At its most basic, rental yield is your annual rental income divided by the property's total value, then multiplied by 100 to get a percentage. This simple calculation is your starting point for understanding an investment's potential return, offering a clear snapshot of how much income a property generates relative to what it cost you.

How to Calculate Rental Yield: A Guide for Investors in Morocco

Before you even think about putting in an offer on a property, you need a solid way to measure its potential return on investment. That's where rental yield comes in. It’s the single most important metric for gauging a property's earning power. For anyone looking to invest in Morocco's dynamic real estate market, getting this calculation right is absolutely essential for making smart, profitable decisions.

In fact, understanding rental yield is one of the foundational steps to buying a house for investment purposes. The calculation breaks down into two distinct types: gross yield and net yield. Each tells a different part of the story.

-

Gross Rental Yield is your quick, back-of-the-napkin calculation. It gives you a high-level view, making it perfect for quickly comparing different properties on the market because it only factors in the annual rent against the property’s price.

-

Net Rental Yield is where the rubber meets the road. This is the true measure of profitability, as it subtracts all the operating expenses that come with owning a rental. This figure shows you what you'll actually pocket at the end of the day.

Think of it like this: gross yield is the potential in a perfect world, while net yield is the reality.

The Two Sides of Yield: Gross vs. Net

When you're first scanning listings, you don't have time to dig into the detailed expenses of every single property. This is where gross yield shines. It helps you quickly sift through dozens of options to see which ones are even worth a closer look.

Once you’ve narrowed down your list to a few promising contenders, it’s time to calculate the net yield. This is the deep dive that uncovers the true financial health of the investment. It accounts for everything from property taxes and insurance to maintenance costs and syndic (homeowners' association) fees.

Here's a quick breakdown to help you keep them straight.

Gross Yield vs. Net Yield at a Glance

| Metric | What It Measures | Formula Core | Best Use Case |

|---|---|---|---|

| Gross Yield | The property's income potential before any expenses. | Annual Rent / Property Value | Fast, high-level comparisons between multiple properties. |

| Net Yield | The actual profit after all operating costs are deducted. | (Annual Rent – Annual Expenses) / Property Value | Detailed financial analysis of a specific, shortlisted property. |

Ultimately, using both calculations gives you a powerful, two-step process. You can quickly filter out the duds with the gross yield calculation, then use the net yield to zero in on the true winners.

This dual approach is your best defence against investments that look great on paper but are actually money pits once all the hidden costs are factored in.

A Quick Example in Action

Let's put the basic formula to work. Imagine you're eyeing a property in Marrakech for MAD 1,500,000. You estimate it can generate MAD 90,000 in annual rent.

The gross rental yield would be: (90,000 / 1,500,000) * 100 = 6%.

This 6% figure gives you a solid benchmark. You can now compare it to other properties in the area to see if it’s a competitive return. From there, you'd dig into the expenses to find your net yield and make a final decision. Mastering this distinction is fundamental to building a successful real estate portfolio here in Morocco.

Calculating Your Gross Rental Yield

Before you get lost in the weeds of expenses and taxes, the first metric every investor should master is gross rental yield. Think of it as a quick, back-of-the-napkin calculation that gives you an immediate sense of a property's earning power. It’s the perfect tool for making swift, initial comparisons between different investment opportunities.

The concept is beautifully simple: divide the total rent you'll collect in a year by the property's purchase price, then multiply that by 100 to get your percentage. This top-level figure cuts through the noise and tells you what the asset generates relative to its cost.

A Practical Moroccan Example

Let's ground this in reality. Say you have your eye on a new apartment in Casablanca, and the purchase price is MAD 1,800,000. A bit of market research on similar listings suggests you could reasonably expect a monthly rent of MAD 10,000.

First things first, we need the annual rental income.

- Monthly Rent: MAD 10,000

- Annual Rent: MAD 10,000 x 12 months = MAD 120,000

With that annual figure in hand, you can plug it into the gross yield formula.

- Calculation: (MAD 120,000 / MAD 1,800,000) * 100

The result is a gross rental yield of 6.67%.

