To successfully invest in property, you need more than just money. You need a clear strategy, a firm grasp on your finances, and a deep, practical understanding of the market you're entering. This all starts with defining what you want to achieve—like long-term growth or immediate rental income—and then being honest about what you can afford. This groundwork is absolutely essential, especially in a dynamic and competitive market like Massachusetts.

Building Your Massachusetts Investment Strategy

Before you even glance at a listing or step into an open house, the real work begins. I've seen countless investors jump the gun, but the most successful ones know that winning isn't about luck. It’s about building a deliberate, well-researched strategy. Think of this as your personal roadmap, the guide that will inform every single decision you make, from the type of property you target to the offers you write.

This is your investment thesis. It’s a clear statement that outlines your objectives and the logic driving them. Nailing this down now answers the tough questions upfront and helps you sidestep costly mistakes later on.

What Does Success Look Like for You?

First things first, you need to define your "win." Real estate investing is not a one-size-fits-all venture. Your personal finances, your comfort level with risk, and your long-term ambitions all dictate the right path for you.

Let's look at a few common goals I see with clients:

- Long-Term Appreciation: This is the classic "buy and hold." You're betting on a property in an area with strong growth potential, holding it for years, and letting its value climb. It’s often a lower-risk, slower-burn approach to building serious equity.

- Monthly Cash Flow: Here, the goal is to buy a property where the rental income comfortably covers all your expenses—mortgage, taxes, insurance, and maintenance. Multi-family homes are the quintessential cash-flow assets for this reason.

- The "Fix-and-Flip": This is a more active strategy. You acquire an undervalued or distressed property, renovate it efficiently, and then sell it for a profit. It’s a higher-risk, higher-reward game that demands capital, project management skills, and a keen sense of the local market.

The path you choose changes everything. A cash-flow investor might zero in on a duplex near a university, whereas someone focused on appreciation might seek a single-family home in a suburb that just announced a new school project.

Getting to Know the Massachusetts Market

Once you know your personal goals, you have to see how they fit into the unique landscape of the Massachusetts real estate market. The state offers a distinct set of opportunities and challenges, largely driven by its robust economy, world-class universities, and high population density.

To put it into perspective, here's a quick comparison of how Massachusetts stacks up against the rest of the country.

Massachusetts vs National Real Estate Snapshot

| Metric | Massachusetts | U.S. National Average |

|---|---|---|

| Median Home Value | Approx. $605,900 | Approx. $358,700 |

| Homeownership Rate | Approx. 62.3% | Approx. 65.7% |

| Historical Appreciation | Consistently above average | National baseline |

This data shows that while entry costs are higher, the potential for appreciation is strong. Most importantly, the lower homeownership rate points directly to a larger pool of renters.

Key Takeaway: The fact that a lower percentage of the population in Massachusetts owns their homes means a higher percentage are renters. For an investor, this signals a deep, consistent, and reliable demand for rental properties across the state.

A Financial Reality Check

With your goals set and a feel for the market, it's time for an honest look in the financial mirror. Before you even think about talking to a lender, you need to know your own numbers inside and out. Our guide outlining the steps to buying a house is a great resource to help you get organised.

Start by asking yourself these crucial questions:

- How much cash do I have ready for a down payment and closing costs?

- What’s my debt-to-income (DTI) ratio? Lenders will put this under a microscope.

- Do I have a cash reserve for the inevitable—unexpected repairs, maintenance, and potential vacancies? Having at least six months of expenses saved is a solid rule of thumb.

Many first-time investors are pleasantly surprised to find their financial picture is stronger than they realised, especially if they carry little debt and have a good credit history. Banks want to see a track record of responsible financial management. Getting pre-approved isn't just about your income; it's about the complete story of your financial health. This self-assessment is what gives you the confidence to move forward.

Finding High-Growth Investment Locations

If you're only looking at the same popular Boston suburbs as every other investor, you're setting yourself up to overpay. The real wins in property investment, especially when you're starting out, are found where others aren't looking yet. To build serious, long-term wealth, you have to get good at spotting emerging markets before they peak. This isn't about chasing today's hot postcodes; it's about digging into the fundamental trends that signal future growth.

