Finding a maison a vendre a Casablanca isn't just a property search; it's an entry into one of North Africa's most dynamic and complex real estate markets. This is a city powered by immense economic momentum and swift urban growth. For anyone looking to buy here, understanding the forces that shape property values isn't just a good idea—it's essential for making a sound investment.

Decoding the Casablanca Property Market

Before you even start scrolling through listings, take a moment to get a feel for the pulse of Casablanca's real estate scene. Unlike slower, more predictable markets, this one is in constant motion, driven by its undeniable status as Morocco's economic powerhouse. This role acts like a magnet, pulling in a steady stream of people from across the country, which in turn fuels development and keeps housing demand high.

This city is a hub of ambition and opportunity, and its property market reflects that energy. To really get a handle on its rhythm, you have to look past the surface-level asking prices and tune into the bigger trends shaping the city's future.

The Engine of Urban Expansion

One of the biggest factors propping up Casablanca's property market is relentless urbanisation. Morocco is undergoing a major demographic shift, with more and more people moving from rural areas to cities for better jobs and opportunities. This has a huge impact on the demand for a maison a vendre a Casablanca, creating a constant need for new homes.

This isn't a temporary blip. Forecasts suggest that by 2030, nearly 67.8% of Morocco's population will be living in cities. Casablanca is the epicentre of this movement, absorbing a massive share of these new urbanites who are drawn to its jobs and infrastructure. The result is sustained pressure on the housing supply, which provides a strong foundation for property values over the long term.

Infrastructure's Impact on Property Values

In Casablanca, new infrastructure projects are a game-changer for property values. The extension of tram lines, the growth of major business hubs like Casablanca Finance City, and the construction of new, modern residential areas all directly boost the appeal of the neighbourhoods they touch.

A new road, a new tram stop, or a new shopping centre can completely transform a neighbourhood's appeal, turning a quiet residential area into a sought-after hotspot. Watching these developments is key to identifying areas with strong growth potential.

For example, a property that might have felt a bit out of the way can suddenly become a prime spot with the announcement of a new public transport connection. The smartest buyers keep a close eye on the city's urban planning announcements. Having that foresight can lead to incredible returns and is a key reason why Casablanca is Morocco's hottest real estate hub.

Reading Between the Lines of Market Reports

As you begin your search, you'll come across plenty of market reports and price indices. It's crucial to approach this data with a healthy dose of scepticism. A headline might shout about a slight increase in property prices, but that number rarely paints the full picture.

You need to dig deeper and look at inflation-adjusted values to understand the real change in a property's worth. A nominal price bump can sometimes mask a decrease in real-term value once you factor in inflation. Making this distinction is vital for accurately judging the performance of your potential investment.

When you equip yourself with this level of understanding, you transform from a casual house hunter into a strategic buyer—one who is ready to make a confident, well-informed decision in Casablanca's exhilarating market.

Finding and Evaluating Properties

Starting the search for a maison a vendre a Casablanca can feel like a monumental task, but with the right strategy, it becomes an exciting journey. The key is to blend modern efficiency with old-school, on-the-ground expertise. Kick things off by browsing the major online property portals. This gives you a fantastic bird's-eye view of what's available and the current asking prices across the city.

However, don't let your search end there. The real magic happens when you partner with a reputable local real estate agent, or agence immobilière. This is a non-negotiable step in Casablanca. A seasoned agent has access to off-market gems and possesses a deep, nuanced understanding of neighbourhood dynamics—insights you simply won't find on a website. They know what truly drives value in areas like Anfa versus Maarif.

Your Initial Search Strategy

A balanced approach always works best. You should absolutely dedicate time to online research, but it's just as crucial to build a strong relationship with an agent you trust. This two-pronged strategy ensures you see the widest, most relevant selection of properties.

Think of your online browsing as a way to clarify your own thinking. You might begin with a vague idea for a four-bedroom house, but after scrolling through dozens of listings, you'll start to realise what your non-negotiables are. Maybe it’s a garden for the kids or being within a 15-minute drive of an international school. This clarity makes your conversations with an agent incredibly productive.

