Finding an appartement a vendre a Salé is about more than just buying property; it’s about spotting a smart opportunity in one of Morocco’s most dynamic real estate markets. Salé offers a compelling mix of city life and real value, thanks to its close connection to Rabat and more accessible pricing. This is especially true for anyone on the hunt for a two or three-bedroom family home.

Understanding Salé's Property Market

Before you start scrolling through listings, it’s worth getting a feel for the local market. Salé isn't just Rabat's sleepy neighbour—it's a bustling city with its own distinct energy, driven by unique economic and demographic trends. Taking the time to understand these forces will help you manage your expectations and recognise a great deal when you see one.

At its core, Salé's market is tied to the capital, Rabat, but it moves to its own beat, especially when it comes to price. This affordability is the city’s biggest selling point, pulling in first-time buyers, young families, and sharp investors looking for solid rental income and long-term growth. Salé neatly absorbs the demand that spills over from Rabat, where apartments in the best areas can be incredibly expensive.

Key Drivers of Salé's Market

A few key factors are shaping the demand and prices for an appartement a vendre a Salé. Getting to know them is your first step towards a successful purchase.

- Proximity to Rabat: The tramway and road network make the daily commute to the capital a breeze. This means you can tap into Rabat's job market while benefiting from Salé’s lower living costs.

- Government Housing Initiatives: National programmes designed to help middle-income families and first-time buyers get on the property ladder have a real impact here, boosting confidence and keeping the market steady.

- Demographic Demand: Salé is a city for families, and that’s reflected in the strong demand for apartments with at least two bedrooms. This preference influences what gets built and sold.

- Ongoing Urban Development: Fresh investment in infrastructure, from new roads to public parks and facilities, is constantly improving the quality of life in Salé and supporting property values over the long haul. Understanding these dynamics is a key part of appreciating why properties in Morocco are perfect for investment.

The wider Rabat-Salé-Kénitra region has seen some clear trends through 2024 and into 2025. Apartments remain the go-to property type, making up about 66% of all property searches. This is particularly true in Salé, where two and three-bedroom layouts are the norm for Moroccan families.

To put things in perspective, let’s look at a quick comparison.

Salé vs Rabat Apartment Market At a Glance

This table breaks down the key differences between buying an apartment in Salé versus the more expensive districts of Rabat, giving you a clear picture of the value on offer.

| Market Factor | Salé | Rabat (Prime Districts) |

|---|---|---|

| Average Price/m² | 8,000 – 12,000 MAD | 15,000 – 21,000+ MAD |

| Primary Buyer Profile | First-time buyers, young families, investors | High-income professionals, expatriates, investors |

| Typical Property Type | Two and three-bedroom apartments in new builds | Luxury apartments, renovated historic properties |

| Investment Focus | High rental yield, long-term appreciation | Capital preservation, premium rental income |

| Market Pace | Steady and balanced | Competitive and fast-moving for prime stock |

As you can see, Salé offers a much more accessible entry point without sacrificing the potential for solid returns, especially for those looking to rent out their property. It’s a practical, value-driven choice.

A smart buyer looks beyond the price tag. They analyse the market forces—affordability relative to Rabat, infrastructure growth, and government support—that make an apartment in Salé not just a home, but a sound financial asset for the future.

Current Market Conditions

Heading into your search, it’s good to know that buyer confidence in Salé is solid. The market is stable, supported by a healthy economy and consistent demand for housing. While it’s certainly influenced by national trends, Salé’s local market has proven resilient because of its fundamental value.

This creates a balanced environment where you can find quality properties without the frantic pressure you might find in hotter markets. The combination of stability and steady price growth is what makes Salé such a strategic player in the region's housing scene.

Where in Salé Should You Put Down Roots?

Choosing where to look for an appartement a vendre a Salé is just as critical as picking the apartment itself. Salé isn’t one-size-fits-all; it’s a mosaic of neighbourhoods, each with its own rhythm, community, and perks. You’ve got districts perfect for young professionals who need that quick tram ride to Rabat, and others designed for families wanting parks and good schools nearby.

Before you even start scrolling through listings, you need to understand the character of each area. Think of it this way: you’re not just buying bricks and mortar, you’re investing in your daily life. The right neighbourhood makes a great apartment feel like a true home.

