If you're diving into Casablanca's property market, one of the first terms you'll encounter is the référentiel prix immobilier Casablanca. Think of it as the official guide to average property values, broken down per square metre across the city's diverse districts. It’s an indispensable baseline used by everyone—from buyers and sellers to notaries—to anchor real estate transactions in fairness and transparency.

Understanding the Casablanca Property Price Reference

Trying to figure out property values in a market as dynamic as Casablanca's can feel overwhelming. That’s precisely where the price reference comes in. Established by Morocco’s General Tax Directorate (DGI), this system provides a trusted benchmark, not as a fixed price list, but as an authoritative guide grounded in actual market data.

Its importance can't be overstated. The reference system builds a transparent framework that helps prevent the wild over- or under-valuation of properties, which ultimately protects both the buyer and the seller. For any serious investor, getting to grips with this reference is the non-negotiable first step toward a smart purchase.

Core Components of the Price Reference

The real strength of the référentiel prix immobilier Casablanca is its granularity. It doesn't just give a single city-wide number; it standardises valuations by looking at several key factors drawn from official sales records and continuous market analysis.

Here's what it boils down to:

- Price per Square Metre (Prix au m²): This is the fundamental metric. It creates a universal unit of measurement, allowing you to make apples-to-apples comparisons between properties of different sizes, whether they're in the same neighbourhood or across town.

- District-Specific Values: The system recognises a simple truth: location is everything in real estate. It provides distinct price brackets for each district, reflecting the vast differences between premium postcodes like Anfa and up-and-coming areas.

- Property Type Differentiation: An apartment isn't a villa, and a villa isn't a commercial space. The reference accounts for these crucial differences, assigning separate value ranges to each category because their market dynamics are entirely different.

The table below provides a clearer picture of the primary factors that shape these official price references.

Key Factors Influencing Casablanca Property Prices

This table summarises the primary elements that influence the 'référentiel prix immobilier' in Casablanca, providing a snapshot of what determines property values.

| Influencing Factor | Description of Impact | Example District |

|---|---|---|

| Location and Prestige | The single most significant factor. Proximity to the coast, business centres, and amenities drives prices up. | Anfa is a prime example of a prestigious, high-value district. |

| Infrastructure & Amenities | Access to schools, hospitals, public transport (like the tramway), and shopping centres directly impacts desirability and value. | Maârif benefits from excellent commercial infrastructure, boosting its property values. |

| Property Type and Age | New builds and villas command higher prices than older apartments. The condition and features of the building are also critical. | A modern apartment in Bourgogne will be valued differently from a 1950s Art Deco flat. |

| Market Demand and Supply | Economic trends and population growth create demand. Districts with limited new construction but high demand see prices rise. | Emerging areas like Sidi Maârouf have seen values climb due to business development. |

Ultimately, understanding these influencing factors gives you a much richer context for the numbers you see in the 'référentiel'.

This benchmark is more than a set of figures; it's a mechanism for trust. It ensures the declared value of a property for tax purposes is aligned with its realistic market worth, which builds confidence throughout the entire transaction.

By understanding how these prices are set, you put yourself in a much stronger position. It empowers you to evaluate a listing price against objective data, giving you a solid footing for negotiation. Given how quickly things move in Casablanca's real estate market, these references are your best tool for keeping pace. To dig deeper into the city's appeal, you can explore our guide on why Casablanca is Morocco's hottest real estate hub. With this foundational knowledge, you're ready to start looking at prices district by district.

What Drives Casablanca's Property Prices?

The référentiel prix immobilier Casablanca isn't just a set of numbers; it's a direct reflection of the city's economic heartbeat. To truly understand property values and make smart investment choices, you have to look at the powerful forces shaping the market. These factors influence everything from how much it costs to build a new apartment to how many people are looking to buy one.

At its heart, Casablanca’s property market thrives because it's the undisputed economic engine of Morocco. The city is a magnet for businesses, skilled professionals, and foreign investment. This creates a relentless demand for homes and commercial spaces, and when demand outpaces supply, prices naturally climb.