This single number is incredibly useful. It lets you instantly gauge whether this Casablanca flat meets your baseline investment goals and how it compares to that riad in Tangier or the villa in Rabat you were also considering. For a more comprehensive look at this and other calculations, you can explore our full guide on how to work out rental yield.

Key Takeaway: Your gross yield is only as good as the numbers you use. A common mistake is to rely on overly optimistic rent projections from sellers. Always, always do your own homework.

Grounding Your Numbers in Reality

Basing your calculations on solid, real-world data is absolutely critical. I’ve seen many new investors fall into the trap of using aspirational rent figures instead of what the market will actually bear. It’s a surefire way to end up with disappointing returns and a broken financial plan.

To sidestep this, you have to dig into comparable rents (comps) for the specific neighbourhood. What are properties of a similar size, condition, and with comparable amenities actually renting for right now? Looking at historical data can also add another layer of confidence to your projections.

By making sure your potential rental income is rooted in reality, your gross yield calculation transforms from a guess into a powerful first-pass filter. It empowers you to efficiently sift through listings and zero in on the most promising investment opportunities Morocco has to offer.

Calculating Net Yield for True Profitability

While gross yield gives you a quick snapshot, net rental yield tells the real story of an investment’s performance. This is the figure that separates a property that looks good on paper from one that actually makes you money. It forces you to get honest about all the operating expenses that come with being a landlord, giving you a clear-eyed view of your real return.

Experienced investors live and die by this number because it cuts through the noise and reveals the true financial health of their portfolio. Ignoring these costs is a surefire way to end up with flawed projections and a lot of unexpected financial stress. To really understand how your investment is performing, you have to dig into the expenses.

Itemising Your Operating Costs

So, what exactly are these costs? Think of them as the cost of doing business as a landlord in Morocco. They’re all the recurring expenses required to keep the property running, tenanted, and in good shape.

Here’s a typical list of what you need to subtract from your gross annual income:

- Property Taxes: These are the non-negotiable annual taxes your local municipality will charge.

- Insurance: Absolutely essential. This covers the building against damage, fire, and other potential liabilities.

- Syndic Fees: If your property is in a complex or apartment building, these are the homeowners' association fees for maintaining common areas. They’re usually paid monthly or quarterly.

- Maintenance and Repairs: You have to budget for this. It covers everything from a leaky tap to repainting the walls between tenants.

- Vacancy Costs: It’s rare for a property to stay occupied 100% of the time. You must account for periods when the property is empty and not bringing in any rent.

Factoring in these costs is the heart of how rental yield is calculated for genuine profitability. In some markets, these annual expenses can easily eat up 30-40% of rental income, which just shows how critical this step is for an accurate financial picture. You can find more insights on how regional costs affect yield at Steadily.com.

Remember: Net yield is your reality check. It’s the number that tells you what you'll actually have left after everyone else—from the tax authority to the maintenance crew—has been paid.

Putting It All Together: A Real-World Calculation

Let's go back to our Casablanca apartment example. We had a purchase price of MAD 1,800,000 and an annual rental income of MAD 120,000. Now, let's inject a dose of reality by factoring in some typical annual expenses.

- Property Taxes: MAD 4,500

- Building Insurance: MAD 1,500

- Syndic Fees: MAD 3,600 (at MAD 300/month)

- Maintenance Fund (a conservative 5% of rent): MAD 6,000

- Vacancy Allowance (one month's rent): MAD 10,000

Total Annual Expenses: MAD 4,500 + MAD 1,500 + MAD 3,600 + MAD 6,000 + MAD 10,000 = MAD 25,600

With our expenses tallied, we can figure out the net annual income.