Hay Karima: A Top Choice for Families and Professionals

Hay Karima has earned its reputation as one of Salé's most sought-after residential areas, and for good reason. It’s particularly popular with families who are drawn to its modern infrastructure and thoughtfully planned layout, which creates a genuinely comfortable and secure environment. You immediately notice the clean streets, well-kept public spaces, and an undeniable sense of community.

What really sets this neighbourhood apart is its sheer convenience. It has a fantastic mix of amenities right on your doorstep:

- Great Schools: You'll find a solid selection of both public and private schools, which makes the morning drop-off a lot less stressful.

- Everyday Shopping: The area is sprinkled with supermarkets, local markets (souks), cafés, and all the essential services you need. Daily errands don't require a major expedition.

- Green Spaces: Parks and playgrounds are a common sight, offering safe spots for kids to play and for the whole family to unwind outdoors.

The apartments for sale here are mostly in mid-to-high-range buildings, many of them being new or recent constructions. An appartement a vendre a Salé in Hay Karima often includes modern finishes, secure parking, and sometimes shared facilities. It’s a smart, balanced investment in both your lifestyle and the property's long-term value.

Sala Al Jadida: Modern Living Without the Hefty Price Tag

If you're after modern comforts but are working with a more modest budget, Sala Al Jadida (or "New Salé") should be high on your list. This newer part of the city was specifically designed to provide contemporary housing at a more accessible price point. It's a rapidly growing area that’s attracting a vibrant mix of young couples, first-time buyers, and forward-thinking investors.

The main appeal of Sala Al Jadida is its intelligent urban planning. The neighbourhood features wide avenues, organised residential complexes, and a growing number of commercial hubs. It manages to strike a great balance, offering a quieter, more suburban atmosphere while still being well-connected to the city centre and Rabat via major road networks.

The real secret to Sala Al Jadida is its potential. Buying here isn’t just about the neighbourhood today, but what it’s set to become. Those who get in early are perfectly positioned to benefit from its ongoing development and future infrastructure projects.

Bettana and Hay Salam: Central, Connected, and Full of Life

For anyone who thrives on being in the middle of it all, Bettana and its neighbour, Hay Salam, are hard to beat. These are some of the most established and central districts in Salé. They offer phenomenal access to the tramway, which makes the commute to Rabat's business and administrative centres incredibly simple—often taking less than 30 minutes.

Life here is dynamic. These areas bustle with energy and are packed with shops, restaurants, and public services. While the apartment buildings are a mix of older and newer styles, the unbeatable access to transport and amenities is a trade-off many are happy to make.

So, how do these areas stack up against each other? It all comes down to what you value most.

| Feature Comparison | Hay Karima | Sala Al Jadida | Bettana / Hay Salam |

|---|---|---|---|

| Primary Vibe | Family-Friendly, Modern | Suburban, Developing | Urban, Central, Bustling |

| Best For | Families, Professionals | First-Time Buyers, Investors | Commuters, Urbanites |

| Tramway Access | Good | Developing | Excellent |

| Property Style | Newer Builds | Modern Complexes | Mixed Ages, Varied |

| Price Point | Mid to High | Affordable to Mid | Mid-Range |

Ultimately, no amount of research can replace getting a feel for a place yourself. My best advice? Spend a weekend exploring your top choices. Grab a coffee, walk the streets at different times of day, and just watch the world go by. That first-hand experience is the only way to know if a neighbourhood truly feels like home.

How to Secure Financing for Your Apartment

Alright, let's talk about the money. Finding the perfect appartement a vendre a salé is exciting, but securing the funds to actually buy it is where things get real. The mortgage system in Morocco is quite straightforward, but knowing what the banks are looking for is half the battle. Whether you're a local resident or buying from abroad, the fundamental requirement is the same: you need to prove you're a good bet.

The very first thing any Moroccan lender will look at is your down payment, or apport personnel. Don’t even think about a 100% mortgage; it’s not common here. As a rule of thumb, you’ll need to put down at least 20% of the property's price. If you’re a non-resident, be prepared for that number to climb, often closer to 30%.

Putting more money down isn't just about reducing your loan. It’s a powerful signal to the bank that you’re financially disciplined and a lower-risk borrower. This simple fact can do wonders for your approval chances and might even land you a better interest rate.

Building a Strong Financial Profile

Before you walk into any bank, you need to get your financial house in order. Your goal is to present a profile that screams "reliable." Lenders are going to comb through your income, your existing debts, and your job stability. You're essentially making a case for why they should trust you with their money.

