Before you even think about scrolling through property listings in Morocco, the most important work begins with a hard look at your finances. This initial stage isn't just about saving up; it's about strategically preparing yourself to be the kind of buyer that sellers and banks take seriously, especially in Morocco's dynamic property market.

Getting your financial house in order is what sets the stage for a smooth, successful purchase. It's your key to securing a good financing rate and gives you a powerful advantage when it comes time to negotiate.

Building Your Financial Foundation for a Moroccan Home

Before you fall in love with a riad in Marrakech or a villa in Casablanca, the real work happens at your desk. Building a rock-solid financial foundation is the absolute first step, and it’s non-negotiable. This process is much deeper than just putting money aside. It’s about methodically positioning yourself as an ideal candidate for lenders in a country where the property market can be quite competitive.

A strong financial profile not only helps you secure better financing terms but also signals to everyone involved—from the seller to their agent—that you are a serious, reliable buyer. In a competitive situation, that credibility can make all the difference.

First, Figure Out Your Real Budget

You need to know exactly how much home you can realistically afford. A trusted guideline that lenders often look at is the 28/36 rule. The idea is simple: your total monthly housing costs (what we call PITI: principal, interest, taxes, and insurance) shouldn't be more than 28% of your gross monthly income.

At the same time, your total debt—including that new mortgage payment, plus any car loans, credit cards, or other debts—shouldn't top 36% of your gross monthly income. Following these ratios is a great way to avoid becoming "house poor," where your home eats up so much of your income that there's little left for savings, travel, or just living your life.

Look Beyond the Down Payment

Saving for a down payment is a major milestone, but it's just one piece of the financial puzzle. Far too many first-time buyers get blindsided by the other substantial costs that pop up.

- Closing Costs: Plan for these to be between 2% to 5% of the home's final sale price. On a MAD 2,000,000 home, that’s an extra MAD 40,000 to MAD 100,000 you'll need in cash for things like notary fees, title registration, and taxes.

- Earnest Money Deposit (l'avance or aârboun): When your offer is accepted, you’ll make a "good faith" deposit, typically 1% to 3% of the purchase price, to show the seller you're committed.

- Moving Expenses: Don't forget the practical costs. Hiring movers, buying furniture, and setting up utilities can add up faster than you think.

The biggest mistake I see buyers make is wiping out their savings for the down payment and closing costs. You absolutely must keep a separate emergency fund with 3-6 months of living expenses. That way, if the water heater breaks a week after you move in, it’s a manageable problem, not a full-blown financial crisis.

Strengthen Your Credit Profile

Your credit history is a testament to your financial discipline, and it’s one of the first things a lender will scrutinise. A strong credit profile often leads to a lower interest rate on your mortgage, which can save you a significant amount of money over the years. Before you even approach a bank, get a copy of your credit report.

Comb through it for any mistakes or old issues that might be pulling your score down. If you need to improve it, the game plan is straightforward:

- Always pay your bills on time.

- Keep your credit utilisation low (using less than 30% of your available credit is a good target).

- Resist the temptation to open new credit cards or take out new loans in the months before you apply for a mortgage.

Get a Handle on Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio is a simple percentage that shows how much of your monthly income goes toward paying off debt. As we touched on with the 28/36 rule, lenders rely heavily on this number to gauge your ability to handle a new mortgage payment.

Let’s run a quick scenario. Say your gross monthly income is MAD 25,000. Your current debts (a car loan and credit card payments) add up to MAD 3,750 per month. That puts your DTI at 15% (3,750 / 25,000).

Now, add a potential mortgage payment of MAD 8,000. Your total monthly debt becomes MAD 11,750, and your DTI jumps to 47% (11,750 / 25,000). Since many lenders want to see a DTI of 43% or lower, that high ratio could either limit how much you can borrow or stop you from getting approved at all. One of the most powerful moves you can make is to pay down existing debt before you start your property search.

Getting Mortgage Pre-Approval to Win in a Tough Market

Once you have a handle on your finances, the next move is getting a mortgage pre-approval. Honestly, in a market as competitive as Morocco's, this isn't just a step—it's your golden ticket. It’s what separates the serious contenders from the casual browsers. In my experience, sellers and their agents won't even look at an offer without one.

