When you search for terrain a vendre au Maroc, you're not just looking at plots of land; you're exploring a world of investment possibilities. Morocco has become a real hotspot for international buyers, and for good reason. It offers a unique mix of a stable economy, a deep cultural tapestry, and smart government incentives that make investing here a compelling choice.

This guide is designed to walk you through everything you need to know to make that opportunity a reality.

Why Invest in Land in Morocco Today?

Putting your money into Moroccan land is about more than just owning a piece of property. It's an investment in a dynamic economy with a rich history and a clear vision for the future. The country's unique position, linking Europe and Africa, combined with its political stability, creates a secure and promising playground for real estate ventures. It’s this powerful combination that has put Morocco on the map for sharp investors from around the globe.

The appeal goes far beyond the balance sheet. Think about the sheer diversity of the landscape—from the windswept, sun-soaked coasts of Essaouira to the thriving cityscapes of Casablanca and the ancient, vibrant heart of Marrakesh. This variety opens up a huge spectrum of possibilities. Whether you're dreaming of developing a luxury resort, building a private getaway, or securing land for agriculture, the opportunities are there for the taking.

The Economic Case for Moroccan Land

The numbers behind Morocco's real estate market tell a compelling story. A young, growing population and a steady march towards urbanisation mean there's a constant hunger for new homes and commercial properties. The government also rolls out the welcome mat for foreign investors with initiatives designed to make buying here straightforward and secure.

Morocco’s real estate sector isn't just holding steady; it's primed for significant growth. For investors getting in now, this creates a solid foundation for long-term appreciation.

The entire real estate market, including land, is on an upward trajectory. Projections show it expanding by around 4.7% annually from 2024 to 2029. This growth is fuelled by that ongoing urbanisation, a demographic sweet spot where 47% of the population is between 15 and 44, and a rising middle class driving demand. For a deeper dive, you can check out insights into this "real estate gold rush" on hac.ma.

Strategic Advantages for Investors

Beyond the economic data, there are some very practical, strategic reasons why buying land in Morocco makes so much sense. These factors create fertile ground for both quick projects and long-term holds.

- Geographic Proximity: Being just a stone's throw from Europe makes Morocco incredibly accessible for tourism, trade, and personal trips. This directly boosts the value of holiday homes and commercial plots.

- Infrastructure Development: The government is pouring money into major infrastructure projects—think high-speed rail, modern ports, and new motorways. This is opening up previously overlooked regions and driving up land values everywhere.

- Tourism Growth: Morocco is a world-class destination, and its popularity fuels a constant demand for hotels, resorts, and private villas for the rental market.

Getting a handle on these fundamentals is the first step. For a more detailed look, you can explore our analysis on why properties in Morocco are perfect for investment. With this foundation in place, let's move on to the practical side of things—from market trends to the actual steps of buying your land.

Reading the Signs: A Look at Morocco's Real Estate Market Trends

Before you even start looking for a terrain à vendre au Maroc, you need to get a feel for the market's pulse. Think of Morocco's property market less as a single entity and more as a collection of distinct ecosystems. Each region, from the commercial heart of Casablanca to the sun-drenched coast of Agadir, moves to its own rhythm.

Understanding this from the get-go is crucial. The market forces shaping land values in Marrakesh are worlds away from those in a rural plot in the Atlas Mountains. Getting to grips with these regional nuances is the first step in making a truly savvy investment that aligns with your specific goals.

Let's break down these dynamics so you can learn to read the signs—from price fluctuations to the bigger economic currents driving them.

City-Specific Dynamics: A Tale of Many Markets

The property market's heartbeat is different in every major Moroccan city. Local economies, tourism trends, and residential demand all create unique conditions that have a direct impact on the price of land.

The data tells the story perfectly. In the first quarter of 2024, Casablanca saw a slight nominal dip in residential property prices of 0.1% year-on-year. Once you factor in inflation, that's actually closer to a 1% drop. At the same time, Marrakesh enjoyed a modest 3% nominal price increase, while Tangier surged ahead with a 3.2% rise. You can explore more historical data like this over at the Global Property Guide.

These numbers prove that a one-size-fits-all strategy just won't cut it. To succeed, you have to dig into the specific drivers of your target location.

What’s Really Driving Land Values?

Across Morocco, a few powerful forces consistently shape the demand and price of land. Keeping these on your radar will help you spot emerging opportunities and accurately judge a plot's long-term potential.

