Forget about browsing Zillow for a minute. Before you even think about open houses or paint swatches, the real first step in buying a home is a deep dive into your finances. It's not the glamorous part, but getting your financial house in order is what separates the dreamers from the serious buyers who actually get the keys.

This initial work transforms you from a window shopper into a confident, empowered buyer ready to make a winning offer when the right home comes along.

Laying the Financial Groundwork

Before you start picturing your future life in a new home, the most critical work is happening quietly, behind the scenes. Think of it as building the foundation for your house—without a solid base, everything else is at risk. This isn't just a quick peek at your bank balance; it’s a full financial health check.

Taking this prep work seriously is the difference-maker. It ensures you're not just hoping to buy a home, but are actively and capably on the path to owning one.

Here’s what you need to focus on:

- Your Credit Score: This little number has a massive impact. Lenders use it to decide if you're a good risk and what interest rate you'll get. A strong score can save you tens of thousands of pounds over the life of your loan. It’s that important.

- Debt-to-Income (DTI) Ratio: Lenders will look closely at your DTI—that’s your total monthly debt payments divided by your gross monthly income. In my experience, they typically want to see this ratio stay below 43% to feel confident you can handle a mortgage payment.

- Your Down Payment Strategy: How much you can put down upfront influences everything—your loan options, your interest rate, and whether you’ll have to pay extra for Private Mortgage Insurance (PMI).

Getting Pre-Approved: Your Golden Ticket

One of the most powerful moves you can make right out of the gate is to get pre-approved for a mortgage. This is a huge step up from a simple pre-qualification, which is just a rough estimate. For a pre-approval, a lender will actually comb through your financial documents—tax returns, pay stubs, bank statements—and give you a conditional commitment for a specific loan amount.

A mortgage pre-approval letter is your signal to the market. It tells sellers you're a serious, verified buyer who has already done the heavy lifting with a lender. In a competitive market, this gives your offer serious clout.

Getting pre-approved does two things. First, it gives you a firm, realistic budget, which stops you from falling in love with homes you can't afford and focuses your search. Second, it lets you move fast. When you find that perfect property, you're ready to pounce.