One of the most critical metrics is your debt-to-income ratio. Banks in Morocco generally want your total monthly payments—including the new mortgage—to stay below 40-45% of your net monthly income. If you have outstanding personal loans or high credit card balances, clearing those up before applying is a smart, strategic move.

To get the ball rolling, start gathering your paperwork. Every bank has its own specific list, but the core documents are nearly always the same:

- Proof of Identity: Your Moroccan ID card (CIN) or a valid passport.

- Proof of Income: Typically your last three to six months of salary slips, plus your employment contract.

- Bank Statements: At least three recent months of statements to demonstrate a steady income and sensible spending.

- Preliminary Sales Agreement: The compromis de vente, showing you have a specific property lined up.

Getting all this organised upfront does more than just speed things up. It shows the lender you're serious and prepared. I've seen this simple step alone make a real difference in how smoothly the process goes.

Understanding Your Mortgage Options

When you start looking for a mortgage for an appartement a vendre a salé, you'll find two main products on the table. The right choice really comes down to your personal finances and how comfortable you are with a bit of uncertainty.

Fixed-Rate Mortgages (Taux Fixe)

This is the classic, straightforward option. Your interest rate is locked in for the entire life of the loan. Your monthly payment never changes, which makes budgeting a breeze and protects you if market rates go up. For most people who value stability, this is the way to go.

Variable-Rate Mortgages (Taux Variable)

Also known as an adjustable-rate mortgage, the interest rate on this loan can fluctuate. They often lure you in with a lower initial rate, which can be tempting. The catch? If benchmark rates rise, so will your monthly payments. It’s a bit of a gamble, but it can pay off if rates stay low or fall.

Shopping Around for the Best Deal

Here’s a piece of advice I give everyone: never, ever take the first offer you get. You need to shop around. Go to several different banks and get them to compete for your business.

And don’t just fixate on the interest rate. You need to look at the whole picture—application fees, mandatory insurance costs, and any penalties for paying the loan off early. Ask for a complete breakdown of all associated costs. Sometimes, an offer with a slightly higher rate can actually be cheaper in the long run once you factor in all the hidden fees.

Don't be afraid to negotiate. If you have a strong financial profile and a competing offer in hand, you have leverage. A good deal on your financing is just as important as a good price on the apartment itself.

Navigating the Legal Steps and Paperwork

Once you've found the perfect appartement a vendre a salé and your offer has been accepted, it’s time to move into the more structured part of the process: the legalities. Buying property in Morocco is a formal affair, and for good reason—it’s designed to protect everyone involved. This isn't a stage you can rush; it requires patience and a good grasp of what happens next.

The entire transaction is managed by a notaire, a government-appointed legal professional who serves as a neutral party. Their involvement isn't just a good idea; it's a legal requirement. The notaire is your safeguard, responsible for verifying every document, ensuring the property title is clean, and finalising the legal transfer of ownership.

The Preliminary Sales Agreement

Your first official step is signing the compromis de vente, or the preliminary sales agreement. Think of this as the definitive handshake. It’s a legally binding contract that locks in all the terms of the deal and effectively takes the apartment off the market. It’s a serious commitment from both you and the seller.

When you sign this agreement, you'll typically pay a deposit, which is usually 10% of the total purchase price. This money doesn’t go to the seller directly. Instead, it's held safely in an escrow account managed by the notaire until the sale is finalised.

The compromis de vente needs to be incredibly detailed. It should clearly outline:

- Full legal identification for both you (the buyer) and the seller.

- A precise legal description of the property, matching what’s on file at the land registry.

- The agreed-upon final price and the exact deposit amount.

- Any conditional clauses (clauses suspensives), like making the sale contingent on securing your mortgage.

- A target date for signing the final deed of sale.

Don't rush your review of the compromis de vente. This is your chance to make sure every single detail is correct before you're legally locked in. A good notaire will walk you through it, but you need to be confident you understand every clause.

