Missing or incorrect documents can lead to costly delays and frustrating administrative hurdles.

Proper preparation is not just about having the right paperwork; it's about having it readily available when needed. Procrastination can create significant bottlenecks, delaying your transaction and potentially leading to unexpected expenses.

The Perils of Inexperience: Choosing the Right Notary

Selecting an inexperienced notary can prove costly. A notary unfamiliar with the intricacies of Moroccan property law or regional variations in frais notaire maroc might overlook potential cost savings or miss critical legal details.

Similarly, neglecting thorough due diligence can have severe financial repercussions. Due diligence protects your investment by uncovering any potential issues with the property or its legal status before finalizing the purchase.

Red Flags and Preventive Measures: Protecting Your Investment

Early recognition of potential problems is essential. Red flags such as unclear ownership titles, discrepancies in property documentation, or unusually low frais notaire maroc quotes should raise immediate concerns.

Smart buyers approach the process cautiously. They ask questions, seek expert advice, and carefully review all documentation. Consider this helpful checklist:

- Obtain detailed frais notaire maroc quotes from multiple notaries. This comparison ensures competitive pricing and transparency.

- Verify the notary’s credentials and experience. Choose a reputable notary with a proven track record in Moroccan property transactions.

- Conduct thorough due diligence. Don't underestimate this critical step. Uncovering problems early is always preferable to costly surprises later.

- Prepare all necessary documents in advance. Organization and proactivity can prevent delays and minimize stress during the buying process.

- Seek professional guidance. An experienced real estate agent can provide invaluable support and help you navigate potential pitfalls.

By avoiding these common mistakes and taking proactive measures, you can safeguard your investment and navigate the Moroccan property market with confidence.

Your Action Plan For Frais Notaire Maroc Success

Ready to navigate the complexities of frais notaire maroc with confidence? This action plan provides a practical roadmap, consolidating key information into actionable steps.

Budgeting For Frais Notaire Maroc: A Comprehensive Checklist

Understanding and preparing for frais notaire maroc is crucial for a smooth property purchase. Start by estimating these fees, typically 6-7% of the property price. For a 2,000,000 MAD property, this translates to 120,000 – 140,000 MAD.

Obtain a detailed quote from your notary specifying all fee components. This should include notary fees, registration fees, land registry fees, administrative costs, and VAT. Don't forget to factor in additional costs like potential property taxes (for the seller) and any mortgage clearance fees.

Secure your financing arrangements well in advance to avoid delays and potential penalties. Finally, set aside a contingency fund for unexpected expenses that may arise during the process.

Choosing The Right Notary: Essential Questions To Ask

Selecting the right notary is a critical step. Inquire about their experience with property transactions, particularly in your chosen region. A notary specializing in Marrakech real estate, for example, will offer valuable local expertise.

Fee transparency is essential. Request an itemized breakdown of all fees and compare quotes from multiple notaries to ensure competitive pricing. Effective communication is vital; choose a notary who responds promptly and addresses your concerns thoroughly.

Research the notary's reputation by seeking recommendations from trusted sources, such as real estate agents or previous clients. Finally, clarify the services included in their fees to avoid paying for unnecessary extras.

Timeline And Milestones: Setting Realistic Expectations

Understanding the typical timeline helps manage expectations. Due diligence, involving verification of the property's legal standing, can take several weeks. The Compromis de Vente, a preliminary contract usually requiring a 10% deposit, is a significant milestone.

The Titre Foncier, the final deed transfer, officially grants you ownership. This stage typically takes a few weeks, culminating in the payment of the remaining balance, including the frais notaire maroc. Be aware that unforeseen circumstances can cause delays. Maintain open communication with your notary and real estate agent to address any issues proactively.

Document Preparation: Stay Organized And Proactive

Gathering the necessary documents early streamlines the process. Prepare your identification, financial documents, and any property-related certificates in advance. Checklists are invaluable tools for tracking progress and ensuring no crucial documents are overlooked. This proactive approach can prevent costly delays. Don't hesitate to consult with your real estate agent or notary for any questions regarding document requirements.

By following this action plan, you can effectively manage your frais notaire maroc and ensure a smoother, more transparent property buying experience. Ready to begin your property search in Morocco? Contact Rich Lion Properties today at https://richlionproperties.com for expert guidance and personalized support. We specialize in helping clients navigate the Moroccan real estate market, from finding the perfect property to ensuring a seamless transaction.