- Major Infrastructure Projects: New motorways, high-speed rail lines (like the TGV), and port expansions are game-changers. They dramatically boost accessibility and commerce, often causing land values in the surrounding areas to climb.

- The Flow of Tourism: Regions popular with tourists have a constant demand for land to build hotels, villas, and riads. The rise of eco-tourism is also unlocking new potential in more rural, scenic areas.

- Government Zoning and Policy: Pay close attention to local urban plans, known as plans d'aménagement. These documents dictate exactly what can be built and where. If a plot's zoning changes from agricultural to constructible, its value can skyrocket overnight.

The most successful investors don’t just look at the price tag today. They anticipate the future, gauging how these powerful external forces will shape the landscape tomorrow.

Regional Land Price and Market Trends Overview

To give you a clearer picture, it helps to see these dynamics side-by-side. This table offers a comparative look at the property price trends and market dynamics across key Moroccan cities, helping you identify potential investment hotspots.

| City | Average Price Trend (Nominal YoY) | Market Dynamic | Key Driver |

|---|---|---|---|

| Casablanca | Stable to slight decrease (-0.1%) | Driven by local business and residential demand | Economic activity and corporate investment |

| Marrakesh | Moderate increase (+3.0%) | Strong influence from luxury tourism and foreign buyers | International tourism and lifestyle appeal |

| Tangier | Strong increase (+3.2%) | Rapid growth fuelled by port development and industry | Strategic location and industrial expansion |

| Agadir/Coastal | Varies by location | Seasonal demand for holiday properties | Beachfront appeal and tourism infrastructure |

As you can see, the right choice really depends on your strategy. For stable, long-term growth tied to the national economy, Casablanca is a solid bet. If you're targeting the high-end tourism sector, Marrakesh presents a completely different set of opportunities. And for growth tied to industry and logistics, Tangier is a compelling story.

By learning to decode these trends, you can position yourself to take full advantage of the unique strengths each region has to offer.

A Step-by-Step Guide to the Legal Purchase Process

So, you've found the perfect terrain a vendre au Maroc. Navigating the legal side of things can feel a little daunting at first, almost like learning the rules to a new game. But it’s actually a very structured and secure process, designed from the ground up to protect everyone involved.

Think of it like buying a classic car. You wouldn't hand over the cash without meticulously checking its logbook, service history, and ownership papers. The principle is exactly the same here, but the stakes are higher and the paperwork is far more specific. Your journey begins by finding the one professional who will be your impartial guide and legal guarantor through it all: the notary.

Your First and Most Important Step: Engage a Notary

In Morocco, a certified notary, or notaire, isn't just an optional legal advisor. They are a state-appointed official who is legally required to oversee and execute all property transactions. They serve as a neutral third party, ensuring every legal box is ticked, funds are transferred securely, and the final deed is registered correctly.

Choosing a reputable notary is the bedrock of your purchase. This professional will draft all the legal documents, run the essential background checks, and hold your deposit safely in an escrow account. Their role is a non-negotiable layer of security for your investment.