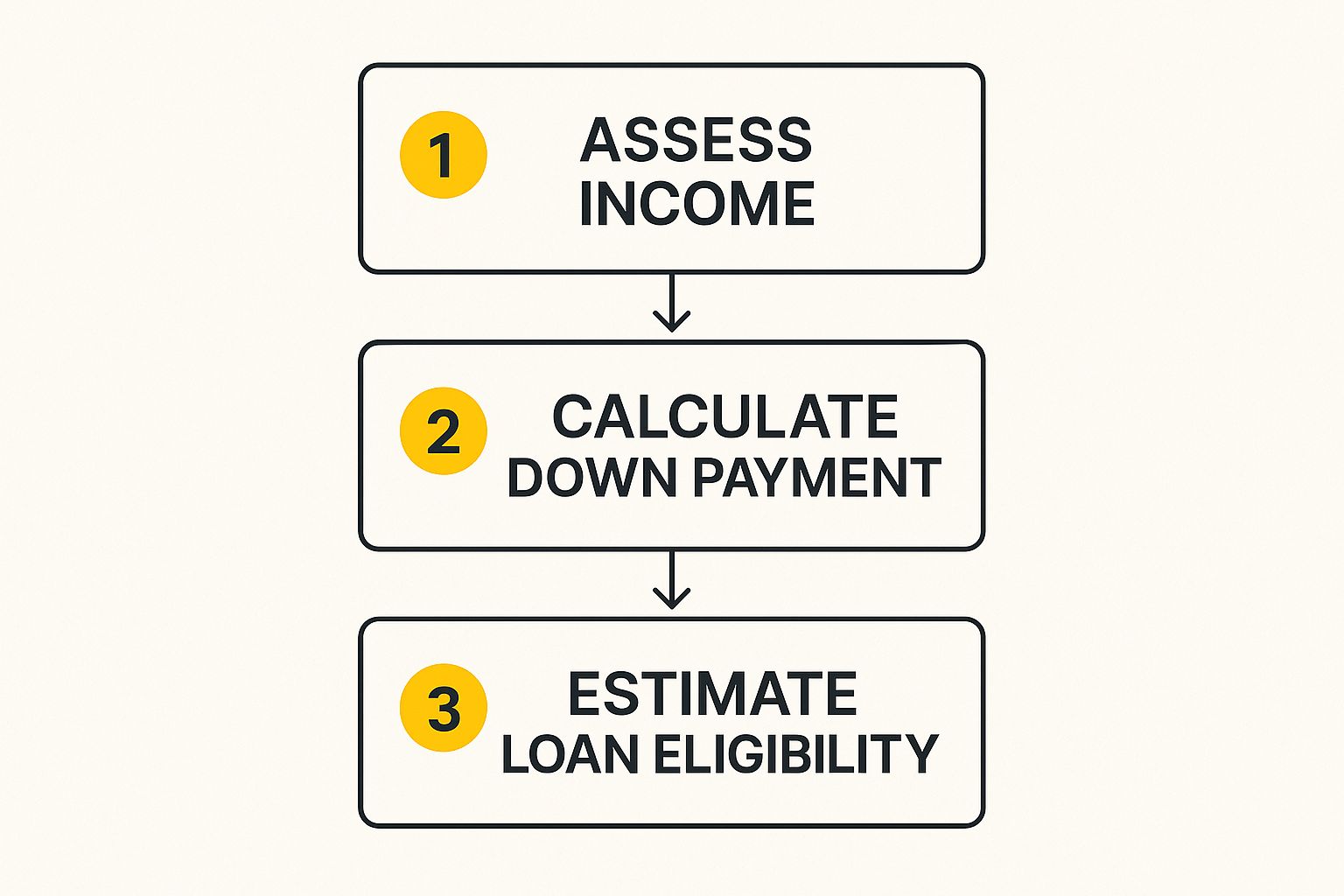

This image really breaks down how these initial financial pieces fit together.

You can see how everything flows—from your income to your down payment and, ultimately, to what you can realistically borrow.

Getting Your Paperwork in Order

When you start the pre-approval process, your lender is going to ask for a stack of documents. My advice? Get everything together before you even talk to them. Create a dedicated digital or physical folder. Being organised here will save you so much time and stress. Any delays in getting this information to your lender can stall your pre-approval, and in a fast-moving market, that could cost you a house.

Though the exact list can differ slightly from one lender to another, here's the core set of documents you'll need to pull together:

- Income Verification: This usually means your last two years of W-2s, your most recent pay stubs, and your federal tax returns.

- Asset Verification: Lenders need to see you have the cash for the down payment and closing costs, so gather your last few months of bank and investment account statements.

- Debt Records: Have statements ready for any outstanding loans—think car loans, student loans, or credit card balances.

- Identification: A simple one, but essential—a clear copy of your driver's licence or other government-issued ID.

This level of organisation isn't just for your lender's benefit; it gives you a crystal-clear snapshot of your own financial reality. If your property search extends overseas, say to Morocco, understanding the local financial nuances is equally vital. For anyone in that position, I'd recommend looking into specific guides on how to invest in Morocco real estate to get a handle on the unique requirements for foreign buyers.

Ultimately, this upfront preparation—whether for a local or international purchase—is what sets the stage for a smooth, confident, and successful home-buying journey.

Decoding the Massachusetts Real Estate Market

Once you’ve got your financial ducks in a row, it’s time to shift your focus from your own numbers to the market itself. Getting a handle on the local Massachusetts real estate scene is more than just scrolling through online listings; it’s about becoming a bit of a detective, gathering strategic intelligence that will give you a real advantage.

This isn’t a passive activity. You’ll need to dig deep into specific neighbourhoods, take a hard look at the data, and start to understand the subtle forces that shape prices and competition here in the Bay State.

Beyond the Pictures: Researching Neighbourhoods

The perfect house doesn't exist in a vacuum—it's part of a community. That’s why your research has to extend far beyond the property lines. Start thinking about what really matters to your daily life. Is a quick commute into Boston the top priority? Are you looking for access to top-tier public schools? Or is it all about being close to parks, cosy cafes, and cultural spots?

I always advise clients to create a "lifestyle checklist" to keep their search on track. Think about things like:

- Commute Times: Don't just guess. Actually map out the drive or public transport journey from potential neighbourhoods to your workplace during rush hour.

