The Evolution of Massachusetts Commercial Real Estate Today

The Massachusetts commercial real estate market is a dynamic environment, constantly responding to economic fluctuations and shifting tenant needs. Understanding these changes is critical for success, whether you're focused on Boston's bustling city center or exploring opportunities in the surrounding suburban areas. Keeping a close eye on key indicators like vacancy rates, rental prices, and absorption trends provides valuable insights into market performance.

Emerging Trends and Key Indicators

Even with economic uncertainties, some property sectors are demonstrating remarkable resilience. The life sciences industry, for instance, remains a strong performer, fueling the demand for specialized lab and research spaces. Similarly, the industrial sector, especially logistics and warehousing, is experiencing growth driven by e-commerce expansion and the rising need for last-mile distribution hubs. These trends underscore the importance of identifying where savvy investors are finding value.

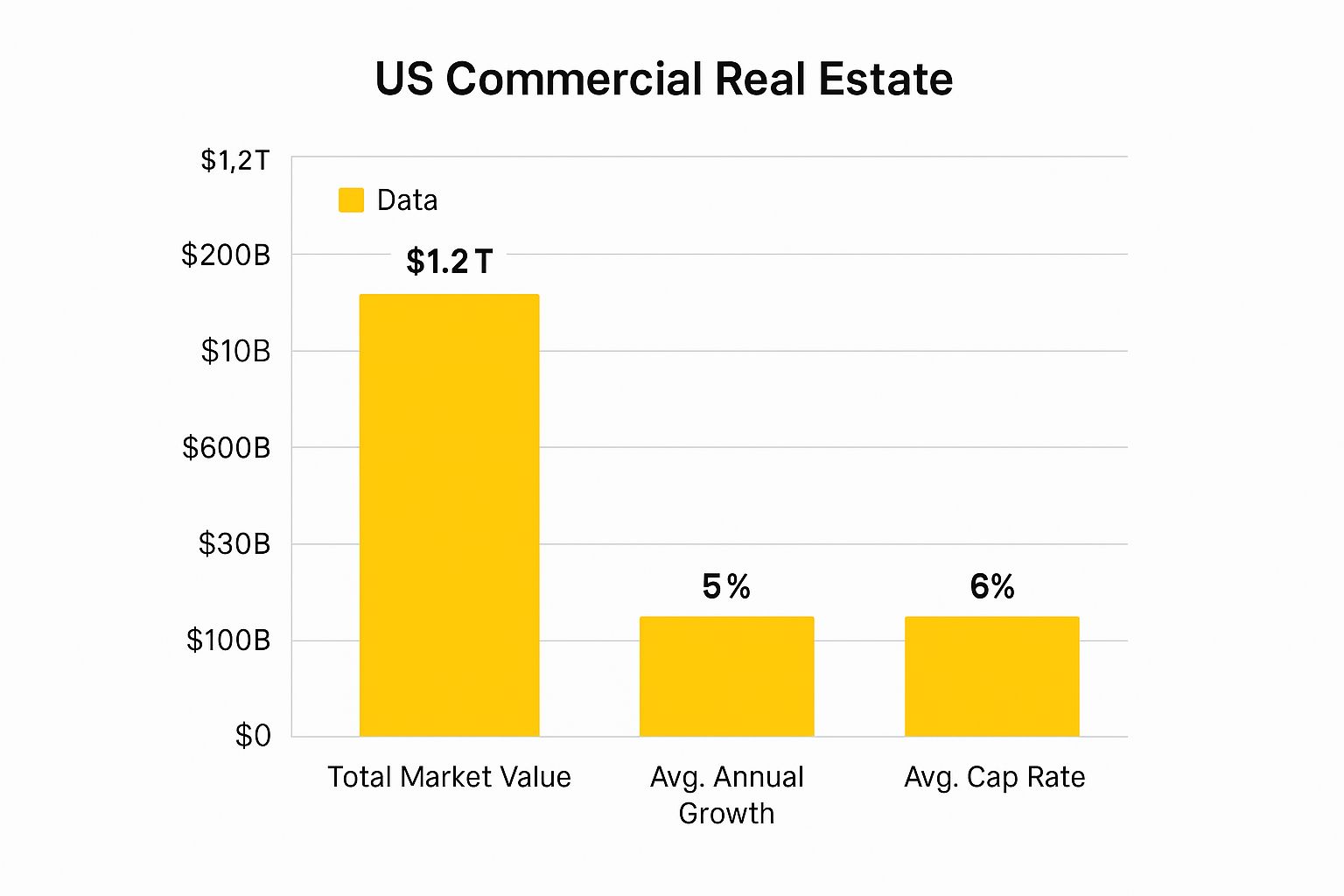

The infographic above provides a visual representation of the overall US commercial real estate market. It compares the total market value, the growth rate over the past ten years, and the average capitalization rate by property type. The visualization emphasizes the market's significant size and consistent growth, while also highlighting the varying return potential (cap rates) across different property segments. This reinforces the importance of careful segment selection when investing in commercial real estate.

The office market in Massachusetts, however, tells a different story. The Boston commercial real estate (CRE) market is currently navigating significant changes influenced by high office vacancy rates and evolving sector dynamics. As of Q4 2024, Boston's office vacancy rate reached 18.5%, indicating a challenging post-pandemic recovery. Despite this high vacancy, the average asking rent remains at $64.18 per square foot, suggesting sustained pricing power in specific high-demand areas. The sublease market has contracted, with available space decreasing from 4.7 million square feet at the end of 2023 to 3.7 million square feet, implying that some companies are either absorbing excess space or terminating secondary leases.

