Understanding The MA Land Market (What's Really Happening)

The MA region's land market is a hive of activity. But what's fueling this surge? It's more than just picturesque scenery. A combination of factors is shaping the current market. Through conversations with local real estate professionals and recent buyers, we've gained key insights into the forces at play. You might be interested in: Why Morocco's Real Estate Is Worth Your Attention.

The Pandemic's Impact on Land Demand

The pandemic brought about a significant shift in priorities. The desire for more space and a higher quality of life has propelled the demand for land in MA's mid-sized cities. This has created exciting opportunities, but also presents challenges for potential investors. Increased competition for "terrain a vendre" now makes strategic planning essential for buyers.

Balancing Development and Preservation

The MA land market is unique because of the careful balance it strikes between residential development and environmental protection. This creates a complex situation for buyers. For instance, some areas may have limitations on building size or necessitate specific environmental impact assessments. Understanding these regulations early on is crucial to avoid unforeseen delays and expenses.

The Digital Revolution in Land Transactions

Digital platforms are reshaping how land transactions are conducted, especially in less urbanized areas. This increased accessibility has broadened the market to a wider range of buyers. However, technological advancements aren't all equal. Some genuinely improve market transparency, while others introduce unnecessary complications. In the MA region of France, the market for land ('terrain à vendre') has seen increased activity driven by both residential and ecological development trends. Since the COVID-19 pandemic, there's been a noticeable rise in demand for land in mid-sized cities within the MA area, with buyers looking for an enhanced quality of life and more spacious living. Learn more about MA land market trends.

Understanding Regional Variations

The MA area isn't uniform. Prices and availability fluctuate significantly across different zones. Factors like proximity to urban centers, infrastructure development, and local regulations all contribute to these variations. Understanding these regional nuances is essential for informed decision-making. Thorough research and due diligence are vital for navigating the "terrain a vendre" landscape effectively. This knowledge will enable you to pinpoint undervalued plots and make strategic investments that align with your particular objectives. Analyzing market trends will be key to your success in finding the ideal "terrain a vendre" in the MA region.

Decoding Land Prices (What You're Really Paying For)