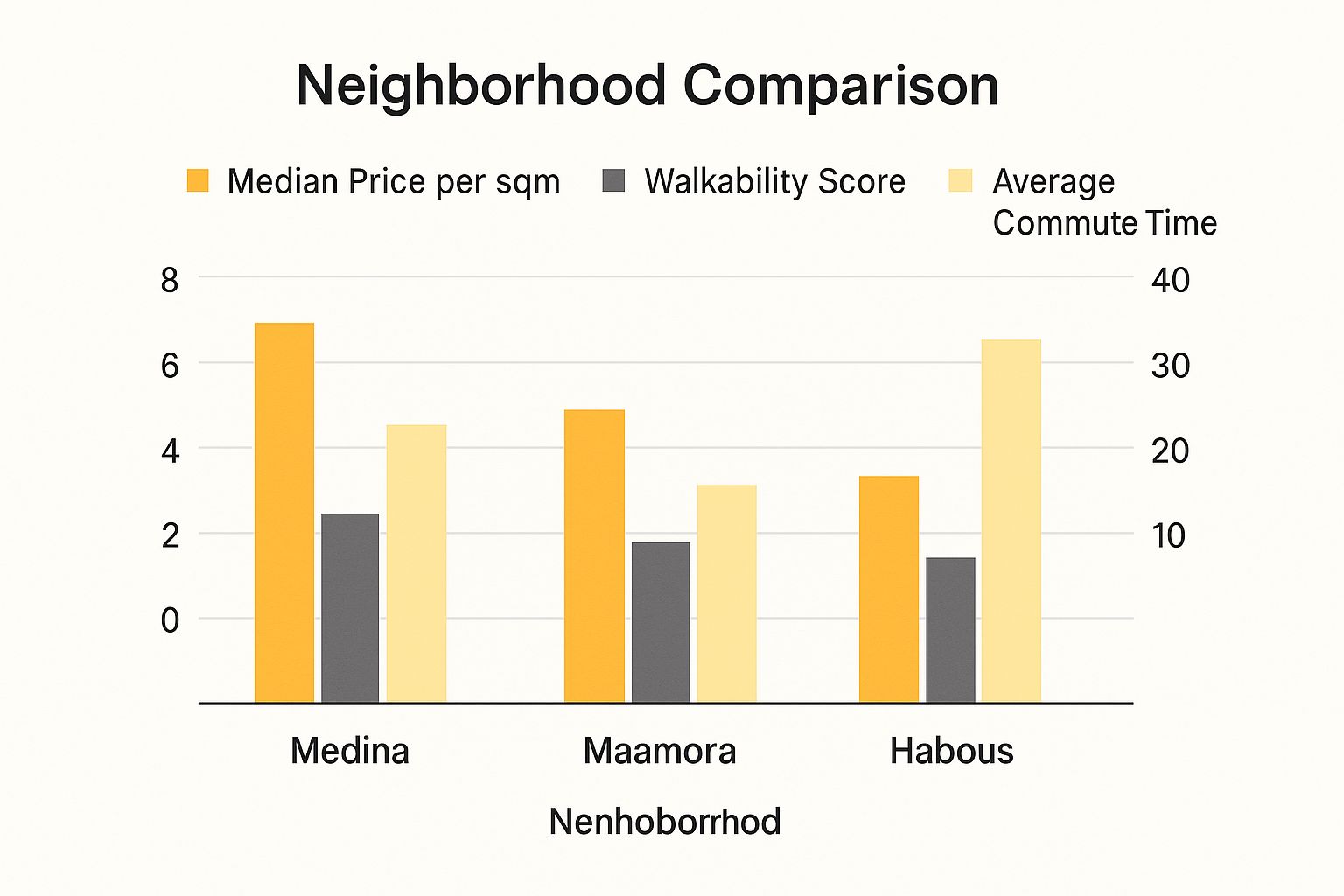

This image gives a bit of context, comparing key factors across Salé's different neighbourhoods. It can help you understand where your legal and financial efforts are being focused.

As you can see, areas like the historic Medina offer fantastic walkability but potentially longer commutes, which contrasts with modern districts where the price reflects a different set of lifestyle priorities.

The Role of the Notaire and Due Diligence

With the preliminary agreement signed, the notaire gets to work on the due diligence. This is a critical investigation to confirm the property's legal standing. They’ll pore over the titre foncier (the property title deed) to confirm the seller is the genuine owner and check for any outstanding claims, mortgages, or legal disputes tied to the apartment.

This phase is your ultimate protection against any future surprises or legal headaches. The notaire's final approval is your assurance that the property you’re buying comes with a clean slate. This step really highlights why a professional approach is so important, and you can learn more about the broader process by reading our guide on how to buy property in Morocco easily.