It's easy to get confused between a pre-qualification and a pre-approval, but the difference is huge. A pre-qualification is just a rough estimate based on numbers you provide. A pre-approval, however, is the real deal. It’s a lender’s conditional promise to loan you a specific amount after they’ve put your finances under a microscope.

The Power of a Solid Pre-Approval

Walking into a negotiation with a pre-approval letter gives you incredible leverage. It sends a clear message to the seller: "My financing is solid, a bank has vetted me, and I can close this deal." That's a powerful statement, especially when you’re up against multiple offers for the same property.

This confidence is absolutely essential where timing is everything. The Moroccan property market often sees intense competition for desirable homes due to a persistent shortage of inventory. This means first-time homebuyers frequently find themselves in bidding wars where they need to act fast. Having that pre-approval ready lets you make a decisive, compelling offer that immediately stands out. You can learn more about how current market conditions are impacting buyers from leading local experts.

A strong pre-approval also brings much-needed focus to your search. When you know exactly what you can afford, you stop wasting time and emotional energy on homes that are out of reach. It keeps you grounded and makes your house hunt far more efficient.

Gathering Your Financial Documents

To get pre-approved, your lender is going to want to see everything. The process is thorough, so the more organised you are, the smoother it will be. I always advise my clients to start gathering these documents well in advance.

Here’s a typical checklist of what you'll need to pull together:

- Proof of Income: Your most recent pay slips, W-2 forms from the last two years, and possibly your last two federal tax returns.

- Asset Information: Bank statements and any investment account statements from the last few months are needed to verify you have the funds for a down payment and closing costs.

- Debt Information: Have statements ready for any car loans, student loans, or credit card balances.

- Personal Identification: A copy of your driver’s licence or another form of government-issued ID.

A pro tip I always share: Scan these documents and save them in a secure digital folder. When the lender asks for something, you can email it over in minutes, not days. This can seriously speed things up.

Shopping for the Right Lender and Loan

Don't just go with the first lender you find. Not all loans—or lenders—are the same. It’s smart to talk to at least three different types, maybe a large national bank, a local credit union, and a mortgage broker. Compare their rates, fees, and, just as importantly, their customer service. You want a lender who feels like a partner, someone who takes the time to actually explain your options.

They'll walk you through the various types of home loans available. Some common choices in Morocco include:

- Conventional Loans: These aren't government-insured and typically require a stronger credit score and a larger down payment.

- FHA Loans: Backed by the Federal Housing Administration, these are a favourite among first-time buyers. They come with lower down payment requirements—sometimes as little as 3.5%—and more forgiving credit standards.

- VA Loans: A fantastic option for eligible veterans and service members. These loans often require no down payment at all, which is a huge benefit.

Be open with each lender about your financial picture and what you’re looking for. Finding the right loan is about aligning the product with your long-term goals. Taking the time to get pre-approved is one of the most strategic things you can do; it truly sets the foundation for a successful purchase.

Finding Your Perfect Home in the MA Market

Alright, you’ve got your mortgage pre-approval in hand. Now for the exciting part—the actual house hunt. But let’s be honest, diving into the Massachusetts real estate market without a clear strategy can feel like trying to drink from a firehose. It's time to shift gears from financial planning to becoming a truly savvy home shopper.

The secret to a successful search isn't just about endless scrolling through online listings. It's about focus. Without a solid plan, it’s far too easy to get overwhelmed by the sheer number of options or, worse, fall for a beautiful home that just doesn't work for your life. A methodical approach will save you time, cut down on stress, and ultimately guide you to a place that’s not only a perfect fit but a smart investment for your future.

Choosing the Right Real Estate Agent

Let me be direct: the most important partner in this entire process is your real estate agent. I’m not just talking about someone who can unlock doors. A great agent is your strategic advisor, your negotiator, and your neighbourhood expert, all rolled into one. You need someone with deep, proven experience in the specific towns you’re considering.

They should know the local market inside and out—from the reputation of school districts to which side of the street gets the best afternoon sun. When you're interviewing agents, ask them about their track record with buyers like you and how they find properties, especially the ones that haven't hit the major websites yet. That local insight is priceless, particularly in a market where the best homes can go under contract in a matter of days.

Creating Your Must-Haves and Nice-to-Haves List

Before you step foot in a single open house, you need to know exactly what you’re looking for. The best way I’ve found to do this is with a simple 'needs vs. wants' checklist. This isn't just busywork; it's one of the most critical steps to buying a house because it brings clarity and keeps emotion from derailing your search.