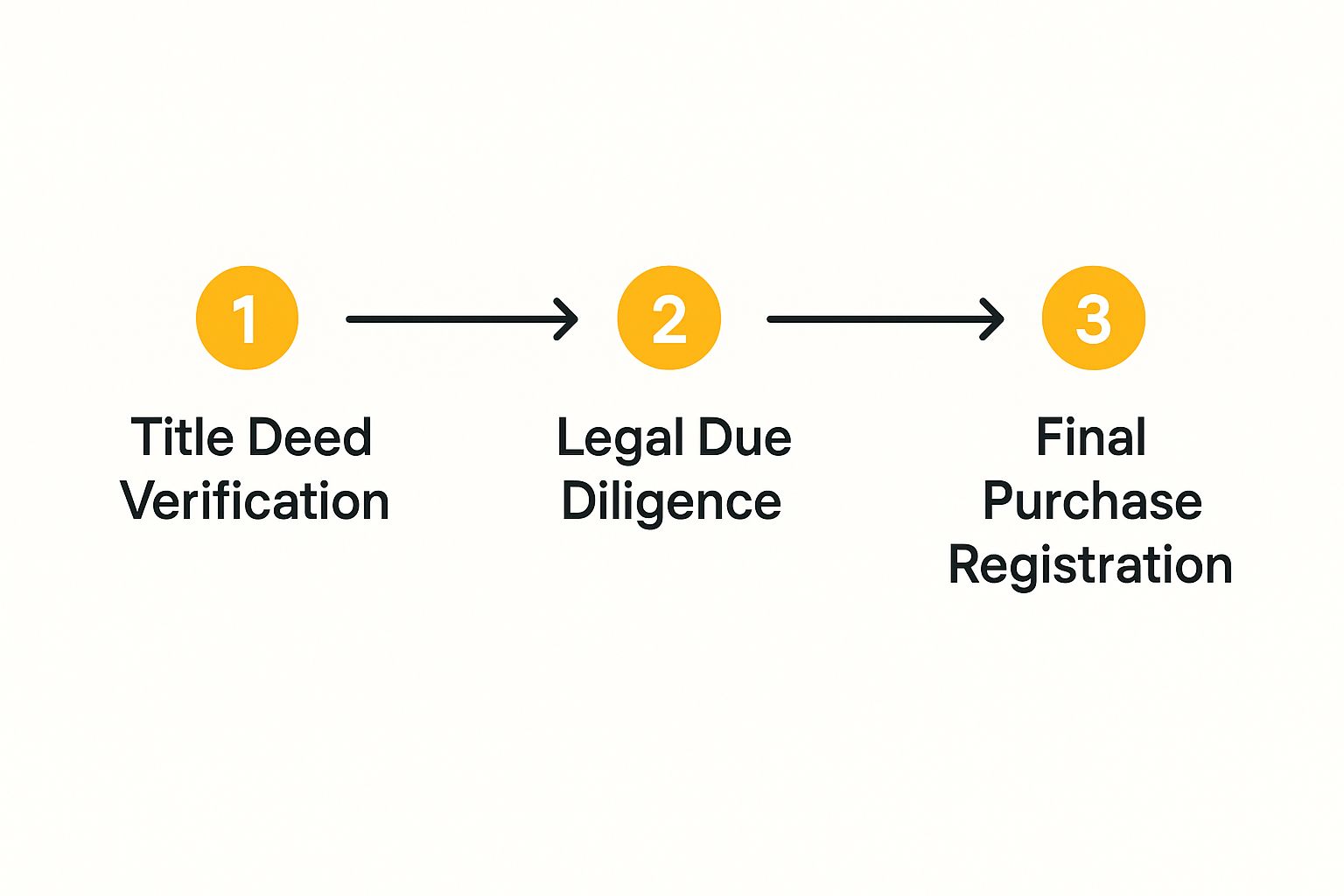

The process your notary will guide you through has three core phases, as shown below.

As you can see, it’s a logical progression from initial verification and due diligence right through to the final, official registration of your ownership.

Conducting Thorough Due Diligence

Once your notary is on board, the real investigation begins. This is where your professional team scrutinises every detail of the land you want to buy. The most important document in this whole process is the land title, known as the titre foncier.

You can think of the titre foncier as the land's official passport. It's a unique document held at the Land Registry (Agence Nationale de la Conservation Foncière, du Cadastre et de la Cartographie, or ANCFCC for short) that confirms the property's exact boundaries, who legally owns it, and whether there are any mortgages, claims, or other financial burdens attached to it.

Your notary's due diligence will cover several crucial checks:

- Title Verification: Confirming the seller is the undisputed legal owner and has every right to sell the property.

- Certificate of Ownership: Obtaining a recent certificat de propriété to check for any hidden financial burdens or legal disputes tied to the land.

- Zoning Compliance: Reviewing the local urban plan (plan d'aménagement) to make sure the land is zoned for what you want to do with it, whether that's residential, commercial, or agricultural. This step is vital to avoid buying a plot you can't legally build on.

A clean and verified titre foncier is your ultimate guarantee of a secure purchase. Without it, you’re exposed to significant risk. This is why untitled land, known as Melkia, involves a much more complicated and risky legalisation process.

From Preliminary Agreement to Final Deed

With the due diligence done and all the checks coming back clear, it's time to make the agreement official. This typically happens in two main stages, both managed by your notary.

First up is the preliminary sales agreement, or compromis de vente. This is a legally binding contract that locks in the terms of the sale and lays everything out in black and white. It will outline key details such as:

- The agreed-upon sale price.

- The payment schedule and deposit amount (usually 10% of the purchase price).

- Any conditional clauses (clauses suspensives), like making the sale dependent on securing financing.

- A target date for the final signing.