Thinking like a seasoned investor means looking past the surface and identifying the real drivers of appreciation. These aren't just hunches. They are tangible, on-the-ground developments that create genuine, lasting value. Things like new infrastructure projects, a growing job market, and demographic shifts are the tell-tale signs that bring new people and fresh demand into an area.

Pinpointing Tomorrow's Hotspots

Finding a town on the cusp of a boom isn't luck—it's the result of a proactive, data-led approach. You're searching for a specific combination of signals that, together, build a compelling case for future growth. It really comes down to connecting the dots between municipal investment and market potential.

Here are the critical indicators I always keep an eye on:

- Infrastructure Investment: Keep your ear to the ground for news about new public transport links, highway expansions, or major public works. A new commuter rail station, for instance, can be a game-changer, suddenly making a town far more attractive to Boston commuters and pushing property values up.

- Job Market Expansion: Watch for announcements of new corporate headquarters, hospitals, or tech hubs moving into an area. Nothing fuels housing demand quite like job growth.

- Demographic Shifts: I always analyse census data to spot trends in population growth, age, and income. An influx of young professionals or families is a classic leading indicator of rising demand for both rentals and starter homes.

- Quality-of-Life Improvements: Don't underestimate the small things. New parks, a revitalised town centre, or the arrival of popular cafes and shops all boost a town's appeal. These amenities make an area a more desirable place to live, justifying higher rents and property prices down the line.