The Impact of Inflation and Construction Costs

Inflation, both at home and abroad, has a direct and immediate effect on property prices. When the cost of everyday goods goes up, you can be sure the real estate sector is feeling it too. This is especially true when it comes to the cost of essential building materials like steel, cement, and glass.

Developers have seen these costs skyrocket, forcing them to raise the prices of new properties just to stay profitable. It's not just a local problem—global supply chain issues have a ripple effect that ends up on construction sites right here in Casablanca. As new builds become more expensive, the value of existing homes gets pulled up along with them, leading to a rise in prices across the board.

The combination of a strong business climate and rising material costs creates a market where property values are consistently pushed upward. Even with new financing options, the fundamental cost to build is increasing, and that's a reality baked into the latest price guides.

Urbanisation and Soaring Demand

As Morocco's primary economic hub, Casablanca continues to draw people from all over the country and the world. This rapid urbanisation is a massive driver of the real estate market. In 2025, Casablanca stands out as one of Morocco's most dynamic property markets, with prices on a steady upward trajectory thanks to this influx and ongoing infrastructure development.

The city's strong business environment has sparked a surge in both residential and commercial projects, which only adds to the pricing pressure. For a closer look at these market dynamics, you can find a detailed analysis of 2025 real estate trends and new solutions for Moroccan buyers on Vaneau-Maroc.com.

This constant demand fuels a highly competitive environment, particularly in the most sought-after districts. Several key factors are at play:

- Job Opportunities: With so many corporate headquarters and industrial zones, Casablanca attracts a talented workforce that needs quality housing.

- Infrastructure Growth: Major public works, like the tramway expansion and the development of new business districts, make the city—and specific neighbourhoods—even more appealing.

- Investment Value: Real estate in Casablanca is seen as a stable and profitable asset by both local and international investors, adding another layer of demand to the market.

Ultimately, these economic and demographic forces are what make the référentiel prix immobilier Casablanca a true mirror of this vibrant, growing metropolis. For any serious buyer or investor, looking past the numbers to understand the story behind them is the key to success.

How Urban Growth Shapes Property Values

Urban growth is arguably the single most significant force shaping real estate in Casablanca, directly impacting the figures you see in the référentiel prix immobilier Casablanca. The city isn't just expanding; it's constantly absorbing a stream of new residents migrating from rural areas, all in search of housing. This creates a relentless demand that underpins the entire market.

This migration is driven by a simple, powerful motive: the pursuit of better job prospects and a higher quality of life. As more people pour into the city, the competition for a limited number of apartments and homes naturally heats up, pushing prices higher. It's this constant demographic pressure that provides such a solid foundation for property appreciation across the city.

Demographic Pressure and Housing Demand

The link between a growing population and rising property prices is straightforward. With Casablanca's population on a steady incline, the fixed supply of housing—especially in sought-after central districts—becomes inherently more valuable. This fundamental economic principle is exactly what the price reference system tracks and adjusts for year after year.

This isn't just a local trend; it defines Morocco's national real estate landscape. Projections indicate that by 2030, nearly 68% of Morocco's population will live in urban areas, and Casablanca is a top destination for this internal shift. High youth unemployment and fewer opportunities in the countryside compel many to seek their fortunes in the city, which in turn fuels the demand for both rental and for-sale properties. You can read more about what's happening in Morocco's real estate market on InternationalInvestment.biz. This dynamic ensures that real estate activity, and its corresponding price growth, remains heavily concentrated in major urban hubs.

The Role of New Infrastructure

To keep pace with this expansion, Casablanca has poured massive investment into major infrastructure projects. Think of these developments as more than just modern conveniences; they are powerful value multipliers for property.

Several types of infrastructure projects are known to significantly lift property values:

- Transport Networks: Every time the tramway line extends or a major road is upgraded, it makes once-hard-to-reach neighbourhoods far more appealing. A property's value can jump noticeably the moment it gains access to a reliable transit line.

- New Residential and Business Zones: The development of master-planned districts like Casa Anfa or business hubs in areas like Sidi Maârouf creates new economic centres. These zones attract companies and residents alike, which elevates property values in the immediate vicinity and surrounding areas.