Net Annual Income: MAD 120,000 (Gross Income) – MAD 25,600 (Expenses) = MAD 94,400

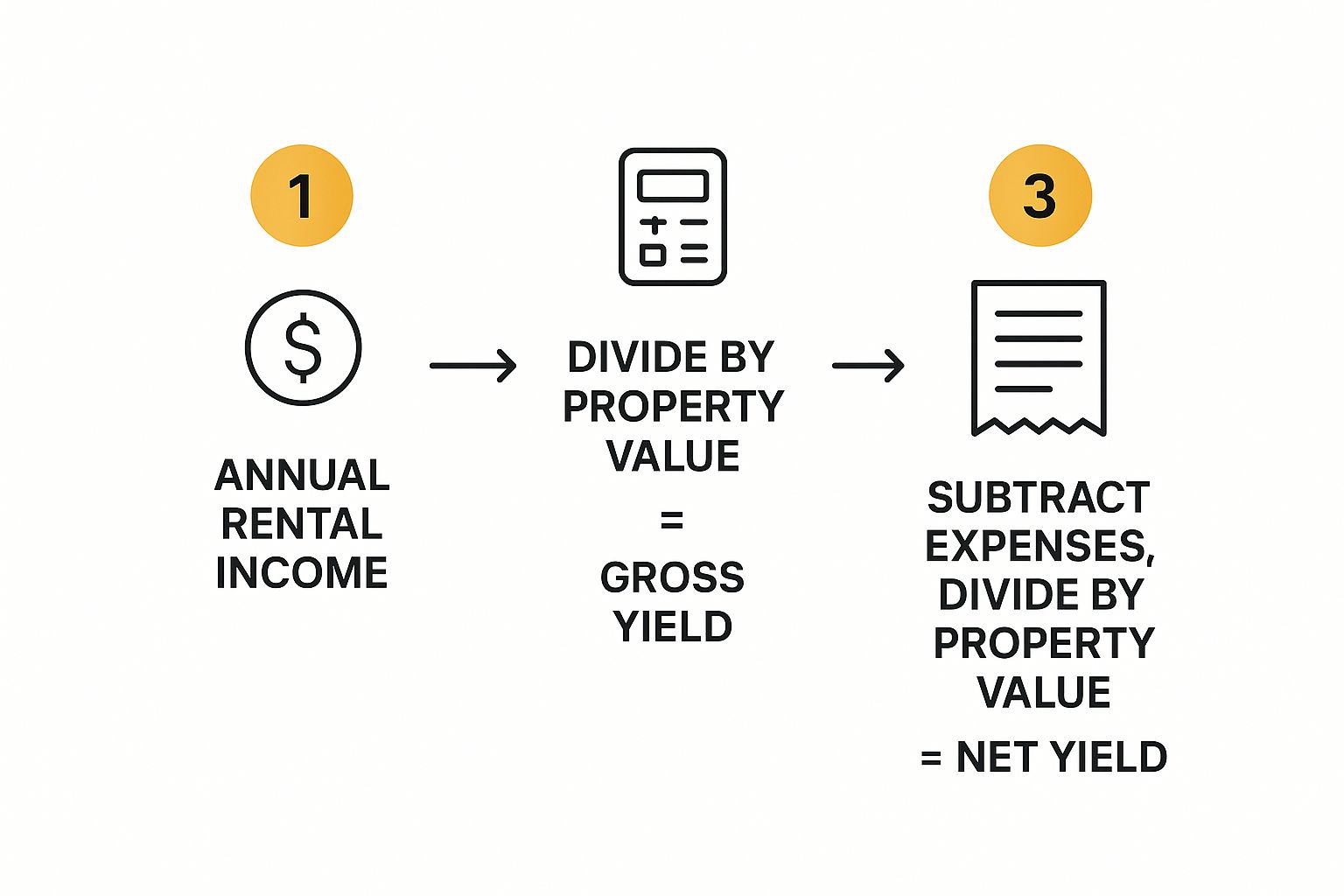

This infographic breaks down the journey from gross income to your final net yield.

As you can see, subtracting those expenses is the critical middle step. It’s what turns a simple gross yield into a much more reliable net yield.

Finally, we can calculate the net rental yield.

- Calculation: (MAD 94,400 / MAD 1,800,000) * 100

The result is a net rental yield of 5.24%. That’s a noticeable drop from the 6.67% gross yield, but it's a far more realistic and trustworthy measure of this property's financial performance. This is the number you can actually take to the bank.