Year-to-date net absorption remained negative at -315,472 square feet, highlighting ongoing demand challenges. These difficulties stem in part from the lingering impact of remote work, economic uncertainty, and fundamental shifts in how companies utilize office space. The completion of Amazon’s 700,000 square foot Seaport project provided a temporary boost but wasn't enough to counteract the overall negative trend. Based on current absorption rates, experts predict it could take over a decade for Boston office occupancy to rebound to pre-pandemic levels, emphasizing the substantial market adjustment occurring in 2025. For a deeper dive into these statistics, see: Is Boston a Strong Market for Commercial Real Estate in 2025?

To better understand the nuances of the Boston commercial real estate market, let's examine some key indicators across various property types:

Boston Commercial Real Estate Market Indicators: Key metrics showing the current state of the Boston commercial real estate market across different property types

| Property Type | Vacancy Rate | Average Rent ($/sq ft) | Net Absorption (sq ft) | Year-over-Year Change |

|---|---|---|---|---|

| Office | 18.5% | $64.18 | -315,472 | Negative |

| Industrial | Data Unavailable | Data Unavailable | Data Unavailable | Data Unavailable |

| Retail | Data Unavailable | Data Unavailable | Data Unavailable | Data Unavailable |

| Life Sciences | Data Unavailable | Data Unavailable | Data Unavailable | Data Unavailable |

This table highlights the challenges faced by the office sector, while further research is needed to fill in the data gaps for other property types to get a complete picture of the Boston CRE market.

Regional Variations and Opportunities

While Boston often takes center stage in discussions about Massachusetts commercial real estate, promising opportunities exist in other parts of the state. Emerging submarkets are attracting investment and witnessing growth in sectors like industrial and retail. This presents a chance for investors and developers to explore areas beyond Boston, uncovering attractive deals and tapping into underserved markets. This requires in-depth knowledge of local demographics, economic drivers, and future development plans.

Adapting to the Changing Landscape

The evolving commercial real estate landscape in Massachusetts demands adaptability and strategic thinking. Property owners must consider how to reposition assets to align with current tenant needs, which often includes incorporating amenities such as flexible workspaces, updated technology, and sustainability features. For instance, adopting green building practices and pursuing LEED certification can attract environmentally conscious tenants and boost property value. These strategies are crucial for maintaining competitiveness in a rapidly changing market.