Buyer Closing Costs

Before you get to the final signing, it's crucial to budget for the associated closing costs. These are the various fees and taxes you'll pay on top of the apartment's price. A notaire can give you a precise breakdown, but having a solid estimate from the start helps avoid any last-minute financial stress.

Estimated Buyer Closing Costs in Salé

Here’s a general breakdown of the typical closing costs a buyer in Salé can expect to cover.

| Cost Item | Estimated Percentage of Property Price | Brief Description |

|---|---|---|

| Registration Tax | 4% | A mandatory tax paid to the government to register the property transfer. |

| Land Registry Fee | 1.5% | Fee for updating the official land registry (Conservation Foncière) with your name. |

| Notaire Fees | 0.5% – 1.5% | The notaire's professional fee for managing the entire legal process. It's often on a sliding scale. |

| Miscellaneous Fees | ~1% | A catch-all for smaller costs like stamp duty, certificates, and other administrative charges. |

| Total Estimated Costs | ~7% – 8% | As a rule of thumb, budget for around this percentage of the purchase price for all closing costs. |

Remember, these figures are estimates. The final amount can fluctuate slightly, but this table gives you a reliable starting point for your financial planning.

The Final Deed and Property Registration

Once the notaire has completed all the checks and your financing is officially in place, you’re ready for the final step: signing the acte de vente, the final deed of sale. This is the document that makes the transfer of ownership official.

This signing ceremony happens at the notaire’s office. Here, you'll transfer the remaining balance of the purchase price and pay the notaire's fees and all associated taxes and duties.

After everything is signed, the notaire submits the paperwork to the Land Registry (Conservation Foncière). This finalises the process, officially recording you as the new owner and issuing an updated title deed in your name. This registration can take a few weeks, but once it’s done, the apartment is legally and entirely yours. Congratulations

Tips for Negotiation and Closing Your Deal

https://www.youtube.com/embed/fBP2E8J6SZ0

You’ve done the legwork—you've researched the market, picked the perfect neighbourhood, and have your financing in place. Now for the exciting part: turning a good deal into a great one. Successfully negotiating for an appartement a vendre a salé and getting to the finish line is an art, blending solid preparation with a bit of local know-how.

This is where all that research you did earlier really comes into play. Knowing what similar apartments in the area have recently sold for isn’t just good information for you; it's your most powerful tool in a negotiation. When you can confidently reference comparable sales, it gives your offer weight and shows the seller you’re serious and well-informed.

Making Your First Offer

Your opening offer really sets the stage. Go in too low, and you might insult the seller and kill the conversation before it even starts. Offer too close to the asking price, and you’ve left yourself no wiggle room.

A good rule of thumb is to start with an offer that's 5-10% below the list price, though this depends entirely on how well-priced you think the property is to begin with.

Don't just pull a number out of thin air. Your offer should be grounded in logic. For example, if your property inspection revealed that the plumbing needs work or the electrical system is dated, you can use the estimated repair costs to justify your lower offer. It’s not about criticising the property; it's about presenting a realistic valuation of the apartment as it stands today.

It also pays to understand the seller's situation. Are they moving for a new job and need a quick sale? Or are they in no rush and willing to wait for the highest price? Your estate agent can be a goldmine of information here, offering insights that help you shape your strategy. Knowing what motivates the seller gives you a real edge.

Understanding the Negotiation Dance in Morocco

In Morocco, negotiation is often more of a relationship than a transaction. It’s a polite, patient, and firm dance. Rushing the process or coming across as too aggressive will almost certainly work against you. Keeping a calm, respectful attitude is key.

A few things to keep in mind as you talk:

- Expect a back-and-forth. It’s extremely rare for a first offer to be accepted outright. The seller will likely come back with a counteroffer, so be prepared with your next move.

- Keep it professional. Emotions can cloud your judgment. Stick to the facts—market data, the inspection report, and the property’s condition.

- Know your absolute limit. Before you even make that first offer, decide on the maximum price you’re willing to pay and don't go a dirham over. This is your walk-away price, and it will save you from getting swept up in the moment and overpaying.

It's also worth noting the investment potential, as this can be a subtle but effective negotiation point. The short-term rental market in Salé is growing. Data shows that Airbnb listings can bring in an average monthly revenue of around $4,495 with occupancy rates hovering near 34%. This underlying demand reinforces the property's value, which can be a useful card to play in discussions. For a deeper dive, the data on AirROI.com offers some great insights into Salé's rental landscape.