- Public Amenities: Investment in new schools, parks, hospitals, and shopping centres directly improves a district's quality of life. For homebuyers, these amenities are often deciding factors, and that desirability translates directly into higher prices.

Infrastructure development acts as a catalyst, completely changing the perception and market value of entire districts. This impact is a critical variable that the référentiel prix immobilier Casablanca must factor in to maintain its accuracy.

For anyone looking to buy or invest, paying close attention to these growth patterns is crucial. Knowing where the city is investing and expanding provides a clear map for identifying areas with the strongest potential for future growth. The connection between new infrastructure and rising property values is one of the most dependable indicators in the Casablanca market.

The Impact of Major Infrastructure Projects

Big infrastructure projects are one of the most powerful forces shaping Casablanca’s property market. It’s not just about making daily life easier; these developments can completely change the character and value of a district, leading to major shifts in the référentiel prix immobilier Casablanca. When the city announces new tram lines, commercial zones, or public facilities, it’s a clear signal of future growth, and both homebuyers and investors take notice almost immediately.

You can see a distinct pattern emerge. Areas slated for significant upgrades experience a rush of demand well before the work is even finished. Speculative buying picks up as people bet on better connectivity and an improved quality of life down the road. Unsurprisingly, property values in these zones often climb faster than the city average, creating a real opportunity for anyone who can spot these trends early.

Transport and Connectivity Upgrades

Nowhere is this more obvious than with transport projects. The expansion of Casablanca's tramway network is a classic case study. Neighbourhoods that were once seen as a bit out of the way suddenly become prime real estate once they’re connected by a fast, reliable tram line.

This improved access has a direct and measurable impact on property prices. A commute that used to be a frustrating one-hour drive can be cut to a simple 20-minute tram ride. That kind of convenience makes a location far more appealing for families and working professionals, and you see that premium reflected in local property listings almost instantly.

- Example 1: The Tramway Effect: An apartment just a five-minute walk from a new tram station can easily fetch a price 10-15% higher than a nearly identical property only a kilometre further away. That price difference is purely down to better connectivity.

- Example 2: Road Network Enhancements: The building of new ring roads or flyovers helps ease chronic traffic congestion. In turn, this boosts the appeal of nearby residential areas. Being able to get to the city centre or key business districts more easily is a concrete benefit that buyers are definitely willing to pay for.

Event-Driven Urban Development

Major international events can act as a huge accelerator for urban development, with knock-on effects for the entire real estate market. These events put a city in the global spotlight, forcing upgrades to everything from hotels and transport to housing in order to handle the influx of visitors.

We're seeing this play out in Casablanca right now. The city's preparations for the 2025 Africa Cup of Nations (AFCON) have kick-started numerous renewal projects, from stadium modernisations to a push for more hotel rooms. This has already sparked a noticeable boom in demand for short-term lets and furnished apartments, as investors get ready for the tournament. The expected wave of tourists and media attention is driving a forward-looking investment rush, with many trying to buy properties before prices inevitably climb. You can read more about how major events are shaping Moroccan real estate trends on Housing.place. This trend really cements Casablanca’s status as a key property investment hub.

For any serious investor, keeping an eye on the city's infrastructure plans is just as crucial as analysing the current référentiel prix immobilier Casablanca. It gives you a roadmap to where future value is being built, showing you how to get ahead of event-driven growth and long-term urban development.

Casablanca Property Prices by District

When you're navigating Casablanca's property market, you quickly realise that where you buy is just as important as what you buy. Each district has its own distinct character, and with that, its own price tag. To make sense of it all, the référentiel prix immobilier Casablanca is an indispensable tool, offering a structured look at property values across the city.

Think of Casablanca's neighbourhoods in tiers, grouped by lifestyle, amenities, and overall market feel. This way, you can easily match your search to your budget and what you’re looking for in a home or investment. From the exclusive coastal villas of Anfa to the lively commercial heart of Maârif, prices can vary dramatically. This guide breaks down the key areas, giving you the specific price ranges and local flavour that shape their market value.