- School Districts: Even if you don't have kids, areas with great schools tend to hold their property values much better over the long run.

- Local Amenities: How far will you have to go for groceries, a nice park, a good restaurant, or a doctor's office?

- Future Development: Do some digging. Are there any major infrastructure projects, new shopping centres, or zoning changes on the horizon that could change the feel—and value—of the area?

Getting this specific helps you pinpoint communities that don't just work for your budget but genuinely match the way you want to live.

The Power of Local Market Data

To really understand what you're up against, you need to look at the key metrics. Two of the most telling are the Days on Market (DOM) and the Sale-to-List Price Ratio.

A low average DOM means you're in a fast-moving, competitive seller's market where homes get snapped up in a flash. On the flip side, a higher DOM suggests buyers have a bit more breathing room and negotiating power. The sale-to-list price ratio shows how close homes are actually selling to their asking price. If that ratio is over 100%, it’s a dead giveaway that bidding wars are common.

A savvy buyer uses this data to build their strategy. In a market where homes are selling in a week for 105% of the asking price, a lowball offer is just a waste of everyone's time. But in a slower market, you might have more room to negotiate thoughtfully.

Understanding these numbers helps you set realistic expectations and craft an offer that’s both competitive and smart. This is one of the core https://richlionproperties.com/steps-to-buying-a-house/ that many first-time buyers unfortunately skip over.

Interpreting Current Massachusetts Market Trends

The Massachusetts market is always in motion, and staying informed is everything. Take the recent shift in housing inventory, for example. By April 1st, there were 3,862 single-family homes on the market—a massive 37.12% jump from the roughly 2,800 listings available on the same day last year.

For buyers, this surge in available homes is fantastic news, offering more choice than we’ve seen in a while. But here's the catch: the increased inventory hasn't really brought prices down. The median home price in Massachusetts still hit $600,000 in March, a slight increase from the previous year.

What this tells us is that we're in a complex market. More options are on the table, but prices are holding firm. This kind of environment demands a delicate balance—you have to seize the opportunity of more choice while staying grounded in the reality of high valuations.

The Local Expert Advantage

While data gives you the "what," a great local real estate agent provides the "why" and the "how." An experienced agent working on the ground in Massachusetts brings invaluable context that numbers alone just can't provide.

They understand the distinct character of each town, know which streets are the most sought-after, and often get wind of off-market properties before they ever hit the public listings. For instance, an agent might know that while two towns have similar price points, one is about to get a new commuter rail stop, making it a much smarter long-term investment.

Ultimately, they can read a seller's motivations, advise you on how to structure an offer that stands out, and navigate the back-and-forth of negotiations with the kind of expertise that only comes from hundreds of successful deals. Their insight can transform your home-buying journey from a series of stressful guesses into a confident, well-executed plan.

Making a Winning Offer in a Competitive Market

This is where the rubber meets the road. All that time spent researching neighbourhoods and getting your finances in order has led you to this point. Now, it's time to shift from being an observer to an active player in the Massachusetts real estate market. The process of viewing homes and crafting a compelling offer is as much an art as it is a science—it takes a keen eye, a bit of strategy, and a steady hand.

When you start touring properties, it's easy to get distracted by fresh paint or trendy staging. Your job is to look past the surface and see the bones of the house. Train your eye to spot the big-ticket items that can have a real impact on your finances down the road. How old does that roof look? Are there any subtle stains on the ceiling or a musty smell in the basement hinting at water issues? Get a good look at the HVAC system and the hot water heater. These are the details that truly define a home's condition and future costs.

Anatomy of a Strong Offer

In a competitive market, the "best" offer isn't always the one with the highest price tag. Instead, a winning offer is a complete package, carefully put together to show the seller you're a serious, well-prepared buyer who can get to the closing table without any drama.

Every solid offer is built on four key pillars:

- The Price: This is your starting number, informed by your own research and, crucially, your agent's real-time market insights.

- The Contingencies: Think of these as your safety nets. They are conditions that must be met for the deal to move forward, like a satisfactory home inspection or securing your final loan approval.

- The Earnest Money Deposit: This is your "skin in the game." A deposit of 1% to 3% of the purchase price is held in a neutral escrow account, signalling to the seller that you're committed.