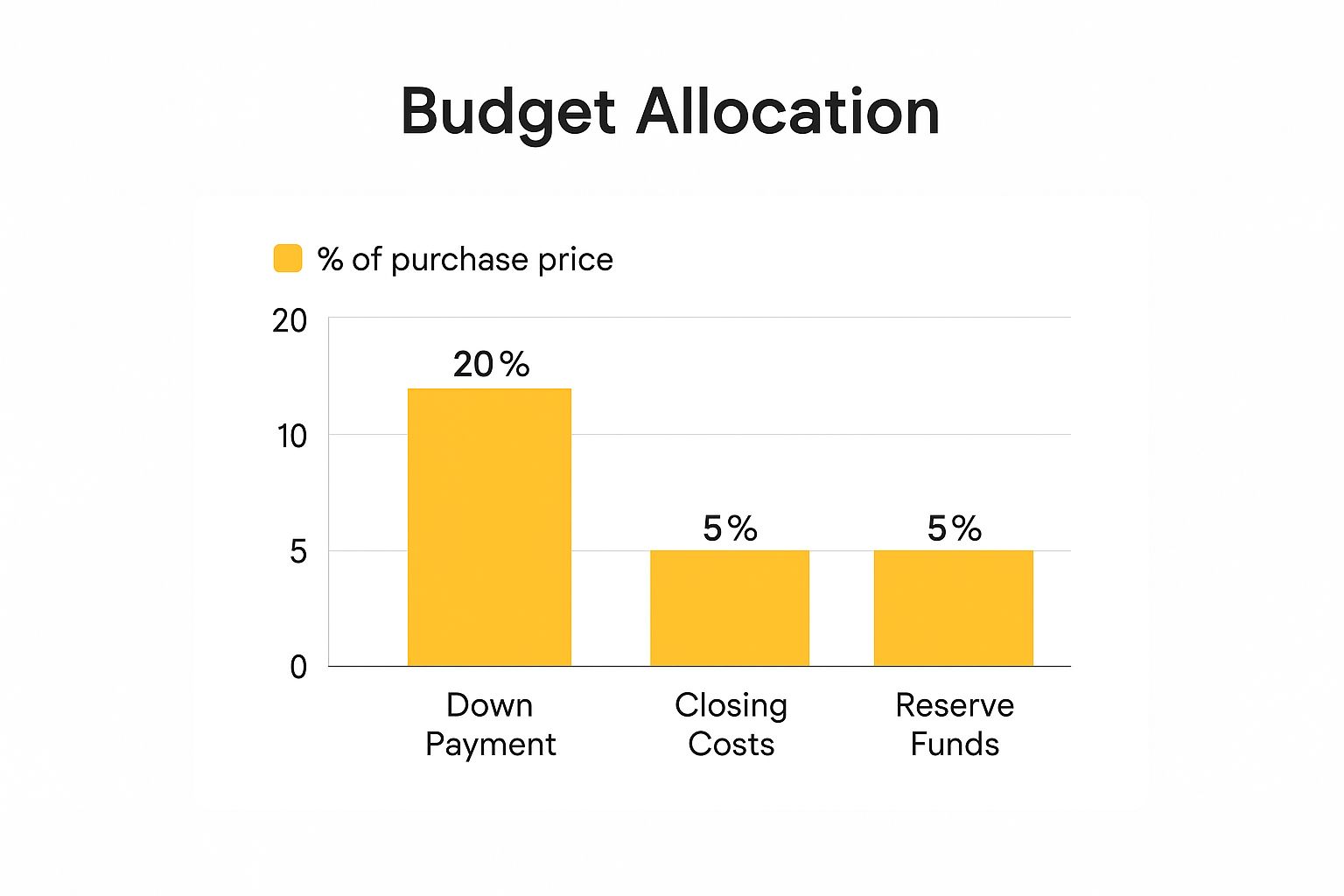

Once you find a promising location, you need to have your finances in order. This infographic breaks down the key budget items you'll need ready.

As the visual shows, it's not just about the down payment. Smart investors always budget for closing costs and maintain a healthy reserve fund for those inevitable surprises.

A Real-World Example of Explosive Growth

Sometimes, the best opportunities are hiding in plain sight, in places that have been overlooked for years. The town of Athol, Massachusetts, is a perfect real-world example of this principle in action. Its recent market performance shows just what can happen when the underlying fundamentals finally click into place.

The housing market in Athol appreciated by an incredible 143.7% between 2016 and 2025. This surge took average home values from $129,740 up to $316,160—a massive return for anyone who invested early.

What’s even more remarkable is how much of this growth happened recently, with a 75.4% jump since 2020 alone. This was fired up by a mix of factors, especially its affordability compared to the rest of the state, which made it a magnet for buyers priced out of more expensive markets. Even after this rapid rise, Athol is still one of the more affordable towns in Massachusetts. You can dig into more data on the fastest-growing housing markets in Massachusetts to see these trends for yourself.

Stories like Athol’s prove the power of looking for value where others don’t. By focusing on affordability and identifying towns with room to run, you can position yourself for some significant gains. The trick is to get in before the market catches on, allowing you to ride the wave of appreciation. This hunt for undervalued assets is truly a cornerstone of building a resilient and profitable investment portfolio.

Navigating the Competitive Moroccan Property Market

Finding a promising investment property in Morocco is just the first step. Now comes the real test: securing it. The Moroccan market, especially in popular cities, can be incredibly competitive. Success isn't always about who has the deepest pockets; it’s about being strategic, moving decisively, and putting together an offer that a seller simply can’t ignore.

First, you need to know where the action is. Morocco's real estate sector is dynamic, with certain areas seeing much more activity than others. For example, prime locations in Marrakech, Casablanca, and Tangier often attract multiple buyers, leading to faster sales and sometimes even bidding wars. This is particularly true for well-maintained riads in the medinas or modern apartments with sea views.

Understanding these local dynamics is crucial. It helps you gauge when to be aggressive with an offer and when a property might be overpriced or out of reach. This allows you to focus your efforts where they’ll have the most impact.

How to Craft a Winning Offer

When you’re competing against other keen buyers, your offer needs to do more than just match the asking price. It has to signal to the seller that you are a serious, reliable buyer who can ensure a smooth, headache-free transaction. Put yourself in their shoes—they want certainty and a straightforward closing.

Here are a few tactics I’ve seen work time and again to give my clients an edge:

- Offer a Substantial Deposit: While a standard deposit (un acompte) is common, offering a larger one upfront can be a powerful statement. It demonstrates your financial stability and serious commitment to the purchase.

- Be Flexible on Closing Dates: Sellers often have their own timelines and logistical challenges. If you can accommodate their preferred closing date, it can make your offer far more appealing than a slightly higher one from a less flexible buyer.

- Minimize Contingencies: In Morocco, sales are often contingent on securing financing or satisfactory inspections. By having your financing pre-arranged and being prepared to conduct inspections swiftly, you reduce the seller's risk. A clean offer with fewer conditions is always more attractive.

These strategies show you’re not just another tyre-kicker. You’re a prepared professional, and that can be the deciding factor.