Casablanca Property Price Reference by District (per m²)

To give you a clearer picture, I've put together this quick-reference table. It summarises the typical price ranges for apartments and villas in some of Casablanca's most popular districts, based on the official benchmarks and current market trends. This is a great starting point for understanding where your budget will take you.

| District | Property Type | Average Price Range (MAD/m²) | Key Features |

|---|---|---|---|

| Anfa | Villa | 25,000 – 45,000 | The city's most prestigious address; ocean views, large plots, ultimate luxury. |

| Anfa | Apartment | 22,000 – 35,000 | High-end modern residences in an exclusive, green, and secure setting. |

| Gauthier/Racine | Apartment | 20,000 – 30,000 | Cosmopolitan hub with chic boutiques, gourmet dining, and luxury flats. |

| Bourgogne | Apartment | 15,000 – 22,000 | Central, artistic vibe with a mix of Art Deco charm and modern buildings. |

| Maârif | Apartment | 14,000 – 20,000 | Bustling commercial centre; high demand from professionals for its convenience. |

| CIL (Cité de l'Air) | Villa | 16,000 – 25,000 | Peaceful, family-oriented area with spacious homes and established greenery. |

| Californie | Villa | 15,000 – 23,000 | Popular for modern villas, larger properties, and a more suburban feel. |

| Sidi Maârouf | Apartment | 12,000 – 16,000 | Developing business hub near the Technopark; attractive to young professionals. |

This table serves as a snapshot. Keep in mind that prices within a district can still fluctuate based on the specific street, building age, and amenities. It’s always best to dig a little deeper once you’ve identified a few areas of interest.

The Premium Districts: Casablanca's Real Estate Elite

At the very top of the market, you'll find Casablanca’s premium districts. These are the neighbourhoods synonymous with luxury, prestige, and access to the city's finest offerings. They are, without a doubt, the most sought-after and command the highest property prices.

Anfa is the undisputed king. Famous for its magnificent villas, sweeping ocean views, and quiet, leafy streets, it has long been the chosen home of Casablanca's elite. Owning property here isn't just about the house; it's a statement. Right next door, Racine and Gauthier offer a more urban, cosmopolitan kind of luxury. These districts are buzzing with high-end boutiques, gourmet restaurants, and sleek, modern apartment buildings, attracting a mix of wealthy professionals and expatriates.

It's important to remember that in these premium areas, prices are driven as much by prestige as they are by the property itself. The "brand value" of an Anfa or Gauthier address adds a considerable premium, a fact that is consistently backed by the official price reference. This built-in exclusivity keeps demand high, cementing their position at the pinnacle of the market.

The Mid-Range Districts: A Balanced and Popular Choice

The mid-range districts strike a fantastic balance between affordability, quality of life, and great amenities. This makes them incredibly popular with a wide range of buyers and they really form the backbone of Casablanca's residential market. Here, you get excellent value without the premium price tags.

Maârif is a perfect example. As a huge commercial and shopping hub, it offers unmatched convenience and a vibrant, energetic atmosphere. Its housing stock is mostly apartments, which are snapped up by young professionals and families. Bourgogne offers something different, blending a central location with a unique, bohemian charm, featuring a mix of older Art Deco buildings and newer apartments.

Other key mid-range districts include:

- Les Hôpitaux: Valued for its close proximity to major medical centres and its central position.

- 2 Mars: A well-established and respected residential area known for its relative calm and solid infrastructure.

- Oasis: A top choice for families, thanks to its green spaces and more suburban, relaxed feel.

The référentiel prix immobilier Casablanca shows consistently strong and stable demand for these areas. They represent both a smart investment and a practical place to live for anyone wanting to be close to the heart of the city.

The Emerging and Developing Districts: Eyes on the Future

For those looking for growth potential, the emerging districts are where the real excitement is. These areas are currently more affordable but are in the middle of rapid development, with demand climbing thanks to urban expansion and major new infrastructure projects.

Sidi Maârouf, located near the Technopark, has completely transformed into a major business district. This has brought a wave of new residents and, naturally, pushed property values up. In the same vein, neighbourhoods like Californie and CIL (Cité de l'Air) are becoming increasingly popular for their modern housing, family-friendly atmosphere, and more spacious properties. They offer newer homes at a lower price per square metre than you'd find in the city centre.