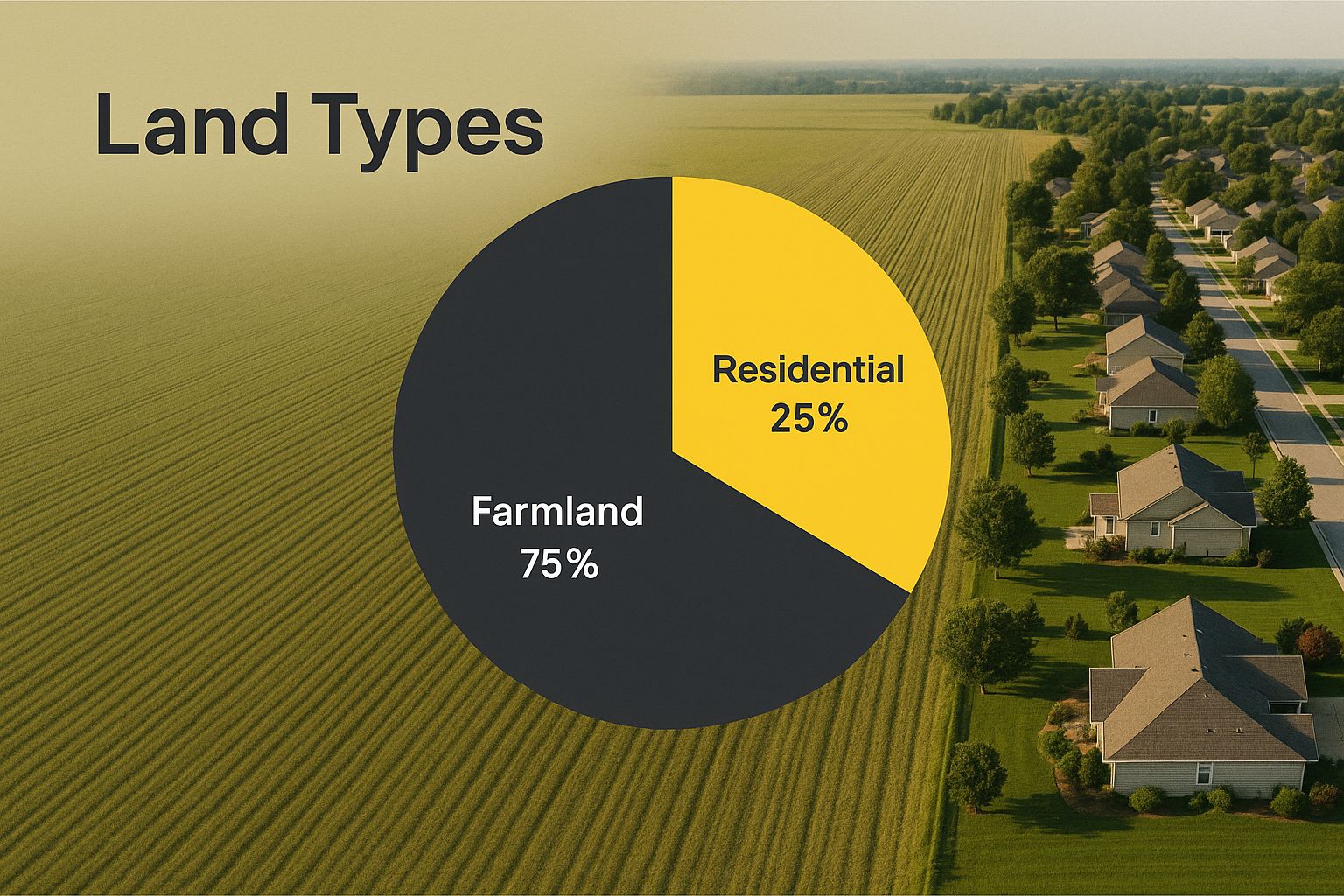

The price of "terrain a vendre" (land for sale) in the MA region isn't random. Several factors contribute to the final cost, and understanding these nuances is key to making a smart investment. This infographic visualizes the different land types available in MA:  As illustrated, the location and intended use significantly influence land value.

As illustrated, the location and intended use significantly influence land value.

Hidden Factors Influencing Land Value

Beyond the obvious, less visible factors can dramatically affect land prices. For example, municipal regulations can dictate what can and can't be built, impacting the land's potential and, consequently, its value.

Proximity to existing infrastructure, like roads, utilities, and public transport, is another important consideration. Access to these amenities can significantly increase a plot's cost.

This means seemingly similar plots can have vastly different prices depending on these less apparent features.

Understanding Price Variations in MA

Why do prices vary so much across seemingly similar areas within MA? Real transaction data provides some key insights. Location is a primary driver. Land closer to urban centers typically commands higher prices.

However, access to amenities and future development plans also play a crucial role. According to L'Observatoire des Territoires, the average price per square meter for building land in certain parts of the MA region fluctuates significantly. It commonly ranges from €50 to €200 per m² depending on proximity to urban centers and infrastructure.

Therefore, researching "terrain a vendre" requires more than simply comparing listed prices. To help illustrate these price variations, let's look at the following table:

To better understand the pricing landscape, the table below provides a breakdown of average land costs based on zone type:

MA Region Land Pricing by Zone Type

| Zone Type | Price Range (€/m²) | Typical Features | Development Potential |

|---|---|---|---|

| Urban Center | €150 – €200+ | High density, established infrastructure, limited space | Redevelopment, high-rise construction |

| Suburban | €100 – €180 | Moderate density, good infrastructure, growing areas | Residential development, mixed-use projects |

| Rural | €50 – €120 | Low density, limited infrastructure, large plots | Agricultural use, potential for residential development |

| Coastal | €180 – €250+ | High demand, scenic views, strict regulations | Luxury homes, tourism-related development |

This table summarizes the key factors impacting land prices across different zones within the MA region. Understanding these distinctions is crucial when evaluating potential investments.

Spotting Value and Avoiding Overpaying

Whether building a family home or planning a larger development, recognizing value is essential. This involves evaluating the land's potential relative to its price.

Factors like zoning regulations, potential for future appreciation, and existing infrastructure all play a crucial role. For instance, a plot with approved building permits might be more expensive initially but could save significant time and money later.

Analyzing Price Trends

Over the past decade, land prices in MA have seen substantial growth. This makes it even more important for buyers to be informed and strategic.

By understanding these historical trends, you can better anticipate future price movements and make more informed purchasing decisions. This knowledge is invaluable when negotiating a fair price and avoiding overpaying for "terrain a vendre." Diligent research and a clear understanding of your needs and goals are key to a successful land purchase in the MA region.

Navigating The Legal Maze (Without Losing Your Mind)

Buying "terrain a vendre" in the MA region involves more than simply finding the ideal plot of land. The legal intricacies can feel overwhelming, but with a strategic approach, you can navigate them successfully. Understanding the local regulations is paramount to a smooth and efficient purchasing experience.