It's also vital to have a feel for the market's pulse. Casablanca is a city on the move, and ongoing urban development and major infrastructure projects keep fuelling demand. In 2025, this trend pushed the average house price to €1,414.2 per square metre, which was a 5.7% jump from the year before.

What to Look for During a Property Visit

The moment you step through the front door of a potential home, your job is to look past the beautiful staging. This is where you become a detective, uncovering the property's true condition and long-term potential. Always go in armed with a list of critical questions for the owner or agent.

Zero in on the big-ticket items: structural integrity and maintenance history. You need to know the age of the plumbing and electrical systems, the roof's condition, and if there have ever been problems with damp or leaks. These are the expensive, foundational components that can quickly turn a dream house into a financial nightmare.

A beautiful interior can easily mask costly underlying problems. Always prioritise questions about the building’s essential systems and structural health over cosmetic details. A fresh coat of paint is cheap; a new roof is not.

Your investigation must also extend to the building's management body, the syndic. Understanding the financial health and competence of the syndic is absolutely crucial, especially when buying into a co-ownership.

Here's what you need to ask the syndic:

- What are the monthly fees? Get a breakdown to see exactly what they cover, like security, cleaning, or garden upkeep.

- Are any major works planned? Things like façade renovations or lift replacements can lead to hefty special levies.

- What is the status of the reserve fund? A healthy reserve fund is a great sign of responsible financial management.

- Are there any ongoing legal disputes involving the co-ownership? This is a major red flag you need to know about upfront.

Assessing a Property's True Potential

A smart evaluation goes far beyond the property line. The perfect maison a vendre a Casablanca isn't just about the house itself; it's about how it fits into your daily life.

Start mapping out your life from that address. How long is the commute to your office? To the kids' schools? Where are the nearest supermarkets and clinics? Don't forget to factor in Casablanca's notorious traffic, as it can dramatically alter your quality of life. Make a point to visit the neighbourhood at different times—a bustling weekday morning and a quiet weekend evening—to get a real sense of its character.

Finally, look to the future. Investigate any development plans for the area. Is a new shopping centre or public park on the horizon? Or is a new high-rise about to go up and block your sunlit balcony? This forward-thinking assessment helps you gauge not just the property's current value, but its suitability for your family for years to come. For an even deeper dive, explore our complete guide on everything you need to know when looking for a home in Casablanca.

Navigating the Moroccan Legal Process

Once you've found the right maison a vendre a Casablanca, you'll step into the most critical part of the journey: the legal process. It’s a well-trodden and secure path, but it has its own unique terminology and key players. For anyone new to the Moroccan system, especially international buyers, it can feel a bit daunting.

Getting to grips with the roles and documents involved from the outset will make all the difference, turning a potentially stressful exercise into a clear, manageable process.

At the very centre of any property deal in Morocco is the 'notaire' (notary). It's crucial to understand that a notaire here isn't just an advisor; they are a public officer appointed by the state. Their job is to be the neutral guardian of the transaction, making sure every step—from checking documents to collecting taxes and registering the sale—is done by the book.

While the notaire ensures the legality of the sale on behalf of the state, I’ve seen many savvy buyers also bring in their own 'avocat' (lawyer). Think of this as your personal safety net. Your avocat is there to fight your corner, digging deeper into due diligence and providing advice that’s solely focused on protecting your interests.

The Key Players on Your Team

It's helpful to see the notaire and avocat as working in tandem. The notaire handles the official, state-mandated steps of the transaction. Your avocat, on the other hand, can scrutinise contracts from your point of view, push for specific clauses that benefit you, and act as a shield against potential pitfalls that a neutral notaire might not flag.

Here’s how their roles generally break down:

-

The Notaire (Notary):

- Serves as a neutral, state-appointed official.

- Drafts the key legal contracts (compromis de vente and acte de vente).

- Manages the collection of all taxes and fees for the government.

- Confirms the identities of the buyer and seller.