Investing here could lead to significant returns as these districts continue to grow and mature. Their development is a clear sign of Casablanca's dynamic future, offering a more accessible way to get onto the city's property ladder.

How to Use the Price Reference When Buying Property

Think of the référentiel prix immobilier Casablanca as more than just a list of numbers. It’s a powerful tool for anyone serious about buying property in the city. When you know how to use this price guide properly, you shift from being a passive house-hunter to a sharp, well-informed negotiator who knows what a property is truly worth.

From your very first search online to shaking hands on a deal, this reference should be your go-to resource. It gives you an unbiased baseline to judge listing prices, helping you spot overpriced properties and make offers with confidence. By rooting your decisions in solid data, you can steer clear of the classic mistake of paying too much out of excitement or sales pressure.

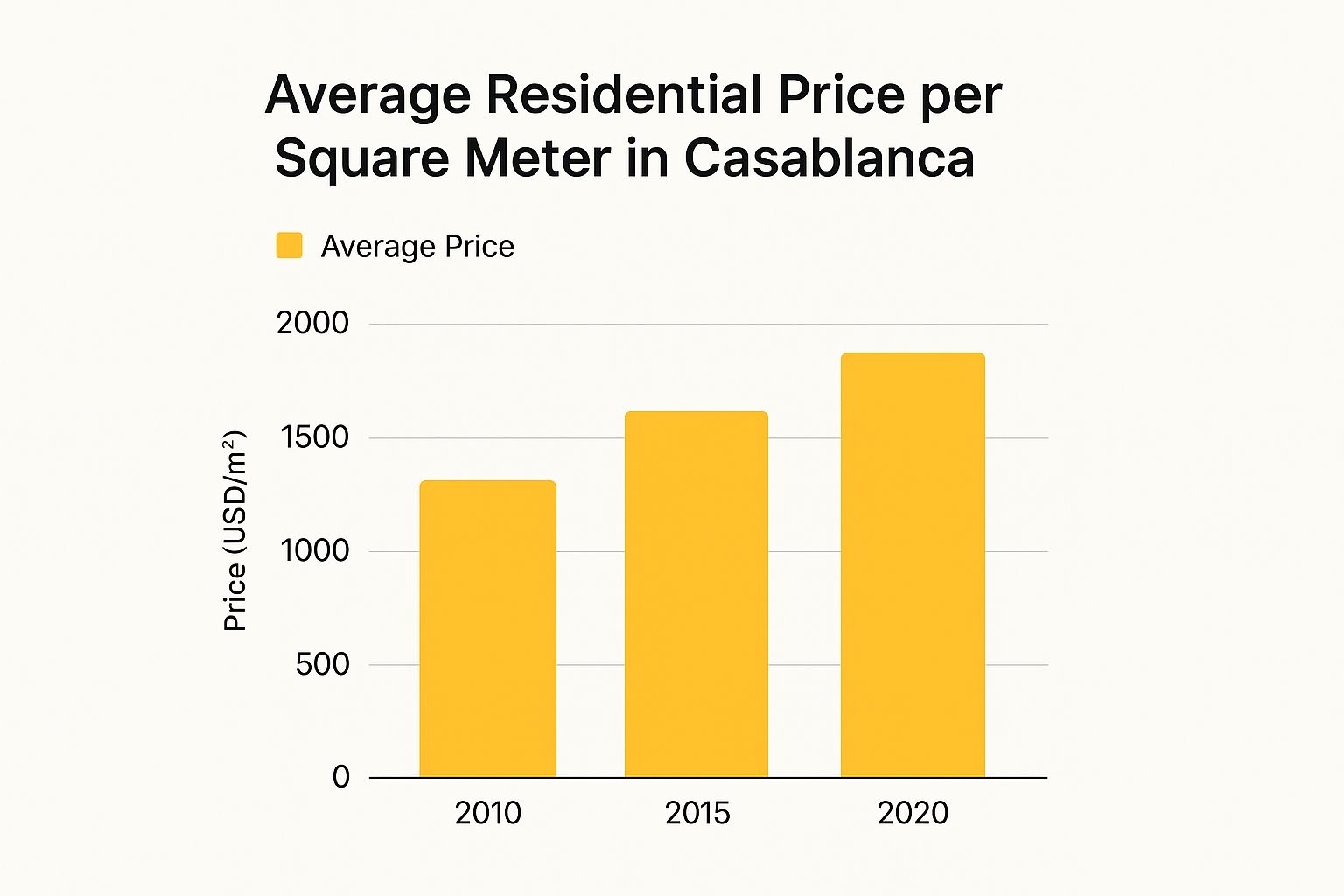

This chart paints a clear picture of the steady climb in Casablanca's residential property prices over the last ten years, proving just how vital it is to have current data.

The market's consistent growth, as shown above, means that what a property was worth even a couple of years ago isn't what it's worth today. Using an up-to-date reference is non-negotiable.

Cross-Referencing Listing Prices

The most immediate way to use the reference is right when you're browsing listings. The moment you see a property that catches your eye, your first step should be to check its asking price against the official benchmark for that neighbourhood and property type.

Let's walk through a practical example.

- You're interested in a 120 m² apartment in the Maârif district, listed at 2,400,000 MAD.

- A quick calculation reveals the asking price is 20,000 MAD/m².

- You consult the price reference and find that the standard range for apartments in Maârif is between 14,000 and 20,000 MAD/m².

This simple check tells you everything. The property is priced at the absolute peak of its expected value. This information is gold; it means you either have significant room to negotiate downwards, or the apartment must offer something truly exceptional to command that price.

Negotiating with Confidence

Walking into a negotiation armed with this data puts you in a position of strength. If a property is listed well above the reference value, you can construct a logical, fact-based argument for a lower price.

The price reference acts as your impartial expert in the room. It changes the conversation from a subjective back-and-forth ("I feel it's worth…") to a discussion based on objective data ("The official benchmarks for this area show…"). This makes your offer far more credible and harder for a seller to simply brush aside.