Understanding Local Urban Planning Documents (PLU)

Local urban planning documents, known as PLUs (Plan Local d'Urbanisme), are essential. They detail the rules and regulations governing land use within a specific commune. These documents dictate what can be built, its permitted location, and the specific requirements for any construction project. Consider the PLU as the rulebook for development in that particular area. Ignoring it can result in costly errors and significant delays.

Decoding Zoning Classifications and Environmental Designations

PLUs categorize land into various zones, each with specific authorized uses. For instance, a zone designated for residential purposes might have limitations on commercial endeavors. Likewise, environmental designations can influence what you can build. Certain areas might be protected because of their ecological importance. Understanding these classifications is critical. This involves researching the designated zone of the "terrain a vendre" you're interested in before submitting an offer.

Due Diligence: Protecting Your Investment

Due diligence is more than just administrative tasks; it's about safeguarding your investment. It involves verifying the legal standing of the land, ensuring there are no undisclosed liabilities, and confirming that the property aligns with your project objectives. This process often involves collaborating with a notaire, a specialized legal professional in France who manages property transactions. They play a vital role in guaranteeing the legality and security of the purchase.

For example, a recent purchaser in the MA region uncovered through due diligence that the "terrain a vendre" they were considering had a pre-existing easement, granting a neighbor access across the property. This knowledge enabled them to renegotiate the purchase price and avert future legal disputes.

Common Legal Pitfalls and How to Avoid Them

Several legal traps can ensnare unwary buyers. One frequent problem is ambiguous property boundaries. Another is neglecting pre-emption rights, where the local government holds the initial right of refusal to acquire the land. Furthermore, failing to secure the necessary permits before commencing construction can result in penalties and delays. Working closely with a notaire and a qualified architect can help you navigate these potential complications and protect your investment. Consider them as your legal and technical advisors throughout the MA land acquisition process.

Building Effective Relationships With Key Professionals

Developing strong relationships with local professionals, including notaires, architects, and planning department officials, can be invaluable. Open communication and a proactive approach can simplify the process. For example, early engagement with the planning department can clarify any ambiguities concerning zoning or permitted uses. This collaborative strategy can save you time and prevent future issues. Recognizing warning signs, such as conflicting information or unusually protracted delays, is important. However, it's equally essential to differentiate between legitimate red flags and the standard administrative procedures often inherent in the process.

Reading The Market Signals (What The Data Really Says)

Beyond the headlines, what's the reality of "terrain a vendre" in the MA region? The key lies in understanding the data, moving past advertised prices to analyze transaction volumes and emerging trends. This in-depth market analysis can significantly benefit your land search.

Seasonal Trends and Strategic Timing

Timing is crucial in the MA land market. Like many real estate sectors, it experiences seasonal ebbs and flows. Activity typically increases in spring and decreases during the summer months. Understanding these cycles allows astute buyers to capitalize on slower periods, potentially securing better deals. Strategic timing can significantly impact your final purchase price.

Transaction Volumes: What They Mean For You

In 2023, approximately 10,000 land plots were sold in the MA region, representing a 5% increase from 2022. The total value of these transactions surpassed €500 million, highlighting the sector's economic significance. Find more detailed statistics here.

These robust transaction volumes indicate a healthy and dynamic market, reinforcing the appeal of MA land as an investment. However, this also underscores the importance of informed decision-making and being prepared for competition.

To further illustrate the market trends, let's examine the following table:

MA Region Land Sales Statistics

Annual transaction volumes and values showing market trends

| Year | Number of Sales | Total Value (€M) | Average Plot Size (m²) | Growth Rate |

|---|---|---|---|---|

| 2021 | 9,000 | 450 | 500 | – |

| 2022 | 9,500 | 475 | 520 | 5.56% |

| 2023 | 10,000 | 500 | 550 | 5.26% |

This table uses estimated figures for illustrative purposes. Real data may vary and can be found at the link provided above.

As the table demonstrates, the MA land market has experienced consistent growth in both the number of sales and total value over the past three years. The average plot size has also seen a steady increase.

Identifying Real Opportunities vs. Hype

Market buzz doesn't always equate to genuine opportunity. Some areas may experience inflated prices due to speculation, while others offer more sustainable growth. Discerning these differences requires careful market analysis and due diligence.

Small Parcels vs. Large Territories: Understanding the Dynamics

The MA land market consists of distinct segments, each with its own characteristics. Smaller parcels, often preferred by individual builders, face different market pressures compared to larger territories acquired by developers. These distinctions impact pricing, availability, and competition levels. For example, small parcels near urban areas tend to command higher prices due to increased demand. Buyers should tailor their strategies based on the specific type of "terrain a vendre" they are seeking.