Economic Forces Reshaping Commercial Real Estate Investment

The Massachusetts commercial real estate market is more than just bricks and mortar; it's intricately connected to the broader economy. This creates both challenges and exciting prospects for investors in the MA area. Understanding these economic dynamics is key to making smart investment choices in this complex market.

Interest Rates and Their Impact

Interest rate fluctuations have a substantial impact on commercial real estate investment. Higher rates translate to increased borrowing costs, potentially squeezing investor profits and slowing down new developments. Lower rates, conversely, can stimulate investment and boost property values.

This makes careful monitoring of interest rate trends a vital part of any successful investment strategy. A sudden rate hike, for example, can quickly make financing a project less attractive, significantly impacting the feasibility of new commercial real estate ventures.

Construction Costs and Inflation

Construction cost inflation is another hurdle for commercial real estate development in Massachusetts. Rising prices for materials and labor can severely impact project budgets and timelines. This can make it challenging for developers to deliver projects on time and within budget.

These cost increases also affect rental rates and property valuations as developers strive to recover their expenses. The added financial burden influences investment decisions, particularly in a competitive market like Massachusetts.

To understand the current investment climate better, let's take a look at the following table which summarizes investor sentiment towards different commercial property types.

Commercial Real Estate Investment Sentiment Analysis

Comparison of investor attitudes toward different commercial property types in Massachusetts

| Property Type | Investor Confidence Score | Expected ROI | Risk Assessment | Growth Forecast |

|---|---|---|---|---|

| Office | 65 | 8% | Moderate | Stable |

| Industrial | 85 | 12% | Low | High |

| Retail | 50 | 6% | High | Slow |

| Multifamily | 75 | 10% | Low-Moderate | Steady |

| Flex Space | 70 | 9% | Moderate | Moderate |

As the table illustrates, industrial properties currently enjoy the highest investor confidence, driven by strong growth forecasts and a lower risk assessment. Retail, on the other hand, faces higher risk and slower anticipated growth, leading to lower investor confidence. The data highlights the importance of considering specific property types when assessing investment opportunities in the Massachusetts commercial real estate market.

Commercial real estate investments in Massachusetts continue to be shaped by material costs and investor sentiment as we move through 2025. A TD Bank survey from early 2025 indicated that 70% of respondents anticipate rising housing material prices within the year, potentially impacting the cost of new construction or renovations. However, only 32% of those surveyed believe these rising costs will significantly influence investment decisions, suggesting a cautious but continued interest in CRE projects despite inflationary pressures. This balanced outlook shows a market weighing cost increases against projected long-term returns.

While rising material costs coincide with broader economic uncertainties in the region, investors remain moderately optimistic. Learn more about material costs and investment sentiment. This optimism is crucial in Massachusetts, where commercial real estate plays a significant role in the economy, supporting sectors such as retail, office, industrial, and flex space. The interplay between rising costs and investment activity will ultimately shape the pace and scale of CRE development, rental rates, and property values moving forward.

Capital Markets and Investment Sentiment

The availability of capital and overall investor confidence significantly impact the commercial real estate market. Staying informed about market trends is crucial for sound investment decisions. For valuable insights into market dynamics, explore resources like Real Estate Market Trends. Periods of economic uncertainty can lead to decreased investment, while periods of robust growth can spur increased investment. For additional information on related topics, you might find our sitemap helpful: Our sitemap. This complex interplay of economic factors requires a nuanced understanding of the market and the ability to adapt to evolving conditions.

Downtown Boston's Commercial Renaissance: Challenges & Victories

Downtown Boston, the heart of Massachusetts' commercial real estate activity, is a dynamic blend of historic charm and modern innovation. This area is experiencing a significant transformation, creating both opportunities and challenges for property stakeholders. Property owners are actively reimagining their assets to meet the evolving needs of today's commercial tenants.