Avoiding Common Rental Yield Mistakes

Even the most experienced investors can get their numbers wrong. I’ve seen it happen time and again. A small oversight in your initial calculations can completely skew your financial projections, turning what looked like a golden opportunity into a real money pit. Knowing how to calculate rental yield is only half the battle; understanding where people usually trip up is the other, arguably more important, half.

One of the classic blunders is basing your numbers on aspirational rent. It's so easy to get swept up in the excitement, especially when a seller or agent is painting a very rosy picture. This single mistake can artificially inflate your gross yield on paper, giving you a completely false sense of security before you've even signed the papers.

Another major pitfall is underestimating the true cost of owning a property. New investors often account for the obvious things like property taxes and syndic fees but forget a whole host of other expenses. This leads to an inaccurate net yield and a lot of painful, unexpected hits to your cash flow down the line.

Forgetting About Vacancies

Your property won't be occupied 365 days a year. It’s a simple truth, but one that many investors conveniently ignore, much to their own detriment. Tenant turnover is a natural part of the rental cycle. Between one tenant moving out and another moving in, you’re guaranteed to have periods with zero income but all the same expenses.

To avoid this trap, you absolutely must factor a vacancy allowance into your net yield calculation. A good, conservative rule of thumb is to budget for 5% to 10% of your total annual rent to be lost to vacancies. This creates a buffer to cover your costs during those empty months, keeping your forecasts grounded in reality.

For instance, if you expect an annual rent of MAD 120,000, a 5% vacancy rate means you should subtract MAD 6,000 from your income right from the start. It’s a simple adjustment that makes a world of difference.

The most reliable financial forecasts are the ones that plan for imperfection. Assuming 100% occupancy year after year is a recipe for disappointment and financial strain.

Ignoring Crucial Upfront and Ongoing Costs

When you’re working out your net yield, the expenses you include are everything. Beyond the obvious monthly bills, there are a couple of cost categories that are constantly overlooked but can seriously drain your returns.

-

Acquisition Costs: These are the one-off fees you pay to buy the property. While they aren't part of your annual operating expenses for net yield, they are vital for understanding your total initial investment. Forgetting things like notary fees, registration taxes, and agency commissions means you're starting with a flawed understanding of your real entry cost.

-

Maintenance Budget: An older property, like a charming riad in a historic medina, will demand more care. You can't just set aside a small, arbitrary amount for repairs and hope for the best. A much better approach is to budget at least 1% of the property’s value each year for maintenance. For older or more complex buildings, you might even want to increase that.

Failing to properly account for these costs gives you a misleadingly high net yield. A truly accurate calculation demands an honest, line-by-line look at every dirham you'll spend. This is the discipline that separates investors who thrive from those who are always caught off guard by the next bill.

What Is a Good Rental Yield in Massachusetts?

Ask ten different investors what a “good” rental yield in Massachusetts is, and you might get ten different answers. There isn't a single magic number. The truth is, a solid return is completely tied to where you're buying and what your goals are.

What passes for a great yield in a pricey Boston suburb will look entirely different from a profitable deal out in the Berkshires. Context is king. Your own financial situation and risk tolerance will ultimately define what you consider a successful investment. Are you after a slow-and-steady, stable return, or are you willing to take on more work for the higher yields that can come with short-term rentals?

Setting a Realistic Benchmark for Your Investment

So, what should you actually aim for? Based on what we're seeing in the market, most long-term rental properties across Massachusetts tend to generate a gross rental yield between 5% and 7%. This range is a practical benchmark to have in your back pocket when you're analysing deals. If a property’s numbers are coming in below that, you’ll want to dig a lot deeper to find out why.

The short-term rental market, however, plays by a different set of rules. Recent data from Rabbu.com on Massachusetts short-term rental markets shows the best-performing areas averaged a gross yield of around 6.3%. These were often high-value properties pulling in annual revenues near $163,000.

It's a classic trade-off. While short-term rentals can bring in more cash, they also bring more headaches, management demands, and market volatility.