- The Closing Timeline: This is your proposed date to finalise the sale. Sometimes, offering a flexible or quick closing can be more appealing to a seller than a few extra thousand dollars.

Thinking strategically about each of these components is one of the most important steps to buying a home. A well-crafted offer tells the seller you respect their time and are ready to proceed smoothly.

The Art of Negotiation

Once your offer is submitted, you'll get one of three responses: acceptance, rejection, or a counteroffer. This is where you need to keep a cool head. It’s easy to get caught up in the emotion of it all, but remember—this is a business transaction. Lean on your agent to help you read between the lines of a counteroffer and figure out what the seller really wants.

Often, the negotiation isn't just about the price. A seller who has already bought their next home might be far more motivated by a buyer who can close in 30 days than one who offers a bit more but needs 60 days. Uncovering these non-financial motivations can give you a powerful advantage.

Pro Tip: Instead of asking the seller to handle repairs found during an inspection, consider asking for a closing cost credit. This gives you the money to hire your own contractors and oversee the work yourself, ensuring it's done to your standards.

Acting with Speed and Confidence

The Massachusetts housing market doesn't wait around. With the average home value sitting around $658,559—a 3.6% increase over the past year—and properties going under contract in about eight days, the pace is brisk. This isn't a market for hesitation. You can explore more about local market dynamics to see just how quickly things move.

This is precisely why all that upfront work is so essential. When you find the right house, you won't have time to go back to the bank for pre-approval or start your market analysis from scratch. Being prepared with your financing secured and a solid grasp of property values is what allows you to act decisively. In a market this fast, confidence and speed are what separate the successful buyers from those who are left wondering what could have been.

Navigating Property Inspections and Finalising Your Mortgage

So, your offer has been accepted. That's a huge step forward, but now the real work begins. This next phase is all about due diligence—a critical period where you’ll be verifying the property's physical condition while your lender puts the final touches on your financing. Think of it as a two-track process, and both tracks demand your careful attention.

This is where the excitement of the hunt gives way to methodical, practical checks. You'll be working with professionals to get a clear, unvarnished look at what you're buying, all while satisfying your bank's final requirements. It can feel like a bit of a whirlwind, but getting this part right is absolutely essential for a smooth closing.

Getting to Grips with the Home Inspection

The home inspection is your opportunity to look beyond the surface and get an expert, unbiased opinion on the property's health. You might have spotted some cosmetic details during your viewings, but a professional inspector has the trained eye to see what you can't—the potential structural or systemic issues hiding in plain sight.

This is particularly vital in Morocco, where building codes and upkeep can vary wildly from one property to another. You need an inspector who understands the local context. They’ll assess everything from the structural integrity and the condition of traditional finishes like tadelakt plaster to the intricacies of the electrical and plumbing systems, which can be quite unique. The cost of an inspection is a small price to pay when you consider the thousands it could save you down the road.

Your inspector will hand you a detailed report, which becomes your guide. It will break down their findings, usually by urgency, helping you see the difference between a quick fix and a serious red flag.

A thorough inspection report isn't just a list of flaws—it's your single most powerful negotiating tool. It gives you the objective proof you need to ask for repairs or a price adjustment on any significant issues that were uncovered.

Armed with this report, you can move forward confidently, renegotiate the terms, or even walk away if the problems are simply too big to tackle.

From the Report to a Resolution

With the inspection report in hand, it's time to sit down with your real estate agent and strategise. Remember, not every imperfection is worth fighting over. You'll want to focus on the significant items that impact the property's safety, structure, or major systems.

Here’s a look at how you might handle what you find:

- Requesting Repairs: The most direct approach. You can ask the seller to have specific problems, like a dodgy water heater or faulty wiring, fixed before you close.

- Asking for a Credit: A great alternative is to ask for a credit at closing. The seller simply reduces the final sale price, leaving you with the cash to hire your own trusted contractors to do the work after you move in.

- Negotiating a Price Reduction: If the inspection reveals a major, costly issue—say, the roof needs a complete overhaul—it often makes more sense to negotiate a lower purchase price to account for the expense you'll be inheriting.

Your agent's experience here is gold. They can give you a feel for what’s a reasonable request in the current market and help you present it in a way that the seller is likely to agree to.