Your 'needs' are your absolute deal-breakers. These are the things your home must have.

- A minimum number of bedrooms and bathrooms

- Location within a specific school district

- A commute time under a certain threshold

- A fenced-in yard for your dog

Your 'wants' are the features you’d love to have but could compromise on for the right property.

- A two-car garage instead of one

- Hardwood floors throughout

- A recently renovated kitchen

- A dedicated home office space

Having this list forces you to have honest conversations, especially if you're buying with a partner. It gets everyone on the same page and gives your agent a clear blueprint to work from, so you stop wasting weekends looking at homes that were never going to be "the one."

Understanding the Current MA Market Dynamics

The Massachusetts market is always moving. To be an informed buyer, you need to understand the trends that will directly impact your search. Looking at the latest data, it’s clear that buyers need to be prepared to act with conviction.

For instance, single-family home sales in Massachusetts recently saw a 7% year-over-year increase, while the median sale price jumped 5.5% to $580,000. What does this tell us? While more homes are changing hands, prices are climbing right alongside them. This means you’re likely to face stiff competition and pricing pressure.

Your agent is the one who can translate these big-picture statistics into what they mean for you on the ground. They'll have the local intel on inventory levels, average days on market, and sale-to-list price ratios—all critical indicators that shape how you should approach your search and, eventually, your offer. This knowledge is not just academic; it has practical applications for international buyers as well, as you can see in our guide on navigating the real estate landscape in Morocco.

Before we dive into the search itself, here’s a quick checklist to keep you organized throughout the process. It summarises the key phases and actions you'll be taking on your journey to homeownership in Massachusetts.

Massachusetts Home Buyer Checklist

| Phase | Key Action | Why It's Important |

|---|---|---|

| Preparation | Get Mortgage Pre-Approval | Shows sellers you're a serious, qualified buyer and defines your budget. |

| Team Building | Hire a Local Real Estate Agent | Provides expert guidance, negotiation skills, and access to listings. |

| Defining Scope | Create Needs vs. Wants List | Focuses your search and ensures you're looking for the right home for you. |

| Market Research | Understand Local Market Data | Helps you set realistic expectations and craft a competitive offer. |

| The Search | Attend Open Houses & Showings | Allows you to evaluate properties in person beyond online photos. |

| The Offer | Submit a Competitive Offer | The first step in securing the property, guided by your agent's advice. |