- Officially registers the final deed to transfer ownership.

-

The Avocat (Lawyer):

- Represents only you and your interests.

- Performs an extra layer of due diligence on the property's legal history.

- Reviews and can propose changes to the sales agreements.

- Advises on ownership structures, which is particularly useful for foreign buyers.

For a major investment like property, having both professionals in your corner is a strategy I always recommend. It ensures every angle is covered, from official compliance to your personal financial security.

Understanding the Crucial Legal Documents

The purchase itself is formalised through two main contracts. The first you'll encounter is the 'compromis de vente', which is the preliminary sales agreement. This isn't just a casual reservation; it's a legally binding document that locks in the deal after your offer has been accepted. It spells out every detail: the price, a precise description of the property, and any 'clauses suspensives' (conditional clauses), like finalising your mortgage.

When you sign the compromis de vente, you'll pay a deposit, typically between 5% and 10% of the purchase price. This money is held securely in an escrow account managed by the notaire. Signing this document officially starts the clock for the notaire to carry out all the necessary legal checks.

The 'compromis de vente' is far more than a simple promise; it's a binding contract. If you back out after signing without a valid reason covered by a conditional clause, you will almost certainly lose your deposit.

After all conditions have been met and the notaire gives the green light, you move to the final step: signing the 'acte de vente' (the final deed of sale). This is the document that officially makes the property yours. The signing happens at the notaire’s office, where you'll pay the outstanding balance, along with all the associated taxes and fees. The notaire then registers this deed with the land registry, finalising your status as the undisputed legal owner.

This legal framework, while detailed, is built on a solid foundation of checks and balances. By understanding who does what and the weight of each document, you can move forward with real confidence, knowing your investment in Casablanca is secure.

Securing Your Financing and Budgeting for Costs

So, you’ve found a maison à vendre à Casablanca that feels like home. It’s an exciting moment, but now comes the part that turns that dream into a reality: getting your finances in order. This isn't just about the purchase price; it’s about understanding the entire financial landscape, from mortgages to the often-overlooked closing costs. A well-thought-out financial plan is truly the foundation of a smooth and successful purchase.

For most people, the first big step is securing a mortgage. Moroccan banks have a variety of financing options available, and they are generally open to working with both residents and international buyers. Be prepared for a thorough application process. They’ll want to see everything to feel confident in your ability to repay the loan.

You'll need to gather documents that prove a stable income, a solid employment history, and a transparent view of your current financial situation—your assets and any existing debts. The down payment, or apport personnel, is also a major factor. While it can vary, you should generally expect to put down at least 20% of the property’s value.

Understanding Your Mortgage Options

My advice? Don't just walk into the first bank you see. It really pays to shop around. Interest rates, the length of the loan (tenure), and who they'll lend to can vary quite a bit from one institution to another. Some banks are much more experienced with international clients and might have more flexible products, like being more comfortable with foreign income statements.

Here’s a pro tip: get a mortgage pre-approval (accord de principe). This is a game-changer. It gives you a firm budget to work with, so you’re not just guessing what you can afford. More importantly, it shows sellers you’re a serious, credible buyer, which can give you a real edge, especially when negotiating in a competitive market.