The Importance of Solid Financing and Clean Terms

Your financial standing is the foundation of your entire offer. Don’t wait until you’ve found the perfect property to talk to a bank. Get a formal pre-approval (accord de principe) from a reputable Moroccan or international lender beforehand. This document tells the seller that a financial institution has already reviewed your profile and is prepared to back your purchase.

Expert Tip: A solid pre-approval can be nearly as compelling as a cash offer. It removes one of the biggest uncertainties for a seller—the financing contingency—and can significantly speed up the entire closing process.

Beyond your financing, the terms of your offer can make or break the deal. While you should never skip due diligence, you can make your offer more attractive by being efficient. For instance, proposing a shorter period for the initial sale agreement (compromis de vente) shows you’re ready to move forward without unnecessary delays. This principle holds true whether you are purchasing a small riad or looking into larger opportunities in commercial real estate.

Ultimately, securing a property in Morocco's bustling market is a game of strategy. It requires a solid understanding of local pricing, an offer that speaks directly to the seller's needs, and the confidence that comes from being financially prepared. By combining a competitive price with compelling, clean terms, you can turn a challenging market into your next great investment.

How to Secure Your Investment Financing

Getting the right financing is what turns a good idea into a tangible asset. In a market as unique as Morocco’s, simply walking into your bank for a standard home loan often isn't the best play. The most successful investors I've worked with know how to think bigger, looking past conventional mortgages to find funding that truly fits their strategy.

We need to move beyond the basics. This means exploring financial tools that give you a real advantage—from building solid relationships with local banks for portfolio loans to knowing when it makes sense to bring on a partner. The goal isn't just to buy the property; it's to structure the deal for profitability right out of the gate.

Building an Offer Lenders Want to See

Before you even think about approaching a lender, your first job is to frame your target property as a solid business decision. Banks, especially when it comes to investment properties, are all about managing risk and seeing a clear path to return. Your application needs to speak that language, loud and clear.

A strong loan package is much more than your personal credit score. It's a professional business case for the property's ability to generate income.

Make sure your proposal includes:

- A detailed breakdown of any current rental income the property generates.

- Realistic projections for future rental income, backed by data from comparable local listings.

- A complete list of anticipated expenses: think taxes, insurance, routine maintenance, and any syndic (homeowner association) fees.

Your objective is to demonstrate that you've done the due diligence and that the asset itself can comfortably cover the loan. This instantly elevates you from just another borrower to a credible business partner in their eyes.

Mastering the Key Investment Metrics

Enthusiasm won't get a deal funded, but solid numbers will. To properly vet a property and present it convincingly, you have to get comfortable with the core calculations of real estate investing. These metrics cut through the emotion and lay bare the financial reality of a potential deal.

Investor Insight: Never fall in love with a property before you've run the numbers. A stunning riad that's a financial drain is a liability, not an asset. The data always tells the true story.

Let's walk through the essential figures every investor in Morocco should have in their toolkit.

Net Operating Income (NOI)

This is the financial pulse of your investment. Net Operating Income (NOI) is simply your property's total income after you've subtracted all the operating expenses. Crucially, this is calculated before you factor in your mortgage payment or income taxes.

The formula is straightforward: Gross Rental Income - Operating Expenses = NOI

A positive and healthy NOI is the first proof that the property can stand on its own two feet financially.

Capitalisation Rate (Cap Rate)

Think of the Cap Rate as a way to measure the raw earning potential of a property, assuming you bought it with cash. It's an indispensable tool for comparing the relative value of different properties on a level playing field.

Here's how you calculate it: NOI / Property Purchase Price = Cap Rate

For instance, a property generating a 200,000 MAD NOI that you purchase for 2,500,000 MAD has a cap rate of 8%. Generally, a higher cap rate points to a better return for the price you're paying.

Cash-on-Cash Return

This might be the most personal—and most important—metric for you. Cash-on-Cash Return tells you the annual profit you're making compared to the actual cash you pulled out of your own pocket (your down payment, closing costs, and any immediate repairs).

The calculation is: Annual Pre-Tax Cash Flow / Total Cash Invested = Cash-on-Cash Return

This number shows you exactly how hard your money is working for you. It's the ultimate litmus test for whether an investment truly aligns with your financial goals in the Moroccan property market.