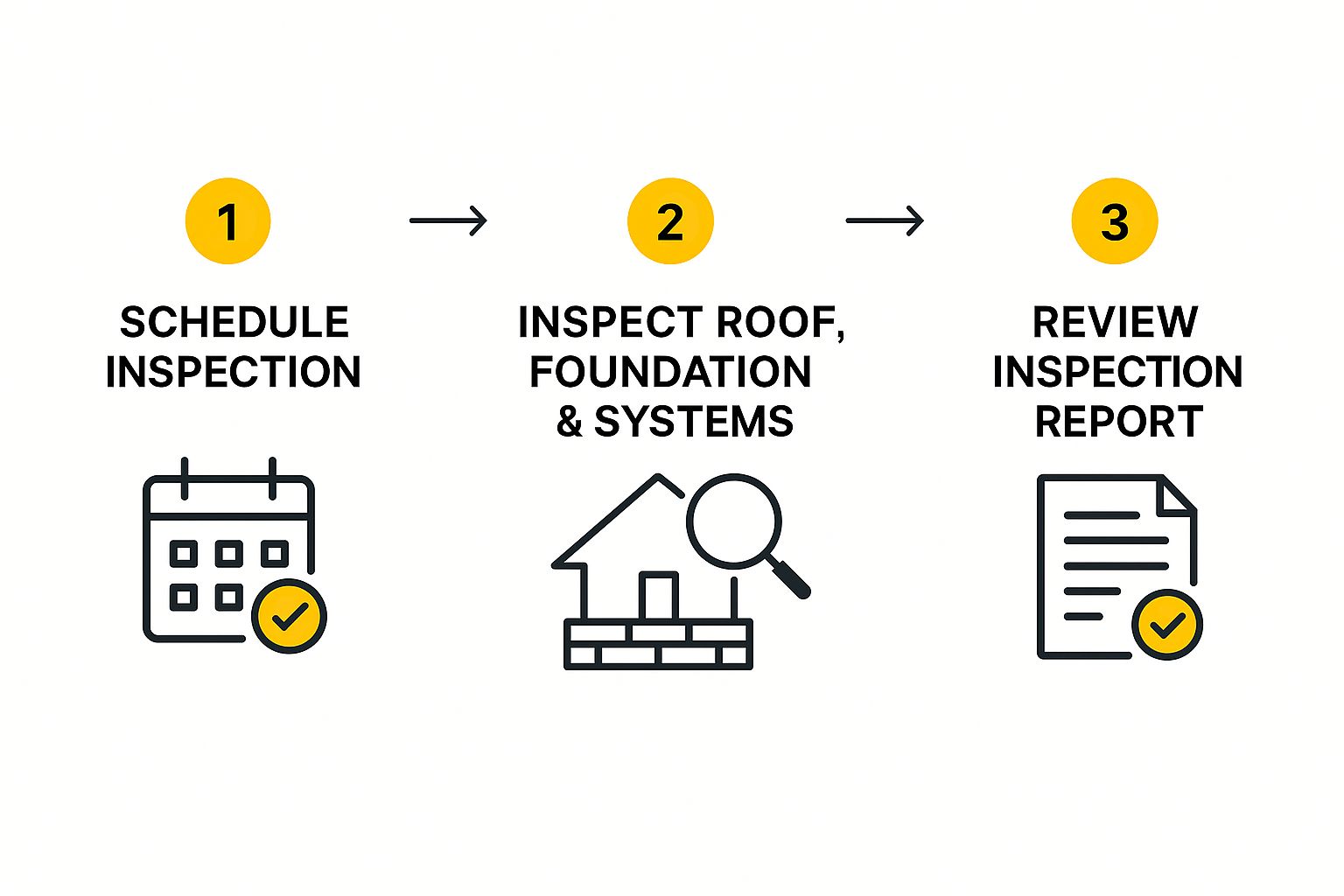

| Due Diligence | Conduct a Home Inspection | Uncovers potential issues with the property before you commit. |

| Closing | Finalise Financing & Paperwork | The last step to officially take ownership of your new home. |

This checklist provides a high-level overview. Each step involves careful consideration and action, but having a roadmap makes the entire experience much more manageable.

Making the Most of Your Search

With your agent chosen and your checklist defined, it's go-time. The search is a smart blend of online homework and hitting the pavement.

Use Online Tools Wisely: Real estate websites are powerful. Set up alerts for new listings that fit your criteria to get a real-time pulse on the market. Really scrutinise the photos, virtual tours, and property details to filter out homes that aren’t a match before you even schedule a visit.

Be Strategic at Open Houses: Don't just wander through. Use this time to assess the home's true condition, its layout, and the vibe of the neighbourhood. Look past the nice staging and focus on the things you can't easily change—the floor plan, the amount of natural light, and noise from the street. This disciplined approach is how you'll spot that hidden gem that truly feels like home.

Making an Offer and Negotiating Your Price

So, you’ve found a property that truly feels like it could be home. Fantastic! Now comes the part where we shift gears from simply looking to actively securing the deal. This is where the process gets real, moving from casual viewings to official, binding paperwork.

The offer you put forward is much more than just a number; it's your opening move in a strategic conversation. You're aiming to convince the seller that you’re not just a buyer, but the right buyer for their property. In Morocco's dynamic market, a thoughtfully constructed offer can make all the difference.

What Goes into a Strong Purchase Offer?

A winning offer is a careful blend of price, terms, and conditions. While the price gets all the attention, the other details can be just as persuasive.

First, the purchase price. This is the figure you’re prepared to pay. To land on a smart number, your agent will pull "comps"—data on comparable sales of similar properties in the area. This isn't guesswork; it’s a professional analysis that positions your offer competitively right from the start.

Next, you'll need to consider the earnest money deposit, known in Morocco as l'avance or aârboun. Think of this as a good-faith payment that shows the seller you’re serious. It's typically 1% to 3% of the offer price and is submitted with your formal offer. A slightly larger deposit can sometimes give your offer a little extra weight.

Finally, your offer should include any contingencies. These are essential safety nets—conditions that must be met for the sale to go through. They protect you from losing your deposit if something unexpected comes up. The most common ones are:

- Home Inspection: This gives you the right to have the property professionally checked out. If major issues surface, you can renegotiate or walk away.