Securing Your Mortgage Approval

At the same time all this is happening, your lender is entering the final stage: underwriting. This is where an underwriter takes a fine-tooth comb to your entire financial profile to give the ultimate approval for the loan. They will double-check your income, your assets, your credit history—everything.

During this period, it is absolutely crucial to keep your financial situation stable. Don't go out and finance a new car, apply for new credit cards, or switch jobs. Any sudden change can throw up a red flag and put your mortgage approval in jeopardy right at the finish line.

A pivotal piece of the underwriting puzzle is the property appraisal. Your lender will hire an independent appraiser to establish the home's fair market value. Why? They need to be sure the property is actually worth the amount of money they're lending you. If the appraisal comes in lower than your offer, it creates a gap. You'll have to either negotiate with the seller to lower the price, find more cash for your down payment, or, in some cases, formally challenge the appraisal.

From The Final Walkthrough To A Successful Closing Day

You’re on the home stretch now. With the biggest hurdles cleared, the last few steps are all about the details—the small but critical actions that pave the way for a smooth and celebratory closing day. This isn't the time to ease up; it's when a sharp eye prevents any last-minute hitches.

From that final look at the property to the moment you sign the last document, every step is a final checkpoint. Let's walk through it together, so you arrive at the closing table feeling prepared, confident, and ready to get your keys.

The All-Important Final Walkthrough

Typically scheduled within 24 hours of closing, the final walkthrough is your last chance to confirm the property's condition. Think of it less like a formal inspection and more like a final verification. You’re there to ensure the home is in the exact state you agreed upon when you signed the purchase contract.

Your two main goals here are simple. First, check that no new damage has occurred since you were last there. Second, confirm that any repairs the seller agreed to make have been completed properly. Always bring your purchase agreement and the original inspection report for reference.

Here’s a practical checklist of what I always advise my clients to do:

- Test every appliance: Switch on the oven, run a quick cycle on the dishwasher, and make sure the fridge and freezer are cold.

- Check the plumbing: Turn on every tap, flush all the toilets, and quickly check for any new leaks under the sinks.

- Verify all repairs: If the seller was supposed to fix that leaky tap or repair a cracked window pane, inspect their work carefully. Don't be shy about checking it closely.

- Look for what’s left behind: Make sure the seller has moved all their belongings out and hasn’t left any rubbish or unwanted items for you to deal with.

What if you spot a problem? A repair that's not quite right or a new scratch on the floor? Don't panic. This is what your agent is for. They'll immediately get in touch with the seller's agent to find a solution. Often, this is handled with a simple credit at closing to cover the cost of the fix.

Reviewing Your Closing Disclosure

You'll receive a crucial five-page document called the Closing Disclosure (CD) at least three business days before you're due to sign. This form lays out the final, definitive numbers for your mortgage: your interest rate, monthly payments, and a detailed breakdown of every single closing cost.

Your job is to compare this document, line by line, against the initial Loan Estimate you were given at the start. Some figures might have minor adjustments, like prorated property taxes, but the core lender fees should be identical. If anything looks off or you don’t understand a charge, pick up the phone and call your lender and agent right away.

Expert Insight: That three-day review period for the Closing Disclosure isn’t just a courtesy; it's a legal safeguard for you as a buyer. It’s designed to give you time to review everything without pressure, ask questions, and be absolutely certain about the financial commitment you're making.

Getting Ready For The Closing Table

Closing day, known locally as the signature de l'acte de vente, is the formal event where ownership is transferred. You'll meet with a notaire (notary), who is a neutral legal professional tasked with finalising the transaction for both parties. The seller and your respective agents will usually be there as well.

You're going to sign a lot of documents, most notably the deed of sale (acte de vente) and your loan's promissory note. The most important thing to bring is your payment for the down payment and all closing costs. This has to be a certified cheque or a confirmed wire transfer—personal cheques won't be accepted.

Getting to grips with the local process is key, especially when you're buying from abroad. For anyone exploring this market, our guide on property investment in Morocco offers some really helpful background.

Once all the papers are signed and the funds have been officially transferred, the keys are handed over. Congratulations—you own a new home.

Answering Your Top Home-Buying Questions

Jumping into the home-buying process can sometimes feel like you’re trying to read a map in a foreign language. There are unfamiliar terms, confusing timelines, and plenty of moments where you might wonder, "Am I doing this right?"