From Closing the Deal to Managing Your Property

So, your offer has been accepted—a huge milestone on your path to becoming a property owner in Morocco. It's easy to get caught up in the excitement, but this is where the real work begins. The next steps transition you from a prospective buyer to an owner, and quite possibly, a landlord.

Successfully navigating this final phase is what separates a smooth, profitable investment from a nightmare riddled with unexpected costs. It's more than just signing on the dotted line. It's about meticulous diligence, getting the right people on your side, and being fully prepared for the responsibilities of ownership. This is how you protect your investment and set it up for success from day one.

Your Essential Closing Team

Finalising a property deal in Morocco is a team sport. You can't go it alone. You’ll need a few key professionals in your corner to ensure every detail is handled correctly and your interests are protected.

Your main point of contact is the notary (notaire). In Morocco, notaries are government-appointed officials who oversee the legal transfer of property. Their job is to draft the final deed (acte de vente), confirm the property’s legal status is clean, and make sure all taxes are settled.

I also strongly recommend hiring your own lawyer (avocat). While the notary is an impartial party, a lawyer is there to fight for you and you alone. They’ll scrutinise every contract, including the initial purchase agreement (compromis de vente), and offer advice tailored to your specific situation—especially if the deal involves any complex terms.

The Critical Due Diligence Phase

Once your offer is accepted, the clock starts on your due diligence period. This is your window of opportunity to uncover any hidden problems before the sale becomes final. Rushing this step is one of the biggest—and potentially most expensive—mistakes an investor can make.

During this time, a professional home inspector will conduct a thorough examination of the property. This is absolutely non-negotiable, particularly for older buildings like historic riads in the medinas, which often come with their own unique structural or plumbing quirks.

Your inspector needs to be on the lookout for major red flags:

- Signs of water damage or old leaks that could lead to mould.

- Outdated electrical wiring that doesn't meet current safety standards.

- Structural problems, like significant cracks in walls or foundations.

- Roofing issues, which are notoriously common and costly to repair.

Any serious issues uncovered during the inspection become leverage. You can use this information to go back to the seller and negotiate for repairs or a reduction in the price before you close.

To Manage or Be Managed: The Landlord's Dilemma

With the keys finally in hand, your focus shifts from acquiring the property to managing it well. The first big decision you'll face is whether to handle things yourself or hire a professional property manager. There’s no single right answer here; it all comes down to your proximity to the property, your experience, and just how hands-on you want to be.

The Self-Management Route

Managing the property yourself offers maximum control and, of course, saves you the management fee. This approach can be a great fit if you:

- Live close by and can respond to tenant issues quickly.

- Are comfortable with tenant screening, rent collection, and basic maintenance.

- Genuinely want to be involved in the day-to-day operations of your investment.

But make no mistake, being a landlord is a real job. It means fielding late-night emergency calls, chasing rent payments, and dealing with tenant turnover.

Investor Insight: The idea of saving a 10% management fee sounds great until you get a call about a burst pipe at 2 AM. Be brutally honest with yourself about the time and energy you can realistically commit.

Hiring a Property Manager

For most investors, especially those living abroad or building a portfolio, bringing in a reputable property management company is a smart, strategic decision. They take over the daily grind, effectively turning your property into a source of passive income.

A good property manager will handle everything:

- Marketing and Tenant Screening: They find and vet high-quality tenants, running background checks and verifying references.

- Lease Management and Rent Collection: They ensure all legal paperwork is in order and take care of collecting rent on time.

- Maintenance and Repairs: They have a network of reliable contractors to handle issues promptly and affordably.

- Tenant Communication: They act as the buffer, handling all tenant requests, complaints, and emergencies.

While they do charge a fee, typically a percentage of the monthly rent, a great manager often pays for themselves by reducing vacancies, securing better tenants, and catching maintenance issues before they become expensive problems. For anyone serious about how to invest in property to build wealth, professional management can be a game-changer. Whether you're dealing with a riad or exploring your options for property investment in Morocco, having the right support makes all the difference.

Common Questions About MA Property Investing

As you get ready to jump into the Massachusetts real estate market, you’re bound to have questions. It’s only natural. Whether this is your first investment property or you’ve owned rentals in other states, you’ll find that MA has its own unique flavour, with specific rules, costs, and quirks. Getting straight answers is the best way to build confidence and sidestep the common traps.