Adapting to the New Normal in Commercial Real Estate

The traditional office space model is facing a significant challenge. The rise of remote work and the changing needs of businesses are key factors driving this shift. As a result, some properties thrive while others struggle to adapt to this new commercial real estate landscape.

Buildings that offer flexible workspace solutions and modern amenities are attracting tenants, highlighting the growing importance of adaptability in this evolving market. This demonstrates a clear shift in tenant priorities and the need for landlords to respond strategically.

A 2025 technical analysis of Boston's downtown market reveals a drastic change in demand for commercial properties, marked by declines in occupancy and shifts in tenant requirements. Explore this topic further.pdf) The report shows a decrease in traditional office demand and a corresponding increase in demand for lab and industrial spaces. This reflects the changing industry needs within this innovation-driven corridor.

The market is also grappling with broader demographic and economic trends, including the increasing adoption of remote work and the evolution of business models. Vacancy rates remain high, coupled with increased sublease availability and slower leasing velocity, creating a complex absorption landscape. These changes hold significant implications for property owners, investors, and city planners. Simply owning a prime location is no longer a guarantee of success.

Winning Strategies in Downtown Boston's Commercial Real Estate

Astute developers are recognizing the need to strike a balance between modern demands and Boston's rich architectural heritage. They are investing in amenities, design elements, and lease structures designed to attract today's tenants.

Amenities such as fitness centers, bike storage, and communal workspaces are becoming increasingly standard. Furthermore, sustainable building practices and certifications like LEED are gaining traction as businesses prioritize environmentally responsible operations. These investments are crucial for attracting and retaining tenants in a competitive market.

The Rise of Life Sciences and Biotech

The increasing presence of life sciences, biotech, and flexible workspace models is reshaping downtown Boston. This is creating entirely new property categories and attracting a diverse tenant base. These specialized spaces demand specific infrastructure and design considerations, leading to a surge in demand for suitably equipped properties.

This growth presents opportunities for investors and developers who understand the unique requirements of these industries. It also creates a challenge for existing property owners looking to repurpose their assets to cater to this expanding market.

Life Sciences & Logistics: The New Commercial Real Estate Leaders

While traditional office spaces struggle, certain sectors within the Massachusetts commercial real estate market are thriving. This growth is primarily driven by the life sciences and logistics industries, which are reshaping the commercial landscape. This presents both exciting opportunities and significant challenges for investors and developers across the MA region.

Life Sciences: From Niche to Dominator

The life sciences sector has quickly evolved from a niche market to a major player in Massachusetts commercial real estate. This expansion is fueled by advancements in biotechnology, pharmaceuticals, and medical devices. This rapidly growing sector has unique real estate needs, impacting design, construction, and investment strategies.

For instance, lab space demands specialized infrastructure, including advanced ventilation systems, increased utility capacity, and specific safety protocols. Adapting existing structures to meet these demands often involves considerable financial and logistical obstacles. However, the high demand and limited availability create a compelling investment prospect despite these challenges. You might be interested in exploring various property types.

Furthermore, the formation of life science clusters, especially near established centers like Kendall Square in Cambridge, increases competition for suitable locations. This has a ripple effect, pushing demand into emerging submarkets across the region. Investors are actively assessing risk in this sector, recognizing the potential for substantial returns while carefully evaluating the unique requirements.

Logistics: Reshaping Industrial Real Estate

The ongoing logistics revolution continues to transform industrial real estate across Massachusetts. The rapid growth of e-commerce and the increasing demand for last-mile distribution are driving the need for warehouse space, distribution centers, and specialized logistics facilities. The rise of logistics has also seen an increased need for streamlined operations, increasing the demand for services like virtual office services. This trend is reshaping the industrial landscape, presenting opportunities for developers and investors prepared to meet these needs.