Once you sign the compromis de vente, you'll transfer the deposit to the notary's secure escrow account. This act commits both you and the seller to the deal, with financial penalties if either party pulls out without a valid reason stipulated in the contract.

Finally, you move to the final deed of sale, the acte de vente. This is the last step. The remaining balance is paid, and ownership of the property is officially transferred to you. The notary will read the deed aloud to both parties before you sign it. From there, the notary registers the transaction with the Land Registry.

Once the ANCFCC updates its records, a brand new certificat de propriété is issued in your name. That’s it. You are now the official, undisputed owner of your new piece of land in Morocco.

Finding Prime Locations for Your Land Investment

Choosing where to look for terrain a vendre au Maroc is easily the most exciting part of the process. Think of the location as the foundation of your entire investment—get it right, and it will amplify your returns, growth, and even your personal enjoyment for years to come. Morocco’s incredibly diverse landscape means you’re not just picking a city; you’re choosing a specific vision for your land.

It’s a bit like a chef selecting ingredients. A plot of land perfect for a slick commercial hub in Casablanca would be totally wrong for a serene yoga retreat, which would feel more at home in the foothills of the Atlas Mountains. The real secret is to match the location's natural strengths with what you want to achieve.

Marrakesh: The Hub for Luxury and Tourism

Marrakesh has long been the crown jewel of Moroccan tourism, and for good reason. Its global brand recognition makes it a powerful magnet for high-end hospitality projects. Land here, especially in the exclusive Palmeraie or on the city's outskirts with those stunning Atlas Mountain views, is prime territory for luxury villas, boutique hotels, and exclusive resorts.

The demand is fuelled by a constant stream of international visitors and a large, well-established expatriate community. Add in its proximity to the Marrakesh-Menara Airport (RAK) and a collection of world-class golf courses, and you have a recipe for a resilient investment. Buying a plot here isn’t just buying land; it’s investing in the proven, timeless allure of the "Red City."

Casablanca: The Engine of Commerce and Urban Development

If your ambitions are tied to Morocco's economic heartbeat—think commercial headquarters or modern residential towers—then Casablanca is the undisputed choice. As the nation's financial and industrial centre, it offers a completely different, but equally powerful, set of opportunities. Here, the value of land is all about strategic positioning for business, logistics, and urban living.

The market in Casablanca is both robust and diverse. To give you a concrete idea, average apartment prices in 2025 are hovering around 13,900 MAD per square metre. For villas in premium districts like Anfa, prices are holding firm at about 20,500 MAD/m². At the same time, strong demand for more affordable housing in peripheral areas shows just how deep the buyer pool is. You can explore more detailed pricing data on agenz.ma.

For a broader look at what different Moroccan cities have to offer, check out our guide on the 9 best places to buy property in Morocco.

Coastal Gems: Essaouira and Beyond

For those dreaming of a holiday property or a more lifestyle-focused investment, Morocco's Atlantic coast is brimming with potential. Cities like Essaouira, with its bohemian vibe and world-famous kitesurfing scene, are perfect for developing rental villas and guesthouses. The demand is seasonal but incredibly strong, driven largely by European tourists chasing the sun and sea.

Further south, the areas around Taghazout and Agadir are also booming, thanks to major government investment in tourism infrastructure. Land in these regions gives you a chance to cater to a growing market of surfers, families, and retirees. The primary driver of value here is simple but powerful: direct access to the ocean or a spectacular sea view.

The best location isn't always the most famous one. It's the one where the local drivers of demand—whether it's tourism, commerce, or lifestyle—are perfectly in sync with the project you plan to build.

To help you connect your investment goals with the right location, the table below breaks down the unique profile of key Moroccan regions.

Investment Profile of Key Moroccan Locations

This table breaks down different Moroccan regions by investment type, target market, and potential ROI, helping buyers match a location to their specific goals.

| Location | Primary Investment Type | Target Buyer/Investor | Growth Potential |

|---|---|---|---|

| Marrakesh | Luxury villas, boutique hotels, riads | High-net-worth individuals, international tourists | High, driven by premium tourism |

| Casablanca | Commercial buildings, residential apartments | Corporations, local professionals, families | Stable, tied to economic growth |

| Essaouira/Coast | Holiday homes, rental villas, guesthouses | European tourists, lifestyle buyers, water sports enthusiasts | Strong, driven by tourism trends |

| Fes/Meknes | Riad restoration, cultural tourism projects | History enthusiasts, cultural tourists | Niche, with strong cultural appeal |

Ultimately, whether you're drawn to the vibrant energy of a major city or the tranquil beauty of the coast, Morocco offers a landscape of opportunity for the savvy land investor.