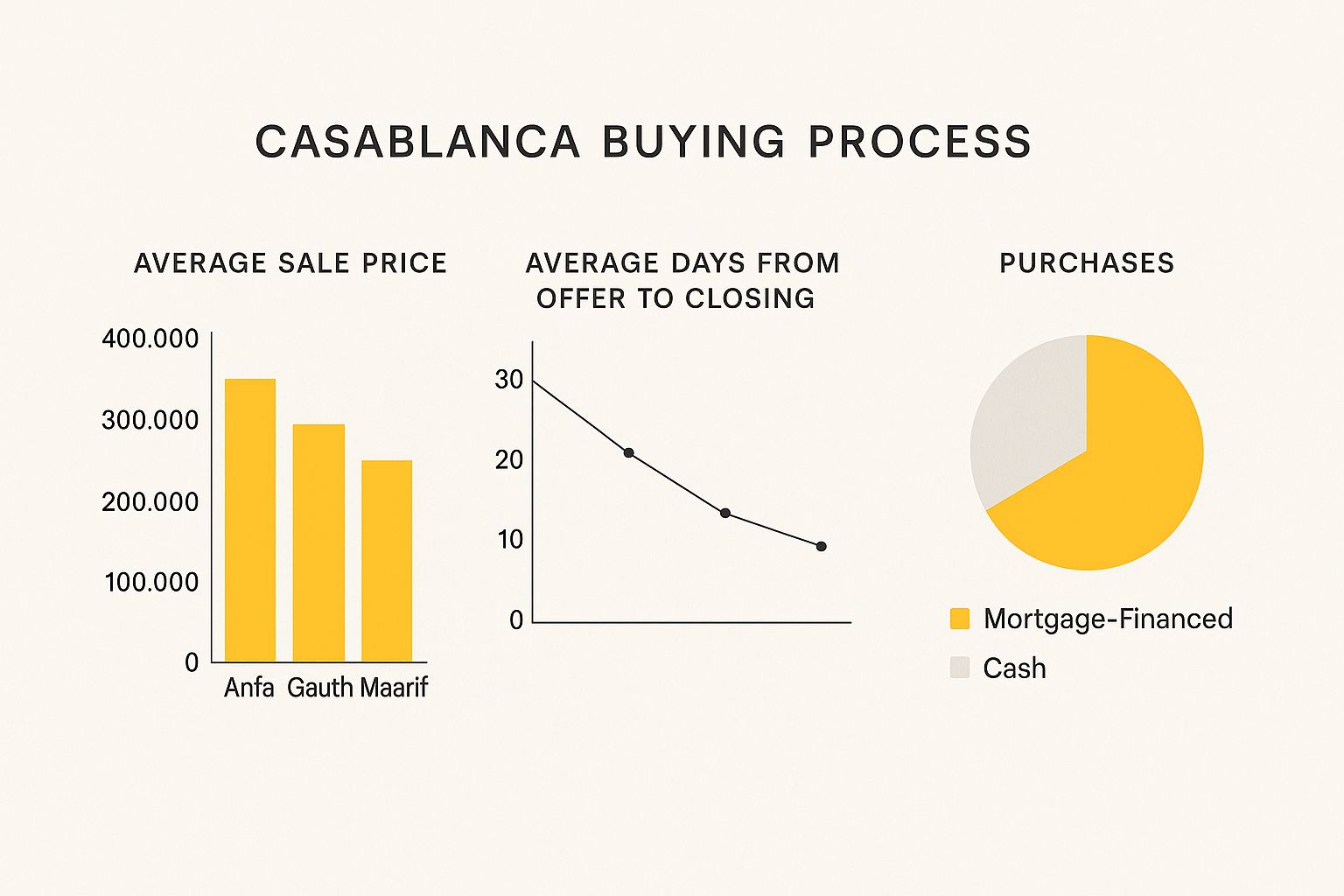

As you can see, most transactions in Casablanca rely on bank financing. This just reinforces how critical it is to get that pre-approval locked in early. The data also highlights how much property values can differ by neighbourhood, which is something to keep in mind as you finalise your budget.

Budgeting Beyond the Purchase Price

One of the biggest mistakes I see first-time buyers make is underestimating the total cost of buying a home. The price you agree on with the seller is just the beginning. There's a whole collection of other fees and taxes, often called closing costs or frais d'acquisition, that you absolutely have to account for.

These costs are not small. You should plan for them to add an extra 7% to 10% on top of the property’s purchase price. For instance, on a MAD 2,500,000 house, that means setting aside an additional MAD 175,000 to MAD 250,000 just for these expenses. It's a significant amount that can catch you by surprise if you're not prepared.

Key Takeaway: Never base your budget solely on the sticker price of a property. A safe rule of thumb is to calculate and set aside an extra 10% for all the closing costs. This ensures you have more than enough to cover everything without any last-minute financial stress.