Remember, a good negotiation isn't about one person "winning." It's about finding that sweet spot where both you and the seller feel you've reached a fair agreement. The goal is to secure the property at a price that reflects its genuine market value.

From Handshake to Keys in Hand

Once you and the seller have shaken hands on a price, things move pretty quickly. Your notaire will step in to handle the final paperwork, drafting the official deed of sale, known as the acte de vente.

At the final signing, you'll transfer the rest of the funds and pay any closing costs. Once all the documents are signed and the notaire has formally registered the transaction, you'll finally get the keys to your new Salé apartment.

While the final steps are quite formal, they represent a huge milestone. By approaching the negotiation with a clear head, a solid strategy, and a respectful attitude, you can make sure your property journey ends on a high note. For more tips, take a look at our guide on how to find the best deals on your dream home in Morocco.

Common Questions About Buying in Salé

As you get closer to making a decision on an appartement a vendre a salé, you'll naturally start to have more specific questions. The process here has its own unique set of rules and professional roles, which can be a little different from what you might be used to.

This section is all about clearing up those final uncertainties. I've pulled together the most common queries we hear from buyers, providing direct, practical answers to help you move forward with complete confidence.

Can Foreigners Buy Property in Salé, Morocco?

Yes, absolutely. Morocco’s property laws are very open and welcoming to foreign buyers. You're free to purchase titled properties, known as titre foncier, which covers pretty much every modern apartment you'll find in Salé.

The great part is that the process is identical for both Moroccan citizens and non-residents.

The only real restriction is on buying agricultural land, which won't be a concern when you're looking for an apartment in the city. To ensure everything is done correctly and securely, you must use a local notaire (notary). They are legally required to handle the transaction, verify the property title, and register the deed, which gives you full legal protection and ownership of your new home.

What Are the Average Annual Property Taxes in Salé?

Owning an apartment in Salé comes with a few annual tax obligations, but they're generally quite reasonable. It's smart to factor these into your budget from day one.

You’ll typically be responsible for two main taxes:

- Taxe d'Habitation: This is the primary housing tax, and its amount is based on the theoretical rental value of your apartment.

- Taxe de Services Communaux: This covers municipal services like rubbish collection and street lighting. It's also calculated based on the property's rental value.

On top of that, if your apartment is in a building with shared amenities, you'll have syndic fees. These are monthly or quarterly payments to the homeowners' association to cover the upkeep of common areas—think lifts, stairwells, and any shared gardens.

Think of the notaire as the impartial referee of the property transaction. While an agent is on your team to find the property, the notaire is there to ensure the game is played by the rules, protecting both buyer and seller and guaranteeing a legally sound outcome.

What Is the Difference Between a Real Estate Agent and a Notaire?

Getting this straight is crucial. In the Moroccan property market, these two professionals work together, but their jobs are completely separate and don't overlap.

A real estate agent, or agent immobilier, is your guide in the property search. Their main job is to:

- Help you find an

appartement a vendre a saléthat fits your needs. - Arrange viewings and give you the inside scoop on different neighbourhoods.

- Assist with negotiations to help you and the seller agree on a fair price.

A notaire, however, is a state-appointed legal expert whose involvement is a legal requirement for any property sale. Their role is purely legal and administrative. They handle the title search, draft the official contracts, collect taxes for the state, and officially register your ownership. Simply put, the agent helps you find the deal; the notaire makes it legally binding and secure.

Is a New-Build or Resale Apartment a Better Choice?

This is the classic dilemma, and the right answer really comes down to your personal priorities. Both new-builds (neuf) and resale apartments (ancien) have great things to offer in Salé.

New-build apartments almost always feature modern finishes, better energy efficiency, and amenities like underground parking or lifts. They are essentially a blank canvas, ready for you to move into without any immediate work.

Resale apartments, on the other hand, are usually in more established, central neighbourhoods with mature infrastructure. They might have more character or larger rooms for the price, but you might also need to budget for some renovations to get them just right. It all boils down to whether you value move-in-ready convenience over the charm and location of an older property.

At Rich Lion Properties, we provide the expertise and local insight needed to navigate every step of your property journey in Morocco. Contact us today to find your ideal apartment in Salé.