Even with the best game plan, questions always come up. That’s perfectly normal. This section is here to tackle some of the most common questions we hear from buyers every day. Consider this your go-to resource for clear, straightforward answers so you can navigate the path to homeownership in Massachusetts with confidence.

How Long Does This Whole Process Really Take?

This is usually the first thing on everyone's mind. From the day you start your serious search to the moment the keys are in your hand, you should generally plan for the process to take about three to six months in Massachusetts.

Of course, this timeline isn't set in stone. The biggest variable is your property search itself. Some buyers get lucky and find their dream home over a single weekend, while for others, it’s a journey that spans several months. Market dynamics also play a massive part. In a hot seller's market, you might go from searching to an accepted offer in a flash, but the closing period that follows is fairly standard.

Once your offer is accepted, the closing process typically takes between 30 and 45 days. This window is essential for all the critical behind-the-scenes work, like the home inspection, appraisal, and the lender's final mortgage underwriting.

Pre-Qualification vs. Pre-Approval: What’s the Real Difference?

You’ll hear "pre-qualification" and "pre-approval" thrown around a lot, often as if they mean the same thing. They don't. Understanding the distinction is absolutely crucial for being seen as a serious contender in the eyes of a seller.

A pre-qualification is little more than a casual financial snapshot. It’s a quick, informal estimate of what you might be able to borrow, based entirely on the numbers you provide about your income and debts. There's no verification. Think of it as a ballpark figure, not a firm commitment.

A pre-approval, on the other hand, is the real deal. It’s a thorough and powerful stamp of approval from a lender. To get pre-approved, you'll go through a much more detailed process where the lender will:

- Pull your complete credit report and score.

- Verify your income using pay stubs, W-2s, and tax returns.

- Scrutinise your bank statements to confirm your assets and the source of your down payment.

After this deep dive, the lender issues a conditional letter stating they are prepared to lend you a specific amount. In a competitive market like Massachusetts, a pre-approval letter tells sellers you’re not just a window shopper—you're a vetted, credible buyer who is ready and able to close the deal.

Are Home Inspections Actually Mandatory in Massachusetts?

While Massachusetts law doesn't force you to get a home inspection, it's a non-negotiable step for nearly every savvy buyer. In fact, adding a home inspection contingency to your offer is standard practice, and for very good reason.

This inspection is your single most important layer of protection. It’s your chance to have a qualified professional look under the hood and uncover potential problems—from a faulty foundation to a leaky roof—before you’re legally bound to the purchase. An inspector can spot red flags you would almost certainly miss on your own.

Choosing to waive an inspection, maybe to sweeten your offer in a bidding war, is a massive financial gamble. You could unknowingly be taking on a property with tens of thousands of dollars in necessary repairs. Any experienced real estate agent or attorney will strongly advise against skipping this critical step.

What Exactly Are Closing Costs and How Much Should I Budget?

Closing costs are the collection of fees you'll pay to make the real estate transaction official and transfer the property's title into your name. It's important to remember these are entirely separate from your down payment and can be a significant out-of-pocket expense.

These costs cover a whole host of services needed to finalise the sale. Here in Massachusetts, you can expect closing costs to run between 2% and 4% of the home's purchase price. So, for a $600,000 home, you should budget for $12,000 to $24,000.

The fees bundled into your closing costs typically include things like:

- Lender Fees: For originating and underwriting your loan.

- Title Insurance: Protects both you and your lender from any historical ownership claims on the property.

- Appraisal Fee: The cost for a professional assessment of the home’s market value.

- Attorney Fees: Payment for your real estate attorney's work in managing the closing.

- Pre-paids: You'll also pre-pay for items like your first year of homeowner's insurance and a few months of property taxes, which are then held in an escrow account.

Don't worry about memorising all this. You'll receive a Closing Disclosure form three days before you close, which will itemise every single fee down to the penny.

Embarking on your property journey in Morocco, whether you're buying your first home or expanding your investment portfolio, requires a partner you can trust. At Rich Lion Properties, we are dedicated to providing the expert guidance and local insight you need to navigate every step with confidence. Let us help you find your perfect Moroccan property.