When you believe a price is inflated, you can politely highlight how it compares to the official reference. It’s a subtle but effective tactic that shows you’ve done your homework and understand the local market dynamics.

Ultimately, the transaction will be validated by a notary, who ensures the final price is in line with market norms—often using this very same reference guide. To better understand the final legal steps, our guide on the certificat de propriété in Casablanca is an excellent resource. Knowing the full process further solidifies your standing as a serious, well-prepared buyer.

Casablanca Real Estate: Future Outlook and Investment

Looking at the horizon, Casablanca's property market is set for sustained growth. This isn't just wishful thinking; it's a trend underpinned by powerful economic momentum, ambitious urban development, and major infrastructure projects reshaping the city. To make smart decisions, we need to look beyond the current référentiel prix immobilier Casablanca and anticipate where the market is headed.

As Morocco's economic engine, Casablanca naturally attracts professionals and businesses, creating a consistent and strong demand for housing. This fundamental economic health, coupled with massive public and private investment, creates the perfect environment for real estate appreciation. For any savvy investor, understanding these larger forces is the first step to uncovering genuine, long-term opportunities.

Districts with High Appreciation Potential

While prestigious districts like Anfa and Gauthier will always be a safe bet, the most exciting growth often happens in areas on the cusp of a major transformation. These are the neighbourhoods where today's investment could translate into significant future returns.

Keep a close eye on these key districts:

- Sidi Maârouf and Casa Nearshore: This area is already a well-known business hub. As more corporate headquarters move in, the demand for nearby residential property will only intensify. Its strategic location near the airport and ever-improving transport connections make it a magnet for professionals.

- Bouskoura: Often called Casablanca's "green lung," Bouskoura is becoming a firm favourite for families wanting a more suburban feel without sacrificing modern amenities. With its new villas and proximity to international schools, its appeal—and property values—are definitely on an upward trajectory as the city expands.

- Dar Bouazza: This coastal strip is quickly evolving from a seasonal holiday spot into a desirable year-round residential community. New developments and better infrastructure are drawing in buyers who crave seaside living but still need access to the city, signalling strong potential for appreciation.