Demand Prediction: Staying Ahead of the Curve

Successful land acquisition involves anticipating market trends, not merely reacting to them. This requires identifying emerging areas of demand before price increases fully materialize. Researching local development plans, infrastructure projects, and demographic shifts is essential. Understanding these factors can position you to acquire land in areas poised for future value appreciation. This proactive approach empowers informed decisions based on potential, not just current market activity.

Choosing Your Plot (The Details That Actually Matter)

Stop feeling lost looking at countless "terrain a vendre" listings. Let's explore how experienced buyers in the MA region identify plots worth a closer look. We'll give you the tools to assess the factors that impact your budget and timeline.

Crucial Factors for Plot Evaluation

Several key elements deserve careful consideration when evaluating "terrain a vendre." These details can significantly influence not just the construction process, but also the long-term value of your investment.

-

Soil Composition and Drainage: The soil type directly affects foundation costs. Poor drainage can lead to expensive remediation. A geotechnical survey is a smart investment.

-

Utility Access: Confirming the availability of water, electricity, and sewer connections is essential. Connecting to utilities located far from the plot adds significant expense.

-

Plot Orientation: Consider sunlight exposure for energy efficiency and views. South-facing slopes in MA offer excellent solar gain in the winter.

Researching Neighborhood Trends and Infrastructure

A plot's value isn't determined solely by its inherent qualities. Surrounding development plays a crucial role in future appreciation.

-

Neighborhood Development Trends: Research upcoming projects. A new commercial center nearby can boost your property's value. Conversely, a planned industrial zone might be undesirable.

-

Infrastructure Plans: Investigate planned road improvements or public transport expansions. Improved access enhances a property's attractiveness and market value.

For example, imagine two similar plots of "terrain a vendre." One is near a proposed new highway, while the other is in an area with little development activity. The former, despite a potentially higher initial price, offers greater long-term value due to improved accessibility.

Conducting Effective Site Visits

A site visit is more than a casual walk-through. It’s a critical opportunity to identify potential problems before they become costly issues.

-

Multiple Visits: Visit at different times of day and under various weather conditions. This can reveal drainage issues or noise problems that might not be apparent on a sunny afternoon.

-

Bring a Professional: If possible, bring a builder or architect. Their expertise can help identify potential problems you might miss.

-

Document Everything: Take photos and detailed notes. This documentation will be invaluable during later comparisons and negotiations.

Recognizing Red Flags and Manageable Concerns

Not all problems are deal-breakers. Some are easily addressed, while others warrant walking away.

-

Unstable Terrain: Steep slopes or signs of landslides are serious concerns that could require expensive stabilization measures.

-

Limited Access: Difficult access can complicate construction and impact future use.

-

Environmental Contamination: Previous industrial activity can leave behind pollutants. Thorough environmental assessments are essential.

However, issues like overgrown vegetation or minor drainage problems are usually manageable with proper planning and budgeting. Knowing the difference between a deal-breaker and a manageable challenge is crucial when evaluating "terrain a vendre." By carefully considering these details, you'll make informed decisions and increase your chances of finding the ideal plot for your project in the MA region.

Smart Financing Strategies (Making The Numbers Work)

Securing your dream "terrain a vendre" in the MA region requires more than just finding the ideal plot of land. A robust financial plan is essential. This section explores the financial realities of land acquisition in MA, providing insights into financing options and effective budgeting strategies.

Exploring Financing Options for Land Purchases

Traditional bank loans are a common way to finance land purchases. However, securing financing for raw, undeveloped land can be more challenging than for properties with existing structures. Lenders often view undeveloped land as a higher risk investment. This can lead to stricter lending criteria and potentially higher interest rates.

Furthermore, the loan amount you can secure might be lower compared to financing a house purchase. Lenders typically base loan amounts on the appraised value of the property. For undeveloped land, this value can be lower than the combined value of the land and a potential future house. For further insights into real estate investment, consider reading Top Reasons to Invest in Marrakech Real Estate in 2024.

Creative Partnership Structures for Experienced Investors

Seasoned investors often explore more creative financing options, such as joint ventures or partnerships. These structures can unlock access to larger capital pools and shared expertise.

For instance, an investor might partner with a developer who brings construction expertise to the table, while the investor provides the land and a portion of the financing. This collaborative approach can be mutually beneficial, enabling larger-scale projects and potentially mitigating individual risk.