How to Finance Your Land Purchase in Morocco

So, you’ve found the perfect terrain a vendre au Maroc. Now comes the practical part: how are you going to pay for it? Getting your financing in order is just as crucial as the legal checks, as it dictates your budget and shapes the entire investment.

The good news is that Morocco's financial system is well-versed in handling property transactions for both locals and foreigners. Think of it like building a bridge to your property—you can use bank financing, work directly with a developer, or simply pay in cash. Each path has its own set of rules and advantages.

Securing a Mortgage from a Moroccan Bank

For most people, walking into a Moroccan bank for a mortgage is the most well-trodden path. This option is open to residents and non-residents alike, though the specific terms and paperwork can vary.

Moroccan banks are generally willing to lend to foreign nationals, but they'll want to see that you're a good bet. The application process isn't a quick signature; it's a thorough review of your financial standing and documentation, designed to protect both you and the bank.

When you start the conversation, be ready to open your books. They'll typically ask for a standard set of documents:

- Proof of Identity: Your passport is a must, along with any residency papers.

- Proof of Income: Recent payslips, an employment contract, or tax returns to show you have a steady income.

- Bank Statements: Usually the last three to six months to give them a clear picture of your financial habits.

- The Preliminary Sales Agreement: The compromis de vente for the land you plan to buy.

A bit of inside advice: getting pre-approved for a mortgage can be a game-changer. It signals to sellers that you're serious and have the funds ready, which can give you a real advantage, especially in a competitive market.

Understanding Loan Terms and Conditions

When you get a mortgage offer, you need to look past the headline number. The loan-to-value (LTV) ratio is a big one. For non-residents, banks are often a bit more cautious, offering somewhere between 50% and 70% of the land's appraised value. This means you'll need to have a larger down payment ready.

You’ll also have to choose between a fixed or variable interest rate. Fixed rates give you predictability—your payment is the same every month. Variable rates might start lower, but they can change over time with market trends. It’s smart to get quotes from a few different banks to see who can offer you the best deal.

Alternative Financing Strategies

A bank mortgage isn't your only option. Depending on your situation and the type of land you're buying, other routes might make more sense.

One popular alternative, particularly for plots in new, large-scale projects, is developer financing. Some developers offer their own payment plans, cutting the bank out of the picture. This can streamline things, but it's absolutely essential to have your notary scrutinise the financing agreement before you sign anything.

Of course, there's always the most straightforward approach: a cash purchase. If you have the capital, paying in cash is the quickest and cleanest way to close a deal. You'll avoid years of interest payments and the hassle of a mortgage application, and sellers often prefer a cash offer.

Budgeting Beyond the Purchase Price

This is where many first-time buyers get caught out. The price on the sales agreement is not the final number you'll pay. You have to account for closing costs, or acquisition fees, which can add a significant chunk to your total outlay.

These extra expenses typically cover:

- Notary Fees: The notary's fee for handling the legal side of the transaction.

- Registration Duties: A state tax required to officially register the property in your name.

- Land Registry Fees: The cost to update the official title deed, or titre foncier.

- Miscellaneous Taxes: Small charges like stamp duty.

To get a really accurate picture of these costs, it's worth taking a closer look at the specific notary fees in Morocco. Knowing these numbers upfront will help you build a budget with no nasty surprises.

Final Tips for a Successful Land Purchase

You've done the research, you understand the process, and now you're ready to find that perfect terrain a vendre au Maroc. This is where the rubber meets the road. Think of this final stage as your pre-flight checklist—a series of crucial steps to ensure everything goes off without a hitch.

Making a smart land purchase in Morocco comes down to a potent mix of local know-how, sharp negotiation skills, and old-fashioned diligence. This isn't just a transaction; it's a major investment. Arming yourself with practical advice and the right people on your side will help you sidestep common mistakes and close your deal with complete confidence.

Assemble Your Local Dream Team

Let's be clear: you can't do this alone. Trying to navigate the Moroccan property market solo is a recipe for disaster. The quality of your local team will directly impact the success of your purchase. They are your eyes and ears on the ground.

Here are the essential people you need in your corner:

- A Reputable Real Estate Agent: A great agent does far more than send you listings. They’re your source for invaluable local intel, have a pulse on fair market prices, and can steer you away from problematic properties right from the start.