Emerging Investment Opportunities

Beyond the traditional buy-and-hold strategy, a few specific investment avenues are gaining real traction in Casablanca. These approaches tap directly into current market needs and development trends.

One of the most promising opportunities is in buy-to-let properties. Furnished apartments aimed at young professionals, students, and expats are in particularly high demand. This niche offers excellent rental yields for those willing to cater to tenants seeking flexible, move-in-ready homes. Another smart play is investing in off-plan developments in the up-and-coming districts we just discussed. Buying before construction is complete often means securing a lower entry price and capitalising on the value increase once the project is finished.

Strategic investing is all about seeing the bigger picture. It's about figuring out which neighbourhoods will benefit most from new infrastructure or demographic shifts, positioning your capital where the growth is going to happen.

For a deeper dive into the market, our comprehensive guide on real estate in Casablanca offers more detailed insights to help you make a successful investment. By pairing on-the-ground knowledge with a solid grasp of market trends, you can effectively position yourself to ride the wave of Casablanca's promising real estate future.

Frequently Asked Questions

When you're dealing with property in Casablanca, questions about official valuations always come up. It's only natural. To help clear the air, we’ve put together answers to the most common queries we get about the référentiel prix immobilier Casablanca. Getting these fundamentals right gives you the confidence you need, whether you're buying or selling.

These are the real-world questions from buyers, sellers, and investors just like you. Think of this as your practical guide to using the price reference to your advantage.

How Often Is the Casablanca Property Price Reference Updated?

The Moroccan tax authorities (DGI) are in charge of updating the référentiel prix immobilier. There isn't a fixed, predictable schedule—you won't see a press release announcing an "annual update," for instance. Instead, the DGI revises it periodically to make sure the figures reflect what's actually happening in the market.

So, what triggers an update? It’s usually a combination of factors:

- Significant Market Shifts: If properties in a certain district are consistently selling for prices well above or below the official reference, that’s a major flag for the DGI.

- Economic Headwinds: Big-picture changes like high inflation or new interest rate policies can force a reassessment of property values across the board.

- Fresh Sales Data: The DGI constantly analyses the data from newly registered property sales, using that information to keep the benchmark grounded in reality.

This flexible approach ensures the reference guide remains a genuinely useful tool for tax purposes.

Can I Negotiate a Price Lower Than the Official Reference?

Yes, absolutely. This is one of the biggest misconceptions out there. The référentiel prix immobilier is not a mandatory price tag. Its main job is to give the DGI a baseline for calculating transaction taxes, preventing people from declaring an artificially low value to dodge taxes.

The final sale price is always down to the negotiation between the buyer and the seller. The reference is a guide, a strong starting point for discussion, but it doesn't lock anyone in.

Think about it this way: if an apartment needs major renovations or is located on a noisy street within an otherwise prime district, you have every right to use those facts to negotiate a price below the reference. On the flip side, a seller with a newly renovated kitchen and a great view will use those features to justify a price above it. The reference simply provides the objective middle ground where that conversation begins.

Does the Price Reference Apply to Commercial Real Estate?

The guide that most people talk about—the référentiel prix immobilier—is designed specifically for residential properties like apartments and villas. While benchmarks for commercial properties do exist, they operate under a completely different and more specialised framework.

Valuing a commercial space is a different ball game altogether. You have to consider things like:

- Location and Footfall: How commercially active is the area? Is it a high-traffic retail spot or a quiet office park?

- Intended Use: An office space is valued differently from a retail shop or an industrial warehouse.

- Lease Agreements: What are the current rental terms, and what's the potential rental income?

Given this complexity, you should always work with a real estate professional who specialises in commercial property. They can give you a valuation that’s based on these unique commercial factors, rather than trying to make the residential guide fit.

Navigating Casablanca's dynamic real estate market is much easier with an expert in your corner. At Rich Lion Properties, we offer the local knowledge and professional guidance you need to make sound decisions. Whether you are buying your first home, selling a long-held property, or looking for an investment, we're here to help.

Explore your options with a partner you can trust. Visit us at https://richlionproperties.com to get started.