This surge isn't confined to major metropolitan areas. Last-mile distribution requires facilities closer to consumers, creating development hotspots in suburban areas and smaller towns throughout the state. Grasping these shifting demand patterns is essential for successful investment. This has sparked innovative solutions such as multi-story warehouses and urban logistics hubs designed to maximize space and minimize transportation expenses. These new models present both construction and investment opportunities within the dynamic logistics landscape.

Investment Implications: Assessing Opportunity and Risk

Both life sciences and logistics offer attractive investment prospects within Massachusetts commercial real estate. However, understanding the unique dynamics of each sector is crucial for informed decision-making.

Life Sciences Investment Considerations:

- Specialized Infrastructure Requirements: Lab spaces require significant investment in specialized equipment and custom build-outs.

- Cluster Development: Proximity to research institutions and other life science companies is essential.

- Long-Term Leases: Life science tenants often prefer longer lease agreements, providing investment stability.

Logistics Investment Considerations:

- Location and Accessibility: Proximity to major transportation routes and population centers is critical for logistics operations.

- Building Size and Functionality: Warehouse size and layout must match the specific needs of logistics tenants.

- E-commerce Growth: The continued expansion of e-commerce fuels demand for logistics real estate.

By understanding these factors, investors can effectively evaluate the opportunities and risks within these dynamic sectors and make strategic decisions aligned with the changing face of Massachusetts commercial real estate.

Smart Buildings and Sustainability: The New Competitive Edge

The commercial real estate landscape in Massachusetts is undergoing a significant shift. Smart building technology is rapidly becoming the norm, impacting how properties function and, importantly, how they attract and retain tenants. This trend emphasizes energy efficiency, operational streamlining, and better tenant experiences, ultimately influencing property values and lease agreements across the MA region.

Technology's Impact on Commercial Real Estate

Developers in Massachusetts are leading the charge by incorporating cutting-edge systems into their commercial properties. These technologies encompass a wide range of solutions. Think smart HVAC systems that optimize energy use based on real-time occupancy data. Or consider advanced lighting controls that dynamically adjust brightness in response to natural light levels. This translates to substantial reductions in energy consumption and operational expenses.

Furthermore, smart building technologies contribute to enhanced security and convenience for tenants. Integrated security systems provide improved access control and surveillance. Meanwhile, smart parking systems efficiently guide tenants to available spaces, mitigating wasted time and parking frustrations. These features are highly attractive to businesses seeking contemporary, efficient work environments.

Sustainability as a Driving Force in Leasing Decisions

Sustainability has emerged as a key factor in leasing decisions across Massachusetts. Tenants are increasingly prioritizing environmentally responsible properties. This shift is fueled by a growing corporate commitment to sustainability and a recognition of the long-term cost savings associated with energy-efficient buildings.

This trend is clearly reflected in the rising demand for certifications like LEED (Leadership in Energy and Environmental Design) and the WELL Building Standard. LEED certification validates a building's adherence to environmentally sound design, construction, and operational practices. The WELL Building Standard focuses on enhancing the health and well-being of building occupants. These certifications serve as powerful marketing tools, attracting environmentally conscious companies.

Achieving Measurable Results Through Sustainable Building Practices

Massachusetts buildings that have embraced sustainability are reaping tangible rewards. Case studies of properties attaining LEED, WELL, or net-zero status reveal significant reductions in operational costs, primarily due to lower energy and water consumption. Moreover, these sustainable buildings frequently command premium rents and achieve higher property valuations.

For instance, studies indicate that LEED-certified buildings in Boston command a 7% increase in rental rates compared to non-certified buildings. This demonstrates that investing in sustainability isn't just environmentally responsible; it’s a financially sound business decision.

Future-Proofing Assets in the Massachusetts Market

By integrating smart building technologies and sustainable practices, Massachusetts developers are effectively future-proofing their assets. This proactive approach addresses the state’s evolving environmental regulations and strategically positions properties to attract and retain high-quality tenants. This is particularly important in a competitive market like Massachusetts, where businesses have multiple leasing options.