- An Independent Notary (Notaire): As we've discussed, the notary is a state-appointed official who is legally required to execute the sale. It’s vital to choose one who is truly independent and has your best interests at heart.

- A Trustworthy Lawyer (Avocat): While not always mandatory, hiring a lawyer who specialises in Moroccan property law adds a critical layer of security. They can review contracts and protect you in ways a notary might not, which is especially important for complex deals.

Choosing this team is arguably one of the most important decisions you will make in the entire process.

Master the Art of Negotiation

In Morocco, negotiation is often more of a conversation than a battle. It’s built on relationships and mutual respect, not aggressive, hardball tactics. Be prepared for things to move a little slower than you might be used to—patience is your greatest asset here.

Never walk into a negotiation unprepared. Your offer should always be grounded in solid research. Know what similar plots of land in the area have sold for and be ready to explain why your offer is a fair one. A well-supported offer signals that you're a serious, informed buyer and sets a professional tone from the get-go.

If there’s one thing to remember, it’s this: know where you absolutely cannot compromise, but be willing to show flexibility on the smaller details. This approach demonstrates respect for the seller while safeguarding your investment, paving the way for a deal where everyone feels they've won.

Spotting and Avoiding Common Red Flags

Your due diligence is your best line of defence. Staying vigilant is absolutely essential. Keep your eyes peeled for a few common red flags that should give you serious pause.

Here’s what to watch out for:

- Unclear or Missing Titles: Always, always insist on seeing the titre foncier. If a seller is cagey about providing it or if the land is untitled (Melkia), you need to understand the immense legal risk you’d be taking on. Proceed with extreme caution, if at all.

- Zoning Discrepancies: Don't just take the seller's word for what you can build. Go directly to the local urban agency (agence urbaine) and verify the land's zoning classification for yourself.

- Pressure for a Quick Cash Deal: Legitimate deals don't need to be rushed. If a seller is pushing you to close quickly and bypass the official notarial process, it's often because they're trying to hide something.

In the end, patience and meticulous checking aren’t just good ideas—they’re non-negotiable. By putting together a strong local team, negotiating with intelligence, and learning to recognise the warning signs, you can turn a potentially daunting process into a secure and deeply rewarding investment.

Frequently Asked Questions About Buying Land in Morocco

As you get closer to buying a terrain a vendre au Maroc, a few specific questions always seem to pop up. Let's tackle some of the most common queries I hear from buyers to help clear things up.

Can Foreigners Legally Buy Land in Morocco?

Absolutely, but there's a crucial distinction you need to understand. Foreign nationals can freely and directly purchase land located within designated urban areas. This type of land is known as "titled" land, or titre foncier, and the process is quite straightforward.

Where things change is with agricultural land. Moroccan law generally restricts foreigners from directly owning agricultural plots. However, that doesn't mean it's impossible. You can still acquire this type of land by setting up a Moroccan-registered company to hold the asset or by securing a long-term lease.

Key Insight: The single most important thing is to confirm the land's official classification with your notary before you go any further. Urban land is simple; agricultural land just requires a different strategy.

What Are the Main Property Taxes Involved?

When you finalise your purchase, you’ll encounter several taxes and fees that make up the total closing costs. Your notary will handle all of these payments, but it's vital to budget for them ahead of time.

The primary costs you should expect are:

- Registration Duty: This is a percentage of the purchase price paid to the government to formally register the property in your name.

- Notary Fees: The professional fee charged by the notary for their essential work in managing the transaction and ensuring its legality.

- Land Registry Fee: A specific fee paid to the ANCFCC (the national land registry agency) for the service of updating the official title deed.

Once you own the land, keep in mind that if you construct a building on it, you'll be responsible for an annual urban property tax, known locally as the taxe d'habitation.

What Is the First Step to Start My Search?

The best way to begin is by finding a reputable, local real estate agency. Nothing beats their on-the-ground knowledge and access to listings you simply won't discover through online portals. It's a game-changer.

A seasoned agent will do more than just show you plots; they'll help you narrow your search based on what you want to achieve, give you a realistic idea of fair market prices, and connect you with other trusted professionals like notaries and lawyers. Building this partnership from day one sets a solid foundation for the entire journey.

At Rich Lion Properties, we provide the local expertise and guidance you need to navigate the Moroccan property market with confidence. Explore our services and find your ideal property with us today.