- Financing: A crucial clause that lets you back out without penalty if your mortgage application doesn't get final approval.

- Appraisal: This ensures the bank's valuation of the property is at or above the price you've agreed to pay.

All these elements work together. Sometimes, a slightly lower price with fewer conditions or a fast closing date is more attractive to a seller than a higher offer that’s full of complexities. It all depends on what the seller values most.

The Art of Negotiation, Especially When It’s Competitive

In a hot market, you might find yourself competing against other buyers. This is when a cool head and a clear strategy are your best friends. The number one rule? Don't let the thrill of the chase push you beyond the budget you so carefully planned.

If you're in a multiple-offer situation, your agent is your greatest ally. They can speak with the seller’s agent to learn what truly matters to them. Is it the absolute highest price? Or would they prefer a flexible closing date to suit their own moving plans? Customising your offer to the seller's specific needs can give you a powerful advantage.

Remember, the 'best' offer isn't always the highest. A solid, clean offer with strong financing and minimal complications can often beat a slightly higher but more complex bid. Sellers value certainty just as much as they value price.

Understanding that negotiation is a dialogue, not a battle, is key to success. This mindset is especially valuable for those thinking long-term; if you're looking to build a portfolio, learning how to invest in Morocco real estate provides a much broader perspective on market dynamics.

Once your offer is accepted, you enter the due diligence period. This is your window to schedule the home inspection—an absolutely vital step to uncover any hidden problems.

The inspection report gives you a complete picture of the property's health. With this information in hand, you can either move forward with confidence or reopen negotiations to have the seller address any issues that were found. This report is your leverage for making sure you’re getting exactly what you paid for.

From Offer to Ownership: Navigating the Final Steps

Getting your offer accepted is a huge milestone, but it's not the end of the road. It’s the beginning of a crucial period, often called being "under contract" or sous compromis. This is where the real due diligence kicks in, a phase that usually takes 30 to 60 days to complete.

This is when those contingencies you carefully included in your offer become your best friends. They are your legal and financial safety nets—conditions that absolutely must be met for the sale to go through. Think of this as your chance to look under the bonnet and make sure you’re getting exactly what you bargained for.

The Home Inspection: Your Moment of Truth

One of your first calls should be to a professional home inspector. I can't stress this enough: get this scheduled within a few days of the seller accepting your offer. You’ll want that time up your sleeve in case you need to investigate things further or negotiate repairs.

An inspector is your expert on the ground. They’re trained to see things you can’t, examining the property’s most critical components from the foundation right up to the roof.

What a Good Inspector Will Look For:

- Structural Integrity: This includes the state of the foundation, any worrying cracks in walls, and the overall condition of the roof.

- Major Systems: They'll assess the age and function of the HVAC (heating, ventilation, and air conditioning), plumbing, and electrical systems.

- Safety Concerns: They’ll check for issues like outdated wiring, signs of mould, or potential water damage.

- Water Damage: They will hunt for any evidence of leaks—past or present—in the basement, attic, and around windows and doors.

The inspector will give you a detailed report, usually with photos and clear recommendations. Don’t expect a perfect score; every home, new or old, has its quirks. The real goal is to uncover significant defects—the kind that could be dangerous or cost you a fortune down the line. A $15,000 bill for a new roof is a much bigger deal than a few loose doorknobs.

Armed with this report, you and your agent can decide what to do next. You might ask the seller to handle specific repairs, or perhaps request a credit at closing so you can manage the work yourself. It's a negotiation, and the inspection report is your primary source of leverage.

The Bank Appraisal and Title Search

While you’re busy with the inspection, your lender will be arranging for a home appraisal. This is carried out by an independent appraiser whose job is to determine the property's fair market value. It’s a crucial step for the bank to ensure they aren’t lending you more than the home is actually worth.

What happens if the appraisal comes in lower than your offer? This creates what's known as an "appraisal gap." You've got a few choices: you can try to renegotiate a lower price with the seller, make up the difference in cash yourself, or—if you included an appraisal contingency in your offer—you can walk away from the deal entirely.

A low appraisal might feel like a major setback, but it's actually protecting you. It stops you from overpaying and starting your homeownership journey already in negative equity. It's one of the most important safeguards in the entire process.