Key Takeaway: A "good" yield is simply one that aligns with your personal investment strategy. Are you hunting for immediate cash flow, betting on long-term appreciation, or trying to find a balance of both? Your answer directly shapes your target percentage.

For example, an investor laser-focused on monthly cash flow might demand a net yield of 6% or more to make a deal worthwhile. In contrast, another investor could happily accept a 3% to 4% net yield on a property in a rapidly appreciating neighbourhood like Cambridge, knowing that their real payoff will come from the property's soaring value down the line.

What Really Moves the Needle on Your Yield?

Several critical factors will dictate what a reasonable yield looks like for any given property. Getting a handle on these from the get-go will help you set much more realistic expectations.

- Property Taxes: Let's be frank—Massachusetts has some of the highest property taxes in the nation. This is a non-negotiable expense that will eat directly into your net yield.

- Property Appreciation: In highly sought-after areas, a lower initial yield is often the price of admission. The trade-off is the potential for significant appreciation over time.

- Local Economy: A strong local economy with steady job growth fuels rental demand. This gives you more leverage to charge higher rents and, in turn, boost your yield.

At the end of the day, knowing the formula for rental yield is just step one. The real skill is applying that knowledge to the unique, and often challenging, Massachusetts market. By understanding the regional benchmarks and the forces that shape them, you're in a much stronger position to make smart investment decisions.

If you’re ready for a broader look at the entire process, our comprehensive guide on how to invest in property is a great place to start.

Frequently Asked Questions About Rental Yield

Even after you’ve got a handle on the formulas, real-world questions always pop up once you start crunching the numbers for an actual property. That’s perfectly normal. The finer points of how rental yield is calculated are often hidden in the details, and getting those details right is what makes an investor confident.

This section tackles the most common questions we hear from investors looking at the Moroccan market. We’ve designed these answers to be direct and practical, clearing up any confusion so you can get on with your analysis.

Should I Include Mortgage Payments in My Calculation?

This is easily the most common question we get, and the answer is a hard no. Your mortgage payments—both principal and interest—are considered financing costs, not operating expenses. Think of it this way: the traditional net rental yield formula is designed to measure the performance of the property itself, completely separate from how you decided to finance it.

If you were to include your mortgage, you'd actually be calculating a different, though equally important, metric: Cash-on-Cash Return. This number shows the return on the actual cash you’ve put down, which is crucial for understanding your personal profit after paying the bank.

Rental yield evaluates the asset's performance. Cash-on-Cash Return evaluates your performance as a leveraged investor. Both are essential, but they answer different questions.

How Does Property Appreciation Affect Rental Yield?

Simply put, it doesn’t, at least not in the standard formula. Rental yield is purely a measure of income return. It focuses entirely on how much cash flow the property generates relative to its market value. It completely ignores any potential increase (or decrease) in the property's price, which is your appreciation, or capital return.

Your total return on an investment property really has two distinct engines:

- Income Return: This is what your net rental yield measures.

- Capital Return: This is the profit you make from property appreciation when you sell.

For example, a modern flat in a high-growth area of Casablanca might offer a modest 4% net yield but experience 10% annual appreciation. On the other hand, a property in a more stable, established town might deliver a strong 7% net yield with very little price growth. Which one is better depends entirely on your personal investment goals.

What’s a Realistic Maintenance Budget for a Moroccan Property?

Budgeting for maintenance is more art than science, but experienced investors rely on some solid rules of thumb. A great starting point is to set aside 1% of the property's value each year for repairs and general upkeep. For an apartment valued at MAD 1,500,000, that’s an annual budget of MAD 15,000.

However, you must adjust this based on the specific property. For an older, historic riad in the Marrakech medina with traditional Tadelakt walls and aged plumbing, you’d be wise to budget closer to 1.5% or even 2%. Skimping on this estimate is a classic rookie mistake that can wreck your net yield. It's always better to be a little too cautious here.

Navigating the Moroccan property market requires expert guidance and a deep understanding of local nuances. For a partner who can help you accurately analyse investments and find the perfect property to meet your goals, trust Rich Lion Properties.

Start your journey with confidence by visiting https://richlionproperties.com today.