These additional costs are all handled by the notaire and are non-negotiable. It’s important to know exactly what you’re paying for.

Estimated Buyer Closing Costs in Casablanca

To give you a clearer picture, here's a breakdown of the typical closing costs a buyer can expect to pay on top of the property price. These percentages are based on the declared value of the home.

| Cost Item | Typical Percentage of Property Price | Description |

|---|---|---|

| Registration Duty (Droits d'Enregistrement) | 4% | A government tax levied on the property transaction. |

| Land Registry Fees (Conservation Foncière) | 1.5% + Fixed Charge | Fee paid to officially register the title deed in your name. |

| Notary Fees (Honoraires du Notaire) | 0.5% – 1.5% + VAT | Regulated professional fees for the notary who handles the legal work. |

| Miscellaneous Costs (Frais Annexes) | Varies | Smaller charges for official stamps, certificates, and other admin. |

Understanding these figures is crucial for creating a realistic and comprehensive budget.

Finally, keep the broader market in mind. Recent data from early 2025 shows a complex picture. While residential property prices in Casablanca nominally edged up by 0.24%, they actually saw a real decline of 1.34% when you factor in inflation. This points to a cooling market with less demand and a tighter mortgage sector. For a deeper dive into these numbers, you can read this in-depth analysis of Morocco's property price history. This market softness could give you more room for negotiation and might even influence the financing terms you're offered.

By meticulously planning for every single expense, you can walk into the final stages of your purchase with the confidence and financial clarity you need.

Finalizing Your Purchase and Taking Ownership

You’ve navigated the search, the viewings, and the financing hurdles. Now comes the most exciting part: closing the deal and getting the keys to your new home in Casablanca. This final stage is where all the paperwork and planning come together, turning your dream into a legal reality. The entire process is orchestrated by your notaire, culminating in a formal signing appointment where you officially become a property owner.

This meeting is the final checkpoint. You, the seller, and the notaire will sit down together to go over the definitive deed of sale, known as the acte de vente. Don't rush this. It's a critical document, so take a moment to carefully review every clause and make sure it perfectly reflects the terms you agreed to in the preliminary compromis de vente.

This is also when the final funds are moved. Your bank will transfer the remaining purchase price to the notaire's secure escrow account, along with any applicable taxes and registration fees. Once the notaire confirms the funds have landed and the documents are signed, you'll finally hear the best words of the entire process: "The keys are yours."

Becoming the Official Owner

Signing the acte de vente feels like the finish line, but there's one last administrative step that truly cements your ownership. The notaire will take the signed deed and formally register it with Morocco's national land registry, the Agence Nationale de la Conservation Foncière, du Cadastre et de la Cartographie (ANCFCC).

This is the official government body that manages all property titles (titres fonciers). The registration process officially updates the land records, removing the previous owner and inscribing your name as the new, undisputed legal owner. It might take a few weeks for the updated title certificate to be issued, but your ownership is legally secure from the moment the deed is registered.

Think of the ANCFCC registration as the final, official seal on your investment. It grants you an indefeasible title, which means your ownership is protected by the Moroccan state against any future claims. This robust system is a cornerstone of the country's secure property market.

Your Post-Purchase Checklist

With keys in hand and your name on the title, the journey isn't quite over. A few practical tasks need your attention right away to ensure a smooth transition into your new home. Taking care of these promptly will save you a lot of headaches later.

Here are your immediate priorities:

- Transfer Utilities: Head to the local offices of Lydec (for water and electricity in Casablanca) with your acte de vente and ID to get the accounts switched to your name.

- Secure Home Insurance: This is non-negotiable. Arrange a comprehensive home insurance policy (assurance multirisque habitation) to protect your property and belongings from day one.

- Update Your Address: Make sure to notify your bank, employer, and any other important contacts about your new address to keep your mail flowing without interruption.