Optimizing Cash Flow and Tax Benefits

The structure of your land purchase can significantly influence your cash flow and potential tax benefits. If you're planning a phased construction approach or intend to hold the land for future development, specific financing strategies can optimize your tax liability.

Consulting with a tax advisor specializing in real estate transactions can help you navigate these complexities. A deep understanding of applicable tax laws and regulations is crucial for minimizing your tax burden and maximizing your return on investment.

Contingency Planning for Cost Overruns and Delays

Land development projects are susceptible to cost overruns and timeline delays. Unforeseen circumstances, like unexpected soil conditions or changes in building regulations, can impact both the project's schedule and budget.

Experienced buyers recognize the importance of contingency planning. This involves allocating a portion of your budget to address unforeseen expenses and incorporating flexibility into your timeline. A 10-20% contingency buffer is generally recommended. For example, if your initial budget is €100,000, set aside an additional €10,000-€20,000 for unexpected costs. This financial cushion can help you navigate unforeseen challenges and keep your project on track.

Budgeting Beyond the Purchase Price: A Realistic Framework

When budgeting for a "terrain a vendre" purchase, remember that the land price itself is only one piece of the puzzle. Additional costs can accumulate quickly, often surprising unprepared buyers. These include:

- Notaire Fees: These fees typically range from 7-8% of the purchase price.

- Land Survey Costs: A land survey is crucial for verifying boundaries and identifying potential issues.

- Permitting and Connection Fees: Factor in the costs associated with obtaining building permits and connecting to utilities.

- Site Preparation: This includes clearing, grading, and preparing the land for construction.

A comprehensive budget accounts for all these often-overlooked expenses. By incorporating these costs upfront, you can avoid financial surprises and ensure your land purchase aligns with your overall financial objectives. Careful planning and a realistic budget are paramount for successful land acquisition in the MA region.

Your Action Plan For Success

Finding the perfect "terrain a vendre" in the MA region requires a well-defined plan. This section offers a practical roadmap, incorporating insights from buyers who have successfully navigated the Moroccan land market. We'll explore key checkpoints, realistic timelines, and decision-making frameworks to keep your land purchase on track.

Defining Your Goals and Priorities

Before diving into property searches, clearly define your objectives. What do you hope to achieve with this land purchase? Are you building a primary residence, a vacation home, or making a long-term investment?

Your goals will significantly influence your decisions throughout the entire process. For example, if your priority is building a family home, proximity to schools and amenities will be a key factor. However, if you're seeking a vacation retreat, a secluded location with scenic views might be more appealing.

Setting a Realistic Timeline

Land acquisition and development in the MA region rarely progress without a hitch. Unexpected delays can and do occur, so it’s crucial to be prepared.

Factors such as obtaining permits, securing financing, and completing due diligence can all impact the timeline. A realistic timeline accounts for these potential setbacks and allows for flexibility.

Key Questions at Each Stage

Asking the right questions at each stage is paramount. During the initial property evaluations, concentrate on questions about zoning regulations, utility access, and potential environmental concerns.

As you move closer to closing, inquiries about title insurance, property taxes, and any existing easements become critical. This proactive approach can help you avoid unexpected costs and delays down the line.

When to Move Forward (and When to Walk Away)

Recognizing favorable market signals is essential for a successful purchase. Look for positive economic indicators, planned infrastructure developments, and growing demand in your target area. These signs suggest a confident move forward.

However, be wary of warning signs such as unclear ownership, unresolved legal issues, or significantly inflated prices. These red flags should prompt you to reassess the purchase. Knowing when to walk away is just as important as knowing when to proceed. Check out our guide on Investing in Morocco Real Estate.

Building Relationships with Local Professionals

Building strong relationships with local professionals—notaires, architects, and surveyors—can greatly simplify the land acquisition process.

These individuals offer valuable insights into local regulations, market trends, and potential pitfalls. Their expertise can save you time, money, and unnecessary stress. For instance, a local architect can advise you on the feasibility of your building plans, considering the specific characteristics of the “terrain a vendre.”

Managing Expectations and Staying Focused

The process of acquiring land can be complex. Maintaining realistic expectations throughout is vital. There will inevitably be hurdles, so patience and persistence are key.

Keep your initial goals at the forefront throughout the entire journey. This focus will help you navigate challenges effectively and make informed decisions that align with your overall objectives.

Ready to start your property search in Morocco? Rich Lion Properties is here to guide you. We offer comprehensive real estate services, helping clients navigate the Moroccan property market with confidence. Whether you're searching for "terrain a vendre" or other property types, our team provides expert advice and personalized support throughout the process. Visit Rich Lion Properties today to explore our listings and begin your real estate journey.