In conclusion, the convergence of smart technologies and sustainability initiatives is reshaping the commercial real estate market in Massachusetts. These strategies provide a competitive advantage by attracting discerning tenants, lowering operating expenses, and increasing property value. This creates a mutually beneficial outcome for both property owners and tenants, fostering a more sustainable and efficient future for commercial real estate in the MA region.

Commercial Real Estate Victory Strategies for Uncertain Times

The Massachusetts commercial real estate market is constantly changing, creating both obstacles and opportunities for property owners, investors, tenants, and developers. Successfully navigating this environment demands strategic planning and a deep understanding of the evolving market dynamics. This means understanding not only overarching trends but also the specific details of individual property sectors and submarkets.

Repositioning Underperforming Assets

Property owners need a proactive asset management strategy in the current climate. Repositioning underperforming properties can be a key to success. This might involve renovating outdated spaces to attract today's tenants or repurposing structures for entirely new uses. For example, converting unused office space into desirable lab space caters to the growing life sciences sector. This proactive approach not only improves occupancy rates but also increases property value.

Strategic capital improvements can also significantly enhance a property's attractiveness. Modernizing building systems, such as HVAC and lighting, boosts energy efficiency and lowers operating costs. This attracts tenants focused on sustainability and efficient operations, aligning with Massachusetts' emphasis on environmentally sound practices. For further information, consider exploring resources on different commercial property types: How to master commercial property types.

Creating Compelling Tenant Experiences

Attracting and retaining tenants in a competitive market takes more than competitive rental rates. Creating a compelling tenant experience is crucial. This means providing amenities tailored to modern businesses. Offering flexible workspaces, on-site fitness centers, and convenient parking can greatly improve tenant satisfaction and retention. These features create a more desirable workplace, leading to higher occupancy and stronger tenant loyalty.

Building a sense of community within the property further enhances the tenant experience. Organizing networking events and creating communal spaces encourages interaction and collaboration among tenants. This fosters a sense of belonging, improves tenant satisfaction, and builds long-term relationships. This strategy sets a property apart and cultivates a more engaged tenant base.

Evaluating Investment Opportunities and Mitigating Risks

Investors navigating the current market need a solid framework for evaluating opportunities. This involves analyzing market trends, assessing potential risks, and creating strategies to limit downside. Diversifying investments across different property types can mitigate risk and capture gains in various sectors. This balanced approach allows investors to adapt effectively to market shifts.

Structuring deals that prioritize downside protection is also essential in uncertain times. This could involve negotiating favorable lease terms, securing strong tenant guarantees, or establishing contingency plans for unexpected events. These proactive measures protect investors and guard against potential losses, ensuring investments are secure and positioned for long-term success.

Strategic Partnerships and Value Creation

Strategic partnerships are a powerful way to improve returns and unlock new opportunities. Collaborating with local developers, property managers, or other industry professionals provides valuable insights and resources. This collaborative approach allows investors to leverage local expertise and navigate market complexities more effectively, creating opportunities for knowledge sharing and resource pooling, ultimately leading to better investment outcomes.

Developers facing entitlement challenges and securing financing need a proactive and strategic approach. Understanding local regulations and engaging early with community stakeholders can streamline the entitlement process, reducing delays and minimizing roadblocks. This also demonstrates a commitment to the community, fostering positive relationships and building project support.

Securing favorable financing in challenging market conditions requires compelling investment proposals. This means demonstrating a clear understanding of market conditions, presenting realistic financial projections, and showcasing a well-defined development plan. This detailed approach builds lender confidence and increases the chances of securing favorable financing terms, strengthening the project's financial viability and enhancing its long-term outlook.

For commercial real estate needs in Morocco, consider Rich Lion Properties. We offer comprehensive services for buying, renting, and selling commercial properties throughout Morocco. Visit our website to learn how we can help you achieve your real estate goals.