At the same time, your real estate attorney or notary (notaire) will perform a title search. This is a thorough investigation into public records to confirm the seller has the legal right to sell the property and to uncover any liens, outstanding claims, or other legal entanglements tied to it. Getting title insurance isn't optional; it's essential protection against any future claims on your ownership.

Preparing for Closing Day

As the closing date gets closer, everything starts coming together. You'll be working with your lender to secure final loan approval. A word of caution: this is not the time to make any big financial moves. Don't go out and finance a new car or change jobs. Any sudden changes to your financial profile could put your mortgage in jeopardy.

It also helps to understand the market you're buying into. In Massachusetts, the homeownership rate is a steady 62.9%. With nearly two-thirds of residents owning their homes, it fuels a competitive market where new buyers often face limited inventory. You can learn more about how these figures shape the Massachusetts housing landscape.

A day or two before closing, you'll conduct a final walk-through. This is your last chance to confirm the property is in the same condition as when you made your offer and that the seller has completed any repairs they agreed to.

Finally, you’ll find yourself at the closing table, ready to sign a mountain of paperwork with your attorney. Once the documents are signed and you've paid your down payment and closing costs, the seller transfers the title. And then, the best part: you get the keys. You are officially a homeowner.

Common Questions About Buying a House in Massachusetts

Stepping into the Massachusetts real estate market for the first time? It's natural to have a lot of questions. From timelines to legal requirements, getting clear answers upfront can make the entire journey feel much less daunting.

Let's break down some of the most common concerns I hear from buyers. Think of this as your practical FAQ for navigating the process with confidence.

How Long Does It Take to Buy a House?

This is probably the number one question on every buyer's mind. While every situation is unique, a good rule of thumb is to budget for three to four months from your active search to closing day.

Of course, this timeline can shift. Finding the perfect home is the biggest variable—it might happen in a weekend or take several months of searching. Once you have an accepted offer, however, things move more predictably. The closing process, which includes the inspection, appraisal, and final loan underwriting, typically takes 30 to 60 days.

Here's a quick look at the major phases:

- Mortgage Pre-Approval: This is your first real step and is usually quite fast, often taking just a few days to a week once your lender has all your paperwork.

- The House Hunt: This is where patience is key. It's the most unpredictable part of the timeline.

- Offer to Closing: Once a seller accepts your offer, the clock starts on a well-defined process that generally lasts between 30 and 60 days.

What Are the Most Important Offer Contingencies?

In Massachusetts, your offer is much more than just a number. It's a legal document that includes contingencies—clauses designed to protect you if something unexpected comes up. These are your escape hatches, allowing you to walk away from the deal with your deposit if specific conditions aren't met.

There are three contingencies you almost never want to skip:

- Home Inspection: This gives you the right to hire a professional to uncover any hidden issues with the property. If major problems surface, you can renegotiate the price, ask the seller for repairs, or back out entirely.

- Mortgage Financing: A crucial safety net. Even with a pre-approval, this contingency protects you if your lender ultimately denies the loan. Without it, you could lose your deposit if the financing falls through.

- Appraisal: Your lender will order an appraisal to ensure the home is worth the price you've agreed to pay. If the appraisal comes in low, this clause lets you renegotiate with the seller or cancel the contract.

In a hot market, some buyers are tempted to waive contingencies to make their offer stand out. I strongly advise against this. Waiving an inspection, for instance, is a massive gamble that could leave you facing thousands of dollars in surprise repairs down the road.

Do I Need a Real Estate Attorney in Massachusetts?

Yes, without a doubt. Massachusetts is an "attorney state," which means you are legally required to have a real estate attorney represent you and manage the closing. This isn't just a suggestion; it's the law.

Your attorney is your legal advocate. They will review the Purchase and Sale Agreement (P&S), perform a title search to make sure the property has no outstanding liens or claims, and prepare all the closing documents. Their job is to protect your interests. For sellers, ensuring a smooth transaction also has its legal hurdles; you can learn more about how to sell my house quickly while covering all legal requirements. Expert guidance is essential for everyone involved.

At Rich Lion Properties, we know that buying a home is one of life's biggest milestones. Our team is here to offer expert guidance through every stage, giving you the clarity and support to turn your homeownership goals into a reality in Morocco. Find your perfect property with us at https://richlionproperties.com.