Understanding Your Ongoing Responsibilities

Owning a home in Casablanca also comes with a few ongoing financial responsibilities, mainly local property taxes. As the new owner, you’ll be responsible for two key annual taxes: the Taxe d'Habitation (residence tax) and the Taxe de Services Communaux (municipal services tax).

These taxes are calculated based on an assessed rental value of your property. Your notaire can give you a good estimate of what to expect, and you'll receive your first bill in the following year. It's smart to budget for these as a regular part of homeownership.

To help you prepare for these costs and other nuances of the local market, our detailed guide can help you find the perfect maison a vendre a Casablanca that fits your life and budget. By following these final steps, you can ensure your move from buyer to homeowner is as seamless and rewarding as possible.

Got Questions About Buying a House in Casablanca? We've Got Answers.

It’s completely normal to have a long list of questions when you're looking for a maison à vendre à Casablanca. Whether you're a local or an international buyer, clarity is key. Let's walk through some of the most common queries we handle every day, so you can feel confident in your next steps.

Having a good handle on these topics will help you ask the right questions and make smart decisions throughout your property search.

Can Foreigners Legally Buy Property in Casablanca?

Yes, they can. Foreign nationals have the right to own property freely across Morocco, including Casablanca. There's just one key detail to know: this right applies to titled property, known in Morocco as a 'titre foncier'. This covers the vast majority of apartments and houses you'll come across in the city.

The only real restriction relates to agricultural land, which non-Moroccans cannot own. For any residential home, the legal process is exactly the same for both foreign and Moroccan buyers. It always involves a state-appointed notaire, and I always recommend working with a good real estate agent and a lawyer to make sure everything goes smoothly.

What Are the Main Closing Costs I Should Budget For?

The sticker price is just the beginning. You need to budget an extra 7% to 10% of the property's value to cover all the closing costs. Forgetting about these can put a real strain on your finances at the last minute.

These fees typically break down into a few main categories:

- Registration Duty (Droits d'enregistrement): This is a government tax on the sale, usually around 4%.

- Land Registry Fees (Conservation Foncière): Expect to pay about 1.5% plus a fixed fee to have the title officially registered in your name.

- Notary Fees (Honoraires du notaire): The notaire's professional fee is regulated and based on a percentage of the sale price.

- Real Estate Agency Commission: If you're working with an agent, their commission is typically 2.5% (+VAT) from both the buyer and the seller.

Make sure to ask your notaire for a detailed estimate of these costs long before you're due to sign the final paperwork.

A classic mistake is getting fixated on the purchase price alone. By setting aside up to 10% of the property value for these associated fees, you'll avoid any stressful financial surprises when it’s time to close the deal.

What's the Difference Between a Notaire and a Lawyer? Do I Need Both?

Understanding the roles here is crucial. In every Moroccan property transaction, a notaire is a mandatory public official. They are neutral and represent the state, ensuring the deal is legally sound, drafting the official deeds, collecting taxes, and registering the new title. Their job is to guarantee the legality of the sale for both parties.

While the notaire is neutral, many buyers—especially those from overseas—also choose to hire their own lawyer, or avocat. An avocat works exclusively for you. They're there to protect your specific interests, conduct deeper due diligence, and give you advice that is solely for your benefit. It’s an extra layer of security that often proves invaluable.

How Long Does the Buying Process Usually Take?

The timeline can vary, but most property purchases in Casablanca take somewhere between one and three months. This clock starts ticking from the moment you sign the preliminary sales agreement, the compromis de vente, and ends when you sign the final deed, the acte de vente.

This timeframe gives the notaire the necessary window to complete all the legal checks and title searches. It also gives you, the buyer, time to get your mortgage financing sorted if you need one. Delays can happen, of course, but a well-prepared preliminary contract should outline a realistic timeline for everyone to stick to.

Navigating the Casablanca property market is much easier with local knowledge and a trusted partner by your side. At Rich Lion Properties, our team provides the expert guidance you need for a secure and seamless transaction. Discover how our dedicated service can help you find your ideal home. Learn more on richlionproperties.com.