This section tackles the questions I hear all the time from investors, both new and seasoned. My goal is to give you direct, no-nonsense answers to help you understand the reality of owning property in the Bay State.

Is Massachusetts a Landlord-Friendly State?

Let's cut right to the chase: Massachusetts is widely considered a tenant-friendly state. That doesn’t mean being a successful landlord here is impossible, but it absolutely means you have to be meticulous about following the law to the letter.

The state has a very strong legal framework designed to protect tenants, especially when it comes to security deposits, eviction processes, and habitability standards. You’ll need to get intimately familiar with the State Sanitary Code, which spells out the minimum health and safety requirements for every rental property. A single misstep here can quickly spiral into serious legal and financial headaches.

This is precisely why I always tell investors—especially those just starting out—to get a local real estate attorney on their team. Find one who specialises in landlord-tenant law. They'll be invaluable in helping you draft bulletproof lease agreements and ensure all your practices are compliant, protecting both you and your investment.

What Are the Property Taxes Like in Massachusetts?

Property taxes are a major and unavoidable cost of doing business in Massachusetts. The state’s effective property tax rate is, on average, higher than the national average, making it a critical line item to get right in your financial projections.

A classic rookie mistake is assuming a single tax rate applies everywhere. The truth is, property tax rates are set at the local city or town level, and they can vary wildly. One town with a top-tier school system might have a much higher rate than the community right next door.

Key Takeaway: Never, ever estimate property taxes. Before you even think about making an offer, you need to find the specific, current tax rate for the exact municipality where the property is located. This number is a huge part of your Net Operating Income (NOI) calculation and directly affects your cash flow.

To put it in perspective, two properties with the exact same purchase price in adjacent towns could have vastly different annual tax bills—a difference that could easily turn a deal that looks great on paper into a financial loser.

Can I Invest in Massachusetts Real Estate If I Live Out of State?

Absolutely. Plenty of successful investors in the Massachusetts market live across the country or even overseas. The key to making it work isn’t about where you are, but about how strong and reliable your local team is.

Investing from a distance is completely doable, but it’s not a solo sport. Building a trustworthy team on the ground is non-negotiable.

Here’s who you need on your team:

- A Real Estate Agent: Look for an agent who lives and breathes investment properties and truly knows the local submarkets you’re targeting.

- An Attorney: As I mentioned, a local lawyer is your go-to for navigating contracts and the state’s specific regulations.

- A Lender: A mortgage broker who’s familiar with the MA market can be a huge asset in securing the right financing.

- A Property Manager: This might just be the most important person on your team. A great property management company handles the day-to-day grind—from finding and vetting tenants to managing repairs and late-night emergencies.

With that solid team in place, investing from out of state can be an incredibly effective strategy for building your portfolio. While this guide is focused on Massachusetts, the principle of building a local team is a universal truth in real estate. You can see how these same strategies are adapted globally by reading about property investment in Morocco.

What Is the Biggest Mistake New Investors Make in MA?

From my experience, one of the most common and damaging mistakes new investors make is underestimating the total costs of owning a property. It’s all too easy to get fixated on the exciting numbers—the purchase price and potential rent—but it's the hidden and recurring expenses that really make or break a deal.

New investors often draft a budget that barely covers more than the mortgage payment. They completely miss the full picture of expenses that come with owning property here, especially with the older housing stock common in New England. A truly comprehensive budget has to include:

- High property taxes

- Homeowners insurance

- A healthy contingency fund for repairs (older homes always have surprises)

- A budget for capital expenditures (think a new roof or boiler a few years down the line)

- Allowances for vacancy periods between tenants

- Property management fees, even if you think you’ll self-manage at first

Performing a rigorous financial analysis that accounts for every single potential cost is what separates a profitable, long-term investment from a money pit. Taking the time to build a detailed, conservative budget is the single best thing you can do to set yourself up for success.

At Rich Lion Properties, we provide the expert guidance and deep local knowledge you need to navigate the Moroccan real estate market with confidence. Whether you're buying your first riad or expanding your commercial portfolio, our team is here to ensure a seamless and successful transaction from start to finish. Start your property journey with us today.